Stocks & Equities

Once a year, the man running the world’s biggest sovereign wealth fund travels around China for a week.

Once a year, the man running the world’s biggest sovereign wealth fund travels around China for a week.

Though assets from that country only make up about 1.5 percent of the $860 billion Norwegian wealth fund’s portfolio, Yngve Slyngstad, its chief executive officer, says almost all investment decisions are affected by what happens in China.

Understanding what’s poised to become the world’s largest economy is crucial for Slyngstad as he manages a fund that Norway predicts will reach $1 trillion in less than three years. He’ll be in China this month, visiting Beijing and other cities.

“Every time I come back, my perception of China has changed,” Slyngstad, who turned 52 today, said in an Oct. 29 interview in his fifth-floor office in Oslo. “There has been more and more of a question mark over what’s the next step for that economy. The uncertainty among investors is partially due to the very simple fact that it’s more difficult to know what’s happening in that large economy than in any other.”

The composition of the global economy, including the future of emerging markets such as….continue reading more on:

Remember the “Halloween effect” for equity markets; it will improve your stock market performance.

The Halloween effect states that investors will significantly outperform the stock market by “buying the market” on October 31 and selling on April 30. Ben Jacobsen and Cherry Zhang of Massey University in New Zealand checked out the Halloween effect by examining 300 years of market data in 108 countries. They determined that stock market returns from November through April were on average 4.52 per cent higher than those between May and October. Over the past 50 years, the average difference was 6.25 per cent.

Quotable

“Our doubts are traitors and make us lose the good we oft might win by fearing to attempt.”

William Shakespeare

Commentary & Analysis

Was it a Hail Mary pass from Japanese Prime Minister Abe?

Did you read about the Bank of Japan (BOJ) surprise last night? Let me just say, I was surprised, as I have been expecting the yen to strengthen.

This is likely the mother of Hail Mary passes by Prime Minister Abe & Co. Success or failure of his government hangs in the balance, I suspect. I’ll explain in a moment.

Now back to the BOJ …please click here to view the issue

Now back to the BOJ …please click here to view the issue

-Jack Crooks

Still most read article. Huge volume – MT/Ed

Worldwide equity markets are a nuisance compared to worldwide debt markets. When you understand that derivatives (think leverage) all have interest rate components and have only seen falling yields the past thirty years. You better pay attention to the following chart. When this chart breaks the Fat Lady has sung and it is game over and I do mean over.

That is a six year topping pattern in the benchmark 10 year US Treasury Note. When that angled, complex pattern breaks down chaos will ensue globally. Examine what happened to the Yen when a similar pattern of HALF the duration broke down.

Harken back to 2008 when the real estate bubble popped. Everything tanked because real estate is illiquid and

everyone needed to raise capital and NO ONE could. Even the mighty GE had trouble rolling over debt. So ask yourself who is going to lend anyone money if rates start rising aggressively? Think about how much debt everyone is holding across the globe. Citizens, corporations, sovereign entities all have financing needs each and every day. Who will be the lender of last resort? Will everyone go to the FED and ask for a loan?

How many people managing money today have ever managed money in a runaway bond bear market? While the move in the late 1970’s was impressive the amount of leverage that existed in the financial system would not even register relative to today. That allowed Volcker to unleash his tightening madness.

How does gold factor into what we are about to see when that first chart breaks down? Again, in 2008 money rushed into the safe haven that is bonds. Now bonds become the source of panic? Where will money hide?

The supply and demand fundamentals for gold at this stage are already completely upside down relative to price. The price continues to follow the value of the yen relative to the dollar as we showed last year. And while some will have you believe that higher rates make gold even less attractive, they could not be more incorrect. When the bond bear comes gold will outperform and society as a whole is completely unprepared for the chaos that will unfold.

October 30, 2014, 11:12 AM EUR/USD Double Bottom Or New Lows? USD/CAD USD/JPY AUD/USD GBP/USD USD/CHF

