Economic Outlook

This week we will cover the ECB QE action, Euro, USD and their implications for global trade. We’ll also update a still-intact rally in gold, silver and the miners along with some (NFTRH+) trade opportunities. But first let’s review December’s Semiconductor Equipment sector Book-to-Bill ratio, just out on Friday evening and discuss some of the dynamics in play with respect to the ‘b2b’ and the US economy.

From Semi.org: The three-month average of worldwide bookings in December 2014 was $1.37 billion. The bookings figure is 12.3 percent higher than the final November 2014 level of $1.22 billion, and is 1.1 percent lower than the December 2013 order level of $1.38 billion.

“While three-month averages for both bookings and billings increased, billings outpaced bookings slightly, nudging the book-to-bill ratio slightly below parity,” said SEMI president and CEO Denny McGuirk. “2015 equipment spending is forecast to remain on track for annual growth given the current expectations for the overall semiconductor industry.”

For our purposes in gauging the US economy, it is the ‘Bookings’ category that is most important, because orders booked today represent future economic activity. So while the actual b2b has declined a bit, it was due to accelerated billings with bookings actually increasing in December.

As for Mr. McGuirk’s forecast, we’ll take that with a grain of salt as this highly cyclical industry in particular is subject to sudden re-do’s when it comes to forecasts. With positive trends currently firmly in place, what is he going to say ‘the trends have been good but we have a feeling it is all about to grind to a halt’?? We’ll just robotically update the b2b each month going forward and use actionable data.

For now, the Canary in the Coal Mine is chirping away, and so a key forward-looking US economic indicator is fine. But you may recall that in Q4 2014 we drew a parallel between high end Semiconductor fab equipment and new Machine Tool sales. So with the caveat that I have no hard data to correlate year-end Semi Equipment sales dynamics with those of Machine Tools, we wondered if the SEMI b2b might get a December bump just as we are able to set our watches by year-end (for tax management considerations) Machine Tool sales. I have marked up the graphic from EDAdata.com:

Far from the days of the skilled machinist deftly turning handles with great precision while making calculations to tight tolerances, today’s machinist is a programmer with a CAD/CAM system and wireless data download to what are in some cases $1,000,000 or higher production beasts. A typical range is in the $150,000 to $700,000 per unit. One machine can easily cost more than a fine 5 bedroom home in a nice neighborhood. The point is, this ain’t Grandpa’s machining industry. It is high end manufacturing technology.

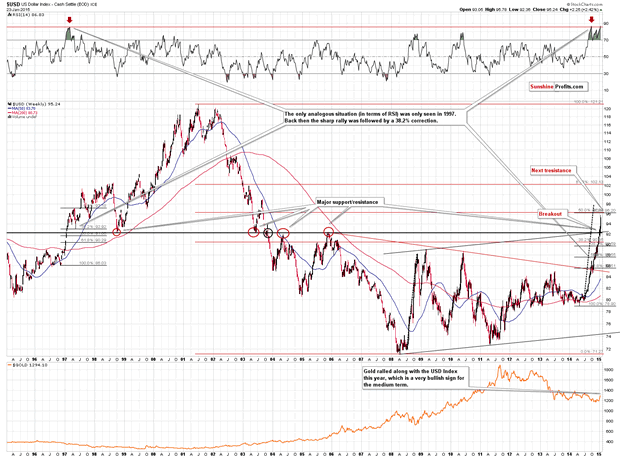

We have been thinking about the strong US dollar and its likely effects on the US economy over time. So far, there is some moderation in the data that mainstream economists and financial media focus on. The December ISM report on manufacturing moderated, with particular focus on ‘New Orders’, Wage growth has failed to take hold, Jobless Claims bumped up last week above expectations and Existing Home Sales came in well lower than forecast by economists.

But generally, the picture is still okay, albeit wavering. Oh, the Consumer is giddy. Okay, well… we have been in an ‘as good as it gets’ phase so why shouldn’t he get out there and run up his credit card a little?

