Gold & Precious Metals

Gold Market Update (extensive- Ed)

Posted by Clive Maund

on Monday, 10 June 2013 15:50

We are very close to or at a major bottom in gold and silver now

The Wrong and Right Way to Buy Gold

Posted by Larry Edelson via Dr. Martin Weiss Ph.D

on Saturday, 8 June 2013 17:22

Nearly 21 months ago, one of the world’s leading analysts and proponents of gold shocked the investment community with the announcement that the yellow metal was headed south.

Nearly 21 months ago, one of the world’s leading analysts and proponents of gold shocked the investment community with the announcement that the yellow metal was headed south.

Most of his colleagues in the industry scoffed. But his loyal followers took action according to his explicit instructions:

They bought gold hedges for protection against the decline.

They liquidated all their mining shares.

And then they waited — sometimes patiently, sometimes anxiously — for his next major “buy” signal.

That gold analyst is Weiss Research’s Larry Edelson.

This week, I talked to Larry at length and reviewed his fascinating, but practical, writings. Here’s Part I of our three-part interview …

![]()

d

d

Martin Weiss: Larry, today I want to focus on the major pitfalls to avoid. But before we jump into specific instructions, please lay out the full dimensions of the opportunity.

Larry Edelson: My analysis tells me the next leg of the gold bull market will not end for three full years. It will not peak until the yellow metal is at $5,000 per ounce or more. And it will spin off a long series of trading opportunities in virtually every investment that’s tied to gold and other precious metals — bullion, shares, ETFs, plus unique trades that most investors are unfamiliar with. I’m talking about the biggest gold opportunities since the Great Depression.

Martin: Talking about the Depression, my father told me how much money he and his colleagues made in the gold market back then.

Their Homestake shares surged from $65 to $540 per share. The company’s dividends doubled, redoubled and doubled again, reaching $56 per share in 1935. So the dividends alone were almost enough to pay back the entire purchase price of the stock.

Their shares in Dome Gold Mines did even better — surging from $6 to $61 per share and throwing off dividends that added up to two and a half times the purchase price of the shares.

Is this the kind of opportunity you see here?

Larry: Yes, but not if you jump in prematurely, like so many gold investors have continually done in the past 21 months or so.

Martin: I know … and as you well know, we’re counting on you to give us the signal. Don’t get me wrong. I recognize no one can ever pick the exact bottom. But if you can just get your readers back into the market reasonably close to a good buying zone, I think they will be forever grateful.

Larry: I’ll do my best. But first, a warning: All too often, investors jump into the precious metals markets thinking that, just because metals are tangible assets, they can’t possibly get ripped off.

But the sad truth is that they often are fleeced by hidden charges, conflicts of interest and, sometimes, outright frauds. This is especially the case in a long-term bull market when investors get complacent and rising prices help camouflage the fraud. When people are making good money, they don’t notice how badly they’re getting clipped.

For instance, in October 2009, Chinese-made counterfeit gold coins flooded online gold auctions and even flea markets — and that was just one example of more than 1 million fake coins that were sold in the U.S. alone.

Even legitimate “replica”-type gold- and silver-plated coins have become a hotbed for scams. In fact,Coin World reported that up to 99 percent of the “replica” items sold into the U.S. market do not contain the required “COPY” markings to make them legitimate replicas.

Martin: Let’s say I’m buying an Australian Nugget or a British Sovereign or a Canadian Maple Leaf, or even an American Eagle. How do I know whether it’s real or counterfeit?

Larry: You don’t. But one way to protect yourself is to buy bars from the refiner. If I bought a Johnson Matthey bar, and Matthey told me it was the original, straight from their refinery, that would be very reassuring. Ditto for Engelhard.

Fortunately, bullion coins are much harder to counterfeit than bars, because the designs are more intricate. Still, even with the coins, counterfeits can be a problem.

It’s almost impossible to make a counterfeit gold bullion coin that’s not obviously different in weight, diameter or width. So the key is to compare its weight and dimensions against a coin you know is real. Even if you’re not experienced with coins, you can tell the difference.

Martin: Suppose I want to buy a piece of jewelry made with gold coins?

Larry: Then buy the coins separately and give them to a jeweler you can trust to make the piece for you.

Martin: In one of your reports, you warned about counterfeit coins made with tungsten.

