Gold & Precious Metals

Earnings Concerning For Bulls

In the markets, everything matters. Common sense tells us that stocks in the long run are tied to corporate earnings. Therefore, it is not particularly surprising that stocks have been going nowhere fast in recent months given the recent negative slant on earnings expectations. From CNBC:

Analysts are widely expecting S&P 500 companies to post their first year-over-year decline since the third quarter of 2012. U.S. markets struggled in the first quarter as investors worry over the impact of falling oil prices on overall earnings and the effect of a strong dollar on multinational companies, whose products are more expensive in foreign markets when the greenback firms up.

Bullish Door Not Closed Yet

With respect to earnings, the easy thing for investors to do is to extrapolate the recent bearish trend several months down the road. While earnings reports may meet bearish expectations, it is also possible that future guidance comes in above low expectations. Is there any support for the “things could turn out better than expected” scenario? Yes, one example comes from the easy to understand triangle formation shown on the weekly chart of the NYSE Composite Stock Index below.

Triangles Are A Reflection Of Conviction

Points A, B, C, and D in the chart below show a series of higher lows. The higher lows tell us that buying conviction has exceeded selling conviction at higher and higher levels in recent months. Another way to visualize the formation of the triangle is that dip buyers have been less and less patient since the October 2014 low. The higher lows are the good news for the bulls. The bad news is that based on numerous concerns, including earnings and the Fed, buying conviction has not been strong enough to exceed the “cap” (see orange line below).

What Does History Tell Us?

The formal name of the pattern above is an “ascending triangle”. According to Investopedia:

An ascending triangle is generally considered to be a continuation pattern, meaning that it is usually found amid a period of consolidation within an uptrend. Once the breakout occurs, buyers will aggressively send the price of the asset higher, usually on high volume. The most common price target is generally set to be equal to the entry price plus the vertical height of the triangle.

All patterns speak to probabilities, rather than certainties. Is it possible the bears seize the day in the coming weeks and stocks experience a correction? Sure, it is possible. Even if the bearish scenario plays out, the charts above can still assist us by giving us a reference point to spot a lower low.

A Bullish Bias, But Momentum A Big Concern

A reader of our recent posts may have a fair argument along the lines of “you clearly have a bullish bias”. The bias is the market’s and has nothing to do with our personal opinions at CCM. The following statement is factual…”the stock market has a bullish bias”. How do we know that? The hard data/facts still side with the bulls. The series of higher lows since the October 2014 low is observable…and it also leans bullish until the chart morphs into a series of lower lows and lower highs. While the weight of the evidence still sides with the bulls, a portion of the evidence is screaming “slowing momentum…be open to lower lows and a correction”. This video clip puts some additional context around some observable changes that would increase our concerns about the stock market.

As we approach the end of the quarter, the global economy has set the fertile ground for more growth. Cutting interest rates and extended stimulus has been the prime action taken by several countries–notably in South East Asia. Meanwhile, the American and British central banks are pondering on a possible rate hike. It remains difficult to predict but it is a matter of when and not if.

The Federal Reserve has unanimously chosen not to raise interest rate for a while. Instead, Fed Chair Janet Yellen sounds rather dovish after her remark at the strong U.S. dollar. A healthy correction on the dollar is underway while we reckon this is only temporary at best. There were various discussions about the strong dollar which affect the equity market. Any plans for a rate hike look set to delay until June or September period. Further evidence of better than expected economic data will drive the need to raise interest rates.

Mark Carney and the Bank of England have a lot to juggle as they look to inflate the British economy in the second quarter of 2015. Interest rate is already very low; inflation at zero and with austerity plan set by the current government, Britain may need to embrace deflation for a short while. Anymore cut in the interest rate has been ruled out and other policies may be in place to kick start the economy again.

Finally, there is some light at the end of the long tunnel for Greece. Some aid money will be release for the Tsipras government to pay their creditors after reforms were agreed with Miss Merkel.

This week promises to end with a bang as there are flurry of economic data that could swift the weight on the current U.S. dollar strength. Expect precious metal prices to consolidate but should react abruptly if there are nasty surprises on those data. All eyes will be on the current dollar strength – long live King Dollar.

Bullish engulfing candlestick stood out from last week commentary. Hedge funds are busy unwinding their short positions for profit and the bears ease off the selling pedal. Obviously the U.S. dollar correction play a significant part; allowing gold prices to rocket higher with resistance at 1205, 1225 and 1244 respectively from the Fibonacci retracement line January 2015 high. Our shorts were stopped out in a momentary flash after the Yemen bombing or shall we say one big whale unwinding short to shock and awe the market. Our argument remains bearish since we see a stronger dollar which will continue to drive the market.

Should upper resistance hold then a potential head and shoulders to resume downtrend?

….read page 2 HERE

I’ve often been criticized over the past year for not being short-term bullish the stock market when I’m so bullish long-term, expecting Dow 31,000 in the years ahead.

The reason that I am not bullish short- and intermediate-term though is simple: Markets never go straight up.

Indeed, to make big moves up, a market must first make a big move down. That’s how it gains the energy to move higher. Longs are wiped out, shorts get their 15 minutes of fame, and then once a market suddenly crashes, new buyers can come in and shorts can cover their positions, turning the market back around to the upside.

And so it is with the Dow Industrials and other major U.S. stock averages. Until they suddenly crash, shaking out all the longs and giving the shorts their time in the sun, there will be no further major move higher. Period.

If you want more evidence besides all the technical evidence I’ve given you recently from my charts and trading systems, consider the following, courtesy of Bob Prechter’s Elliot Wave Financial Forecast.

I’m talking about bullish sentiment toward stocks. It’s off the charts, and set up to see the markets suddenly shake everyone out.

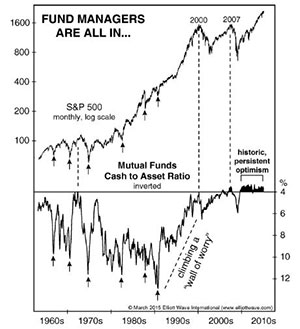

Take a look at this chart. It shows fund managers mutual fund cash-to-asset ratio, meaning how invested those funds are in stocks, how bullish the fund managers are.

The lower the amount of cash they have (bottom right scale), the more bullish and committed those fund managers are to stocks.

You’ll notice two important points …

1. Cash is highest at market bottoms, and conversely, cash is lowest at or near market tops. Just look at the arrows. And …

2. All major tops in the stock market have occurred when cash was near the 4 percent level, or less.

In fact, according to the analysts at Prechter’s research firm, the only lower reading than we have today at less than 4 percent cash occurred in 1972, just before one of the biggest stock market declines since 1930, at that time.

Refer now to the vertical dashed line at the year 2000. Just before that crash and the tech wreck, mutual fund cash stood at 4 percent as well.

And now refer to the second vertical line in 2007 right at the beginning of the real estate bust. Mutual fund cash dipped below the 4 percent level just before that crash hit.

Now look at where this chart stands today. Mutual fund cash is at historic low levels, meaning optimism is at historic highs. There is simply no way the Dow can take off for my long-term target of 31,000 when optimism is so extreme.

Here’s another chart from Prechter’s firm. It shows how bullish retail investors are right now, and what happens when they are so euphoric as well.

The middle graph shows retail sentiment toward stocks via the money market funds of mutual fund investors as a percentage of S&P 500 market capitalization.

Notice how virtually every time those money market holdings — cash — fell below 5 percent, the market tanked.

Now notice where money market holdings are now, at a historic low of less than 3 percent!

Traders too are overly bullish. Look at the bottom graph in the chart. Bullishness among traders is at a 15-year extreme based on weekly data.

Are retail investors and individual traders super bullish? You bet they are.

