Currency

Forex Trading Alert originally published on Apr 16, 2015, 10:39 AM

Yesterday, the Bank of Canada left its monetary policy unchanged (the overnight cash rate at 0.75%), which in combination with a sharp increase in crude oil pushed the Canadian dollar higher against its U.S. counterpart. As a result, USD/CAD broke below important support levels, confirming a bearish formation. How low could the exchange rate go?

In our opinion, the following forex trading positions are justified – summary:

EUR/USD: none

GBP/USD: none

USD/JPY: none

USD/CAD: short (stop loss order at 1.2876)

USD/CHF: none

AUD/USD: none

EUR/USD

The medium-term picture hasn’t changed much as EUR/USD is still trading in a narrow range between the lower border of the declining trend channel and the long-term resistance line, which means that as long as there is no breakout/breakdown, a sizable upward/downward move is not likely to be seen.

Will the daily chart give us clues about future moves? Let’s check.

Quoting our previous Forex Trading Alert:

(…) the pair invalidated the breakdown under the upper border of the blue declining trend channel and the lower line of the consolidation, which is a positive sign. Additionally, buy signals generated by the indicators remain in place, supporting further improvement.

Yesterday, EUR/USD moved lower and verified the above-mentioned breakout, which was a positive sign that triggered a rebound. Although the pair moved lower earlier today, the exchange rate is still trading above the upper border of the blue declining trend channel (and buy signals remain in place), which suggests another attempt to move higher in the coming days (even if EUR/USD tests its nearest support once again). If this is the case, the initial from our last commentary will be in play:

If (…) the exchange rate moves higher from here, the initial upside target would be the previously-broken orange resistance line (currently around 1.0854).

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment.

USD/JPY

The medium-term outlook remains mixed as USD/JPY is still trading in a consolidation (between the Dec high and low) around the 61.8% Fibonacci retracement level (based on the entire 1998-2011 declines). Today, we’ll focus on the very short-term changes.

On Tuesday, we wrote the following:

(…) the green line is still in play and keeps gains in check. Taking this fact into account, and combining it with sell signals generated by the CCI and Stochastic Oscillator, we think that further deterioration is just around the corner. If this is the case, and USD/JPY moves lower from here, the initial downside target would be the previously-broken red declining support line (currently around 119.36). If it is broken, we might see a decline even to 118.71-118.85, where the bottom of the previous pullback is.

Looking at the daily chart, we see that the situation developed in line with above scenario and USD/JPY reached our downside target. Earlier today, the green support zone triggered a rebound, which took the exchange rate above the declining red line. Despite this improvement, sell signals generated by the indicators remain in place, supporting the bearish case. Therefore, in our opinion, today’s increase will be more reliable if we see a daily close above the resistance line.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment.

USD/CAD

In our yesterday’s commentary we wrote:

(…) when we take a closer look at the chart we can see a potential head and shoulders formation. Therefore, if USD/CAD declines below the neck line (the blue support line around 1.2428), it would be a bearish signal, which will likely trigger further deterioration.

As you see on the weekly chart, USD/CAD moved sharply lower and broke below the neck line, which suggests further correction and a drop to around 1.2000, where the size of the downward move will correspond to the height of the formation and where the 38.2% Fibonacci retracement level is.

Are there any short-term support levels that could hinder the realization of the above scenario? Let’s examine the daily chart and find out.

Quoting our last Forex Trading Alert:

(…) the exchange reversed and declined not only below the blue line, but also under the green support line, which suggests further deterioration and another test of the green support zone or even a drop to the lower border of the declining trend channel (currently around 1.2326) in the coming day(s). Please note that this scenario is also reinforced by the sell signal generated by the Stochastic Oscillator at the moment.

On the above chart we see that currency bears pushed USD/CAD lower as we expected. With this downswing the exchange rate broke not only below the green support zone, but also under the lower border of the declining trend channel. Taking the above into account, and combining it with sell signals generated by the indicators and the medium-term picture, we think that further deterioration s more likely than not. Please note that the pair verified yesterday’s breakdown earlier today, which is an additional negative signal. Therefore, in our opinion, the initial downside target for currency bears would be around 1.2040, where the size of the downward move will correspond to the height of the consolidation (on Tuesday, the pair broke below the lower line of the formation, triggering a bearish scenario).

Before we summarize today’s alert we would like to draw your attention to the relationship between the exchange rate and the oil market. The reason? In January, the Bank of Canada surprised markets with an unexpected rate cut, which was “insurance” (in the words of the Governor Stephen Poloz) against the effects of lower oil prices. Meanwhile, since the beginning of the month, the commodity gained almost 18%, which was supportive for the Canadian dollar (in this period of time USD/CAD lost 3%). Therefore, we think that the pair’s further moves will continue to strongly linked to the price of crude oil (if you want to keep up with the changes taking place every day and receive trading signals, we encourage you to read our daily Oil Trading Alerts).

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (which are already profitable) with a stop loss order at 1.2876 are still justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski

Founder, Editor-in-chief

Sunshine Profits: Gold Investment & Silver Investment

Sunshine Profits: Forex Trading

* * * * *

Disclaimer

All essays, research and information found above represent analyses and opinions of Nadia Simmons and Przemyslaw Radomski, CFA and Sunshine Profits’ associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Nadia Simmons, Przemyslaw Radomski, CFA and their associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Nadia Simmons and Przemyslaw Radomski, CFA are not Registered Securities Advisors. By reading Nadia Simmons’s and Przemyslaw Radomski’s, CFA reports you fully agree that they will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Nadia Simmons, Przemyslaw Radomski, CFA, Sunshine Profits’ employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

USDCAD Overnight Range 1.2223-1.2323

The US dollar is Mr.Toad and it has been on a wild ride this morning. Another bout of weak US economic data (Jobless Claims rose, Housing Starts and Building Permits fell) revered hard won US dollar gains in Europe. USDCAD which had scraped back above 1.2310 prior to the data plunged and is now 1.2228, below the overnight low. The break of major support at 1.2330 combined with a re-evaluation of the Canadian economic landscape and the prospect of higher oil prices have triggered a wholesale bail-out of stale Long USDCAD positions.

The overnight session was entertaining. AUDUSD took over where Canada left off in a lively Asian session. Short AUDUSD traders scrambled to cover positions when Australia announced a whopping 37,700 jobs increase and a drop in the unemployment rate to 6.1% from 6.3% and AUDUSD soared. Kiwi followed AUDUSD higher. USDJPY traders saw the carnage in AUDUSD and USDCAD and sold dollars as well. In Europe, EURUSD traders bought dollars and then reversed course just ahead of the New York opening. The US dollar has been offered ever since.

USDCAD technical outlook

The intraday USDCAD technicals are bearish while trading below 1.2270 with the break of the overnight low at 1.2257 pointing to further losses toward 1.2050. Only a move back above 1.2360 would negate the short term downside pressure. For today, USDCAD support is at 1.2220 and 1.2180. Resistance is at 1.2280 and 1.2310

Today’s Range

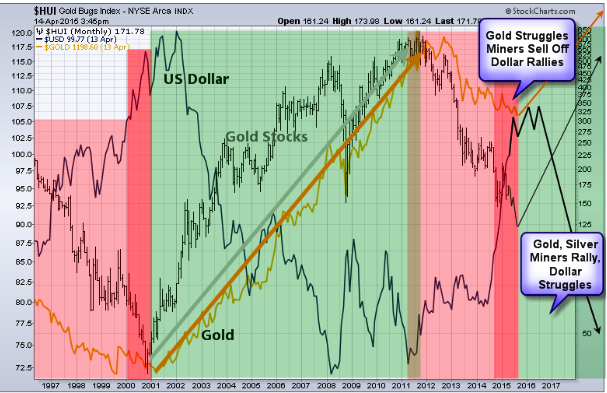

Recently business and financial guru Mark Cuban wrote an article about why this tech bubble is going to be worse than the tech bubble of 2000. This made me take another look at the long term charts again, but instead of looking up the NASDAQ or the tech sector I decided to check out gold mining stocks, gold price and the Dollar index.

From looking at the price action among the precious metals sector and the dollar it looks and feels like these markets are very close to repeating what happened in the year 2000.

The chart below is a monthly chart looking all the way back to 1996. I have color coded areas of the chart that represent weak and strong times for the price of gold.

Gold Price

Key Points:

- The US Dollar is trading roughly at the same level and trending higher as it was in 2000.

- Rising dollar is neutral/negative on commodity prices and resource stocks like gold miners.

- Gold price struggled as the dollar rose in value.

- Gold stocks fell sharply during the last year of their bear market.

- Gold stocks bottomed before physical gold by several months

Concluding Thoughts on Dollar, Miners & Gold Price:

In short, I feel most of the downside damage has already been done to the price of gold. Gold stocks on the other hand could still get roughed up for a few more months before finding a bottom.

Money is likely to continue rolling into the dollar as a safe haven and this will keep gold and silver prices relatively flat. But once the dollar starts to show signs of increased volatility (top) similar to 2000 – 2001 money will find its way into other currencies and precious metals as the new trade and safe haven.

Get My Trades In Real-Time: www.TheGoldAndOilGuy.com

Chris Vermeulen

With gold, silver and crude oil on the move, today King World News wanted to take a step back and look at 7 of the most jaw-dropping charts of 2015.

With gold, silver and crude oil on the move, today King World News wanted to take a step back and look at 7 of the most jaw-dropping charts of 2015.

The following charts are from the Wall Street Journal. The first chart below from WSJ shows that Chinese industrial output is at its lowest since the end of 2008.

….view all 7 HERE