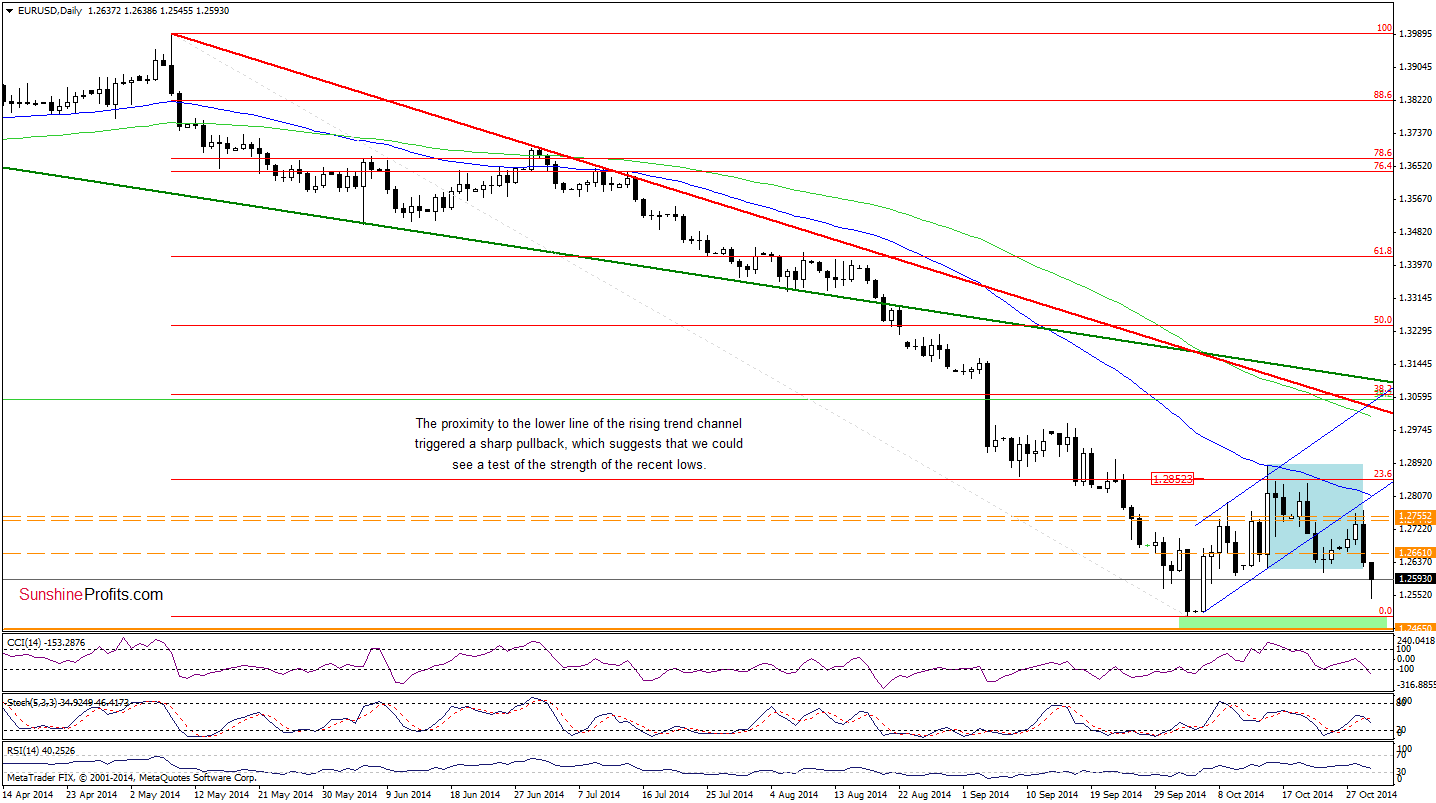

Yesterday, the U.S. dollar strengthened against other major currency pairs after the Fed said it would end its monthly bond-buying program but keep rates near zero for “considerable time”. As a result, EUR/USD declined below the medium-term resistance zone, which triggered a sharp decline to sligthly above the recent lows. Will they withstand the selling pressure and we’ll see a double bottom in the coming days?

Click on EUR/USD image for Larger Charts & Analysis of 6 Currency Pairs

EUR/USD

The situation in the medium term has deteriorated as currency bulls didn’t manage to push EUR/USD above the orange resistance zone (created by the Apr and Jul 2013 lows and the 61.8% Fibonacci retracement), which triggered a sharp decline that took the exchange rate to slightly above the recent lows. Will we see further deterioration? Let’s take a closer look at the daily chart and find out.

Quoting our previous Forex Trading Alert:

(…) although EUR/USD extended gains and climbed above yesterday’s high, the exchange rate still remains under the lower line of the rising trend channel. (…) as long as there is no breakout, the recent upward move could be nothing more than a verification of the breakdown.

As you see on the above chart, the situation developed in tune with our assumption as the lower border of the rising trend channel in combination with the orange resistance zone (marked on the weekly chart) successfully stopped the rally, triggering a sharp decline. In this way, the breakdown was verified, which is a bearish signal that suggests a test of the recent lows – especially when we factor in a breakdown below the lower border of the consolidation (marked with blue).