Larry: Yes, tungsten has the same density as gold. Until recently, a tungsten counterfeit would show up obviously as a counterfeit because the strikes were so poor. Now, with better technology, tungsten counterfeits are almost impossible to detect visually. But you can still use the “ringing test” to see if it’s real or not. Drop it on a hard desk. Then do the same for a coin that you know is real. You’ll hear a distinct difference in the sounds the two coins make.

Martin: I always see ads about so-called “mint state” and “limited edition” bullion coins that are supposedly worth much more than a common bullion coin. What do you think about that?

Larry: It’s pure hogwash. Bullion coins are not rare coins. Period. The governments and marketing firms that sell them don’t seem to care the least bit about the losses investors eventually incur.

If you want to buy bullion, stick with bullion coins you can buy with fair premiums over their melt value.

Stay away from the “limited edition,” “proof” or “mint state” claims, whether it be on proof Pandas, proof Krugerrands, proof U.S. Eagles, proof Sovereigns, proof Australian Nuggets or any other.

As for numismatic coins, they can be great. But it’s a market no one should invest in unless they are an expert, or have one at their disposal.

Martin: A big issue you write about is the premium an investor pays for bullion coins — in other words, how much more they cost than the metal itself. How should I calculate that premium?

Larry: First, divide the price of the coin by the number of troy ounces of pure gold that it contains. That gives you the cost per ounce. For example, if a coin has 0.9999 troy ounces of pure gold and sells for $1,800. That’s $1,800 divided by 0.9999, or $1,800.18 per ounce.

But the spot price of gold at the time was $1,612. So you’d be paying $188.18 per ounce extra for the gold in this coin. That’s your premium.

Convert that to a percentage, by dividing the $188.18 by $1,612, and you get 11.67 percent.

Martin: That seems darn high to me.

Larry: Darn right it is! But if you consistently use this simple formula, you can more easily sniff out the rotten offers and find the good ones.

Martin: What’s a reasonable premium for gold coins?

Larry: Premiums have gone up quite a bit already in recent years. But if a dealer tries to sell you coins at more than 5 percent over the actual value of the gold content — the average premium levels for a particular coin — I’d go elsewhere. You’d be paying too much.

Each bullion coin producer — the U.S. Mint, Canadian Mint, South African Mint, Chinese Mint, Australian Mint, etc. — builds in a mark-up for its coins, a premium over the pure bullion value or “melt value” of the coin. In each case, this premium varies.

Wholesalers also add a small premium to cover their cost of money and to make a profit on their inventory.

The retailer — the company you buy the coin from — also adds a mark-up.

So the premium over melt can vary widely as each mint, wholesaler and retailer add their pre-determined mark-ups.

Martin: So the lower, the better.

Larry: Not always. Yes, sometimes quality dealers deliberately underprice coins as a way of attracting new customers — like a credit card company that offers an extremely low introductory interest rate. And taking advantage of these opportunities might seem to be a great way to save money on bullion.

But in my experience, most dealers that advertise such gimmicks are out to ensnare you in their marketing net. As soon as you buy that one coin, ingot or bar from them, you’re bombarded with all sorts of deals that aren’t so good. And some that are outright fraudulent.

Moreover, if the firm is consistently selling bullion with premiums that are far below the competition, it raises my eyebrows. They can’t do that for an extended period and remain viable as a business.

Martin: You have helped a lot of people save a lot of money with their gold coin transactions. Can you give us some concrete examples of how that’s possible?

Larry: Sure. Again, let’s say that spot gold bullion is at $1,612 per ounce. And let’s say you bought 100 units of 1990 gold Pandas, the bullion coin issued by the Chinese. You’d pay about $240,000.

But that same $240,000 would buy 133 Austrian Philharmonics. So you would get an extra 33 coins, containing a bit less than 33 ounces of pure gold.

The extra gold you get is a dramatic addition to your portfolio — it’s like a free bonus you get for investing intelligently.

Alternatively, you could simply buy 100 ounces of gold in the form of Krugerrands for roughly $166,830 and pocket the difference — a healthy $73,170.

Martin: I get that. When it comes time to buy in significant amounts, what should I be looking at?

Larry: The Austrian 100 Corona and Hungarian 100 Korona are typically among the least expensive bullion coins (over spot) to buy.

Larry: The Austrian 100 Corona and Hungarian 100 Korona are typically among the least expensive bullion coins (over spot) to buy.

They’re a beautiful reminder of the Austro-Hungarian empire. They’re both the same size, weight and alloy, but they have different designs.

I’ve also found that the South African Krugerrands can give a decent amount of gold for your dollar. It is synonymous in the public eye with 1 ounce of gold and, therefore, extremely liquid.

Martin: The importation of Krugerrands was banned in 1985, wasn’t it?

Larry: Yes. At the time, investors were bombarded with advertisements from dealers warning that severe losses were likely to befall Krugerrand owners.

These ads preyed on investors’ fears to try to get them to “swap” Krugerrands for Maple Leafs, Double Eagles or whatever the dealer happened to be pushing.

Martin: You warned our readers that this was pure poppycock. Were you right?

Larry: I was. And now, despite the fact the ban is over, we still hear of brokers who tell their clients that Krugerrands are dangerous. It’s complete nonsense.

The only reason a dealer would suggest switching your Krugerrands or recommending another product is pure profit. Krugerrand swaps can generate as much as an 8 percent net return for a dealer — between his buy-and-sell spread. And those who push other products are often receiving a higher net commission for those recommended products.

So if you own Krugerrands, sit on them. They still have international liquidity. They’ll always be worth the price of the gold that’s in them.

And for new gold holdings, the Krugerrands represent a cheap way to buy a single ounce of gold. But wait for my “buy” signal.

Martin: We definitely will. Plus, next week, please give us a series of other ways you recommend for buying precious metals.

Larry: Will do. In the meantime, you can get the video issue I’ve just released with my important new forecasts and recommendations for gold and silver. Just click //www.gliq.com/cgi-bin/click?weiss_mam+0102301-7+MAMw023+vgbb@shaw.ca+++3+4422655++“>here.

Martin: Great! I think I can speak for our readers in thanking you very much for providing so much valuable information.

Larry: My pleasure.

THIS WEEK’S TOP STORIES

Bond Market Bombshell: Fed Official Gives ‘Sell’ Signal

by Mike Larson

If there’s any doubt that the generation-long bond-market rally has come to a close, Federal Reserve Bank of Dallas President Richard Fisher just ended the discussion

How Much Longer Will This Bull Market Run?

by Douglas Davenport

“To buy when others are despondently selling and sell when others are greedily buying requires the greatest fortitude and pays the greatest reward.” — Sir John Templeton

The stock market is in trouble … but I’m not turning outright bearish

by Larry Edelson

The stock market is in trouble.

I believe that the interim top that I have been waiting for is finally here. I can see it in the thinning volume in the Dow Industrials and the S&P 500 stocks.

I can see it in the smaller and smaller number of stocks that have led the recent advance, compared to the number that are actually falling.

Major Summer Rebound in the Gold Stocks

Posted by Jordan Roy-Byrne - The Daily Gold

on Friday, 7 June 2013 8:03

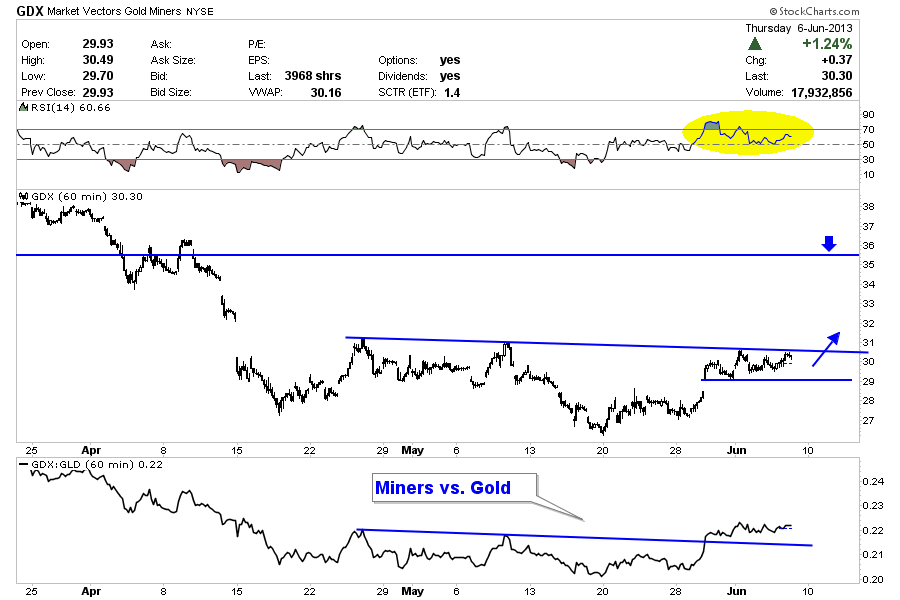

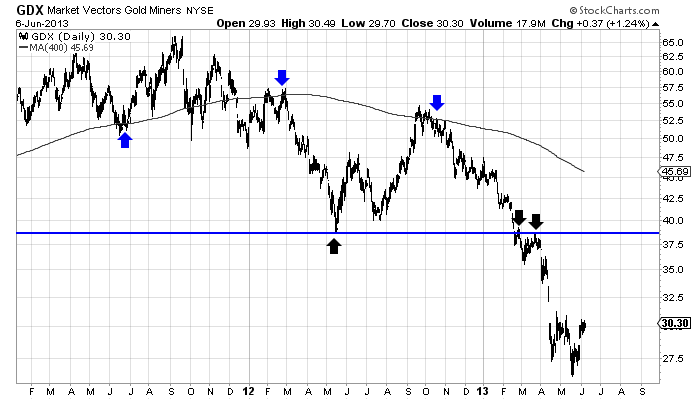

Though we’ve anticipated this rebound since late spring (albeit way too early), it is just about here and will pay big rewards to those who are long. A few weeks ago we wrote 6 Reasons why Gold Stocks will Begin a Big Rally. Since then, the action has been increasingly positive. In four of the past seven days, GDX closed near the high of the day and formed a strong white candle. In the other three days GDX closed well off the lows of the day. The action of the past seven sessions is a sign of accumulation. During these days the sector has performed well in the last 30 minutes of trading (which is when the smart money is most active). We will explain why we are even more confident that a big rally is days away from beginning and why it could continue until late September.

GDX’s price action appears to show a developing reverse head and shoulders bottom. If GDX closes above $31 then it brings a potential target of $35.50 into play. Aside from the bullish price action there are two other important points. Note that the hourly RSI is acting bullish for the first time in many months (yellow). The RSI pierced 70 to the upside and is holding in bullish territory while the market consolidates. Also, the miners have been outperforming Gold. The stocks lead the commodity at key turning points. Gold has struggled to break free but the fact that miners are showing more strength is encouraging for the entire sector.

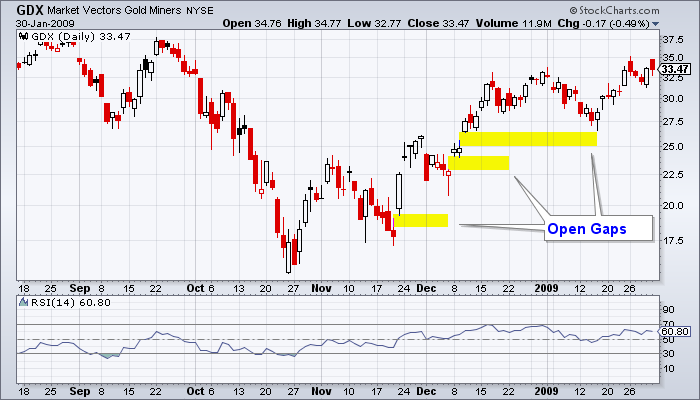

Six days ago the miners gapped up and the majority of the sector (as well as GDX, GDXJ, SIL continues to hold the gap. Checking back to 2008, (chart below) we find that GDX gapped up many times and left three open gaps that were never filled. Two of these gaps occurred immediately after higher lows. The gap from six days ago occurred less than 48 hours following a higher low.

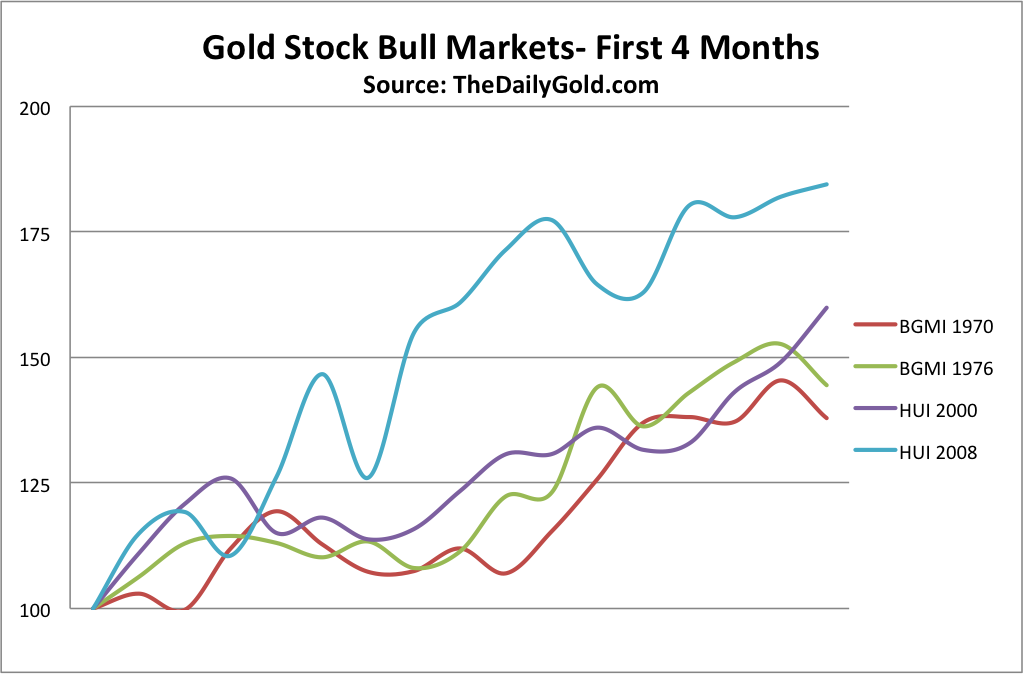

In studying history, we found that following four major bottoms (1969-1970, 1976, 2000, 2008) gold stocks rallied back to the 400-day moving average in an average time of roughly 4.25 months. Currently, GDX has strong resistance at $39, its 38% retracement of the 2011-2013 bear is at $41 and the 400-day moving average is at $45.70 and falling. Four months from now the 400-day moving average should be below $42. In any event, the $39-$41 region is setting up as a potential strong target following the aforementioned $35.50.

If GDX reaches $39 by October then that is a 50% rebound in less than five months. History suggests this is not extreme. In the chart below (which uses weekly data) we show the performance of the gold stocks following their most oversold points within the two secular bull markets. The biggest rebounds followed the 2000 and 2008 lows. Note that the rebounds accelerated in earnest about five weeks after the bottom.

Traders should use the low in late May (on GDX & GDXJ) as a stop.

Some may decry our analysis because Gold has yet to break $1420 and Silver has yet to break $23. At market extremes and turning points its best to focus on the stocks as they are the “tell” for the sector and the commodity. We are aware that there are huge short positions in Gold and the unwinding of those positions will add further fuel to the rebound in both the metals and the shares.

Furthermore, a fall in the S&P 500 will not affect this rebound. It will actually help. Since September 6, 2011 the S&P 500 is up 40.6% while GDX is down 53.3%, Silver is down 45.7% and Gold is down 24.0%. There is a clear long-term negative correlation between equities and precious metals. This was also the case from 1972 to 1977 before Gold accelerated into its bubble phase and from 2001-2002. Precious metals can and will perform well when the S&P corrects or goes sideways.

It’s been a tough road for precious metals but the path ahead has strong potential of being significantly profitable and in a short period of time. The buying opportunity that we’ve spoken of for months is now here. When precious metals equities rebound, they rebound violently. If you’d be interested in our analysis on the companies poised to recover now and lead the next bull market, we invite you to learn more about our service.

Good Luck!

Jordan Roy-Byrne, CMT

Gold, Silver & Precious Metal Miners Signals

Posted by Chris Vermulen - GoldandOilGuy.com

on Thursday, 6 June 2013 8:44

It has been a very long couple of years for the precious metal bugs. The price of gold, silver and their related mining stocks have bucked the broad market up trend and instead have been sinking to the bottom in terms of performance.

Earlier this week I posted a detailed report on the broad stock market and how it looks as though it’s uptrend will be coming to an end sooner than later. The good news is that precious metals have the exact flip side of that outlook. They appear to be bottoming as they churn at support zones.

