Gold & Precious Metals

Bernanke’s Real Message for Gold Investors, Translated John Williams

Posted by John Williams - The Gold Report

on Tuesday, 25 June 2013 2:24

Don’t fall for propaganda from the Federal Reserve about tapering quantitative easing, says ShadowStats editor John Williams in this interview with The Gold Report. His corrected economic indicators show the U.S. is nowhere near a recovery and the Fed will have to increase rather than decrease bond buying to prop up the banks and push off inevitable dollar debasement. That could be very bad for savers, but good for gold.

The Gold Report: On Wednesday, the Federal Reserve hinted that it might begin tapering quantitative easing by the end of the year based on signs of an improving economy. Gold immediately dropped from $1,347 an ounce ($1,347/oz) to $1,277/oz, a 7% decline and the lowest price in more than two years. The Dow Jones Industrial Average and NASDAQ were also off more than 2%. You called this “jawboning” and said that due to stresses in the banking system the Fed would be obliged to continue bond buying. Why would the central bank threaten to cut off the flow if it didn’t plan to do it?

John Williams: All the hype over the Fed’s so-called tapering is absolute nonsense. Fed chairman Ben Bernanke said the Fed’s pulling back of quantitative easing was contingent on the economy recovering in line with the Fed’s relatively rosy projections. He also indicated, however, that if the economy worsened, he would expand quantitative easing. When you consider that the official Fed projections are grossly optimistic, the conclusion is that we will have more, not less, bond buying from the government.

The jawboning was a multifaceted attempt to placate the Fed’s critics, while soothing the stock and bond market jitters at the same time. The comments, however, hammered equities and bonds, as well as gold. The negative impact on gold likely would have been viewed as a positive result by the Fed.

The banking system nearly collapsed in 2008. The federal government and Federal Reserve took extraordinary measures to keep the financial system from imploding. Those actions prevented an immediate systemic collapse, but they did very little to resolve the underlying problems. I contend that we’re still in recession, with the economy deepening into a renewed downturn. At the same time, the banking system solvency problems continue. Little has changed in the last five years.

The purported nature of the quantitative easing is a fraud on the public. While Bernanke describes the extraordinary accommodation in terms of trying to stimulate the economy, lowering the unemployment rate and attaining sustainable economic growth in the context of mild inflation, those factors are secondary concerns for the Fed. The U.S. central bank’s primary function always has been to assure banking system solvency and liquidity. All the easing efforts have been aimed at the banking system. The flood of liquidity spiked the monetary base, but it has not flowed through to the money supply and ordinary people.

Simply put, the Fed is propping up the banking system. Bernanke is using the cover of a weak economy to do that because the concept is not politically popular, but it’s what the Fed has to do because the underlying system is just as broken today as it was in 2008.

TGR: Let’s go back to your statement that the economy is doing worse rather than better. Didn’t positive housing start statistics and consumer confidence numbers just come out? How do you know if the economy is getting better or worse?

JW: Housing starts are still down 60% from their peak. Based on the first two months of the second quarter, housing starts are on track for a quarter-to-quarter contraction, a rather substantial one. Industrial production also is on track for a quarterly contraction. These indicators easily could foreshadow a contraction in the current quarter’s gross domestic product (GDP). The underlying economic issues remain, as in 2008, with structural constraints on consumer liquidity and banking system stability. With those ongoing, fundamental weaknesses, there has been no basis whatsoever for the purported economic activity since 2009, or for a recovery pending in the near term.

The consumer directly drives more than 70% of GDP activity. Indirectly, the consumer impacts the balance of the economy. To have sustainable growth in consumption, there needs to be sustainable growth in liquidity, reflected in income and, ideally, supported by credit. Instead, household income is shrinking and traditional consumer credit is heavily constrained.

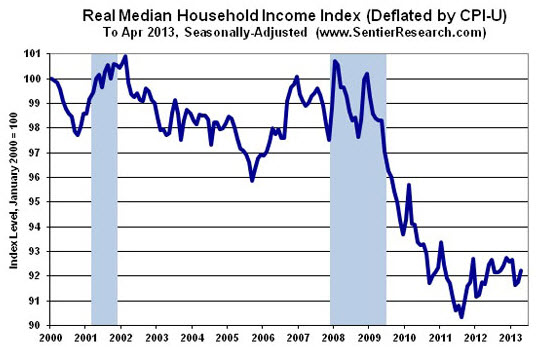

Headed by two former senior Census Bureau officials, SentierResearch.com publishes monthly estimates of median household income adjusted for the government’s headline CPI inflation number. Those numbers show that household income plunged toward the end of the official economic downturn. Officially, the recession went from the end of 2007 to the middle of 2009, but the reality is that household income kept plunging after the middle of 2009. It hasn’t recovered. Right now, it’s flat and bottom-bouncing at the low level of activity for the cycle.

If you look at those numbers on an annual basis, again adjusted for headline CPI inflation, median household income in 2011 (latest available) is lower than it was in the late 1960s and early 1970s. The consumer here is in severe trouble. You can’t have inflation-adjusted or real growth in consumption without real growth in income. Income drives consumption. That’s basic.