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bearish

Trading position (short-term): In our opinion, no positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

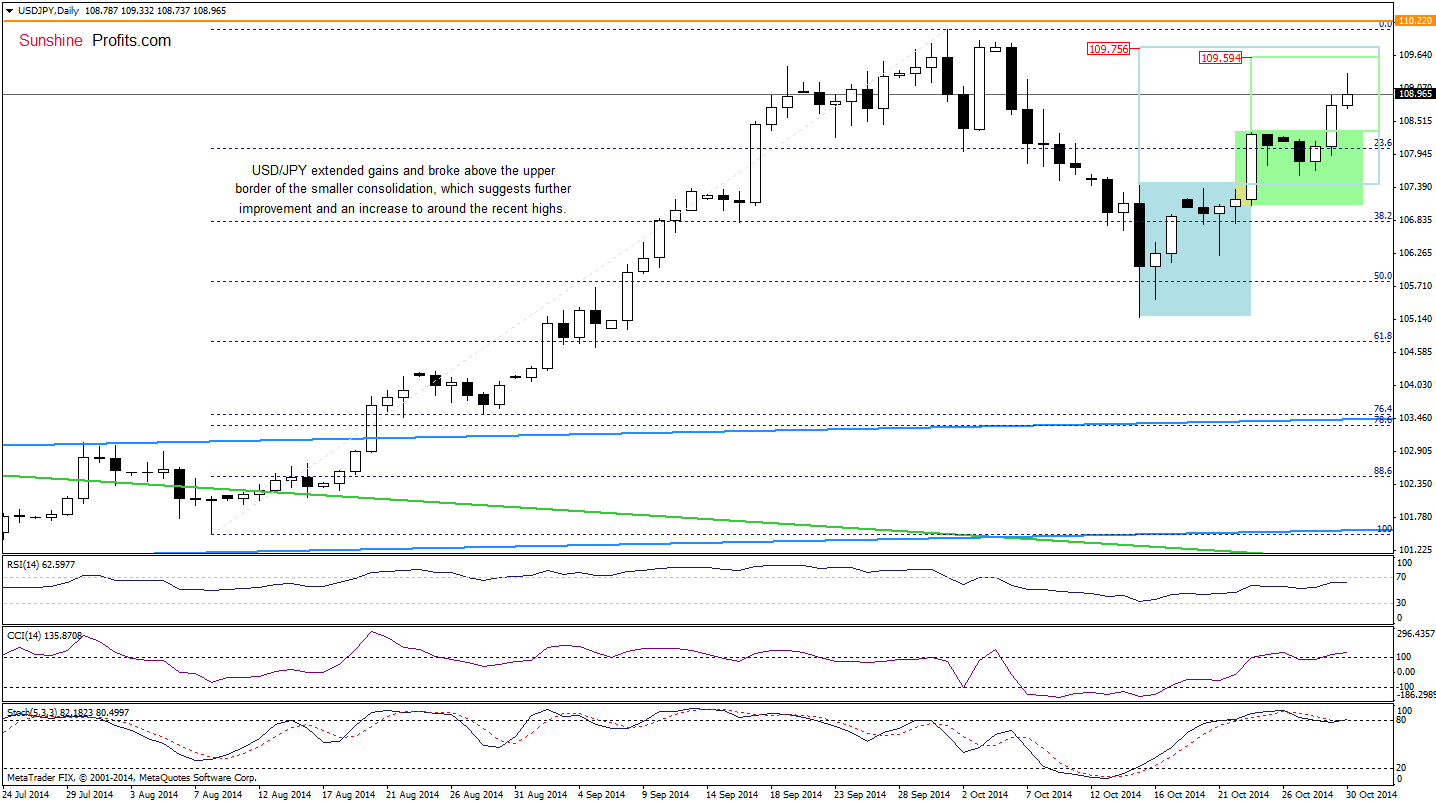

USD/JPY

The situation in the medium term has improved as USD/JPY bounced off the long-term rising support line. How this move affected the very short-term picture?