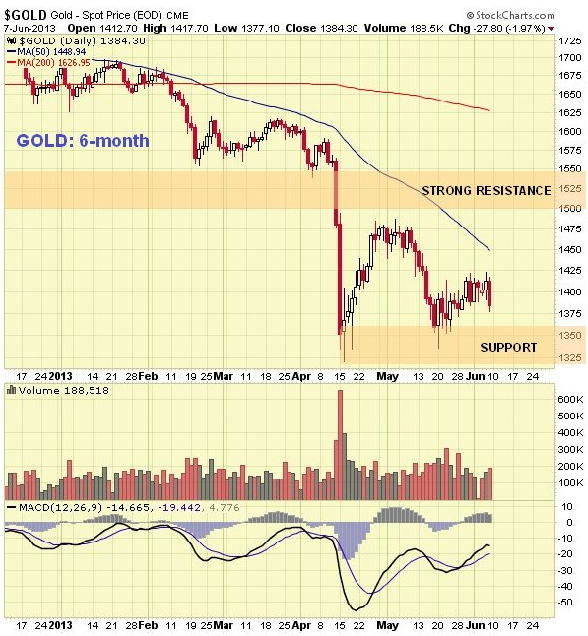

While metals and miners remain in a down trend it is important to recognize and prepare for a reversal in the coming weeks or months. Let’s take a look at the charts for a visual of where price is currently trading along with my analysis overlaid.

WEEKLY PRICE OF GOLD FUTURES:

Gold has been under heavy selling pressure this year and it still may not be over. The technical patterns on the chart show continued weakness down to the $1300USD per once which would cleanse the market of remaining long positions before price rockets towards $1600+ per ounce.

There is a second major support zone drawn on the chart which is a worst case scenario. But this would likely on happen if US equities start another major leg higher and rally through the summer.

WEEKLY PRICE OF SILVER FUTURES:

Silver is a little different than gold in terms of where it stands from a technical analysis point of view. The recent 10% dip in price which shows on the chart as a long lower candle stick wick took place on very light volume. This to me shows the majority of weak positions have been shaken out of silver. Gold has not done this yet and it typically happens before a bottom is put in.

While I figure gold will make one more minor new low, silver I feel will drift sideways to lower during until gold works the bugs out of the chart.

SILVER MINING STOCK ETF – WEEKLY CHART:

Silver miners are oversold and trading at both horizontal support and its down support trendline. Volume remains light meaning traders and investors are not that interested in them down where and it should just be a matter of time (weeks/months) before they build a basing pattern and start to rally.

GOLD MINING STOCK ETF – WEEKLY CHART:

Gold mining stocks continue to be sold by investors with volume rising and price falls. Fear remains in control but that may not last much longer.

GOLD JUNIOR MINING STOCK ETF – WEEKLY CHART:

Gold junior miners are in the same boat with the big boys. Overall gold and gold miners are still being sold while silver and silver stocks are firming up.

PRECIOUS METALS TRADING CONCLUSION:

In the coming weeks we should see the broad stock market top out and for gold miners along with precious metals bottom. There are some decent gains to be had in this sector for the second half of the year but it will remain very dicey at best.

If selling in the broad market becomes intense and triggers a full blown bear market money will be pulled out of most investments as cash is king. Gold is likely to hold up the best in terms of percentage points but mining stocks will get sucked down along with all other stocks for a period of time. This scenario is not likely to be of any issue for a few months yet but it’s something to remember.

Get My Daily Precious Metals Report Each Morning And Profit!

www.TheGoldAndOilGuy.com

Chris Vermeulen

The five stages of the historical lessons of gold versus paper outlined in this interview with the author of:

$10,000.00 Gold: Why Gold’s Inevitable Rise is the Investor’s Safe Haven.

-

I know Mike is a very solid investor and respect his opinions very much. So if he says pay attention to this or that - I will.

~ Dale G.

-

I've started managing my own investments so view Michael's site as a one-stop shop from which to get information and perspectives.

~ Dave E.

-

Michael offers easy reading, honest, common sense information that anyone can use in a practical manner.

~ der_al.

-

A sane voice in a scrambled investment world.

~ Ed R.

Inside Edge Pro Contributors

Greg Weldon

Josef Schachter

Tyler Bollhorn

Ryan Irvine

Paul Beattie

Martin Straith

Patrick Ceresna

Mark Leibovit

James Thorne

Victor Adair