You can buy a little extra consumption through debt expansion. The consumer in the precrisis era tended to maintain his or her standard of living by borrowing from the future. Recognizing a developing liquidity squeeze, then-Fed Chairman Alan Greenspan encouraged the consumer to take on as much debt as possible. In the decade prior to the 2008 panic, the bulk of economic growth was fueled by debt growth, not income growth. For the consumer, the credit crisis dried up everything except federally issued student loans, and those don’t buy washing machines and houses.

If you don’t have income growth or credit availability, that takes a toll on consumer confidence. Usually consumer sentiment follows the tone of the popular press on the economy, and monthly movement in the different consumer measures can be quite volatile. Despite the happy hype of recent headline monthly gains in consumer confidence, the news doesn’t have much relevance to our being out of economic trouble. Consumer confidence plunged starting in 2006 and we’ve been bottom-bouncing ever since. Current levels are consistent with numbers seen during the depths of the worst recessions in the post-World War II era. We’re still at recession levels in consumer confidence; those measures have not shown the full recovery that has been reported in the GDP.

Official GDP reporting shows that the economy turned down right after the end of 2007, plunged through 2008 into the middle of 2009, and then started turning higher and has continued higher ever since. If you believe the GDP numbers, the economy fully recovered as of the fourth quarter of 2011, regaining its prerecession highs, and has continued to expand ever since. No other economic series confirms that pattern.

The big issue in the reporting of the GDP is with the inflation-adjustment process. The government in the last several decades has changed its inflation estimation methodologies to lower the reported rate of inflation. In the case of the CPI adjustments, it’s has been trying to cut budget deficits by using a lower inflation rate to calculate cost of living adjustments for Social Security. A number of the changes to CPI reporting also affected estimates of the GDP’s implicit price deflator, the inflation measure used to remove the effects of inflation from the GDP calculations.

If you correct for the understatement of GDP inflation, the accompanying overstatement of economic growth reverses, showing that the GDP started to turn down in 2006, plunged into 2009 and has been bottom-bouncing along with other indicators, including housing starts, median household income and consumer confidence measures, and along with reporting of other series corrected for inflation overstatement, particularly industrial production and real retail sales. Other real world business indicators, including corporate sales of consumer products, are showing the same pattern of plunge and bottom-bouncing, as opposed to plunge and recovery. The reality is that the economy is weak and it’s going to get weaker.

We haven’t seen a recovery and that is why the Fed won’t end quantitative easing. Any talk of tapering is pure propaganda to placate global markets on the U.S. dollar, trying to hit gold and maybe get a sense of how the markets would respond to an actual withdrawing of quantitative easing.

TGR: We saw the response loud and clear on Thursday.

JW: Yes, the stock market is like a drug addict and Bernanke’s been the drug dealer, pushing direct liquidity injections.

TGR: The market came back a little bit on Friday. Do you think the plunge was just a temporary knee-jerk reaction and things will be back to their upward trajectory in no time?

JW: The stock market is irrational. It’s heavily rigged with big players manipulating it, and with the President’s Working Group on Financial Markets taking actions to prevent “disorderly” conditions in the equity market, as well as other markets. I would tend to avoid the stock market. Gold took a big hit, too, but the underlying fundamentals remain extraordinarily strong for gold. This is not a situation where everything’s right again with the world and the Fed is going to pull back from debasing the dollar. If anything, the Fed is going to have to move further into dollar debasement. That is what Bernanke was saying. If the economy doesn’t recover we’ve got to expand the easing. He is propping up the banking system under the cover of propping up the economy. Nothing that he is doing is helping the economy.

TGR: You called the dollar “a proximal hyperinflation trigger” and said that “gold is the primary and long-range hedge against the upcoming debasement of the dollar irrespective of any near-term price gyrations.” Yet the dollar seems to be stronger than ever. What would trigger the dollar-selling panic that you have predicted by the end of the year?

JW: A visibly weaker economy could have a devastating impact on the dollar. It would force Bernanke to expand rather than contract quantitative easing. That would result in heavy selling pressure against the dollar and a spike gold prices.

At present, there are four major factors out of whack between market perceptions and the fundamental, underlying reality. These misperceptions will tend to shift toward reality, and a confluence of these factors would be devastating to the U.S. currency.

At the top of the list, at the moment, is Fed policy, which we’ve been discussing. My contention is that the Fed is locked into quantitative easing. It can’t escape it.

A close second are U.S. fiscal conditions and long-range sovereign insolvency risks. Fiscal issues should come to a head after Labor Day, when the government runs out of room with all its current bookkeeping finagling so as not to exceed the debt ceiling. Prospects for a meaningful resolution of the fiscal problems remain nil. In the summer of 2011, the market reaction to the government’s fiscal inaction was clear: Heavy dollar selling and gold buying came out of that.

The third factor, again, is the economy being a great deal weaker than consensus expectations, based on the indicators I outlined. As weakening business conditions become more evident in the popular economic releases, that should be a large negative for the dollar. Aside from increasing speculation as to increased Fed easing, it also would have a negative impact on the federal budget forecasts going forward. Economic growth of 4% projected for 2014 is not going to happen. The deficit will explode, and, again, that is very bad for the dollar.

Finally, developing scandals in Washington have the potential to hit the dollar hard. The press has started raising questions about a number of cover-ups. I was involved in the currency markets during the Watergate era. I can tell you that on a day-to-day basis, as the scandal began to unfold, whenever the news was bad for President Nixon, the dollar took a hit. Anything that questions the stability of the government is a big negative for the dollar.

All of these factors work in conjunction with each other. That is why I am predicting a massive decline in the dollar at some point this year, which will spike inflation, certainly spike gold prices and will lead us into the very high inflation environment that will provide the basis for actual hyperinflation in 2014. It’s not just current government actions. It’s series of circumstances that have evolved over decades into a developing crescendo of dollar debasement or inflation.

TGR: You recently wrote that we’re approaching the endgame based on volatility in equities, currencies and monetary precious metals of gold and silver. What will that endgame look like? And how will we know if we are in it?

JW: Primarily I would look at the U.S. dollar as an indicator, when very heavy, consistent, massive selling of the U.S. dollar and dollar-denominated assets begins. As the selling becomes heavier, pressure to remove the dollar from its current world currency reserve status should become unstoppable. I would take that as a sign that we are moving into the position that will set the stage for the hyperinflation.

TGR: Whatever happens in the economy, it sounds as if Bernanke’s days will be numbered. What could that mean for economic policy and Federal Reserve actions? And what advice do you have for whoever takes his place?

JW: I wouldn’t want to be the person who takes his place. Bernanke is a very smart and generally well-intentioned individual who’s in a situation that was not of his creation, but one that he has been trying, with great difficulty, to extricate the Fed from. The Fed doesn’t have any real options here. The best it can do is continue to buy time.

There’s nothing the Fed can do that will stimulate economic activity, except possibly to raise interest rates. Low interest rates are actually negative for economic activity at this point. They constrain loan growth. With higher interest rates, banks have the ability to make more of a profit margin on their lending. The greater the profit margin, the greater the ability to lend to perhaps less qualified borrowers, to take a little more credit risk, but with that also comes loan growth. That helps fuel economic activity. It might even cause the money supply to pick up. The biggest constraint on bank lending, though, remains the still-troubled nature of the banking industry.

Separately, low interest rates devastate the finances of those trying to live on a fixed income. It used to be you could go invest your money in a CD and make a positive return, after inflation, and your money was safe, at least within the insured limits of the banking system. That’s not the case anymore. Domestically, there is no safe investment where you can beat the rate of inflation. Government policies are driving savers into riskier investments, such as the highly unstable stock market.

TGR: So you think by default we will have a continuation of the current policies?

JW: Yes, effectively. The Federal Reserve board has run along with the program, moving in accord with the government to save the financial system. Back in 2008, it could have let the banking system fail. Understandably, though, the Fed and the federal government decided to save the system at all costs. That meant spending, creating, lending and guaranteeing whatever money was needed. Whatever had to be done they did. They prevented the system from collapsing, pushing the problems down the road. Now all those problems again are coming to a head. With many of the same risks in the system today, as in 2008, there is potential for another panic. The Fed has to keep easing here to maintain liquidity in the banking system. The U.S. central bank does not have a choice in the matter.

TGR: It sounds as if there isn’t a lot that Bernanke’s replacement could do. Would your only advice be don’t hold a lot of press conferences?

JW: That would be a big plus. If there’s bad news, basically the central banker has to lie. If he or she says, “The banks are going to collapse,” or “The economy is going to hell,” that will move the process along in a self-fulfilling negative cycle. Accordingly, central bankers often attempt to put false a positive spin on things. Having a Fed chairman hold press conferences is actually something relatively new. “Jawboning” was one tool Bernanke thought he could use to influence the economy and market behavior. That’s deliberate policy, but it has problems, as we saw on Wednesday. The tradition for Fed chairmen has been to keep remarks to the minimum, whenever possible.

TGR: Sounds like some very good advice. Thank you for your time.

JW: Thank you.

Walter J. “John” Williams has been a private consulting economist and a specialist in government economic reporting for more than 30 years. His economic consultancy is called Shadow Government Statistics (shadowstats.com). His early work in economic reporting led to front-page stories in The New York Times and Investor’s Business Daily. He received a bachelor’s degree in economics, cum laude, from Dartmouth College in 1971, and was awarded a master’s degree in business administration from Dartmouth’s Amos Tuck School of Business Administration in 1972, where he was named an Edward Tuck Scholar.

DISCLOSURE:

From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise. John Williams was not paid by Streetwise Reports for participating in this interview. Interviews are edited for clarity.

Streetwise – The Gold Report is Copyright © 2013 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part.

Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported.

Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

Participating companies provide the logos used in The Gold Report. These logos are trademarks and are the property of the individual companies.

PRECIOUS METALS fell for the 5th session in six Monday morning in London, with gold retreating to $1280 per ounce as the US Dollar rose and most other tradable assets fell once again.

London and Paris’ stock markets dropped 2.0% by lunchtime. Commodities also fell, extending their worst 1-week drop since October.