Looking at the above chart, we see that after several days in a consolidation range (marked with green), USD/JPY moved higher once again, breaking above the upper line of the formation. This is a positive signal, which suggests further improvement to 109.59 or even to 109.75, where the size of the upward move will correspond to the height of the green or blue consolidation.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: mixed

LT outlook: bearish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

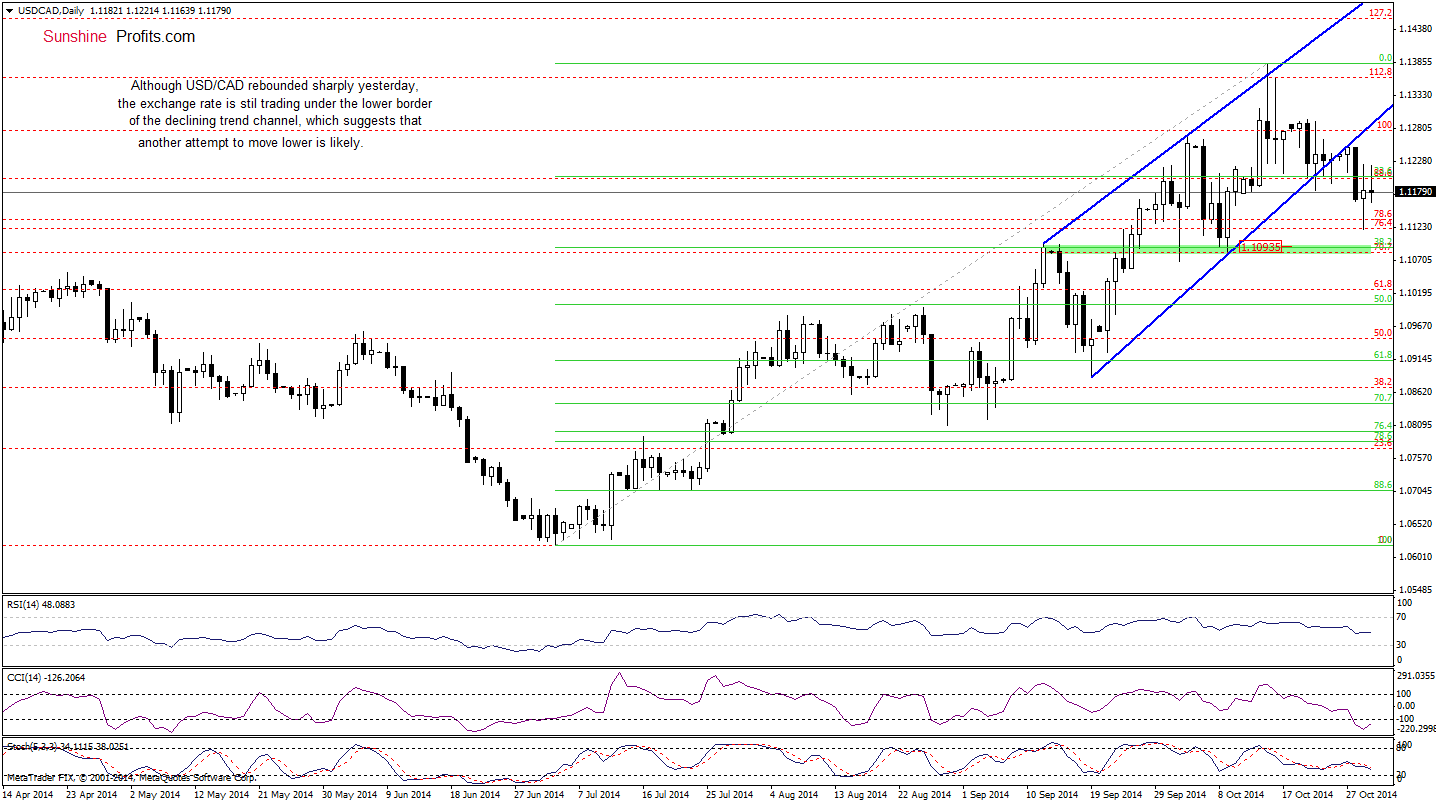

USD/CAD

The medium-term picture hasn’t changed much as USD/CAD is still trading under the upper line of the rising trend channel. Today, we’ll focus on the very short-term changes.

From this perspective, we see that although USD/CAD extended losses yesterday, the pair rebounded sharply and erased almost 80% of Tuesday’s decline. Despite this improvement, the exchange rate is still trading below the lower border of the rising trend channel, which means that as long as there is no invlidation of the breakdown another attempt to move lower should not surprise us. If this is the case, the initial downside target would be around 1.1093, where the 38.2% Fibonacci retracement (based on the entire Jul-Oct rally) and the green support zone (marked on the daily chart) are.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed with bearish bias

LT outlook: bearish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts