You scan the menu and notice that the prime rib and the hamburger are the same price. What do you order? The precious metals market isn’t so different, according to “Mexico Mike” Kachanovsky, consultant to hedge funds and mining companies and contributor to SmartInvestment.ca. The market has pulverized the price of top-notch mining stocks to the same level as the struggling names. So, which would you buy? In this interview with The Gold Report, Kachanovsky reveals how to find the prime rib of the gold market.

The Gold Report: Mexico is a mining jurisdiction where mining investors have made a lot of money, especially over the last decade. Mexico recently passed a 7.5% royalty on earnings before interest, depreciation and amortization (EBIDA) for mining companies operating there. Are the salad days over for miners in that jurisdiction?

The Gold Report: Mexico is a mining jurisdiction where mining investors have made a lot of money, especially over the last decade. Mexico recently passed a 7.5% royalty on earnings before interest, depreciation and amortization (EBIDA) for mining companies operating there. Are the salad days over for miners in that jurisdiction?

Mike Kachanovksy: There are still a lot of unknowns on how this new royalty is going to affect mining companies in general and how it’s going to be applied within the country.

The majority of the producers I talk to don’t feel it is going to be that disruptive because it’s a royalty on earnings, not a gross smelter royalty. The way it is structured, companies that aren’t making a lot of money right now won’t be paying a lot of extra taxes. There are also going to be deductions that companies can put in play that would lower their overall tax spike from the new royalty.

For the companies that are already in production and that have been established in Mexico, it’s really not going to doom their operations. However, it is discouraging retail investors from participating and buying up Mexico-related stocks. There’s uncertainty and fear in the market until people start to understand it’s not going to devastate the bottom lines of miners.

TGR: Could the tax be lowered?

MK: I don’t think the Mexican government will change the actual total amount, but it will probably allow more leeway and flexibility on what counts as earnings and what deductions will be allowed against that royalty. One thing to keep in mind: Part of the rationale for bringing this new law into place was that it would force companies to pay a certain amount of money back. It would go to the immediate local domestic or regional government. That money could be used to pay for schools or road construction or a lot of the things that the mining companies are doing now voluntarily.

Perhaps some of these companies that already have scholarship programs and are building playgrounds and schools for their local communities will be able to deduct that money they’re spending already in goodwill. My feeling is that there will be enough pressure behind the scenes that the structure of this royalty will be less restrictive than how it stands right now.

TGR: Do you think companies are going to avoid Mexico as a result of this royalty?

MK: I’ve heard some saber rattling from certain companies that say they are going to restrict investment within Mexico and start looking at other jurisdictions. I think it’s a lot of political brinkmanship. The arguments for continuing to operate in Mexico are still more positive than negative. Even with this new royalty, Mexico is still one of the most favorable and lowest-cost mining jurisdictions in the world.

TGR: Timmins Gold Corp. (TMM:TSX; TGD:NYSE.MKT) and Torex Gold Resources Inc. (TXG:TSX), which both operate in Mexico, were among a handful of junior mining companies that recently completed bought-deal financings. Does this signal a warmer financing environment for junior mining companies—especially those operating in Mexico?

MK: I consult for a number of funds that are saying now is the time to start investing in these junior mining stocks. The stocks are so beaten down that a firm can put $2 million ($2M) down on a financing and end up owning a third of the company. I believe that we’re going to see bought-deal financings and more appetite for private placements that will allow companies to get funded and move forward.

However, there are still companies that have extremely attractive projects that are not able to get financing just yet. The market is still too weak for them to attract funding. I think we’re still at the much earlier stage. At some point we’re going to see a lot of money flowing into the sector. Right now, the lowest-hanging fruit is being picked. We’re still a long way from a healthy speculative market.

TGR: SNL Metals Economics Group, which is based in Halifax, Nova Scotia, estimated that the total worldwide budget for non-ferrous metals exploration dropped about 30% to $15.2 billion ($15.2B) in 2013 from $21.5B in 2012. Yet Mexico remained a top-five destination for exploration spending. What keeps the drills turning in Mexico?

MK: Mexico is still relatively underexplored and it has a treasure trove of prospective geology. There’s always going to be that discovery potential that makes the risk/reward balance in favor of continuing on with exploration. Even in an environment where metals prices have come down, the chance of finding a brand-new high-grade deposit in Mexico that could be economic to develop will have companies spending money.

The cost of exploration in Mexico is still much lower than many other places in the world. Exploration spending has dropped now that a lot of junior mining companies have access to high-quality consulting firms and drilling contractors. A company can get a lot more meters of drilling done today for less than it would have cost two years ago.