The point is, we have expected a couple things…

1) The relentless strength in USD to eventually wear away at US manufacturing and exports (this maybe be in its very early stages) and…

2) A year-end phenomenon in the US Machine Tool industry to remain unbroken. This would see a spike in December’s Machine Tool sales primarily due to reasons other thanthe economy.

The usual sources in the mainstream economic analysis sphere are looking at the usual economic data sets. We will watch those, but to be as early as possible in getting real economic signals we need to watch the Canaries that started the whole economic upswing as we noted in real time in January of 2013; Semiconductor Equipment and by extension, manufacturing in general. These led by a country mile the now readily observable economic revival.

Machine Tools sales are due for a spike and we have identified one company (NFTRH+, reviewed next segment) as a short after the year-end sales bump and continued stock price appreciation. We also have another company from the long side (NFTRH+, also reviewed next segment) for a trade. Company #1 is a standard US based machine tool builder with a lot of competition and Company #2 is also based in the US, but has far less competition for its unique product line. Back on the main topic…

Bottom Line

Certain economic data have softened in recent weeks in line with the idea that an impulsively strong US dollar can start to fray the edges of certain industries and sectors. But we will await confirmation by the Canary that started it all in January of 2013. SEMI just reported a very decent Semiconductor Equipment b2b and the Machine Tool segment is due for its traditional year-end bump.

If these prove to have been seasonal bumps, perhaps trades can be made but more importantly, we may yet get some confirming negative economic data points a little further into 2015. We should watch future ISM, b2b and Machine Tool sales closely.

The Euro continued its correction higher from the lows seen yesterday morning and is currently trading at 1.1322 ( +.75%), after the panic from an election win by the left leaning Syriza party subsided. This was helped when the political leader of the party promised to keep Greece in the euro zone while he negotiates a write-down of Greek debt. Reports that the Swiss national bank was in the market yesterday countering the Swiss francs ascent also helped the bid in the Euro currency. Continued commentary from Bank of England officials about the need to look through current inflation data has lent its hand to a strong bid in sterling (1.5189) despite slightly weaker 4th quarter GDP data. Durable Goods orders for the US which missed expectations ( -3.4% VS exp +0.6%) also contributing to the USD weakness. The Canadian dollar has also benefited from the general USD weakness and a rebound in crude from the lows.

CAD Range 1.2416-1.25 currently 1.2416

In This Week’s Issue:

– Stockscores’ Market Minutes Video – Small Cap vs. Large Cap

– Stockscores Trader Training – Small Cap vs. Large Cap

– Stock Features of the Week – Stockscores Simple Weekly

Stockscores Market Minutes Video – Small Cap vs. Large Cap

There are two important factors which affect how we trade small cap stocks versus large cap stocks. This week, a focus on that before my regular weekly market analysis.

Trader Training -Small Cap vs Large Cap

Investors often group stocks by their market capitalization, the total value of the company based on the price of their shares multiplied by the number of shares outstanding. Microcap stocks might have 20,000,000 shares out with a price of $0.50 – these tend to dominate the TSX Venture Exchange. A company with a few hundred million is more of a real business but still considered a small company compared to the large cap stocks that dominate the major market indexes, each valued at many billions of dollars. Apple, currently the largest company listed in North America, has a market cap of $659 Billion.

There are significant differences in how stocks small cap stocks trade compared to large caps. It is important to understand these difference so you can approach trading the in the right way. Here are some things to consider:

Liquidity – liquidity is a measure of how actively a stock trades and how smooth the price movements are for a stock. Generally, large cap stocks are more actively traded and make less volatile changes in price. Small cap stocks don’t have as many investors which makes them subject to a higher level of price volatility. This means that the reduced liquidity of small cap stocks makes them riskier. A stock that does not trade actively can make big price swings because of the actions of one large investor.

From a practical standpoint, this means you can suffer a bigger loss than you plan for in your risk management. You may plan to exit a trade if the stock hits your stop loss point at $5. However, if the stock is not very liquid and many investors try to exit at the same time, you could end up getting out at a much lower price than what you had planned for.