Silver prices retouched last Thursday’s 34-month low of $19.65 per ounce.

Gold last week lost 6.9% against the US Dollar, its worst drop since the crash of mid-April and the 8th worst Friday-to-Friday of the last 5 years.

“The relatively mild nature of the attendant ETF [trust fund] liquidations at only 18.8 tonnes is surprising,” writes Marc Ground at Standard Bank, noting that the 19 weeks of consecutive exchange-traded gold fund selling have averaged more than 28 tonnes.

“Perhaps the ETF sell-off is losing momentum.”

For the gold price, however, “We’re down 40% from the [2011] top,” said Tom Kendall, head of precious metals research at Credit Suisse, to CNBC this morning, “and that’s some very strong momentum for gold bulls to fight against.

“What we’ve seen is a lot of fear removed from the markets over the last two to three years. One of the big fears now playing against gold prices is the fear that we’re going back into a world of positive real interest rates.”

Government bond yields rose further Monday morning as debt values fell, taking 10-year US Treasury yields up to 2.64%.

Nearly one percentage higher from 12 months ago, 10-year US yields are now well above the last reading of US consumer price inflation at 1.7%.

“Right now equities, bonds and gold are very over-sold,” said Dr.Marc Faber – author of the Gloom, Boom & Doom Report – to Bloomberg on Friday, “and they could easily rally.”

Compared to the stock market however, “sentiment in bonds and gold is incredibly negative. In other words, as a contrarian I would rather buy bonds and gold than equities.”

Also giving a reading contrary to the headlines about ending QE which followed Ben Bernanke’s press conference last Wednesday, “Unless the economy has essentially fully recovered by mid-2014, more QE will be forthcoming,” said Faber.

“Gold miners are as hated as anything I’ve seen,” CNBC today quotes Arnold Espe, co-manager and vice-president of mutual fund portfolios at USAA.

World-leading gold miner Barrick will this week lay off one third of the 400 staff at its corporate HQ, the Toronto Sun reports.

In US gold futures and options, speculative traders last week slashed their bullish betting below the “net long” low of late 2008, new data showed Friday.

Globally, fund managers now hold a record-low allocation to commodities, according to Bank of America Merrill Lynch.

US investors have meantime pulled a record volume of money out of bond funds this month, according to TrimTabs Investment Research, beating the previous low of October 2008.

“Lost decade for bonds looms with growing stocks returns,” says a newswire headline today.

Meantime in China – the world’s second-heaviest market for gold after India – the Shanghai and Shenzen stock markets today sank 5.3% and 6.1% respectively, the worst 1-day drops in 4 years.

With overnight interest rates still high, but well below this month’s spike above 10%, “Overall bank liquidity conditions are at a reasonable level,” said the People’s Bank in a statement on its website this morning.

Instead of pumping loans into China’s money markets, the PBoC tells commercial banks to “prudently manage risks that have resulted from rapid credit expansion.”

Over in India today, shares in major gems and jewelry companies sank by up to 20% on rumors of fresh government action to try and curb gold demand and thus imports.

“Falling gold prices, [Reserve Bank] policy, and impositions of high taxes are primary reasons,” the Economic Times quotes A.K.Prabhakar at Anand Rathi Financial Services, who also warns that “demand for gold will slump further” if buyers are forced to show their tax-number PAN card.

Purchases worth over 500,000 Rupees ($8,300) already require the buyer to present their PAN card, which is issued by the Income Tax Department.

A central bank committee proposed in February making PAN cards mandatory for all gold purchases. India has a 1% wealth tax, applied on assets and portfolios worth over INR 1,500,000 ($25,000).

The government of neighboring Sri Lanka at the weekend imposed a new 10% import tax on gold, aimed at restricting gold smuggling to India spurred by New Delhi’s recent curbs.

Adrian Ash

Gold price chart, no delay | Buy gold online

Adrian Ash is head of research at BullionVault, the secure, low-cost gold and silver market for private investors online, where you can buy gold and silver in Zurich, Switzerland for just 0.5% commission.

(c) BullionVault 2013

Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it.

Final Capitulation Coming in Precious Metals

Posted by Jordan Roy-Byrne - The Daily Gold

on Saturday, 22 June 2013 5:03

Our recent calls for a bottom have been proven wrong as precious metals plunged to another new low. Two trading rules we have is to always use a 20% stop and never add to a losing position. Note our previous article in which we said use the late May low for a stop. This helps minimize risk and potential losses, though we have a handful of small losses trying to anticipate the coming rebound. We always admit mistakes to subscribers and we never blame manipulation. That is just unprofessional. All being said, a close examination of history tells us that this could be the final capitulation that would lead directly to a huge rebound in the ensuing months.

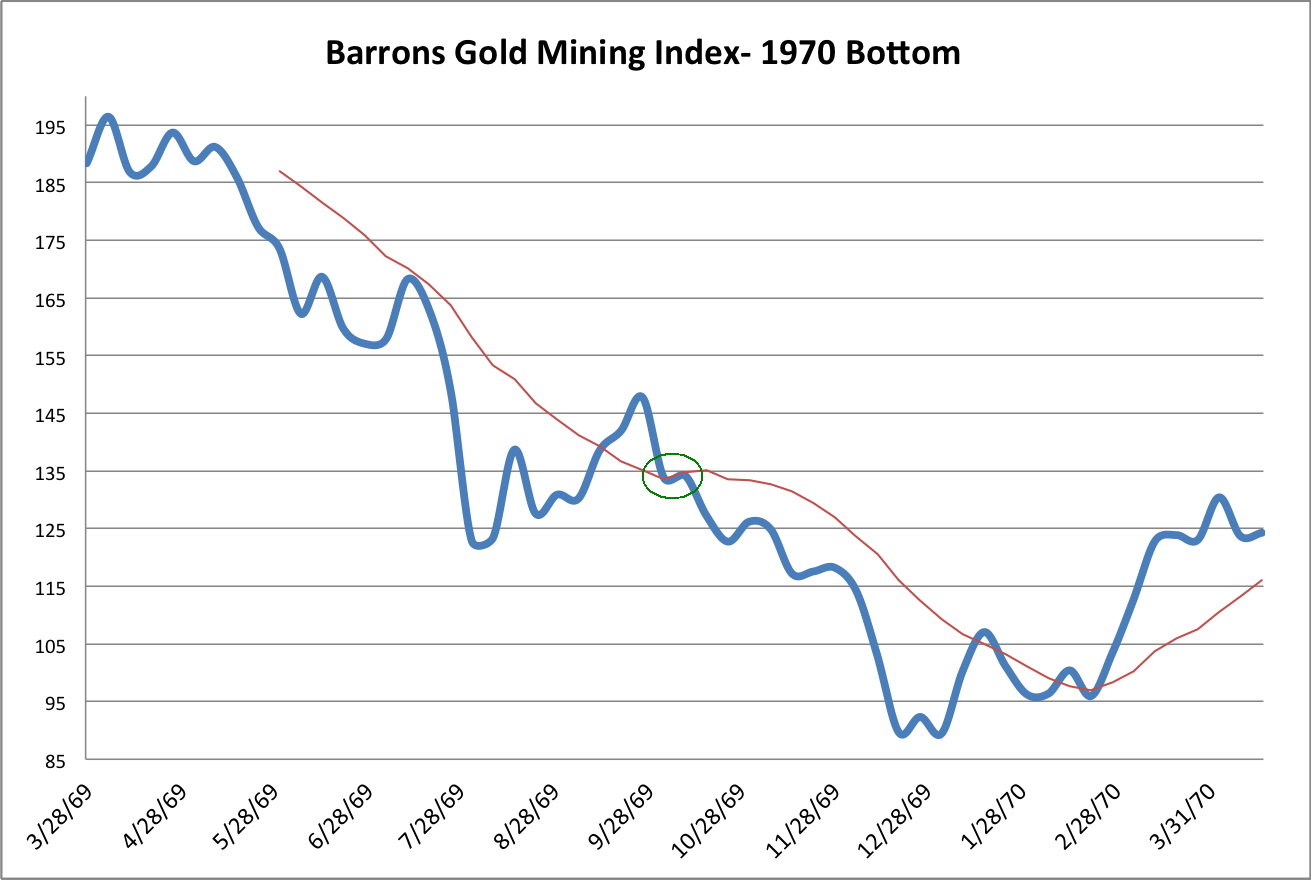

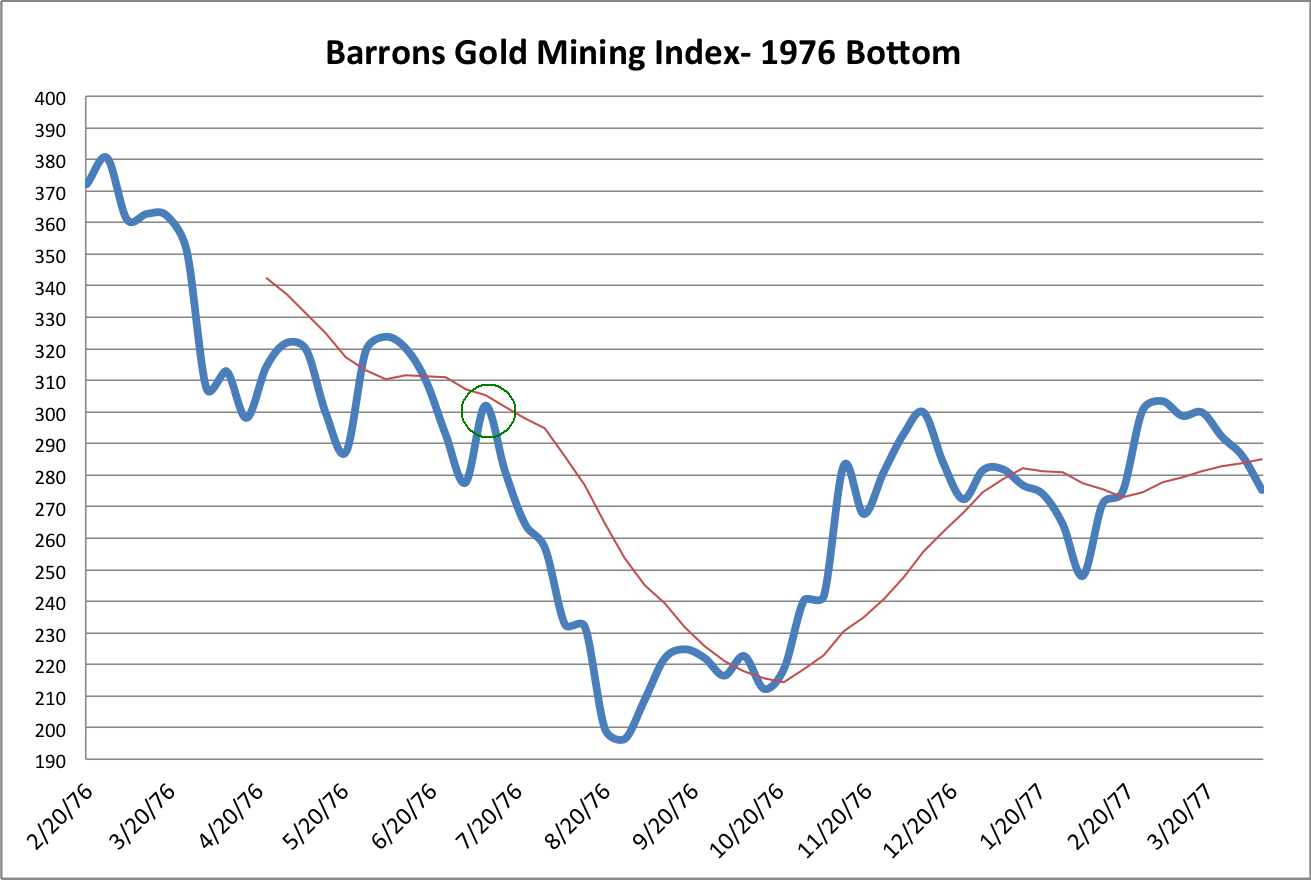

Below we plot the four major downturns within the two secular bull markets in gold stocks. The HUI is now down 64% since 2011 and just surpassed by inches (in time and price) the 1968-1970 downturn. The Barron’s Gold Mining Index (BGMI) lost 67% from 1974-1976 before rising nearly 700% over the next four years.

A 67% downturn would take the HUI down to 210. Interestingly, Fibonacci analysis shows that 210 lines up exactly with the HUI’s 2012 low and 2011 high. So 210 is a target to keep in mind. The GDX equivalent is $21.64.

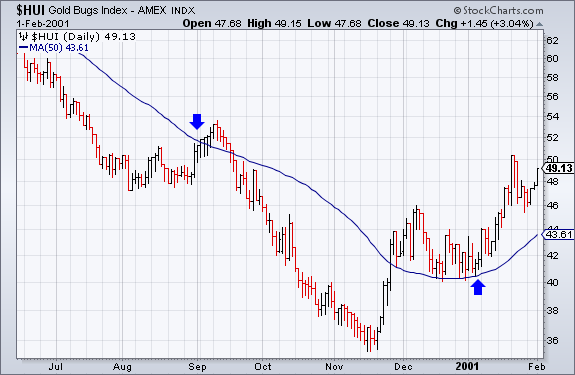

It’s important to note the 50-day moving average (or the 10-week moving average) as it plays a very important role in how gold stock bottoms evolve. Note that the HUI failed at the 50-day moving average at 283 and has already fallen to 228. Keep that in mind as we go over some important history.

Several months before the bottom at the start of 1970, the BGMI failed at the 10-week moving average. See the circle. From that point, the BGMI declined about 33% to its final bottom.

The BGMI failed at the 10-week moving average in summer of 1976. It declined about 35% to its final bottom.

In September 2000, the HUI rallied above its 50-day moving average but eventually about 35% down to its final bottom.

In September 2008, the HUI failed at its 50-day moving average. It then declined a whopping 57% before hitting its final bottom.

In three of the four cases, the market (after failing at the moving average) declined 33%-35% to its final bottom. At present, the HUI peaked at the moving average at 283. Note that at the recent failure of the 50-day moving average, the market was far more oversold than it was at that specific point in the four historical examples. Thus, we shouldn’t expect the same type of downturn. My downside target of 210 would mark a 26% decline from 283. It’s not 33%-35% but it is substantial.

If you take another look at the four charts, you’ll notice that the moving average plays a key role following the bottom. It provides initial resistance but once it gives way, the recovery begins in earnest. In the chart below we plot the paths of the recoveries that followed the four major bottoms discussed above. It’s not unreasonable to anticipate a 50% rebound in a four month period. In only four months the gold stocks rebounded 85% (starting in Q4 2008) and 60% (starting in Q4 2000).

Gold is a speculative asset that is prone to big declines even in a secular bull market. When inflation is falling and the stock market is performing well, precious metals can really tumble. This is what occurred from 1975 to 1976 and during the last two years. Meanwhile, loose monetary policy and debt monetization since 2008 has already been factored in. Gold ran from $700 to $1900 and Silver surged almost 6-fold. Junior exploration companies went from pennies and dimes to $2 and $5. Junior producers went up 10-fold and more.

The cyclical bear market began with precious metals reaching very overbought conditions as noted above. Fundamentals slowly deteriorated as price inflation declined and Chindia (crucial for metals demand) slowed down economically. Global fear subsided. QE 3 was factored in but didn’t have a sustained impact above and beyond the aforementioned bearish factors. Furthermore, a major technical breakdown intensified the bear market.

Currently, the precious metals complex is plunging but should find a bottom sooner rather than later. A catalyst is definitely needed for the complex to sustain a bottom. Twelve months from now we could see tremendous support for precious metals. The smartest guys are talking about the Fed doing more and not less. By smartest guys I’m talking about folks like Jeff Gundlach and John Brynjolfsson and not fanatical gold bugs. China will have to take action at somepoint to prevent a full blown credit collapse and deflationary spiral. The ECB is talking about pursuing unconventional measures and Mark Carney, the new chair at the BOE, would like to take more action. Does this sound like a bearish recipe for precious metals over the coming quarters?

It’s been a tough road for precious metals but the path ahead has strong potential of being significantly profitable and in a short period of time. The buying opportunity that we’ve spoken of for months could be days away. When precious metals equities rebound, they rebound violently. If you’d be interested in our analysis on the companies poised to recover now and lead the next bull market, we invite you to learn more about our service.

Good Luck!

Jordan Roy-Byrne, CMT

All Hell Breaks Loose!

Posted by Bill Bonner & Richard Russell Comment

on Friday, 21 June 2013 17:41

Yesterday, it felt like all hell was breaking loose. It was the kind of day when each man looked to his own. He checked his bank balance and his margin account. He counted his gold coins and looked in his liquor cabinet. He wondered what would happen next…

Yesterday, it felt like all hell was breaking loose. It was the kind of day when each man looked to his own. He checked his bank balance and his margin account. He counted his gold coins and looked in his liquor cabinet. He wondered what would happen next…

The Dow fell -353 points. Gold lost $87 an ounce.

What does this tell us? It shouts a warning: Ben Bernanke is losing control. He desperately wants inflation. He’s getting deflation instead. He wants low interest rates; yet rates are rising.

Bernanke is now getting the worst kind of deflation – sluggish price increases against a backdrop of rising interest rates. Consumer prices are rising at their slowest pace in 53 years. And as PIMCO’s Bill Gross says, it looks as though the long bull market in bonds, which began 30 years ago, is finally over. Yields are rising. The feds’ borrowing costs are going up.

This is the exact opposite of what the Fed wants… and needs. Its strategy is to hold interest rates down while it pushes up consumer and asset prices. This would make possible a gradual growth in GDP while the real value of debt was whittled away by inflation. Then it could “taper” its QE.

Losing the Battle Against the Primary Trend

Instead, the debt gets heavier as yields rise. Backs ache. Legs buckle. Nerves crack.

Old timer Richard Russell comments:

Bernanke has finally realized that the Fed has lost its battle with the primary trend. The Fed and the economy are now at the mercy of the strengthening primary bear trend. Deflation, which the Fed has tried frantically to hold back, is now taking over. The Fed would like to exit the battle field but it can’t. The mere thought of the Fed giving up the battle to hold back deflation terrifies the stock and bond markets.

Years ago Ben Bernanke stated emphatically that he would never, ever allow the nation to deflate – even if he had to drop cash from helicopters to prevent it. But now deflation is happening. And Bernanke, the academician who has never understood markets, is frozen with confusion, consternation, and fear.

Everybody’s escape, so far, has been to rush headlong into Treasury bonds. But that avenue is no longer working (the bonds are sinking). The next avenue of escape is the dash for cash. Cash today amounts to intangible Federal Reserve notes, which are fiat paper and actually intangible financial garbage. The last and final avenue of escape will be to gold…

All over the world, the feds are trying to lock the exits and bar the doors.

David Franklin at Sprott Asset Management:

With the Indian rupee plumbing new lows against the US dollar and the country’s current account deficit at record levels, the Reserve Bank of India (RBI) is taking the easiest route to tackle both; it has declared a war on gold.

[T]he central bank has announced a series of measures over the past month, including restraining lending against gold-backed assets, and restricting gold imports. The hike in gold import duty to 8% this month is the most recent announcement in this drive and doubles the duty that was applied at the beginning of this year… Indian finance minister P. Chidambaram has even urged banks to advise their customers not to invest in gold.

Meanwhile, this news from France:

On May 23 the French government banned the delivery of all forms of precious metals, currency and jewelry by La Poste and all other branches of the French postal service.

The announcement was made through Legifrance, the legal publishing house responsible for all legislative publications. The ban was not reported by the press and the French government has made no statement.

[A]ll registered or insured precious metal shipments are forbidden by the French government.

Although the decree is limited in language to France, FedEx had also stopped shipping precious metals in March, without explanation. More recently, FedEx suspended all shipping or taking delivery of precious metals in Germany and Britain.