TGR: Mexico is known more for its silver than gold. Which are you more excited about right now?

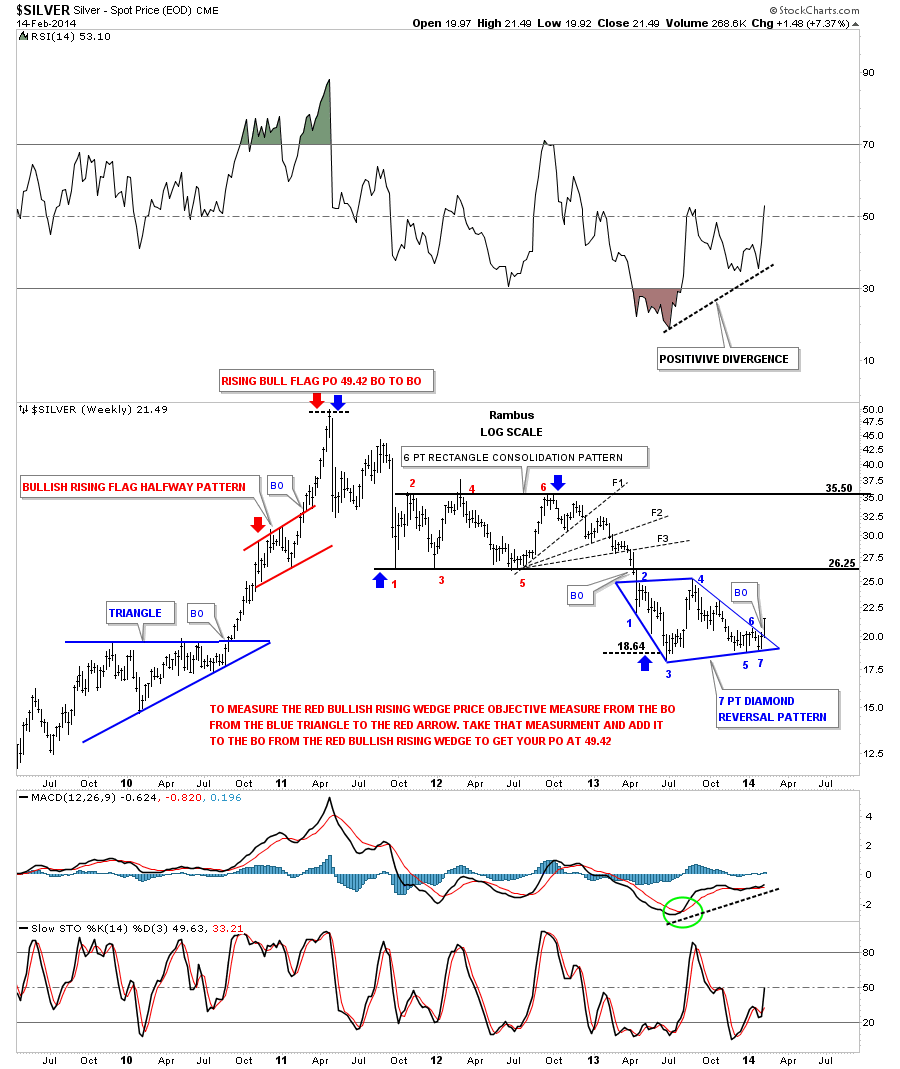

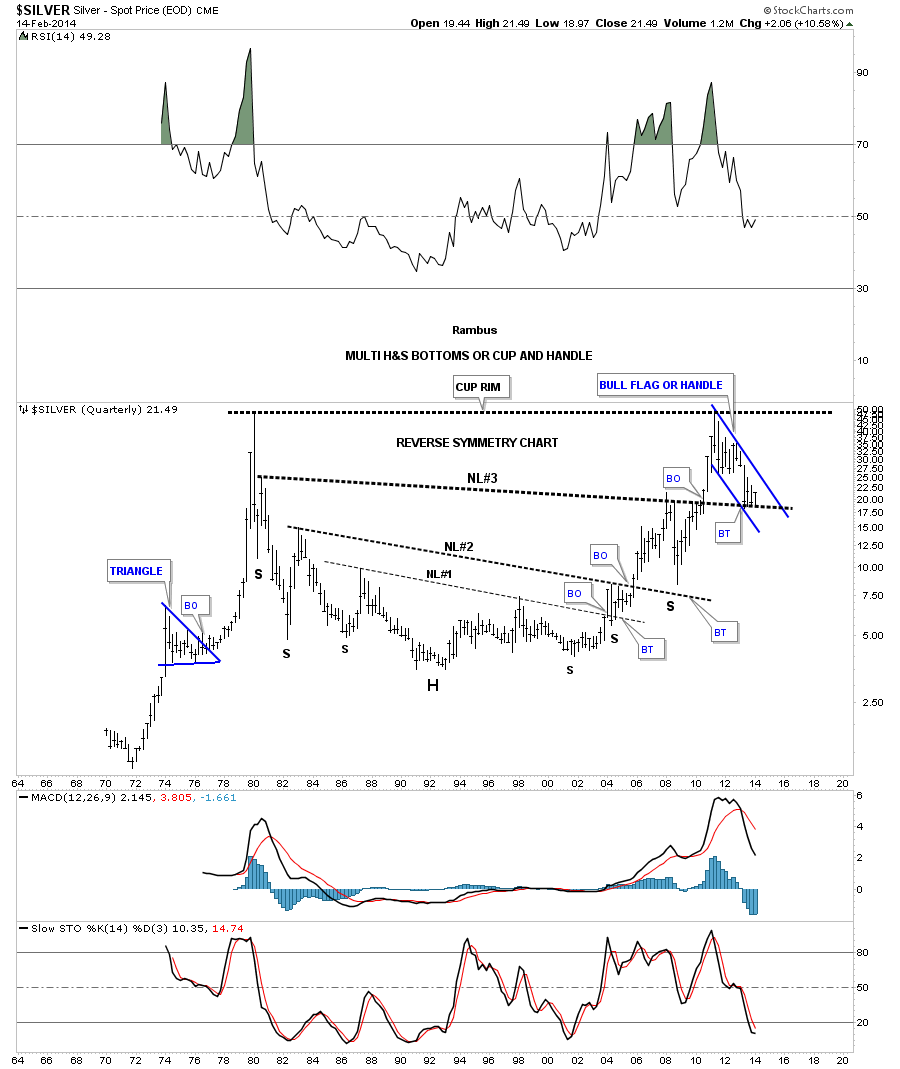

MK: I’m a silver bull, but investors need to have leverage to both. We’re at the latter stage of a very long and severe correction for both metals. As things roll over into a more bullish posture, silver tends to outperform gold on the upside. If I were going to be putting new money into a metal today, I would probably put a little bit more weight toward silver.

TGR: Mining magnate Rob McEwen, who’s well known in mining circles, told Mineweb.com that consolidation will pick up this year. He added that his namesake company, McEwen Mining Inc. (MUX:TSX; MUX:NYSE), is likely to grow through mergers and acquisitions (M&A). Do you see an uptick in M&A coming?

MK: Absolutely. The urgency and likelihood that it’s going to pick up this year is just that much higher because there’s less exploration spending and existing mines are being depleted. If these companies want to stay in business they’re going to need to either find more minerals or buy them. The severity of this correction means there are a lot of very attractive projects available that have lost half or even 90% of their market value. It’s cheaper to buy late-stage defined deposits than it is to look for them and drill them.

TGR: What are some companies producing silver and gold in Mexico that finished the year strong and are poised for further gains this year?

MK: Investors have to look for the companies that survived the downturn intact with prospects for growth. I’d select a company like Great Panther Silver Ltd. (GPR:TSX; GPL:NYSE.MKT), where production is increasing 19% on a silver equivalent basis year-over-year and guidance for 2014 is for a further 10% increase in total metals output. Great Panther has $24M in cash on the books with no long-term debt. It has a very strong financial position and the market cap is a fraction of where it was a couple of years ago when there was a lot more risk in the story.

TGR: Do you think that Great Panther is likely to attract an acquirer?

MK: A lot of companies have been saying they want to do acquisitions and are looking at possible targets for mergers. The problem is that a lot of the acquisitions won’t be acquired at current market value. Companies are going to have to pay a premium to get them. All of a sudden it doesn’t look as if a project is an accretive acquisition any more. Sure, assets are cheap, but some of these companies that are in a position to do a deal are gun shy because by the time they pay a premium to take over something, it looks expensive in hindsight. We’re going to need to see a rebound in the price of the metals and locking in the cheap market caps of some of these acquisition targets. We may be just on the cusp of that. It’s too early to say.

TGR: Great Panther exceeded its 2013 production guidance. Are you willing to go out on a limb and say it might beat its guidance for 2014?

MK: It will at least be in the ballpark. Great Panther’s president has done a very good job of underpromising and overachieving. Companies that have missed expectations get severely punished in the market. Just this week, Alamos Gold Inc. (AGI:TSX), which is a very successful midtier producer in Mexico, missed expectations and issued lower guidance for 2014. The stock is down by more than 30% in one week on numbers that are not that bad. It makes more sense to be very conservative with guidance and then go out and surprise the market.

TGR: What are some other companies that you like in 2014?

MK: Excellon Resources Inc. (EXN:TSX; EXLLF:OTCPK) has operational and financial strength. It had about 2.1 million ounces (2.1 Moz) of silver equivalent output in 2013, but plenty of spare capacity in its mill. It has a defined resource with more than 10 years of mine life. Its cash costs are extremely low. It has $9M in cash. It’s positioned to move forward even if the market remains unmoved.

Another junior I’ve liked for a long time is Avino Silver & Gold Mines Ltd. (ASM:TSX.V; ASM:NYSE.MKT; GV6:FSE). Even in this market, it reported a 260% increase year-over-year in silver production numbers. Gold output increased by 162% and its all-in costs are still below $11 per ounce of silver net of byproduct. This is the kind of company one can buy right now. It’s still very cheap relative to its peers, but it’s not likely to surprise anybody or get in trouble with weak margins if metals prices don’t start rebounding in the next little while. It gives investors that extra degree of confidence.

The final company I should talk about is Endeavour Silver Corp. (EDR:TSX; EXK:NYSE; EJD:FSE), which is one of those companies that year after year, good conditions or bad, has always been able to report increases in production. This most recent year is no exception. Endeavour Silver has been able to lower its costs and increase profit margins. Its production was 6.8 Moz silver in the most recent year. It has $35M on the books. Endeavour Silver is a proven winner and has been able to build shareholder value year after year.

TGR: What about some other juniors that are having exploration success but are not yet producing?

MK: A producer that I would categorize as more of an explorer—the best exploration story in all of Mexico—is IMPACT Silver Corp. (IPT:TSX.V). The company has identified literally thousands of historic mine workings within the property holdings that it controls. These are high-priority exploration targets that the company can look at to outline new resource zones that were overlooked in the past. It’s not just a theoretical model. Over the last five years IMPACT put several new mines into production that it discovered just through advancing exploration around old workings.

IMPACT advances an extremely aggressive exploration budget year after year. This year, the company is planning on drilling between 15,000 and 20,000 meters, funded by cash from its current production levels. It has more than $6.5M in cash on its balance sheet. IMPACT has an enormous inventory of high-profile targets and a fantastic track record of achieving exploration success and then rapidly advancing to new mine development. To me, IMPACT is head and shoulders above the pack in being able to demonstrate strength in exploration.

TGR: What are your thoughts on IMPACT’s management?

MK: I’ve known CEO Fred Davidson for about 10 years. I first started investing with his other company,Energold Drilling Corp. (EGD:TSX.V). Energold is another superb story with financial flexibility and diversified operations into geotechnical and petrochemical drilling. Davidson has done a good job of building growth and maintains a conservative financial posture, which is hard to do. Usually a company has to take on a lot of risk if it wants to grow quickly. I still own a personal position in both companies and they will probably remain core holdings for me as long as I’m investing in the sector because they’re such solidly run companies.

TGR: Is it a big advantage for IMPACT to have a relationship with a drilling company?

MK: It’s not an advantage right now because so many drillers have inactive rigs that are being offered at a discount. As drill rigs become harder to get on contract as prices start going up, it will become a much bigger advantage to have an in-house relationship with a company like Energold.

TGR: Which strictly explorers do you like?

MK: There are two companies that have seen a nice rebound in the last month. Garibaldi Resources Corp. (GGI:TSX.V) has a core group of holdings in Mexico that the company is currently drilling in proximity to large-scale mines in Mexico. Any drill-bit success that it accomplishes could become a very attractive takeover target. Garibaldi is unique in that earlier in the cycle it did just that. It found a large gold and silver deposit, which it successfully vended to another company, making a lot of money for its shareholders. The company has done a very good job of managing its cash position.

Garibaldi also has an asset in British Columbia that I originally wondered why it even bothered to keep when Mexico was doing so well for it. However, this part of British Columbia has recently become more active, with two other companies at the limits of the property. Speculation is coming into the stock on the basis of “closeology”—that there may be a significant discovery next to its Grizzly property in British Columbia that could suddenly be a much more attractive asset for a transaction. Garibaldi’s share price has more than doubled in just a few weeks based on that speculation.