Correlation – every stock has some correlation to what the overall market is doing. If the general market is going up in value, most stocks will also go up. Large cap stocks tend to be more closely correlated to the market index. If you look at a chart comparing Microsoft (MSFT) with the Nasdaq 100 (QQQ) you will find that they move all most exactly the same way.

This makes it important to analyze the market index as well as the stock when considering the purchase of large cap stocks. Even if the large company you are considering is doing great things in its business, it may not perform well if the overall market heads lower.

This also means that large cap stocks can outperform small cap stocks when the overall market is strong. We have seen this over the past year; small cap stocks have been flat while the large cap stocks have moved in a strong upward trend with the overall market.

If the overall market breaks its long term upward trend, we may see money look for market beating returns in small cap stocks because this group is not so closely correlated to what the overall market is doing.

Performance – small cap stocks have a greater capacity for percentage return, up or down. Smaller companies tend to have a less diverse business which means they can go up or down rapidly based on the performance of their products or services. Consider how a company making a smart watch would do if it was successful. For a company like Apple, the launch of a smart watch might bring in a few billion dollars in sales but that, in the context of their overall business, will not have a huge impact on earnings. If a small cap company had the same success with the same product (and it was their only product), the effect on their stock price would be massive.

Of course, the failure of a business can also have a huge effect on share price. We often see small cap biotech stocks suffer painful and sudden sell offs when a drug that they are developing fails to get approval.

This defines the risk reward trade off that comes with selecting between market caps when investing. Large stocks have a hard time significantly beating the overall market. Small caps can achieve this but they can also suffer significant losses. With smaller cap stocks, risk management is more important.

Yield – many investors like stocks that pay a dividend since they rely on their portfolio for income. Most small cap stocks are working to grow earnings and use their capital to reinvest in their business. Once companies get large, they begin to return their earnings to shareholders as dividends. If you want to collect dividends, you will generally focus on larger cap stocks.

Fun – historically, I have found that trading smaller cap stocks is more fun. It is enjoyable to buy a stock at $5 and watch it go to $10 in a few days. That can happen with small cap stocks, it is rare with large cap.

Of course, making good returns is always going to be fun and you ultimately have to go to where the trend is strong. Large cap stocks have been in an upward trend for a number of years making it likely that any investor in boring, large cap stocks has felt pretty good watching them go up, even it has been slow and steady.

![]()

This week, I ran the Stockscores Simple Weekly Market Scans for the US and Canada. I found a lot of stocks that are well in to their upward trends and then another large group that had good gains last week but which are fighting long term pessimism. There were not many that seem to be initiating a new upward trend, but here are two that are worth considering:

1. BV

BV has been building rising bottoms in recent months, indicating that optimism is improving. This week, it broke to highs not seen for almost a year and the stock looks like it can move up toward the $11

2. BX

BX is breaking to new highs after trading sideways for a year, a good indication that it will continue its long term upward trend. The stock has a healthy historical yield of 5.5%.eks as investors bottom fish the oversold Gold Mining stocks. Since it is a leveraged ETF, be careful with longer term holds.

References

- Get the Stockscore on any of over 20,000 North American stocks.

- Background on the theories used by Stockscores.

- Strategies that can help you find new opportunities.

- Scan the market using extensive filter criteria.

- Build a portfolio of stocks and view a slide show of their charts.

- See which sectors are leading the market, and their components.