Will they experience super-sized gains going forward, or, will they be led to the slaughterhouse next?

My view: The slaughterhouse gates are starting to open!

Soon there will be a sudden, sharp downdraft in stock markets that will scare the bejesus out of nearly everyone.

As to timing it, yes, my timing for an interim top has been off for a while if you want to get picky about it. Price-wise though, my timing hasn’t been off, as all the Dow has done since December 2014 is trade in a range defined by roughly 17,014 on the downside and 18,295 on the upside.

That’s a 1,281 point trading range that has lasted five months. Not the kind of trading range you should be doing much with except waiting for either a breakout above it, or a drop back to test long-term support.

Bottom line: I maintain my view, based on my charts, my system models, cyclical models and more, such as the extreme levels of bullishness that are out there …

That the next BIG MOVE in stocks is going to be DOWN, and DOWN HARD.

Once that unfolds, then, and only then, will stocks be in a position to move to new record highs. My long-term target of Dow 31,000 remains in effect, but unless you hedge, you may have to ride through one heck of a downdraft.

To hedge your stock investments, those that you can’t or don’t want to get out of, consider inverse ETFs on the broad indices. ETFs such as the ProShares UltraPro Short QQQ on the Nasdaq 100 (SQQQ) … ProShares UltraPro Short Dow30 (SDOW) … and the ProShares UltraPro Short S&P 500 (SPXU).

Speculators should consider the same, for your time to make hay is rapidly approaching.

Lastly, there are no changes in any of the other key markets. Gold and silver are bouncing, but their bounces are very weak. Oil’s bounce is weak as well. The dollar’s pullback is very shallow. Deflation still rules!

Best wishes, as always …

Larry

WHAT EXTREMES?

The S&P 500 Index has tripled in 6 years, is overbought, and at an all-time high. See graph showing 7 year cycle highs and overbought indicators.

Earnings do not support the high valuations of US stocks. Note the extreme valuations as shown in the graph below, courtesy of Arabian Money.

Interest rates are currently at multi-generational or all-time lows and consequently bonds are extremely high in the “bubble-zone.” Many European banks and sovereign governments are “paying” negative interest. Unthinkable a few years ago!

The dollar index rallied over 25% between May 2014 and March 13, 2015 – an exceptional and parabolic rally, particularly considering the precarious financial condition of the US government and the Federal Reserve. See article here from Laurence Kotlikoff.

Derivatives, depending on who is counting, are approximately $1,000 Trillion globally. This extreme bubble is growing. All bubbles eventually pop.

Leverage in the financial system is more extreme than in 2008, before the “Lehman moment” crash in which the global financial system nearly froze.

The “Warren Buffett Indicator” is flashing a warning – equity valuations are high compared to GDP. See graph below.

The Bloomberg Surprise Index is flashing a warning.

There are many more extremes that could be shown, but consider a few specifics.

Robert McHugh has listed a sequence of Fibonacci turn dates at the end of March and early April 2015. Risk of a stock market crash or important correction seems high in this time period.

Markets often turn around solar eclipses. We experienced a solar eclipse on March 20.

Greece will exit the Euro. The issue is not Greece, the Greek people, their economy, or austerity, but paybacks to various banks, mostly French and German. The piper and the bankers must be paid or banking cartel profits will be decreased. Banking cartel profits are used to “influence” politicians, so politicians listen to the needs of bankers. It is an old story…

We have many economic and political extremes in our current world. Perhaps this time will be different, but I doubt it. Plan on:

- Debt will increase until a “reset” occurs.

- Politicians will “extend and pretend” and make MANY promises.

- The S&P has enjoyed a large rally in the last 6 years. It will correct.

- Bonds are in a massive bubble, partially created by the low and negative interest rates forced upon the system by central banks. All bubbles eventually burst.

- Gold and silver and their stocks have been beaten down for nearly four years. They will rally to new highs.

Gary Christenson

The Deviant Investor