Another explorer that I like is Minaurum Gold Inc. (MGG:TSX.V). The company had a fund come in and put some money on the table that will enable it to drill on a gold-copper prospect in Mexico that shows a lot of promise.

TGR: You’ve had success as an investor by getting in on a big move at the beginning of a cycle. As an investor, what signs will signal that the next move is close?

MK: I’m encouraged by the fact that the junior miners as a group are outperforming the metals. In the beginning of this correction, the metals were still moving higher but the stocks had started to sell off. They stayed in this bearish posture for more than two years.

A big part of what drives the overall performance of a sector is what big money investors are doing. There were a lot of mutual fund redemptions and hedge funds selling across the board in the mining space during the last several years. A great many of them I suspect were positioned net short. That is now starting to unwind and they’re starting to aggressively accumulate sector leaders that have been beaten down. When I start seeing high-volume accumulation off the lows, the bottom is in for the entire sector.

There is a parallel to 2003 when I first started to make money in these mining stocks. There was a long, painful bear market that had driven a lot of the mining stocks down to extreme lows. Then there was this uptick. The first hint was that metals started to increase in value and mining stocks were increasing at a faster pace than the metals. There were fewer exchange-traded funds in 2003, but some of the larger junior mining ETFs that are available today, like Market Vectors Junior Gold Miners ETF (GDXJ:NYSE.Arca), are showing much faster gains than overall metals. That tells me that investors are starting to buy a basket of these undervalued stocks and position themselves for the next bull market.

TGR: Could the big funds just be coming in to take advantage of a short-term rally?

MK: I don’t think so. The liquidity isn’t there to flip these stocks. Companies are buying these stocks because they’re at extreme low valuations and it’s unlikely that they’re going to trade them after a short bounce.

TGR: Do you have any final thoughts for us?

MK: Investors have to be very systematic. In the more speculative days of the sector, an investor could just about buy any name and make money on it—hype and speculation ruled the day. In this market, investors need to spend more time doing research before putting money on the line to identify the stronger companies, the ones that have the best management, projects that will still be producing years down the road, and that have been able to meet the challenges of lower metals prices by lowering their costs and improving their profit margins. Those are the kind of companies that it takes a little extra time to find and those are the ones that you could buy with confidence now.

The advantage of this terrible correction is that top-quality companies are now priced in the same range as the junk. You’re buying prime rib and paying the price of hamburger. You might as well go and sort through and find where these prime-rib candidates are and load up. You might as well buy the best companies and be positioned to make the most money instead of just picking up some of the weaker performers that are also trading at their lows.

TGR: Thanks for your time today.

MK: It’s always my pleasure.

Mike Kachanovsky is a consultant providing analysis of junior mining and exploration stocks. His work is published on a freelance basis in a variety of publications, including the Mexico Mike column in Investor’s Digest of Canada. He is a founder of www.smartinvestment.ca, which serves as an online community for the discussion of all topics relating to junior mining stocks.

Read what other experts are saying about:

Related Articles

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

DISCLOSURE:

1) Brian Sylvester conducted this interview for The Gold Report and provides services to The Gold Reportas an independent contractor. He or his family own shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of The Gold Report: Timmins Gold Corp., Great Panther Silver Ltd. and Excellon Resources Inc. Streetwise Reports does not accept stock in exchange for its services or as sponsorship payment.

3) Mike Kachanovsky: I or my family own shares of the following companies mentioned in this interview: Great Panther Silver Ltd., Alamos Gold Inc., Excellon Resources Inc., Endeavour Silver Corp., IMPACT Silver Corp., Energold Drilling Corp., Garibaldi Resources Corp., and Minaurum Gold Inc. Great Panther Silver Ltd., IMPACT Silver Corp., Garibaldi Resources Corp. and Minaurum Gold Inc. currently supportwww.smartinvestment.ca with paid advertising. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts’ statements without their consent.

5) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.

The Gold Report: Mexico is a mining jurisdiction where mining investors have made a lot of money, especially over the last decade. Mexico recently passed a 7.5% royalty on earnings before interest, depreciation and amortization (EBIDA) for mining companies operating there. Are the salad days over for miners in that jurisdiction?

The Gold Report: Mexico is a mining jurisdiction where mining investors have made a lot of money, especially over the last decade. Mexico recently passed a 7.5% royalty on earnings before interest, depreciation and amortization (EBIDA) for mining companies operating there. Are the salad days over for miners in that jurisdiction?