Disclaimer

This is not an investment advisory, and should not be used to make investment decisions. Information in Stockscores Perspectives is often opinionated and should be considered for information purposes only. No stock exchange anywhere has approved or disapproved of the information contained herein. There is no express or implied solicitation to buy or sell securities. The writers and editors of Perspectives may have positions in the stocks discussed above and may trade in the stocks mentioned. Don’t consider buying or selling any stock without conducting your own due diligenc

Stock Trading Alert originally published on January 26, 2015, 6:39 AM:

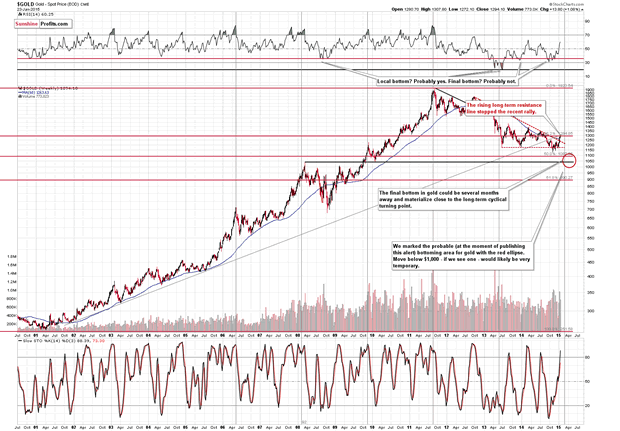

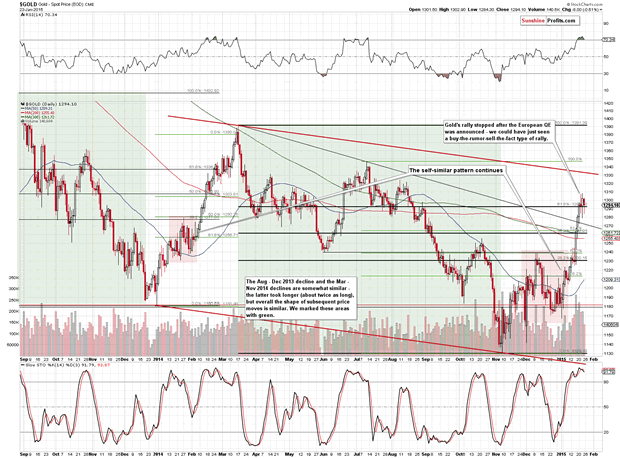

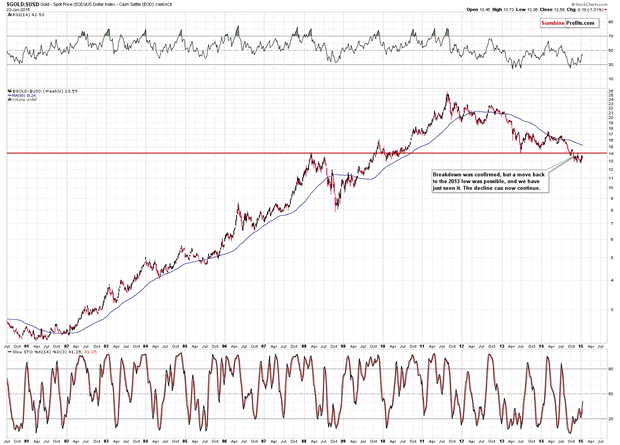

Briefly: In our opinion, no speculative positions are justified.Our intraday outlook remains neutral, and our short-term outlook is neutral:

Intraday (next 24 hours) outlook: neutral

Short-term (next 1-2 weeks) outlook: neutral

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

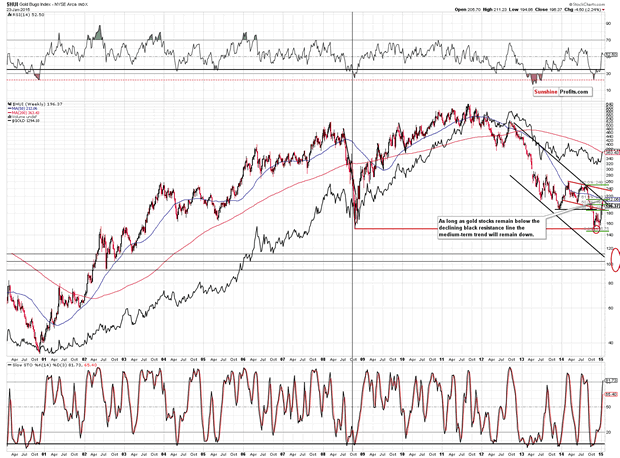

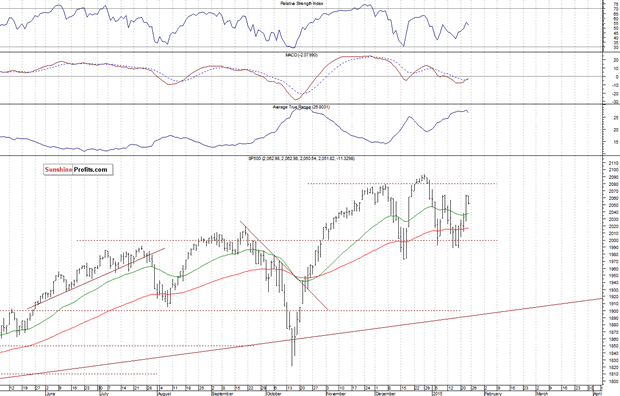

The U.S. stock market indexes were mixed between -0.8% and +0.2% on Friday, as investors took some profits off the table following Thursday’s European Central Bank’s monetary policy decision release. The S&P 500 index remains within its three-month long consolidation, as it continues to trade along the level of 2,000. The nearest important resistance level is at around 2,060-2,065, marked by previous local highs. On the other hand, level of support is at 2,020, among others, as we can see on the daily chart:

Larger Image

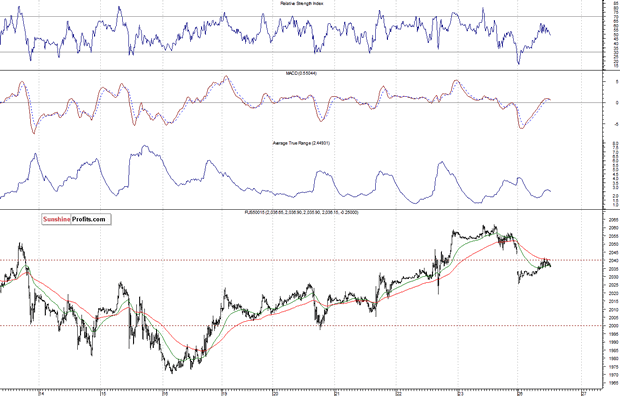

Expectations before the opening of today’s trading session are negative, with index futures currently down 0.2-0.4%. The main European stock market indexes have been mixed so far. The S&P 500 futures contract (CFD) is in an intraday uptrend following a lower opening. The nearest important support level remains at around 2,025-2,030, and level of resistance is at 2,040, marked by Friday’s local low. For now, it looks like a downward correction within a short-term uptrend:

Larger Image

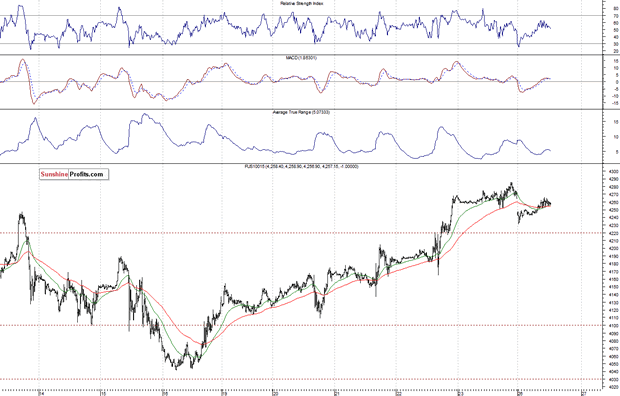

The technology Nasdaq 100 futures contract (CFD) follows basically the same path, as it trades along the level of 4,260. Resistance level remains at around 4,280-4,300, and the nearest important level of support is at 4,230, as the 15-minute chart shows:

Larger Image

Concluding, the broad stock market retraced some of its earlier gains on Friday, as investors took profits off the table. It still looks like a volatile medium-term consolidation following last year’s October-November rally. We prefer to be out of the market, avoiding low risk/reward ratio trades. We will let you know when we think it is safe to get back in the market.

Thank you.