The gold price is falling. This signals to us that the Great Correction, which began in 2008, is entering a new phase. The can was kicked down the road by the feds. Now, the markets are stumbling over it. In the end, markets always triumph. And now, the markets are correcting, whether the Fed likes it or not.

What will happen next? Like everyman we wonder too. But we have a hunch. If the Great Correction intensifies, the feds will be forced to react. They can permit neither a bear market… nor deflation… nor higher interest rates. They will have to resort to Overt Monetary Financing… otherwise known as dropping money from helicopters.

Markets will rock, roll and lay down on the floor in spasms of laughter and revulsion. At the end of the day… when the dust settles and the music stops… gold will be the last man standing.

Regards,

![]()

Bill

, “Bullion’s Day in Sun is Long Gone”,

Gold bullion prices touched fresh three-year lows Friday at $1269 an ounce before recovering a little by lunchtime in London, as stocks and commodities also regained some ground after sharp falls yesterday.

Spot silver prices fell as low as $19.41 an ounce, as with gold their lowest level since September 2010, before they too recovered a little, as other commodities also ticked higher while the US Dollar weakened slightly.

A day earlier, gold fell more than 5% between the London open and US close, while the S&P 500 recorded its biggest daily drop since November 11 2011, with volumes reaching a 2013 high, a day after US Federal Reserve chairman Ben Bernanke said the Fed could begin scaling down its asset purchases “later this year”.

CME Group, which operates the New York Comex exchange on which gold futures are traded, announced yesterday it is increasing margin requirements on gold trading by 25% to $8800 per 100-ounce contract. The new initial margin requirement will come into effect after close of trading today.

“That is definitely affecting gold,” says Joyce Liu, investment analyst at Phillip Futures in Singapore.

“For those who cannot put out margin calls on time, they will be squeezed out even when they don’t want to get out.”

Heading into the weekend, gold in Dollars was down 7% on the week by late morning in London, with silver down 10%.

Gold in Sterling meantime looks set for a drop of more than 5% on the week, trading below £840 an ounce. Gold in Euros was down around 6% on the week at €982 an ounce.

Going by London Fix prices, gold in Dollars looks set for its worst week since April, although a fix price of $1273 an ounce or below would make for the worst week since at least October 2008.

“In the precious metals markets, nothing is simple and now we are at the lows, market sentiment is needless to say very negative,” says David Govett, head of precious metals at broker Marex Spectron.

“I am now hearing from people how a thousand Dollars is the next stop. These are the same people who were predicting two thousand Dollars this year, so I take it all with a pinch of salt. However, there is no doubt that the bull market in gold has had its back broken and its day in the sun is long gone.”

Over in India, traditionally the world’s biggest source of private gold demand, financial services firm Reliance Capital has suspended sales of gold. The Reliance Gold Savings Fund had assets equivalent to eight tonnes of gold under management at the end of the first quarter, newswire Reuters reports. Indian imports last month amounted to 162 tonnes, according to the country’s finance ministry.

The announcement follows the introduction by India’s authorities of new measures aimed at curbing gold imports, such as restricting imports on consignment and raising duties to 8%. The objective is to reduce India’s current account deficit and thus support its currency.

The Rupee however touched an all-time low of Rs.60 to the Dollar Thursday, as the Dollar strengthened and emerging market assets sold off following the Fed’s announcement.

“We are not insulated from what is happening in the rest of the world,” India’s finance minister P. Chidambaram told a press conference in response to the Rupee’s fall.

“My request is we should not react and panic. It is happening around the world.”

In contrast with Reliance, jeweler Shree Ganesh, which in recent years has imported around 70 tonnes of gold a year, said earlier this week that it plans to issue short-term debt to fund bullion imports now that the rules prevent it from obtaining credit from suppliers shipping the gold on a consignment basis.

Indian gold demand usually drops during the summer months during the period known as Chaturmas.

Ben Traynor

Gold value calculator | Buy gold online at live prices

Editor of Gold News, the analysis and investment research site from world-leading gold ownership service BullionVault, Ben Traynor was formerly editor of the Fleet Street Letter, the UK’s longest-running investment letter. A Cambridge economics graduate, he is a professional writer and editor with a specialist interest in monetary economics. Ben can be found on Google+

(c) BullionVault 2013

Please Note: This article is to inform your thinking, not lead it. Only you can decide the best place for your money, and any decision you make will put your money at risk. Information or data included here may have already been overtaken by events – and must be verified elsewhere – should you choose to act on it.

-

I know Mike is a very solid investor and respect his opinions very much. So if he says pay attention to this or that - I will.

~ Dale G.

-

I've started managing my own investments so view Michael's site as a one-stop shop from which to get information and perspectives.

~ Dave E.

-

Michael offers easy reading, honest, common sense information that anyone can use in a practical manner.

~ der_al.

-

A sane voice in a scrambled investment world.

~ Ed R.

Inside Edge Pro Contributors

Greg Weldon

Josef Schachter

Tyler Bollhorn

Ryan Irvine

Paul Beattie

Martin Straith

Patrick Ceresna

Mark Leibovit

James Thorne

Victor Adair