Currency

The blockchain has discovered gold (or gold has discovered the blockchain). Either way, this means several things. First, the decades-long dream of a gold-backed cybercurrency may finally be realized. Second, gold and probably silver are looking at a big new source of physical demand. Third, the huge number of gold-related initial coin offerings (ICOs) in this largely unregulated pipeline will require buyers to learn how to tell the legitimate offerings from the scams.

The blockchain has discovered gold (or gold has discovered the blockchain). Either way, this means several things. First, the decades-long dream of a gold-backed cybercurrency may finally be realized. Second, gold and probably silver are looking at a big new source of physical demand. Third, the huge number of gold-related initial coin offerings (ICOs) in this largely unregulated pipeline will require buyers to learn how to tell the legitimate offerings from the scams.

Two probably-legitimate examples:

UK’s Royal Mint Launches Gold-Backed Cryptocurrency

(Cointelegraph) – The UK’s Royal Mint, the institution responsible for producing all the physical money the country has for circulation, has announced the launch of its own gold-backed cryptocurrency.

The Blockchain-based coin, called Royal Mint Gold (RMG), is a digital representation of gold stored in The Royal Mint vault.

The Royal Mint Bullion, the Royal Mint company that sells physical gold, is the first company to allow customers to hold gold-backed assets on Blockchain, Tom Coghill, RMG’s Commercial Lead, stated in an interview with Express.co.uk. Coghill also mentioned that one RMG coin is equal to one gram of gold, adding that “it’s real gold you’re holding when you’re holding our RMG.”

A recent report published by the World Gold Council (WGC) compared Bitcoin and gold, declaring that though Bitcoin saw a higher growth in value in 2017, gold would remain an important store-of-value investment.

Coghill claimed that Bitcoin investments are more uncertain than investments in gold:

“Gold has probably had an argument that it’s been a store of value for 6,000 years, bitcoin’s a bit younger and the future of bitcoin is uncertain.”

——————–

Cryptocurrency backed by gold being developed by Perth Mint to entice investors back to precious metals

(ABC) – Australia’s biggest gold refiner, the Perth Mint, is developing its own cryptocurrency backed by physical precious metals.

The ambitious plan, which is subject to a confidentiality agreement, will make it easier for consumers to buy gold.

The mint also plans to make use of blockchain technology, first used as the core component of the digital currency Bitcoin, where it works as a public ledger for transactions.

In the 10 years since its inception, blockchain has been used to track transactions in industries from agriculture to land registration and the music recording industry.

For the Perth Mint, the need to bring investors back to precious metals after a boom in alternative investments such as cryptocurrencies posed an opportunity, according to chief executive Richard Hayes.

“I think as the world moves through times of increasing uncertainty, you’re seeing people look for alternate offerings,” he said.

“And you’re seeing this massive flow of funds into the likes of Bitcoin at the moment because people are looking for something outside of the traditional investments.”

But Mr Hayes said the volatility of some of the current cryptocurrencies meant they did not suit all investors.

And that is where a gold-backed offering may fit.

“With a crypto-gold or a crypto-precious metals offering, what you will see is that gold is actually backing it,” Mr Hayes said.

“So it will have all the benefits of something that is on a distributed ledger that settles very, very quickly, that is easy to trade, but is actually backed by precious metals, so there is actually something behind it, something backing it.”

Some thoughts on gold-backed cryptocurrencies (or tokens or whatever the correct term ends up being):

24 hour trading

Most financial markets have trading hours that are limited to the business day. Which means that most US investors can buy and sell, say, Amazon stock or silver coins only when domestic markets are open. Owners of a blockchain asset, in contrast, can wake up in the middle of the night, see an accurate quote, and act on it instantly. Whether this is a good or bad thing depends on the temperament and self-control of the individual. It’s possible that we’re creating a financial time-suck comparable to social addictions like Facebook and Instagram. And maybe a new danger for sleepwalkers…sleep trading?

On the positive hand, when things spin out of control in Asia or Europe, American owners of crypto-gold won’t have to wait until morning (which may be too late) to move their assets out of harm’s way.

Is it allocated?

Lots of different kinds of gold and silver accounts are already available, with the biggest differentiator being the ownership of the bullion sitting in custodial vaults. With allocated accounts buyers own specific metal bars, while with unallocated accounts buyers are in effect creditors of the company running the fund. The former is vastly safer and should be the only way that anyone ever owns remotely stored precious metals, including cryptos.

Good for gold/silver price?

Precious metal cryptos might engage some of the animal spirits that have been driving the bitcoin bull market — especially now that existing cryptos are correcting hard, thus reinforcing the lesson that these currencies aren’t backed by anything real. It’s possible that the contrast between bitcoin and crypto-gold will become a major topic of conversation in 2018, with the latter looking good by comparison and attracting serious speculative cash.

Existing tokens

It turns out that there are already a number of gold-backed cryptocurrencies out there. Here’s a list compiled by GoldScape:

Gold-Backed Cryptocurrency Directory

This is a current list of gold-backed cryptocurrency. This is a directory and not an editorial endorsement, so research all of the alternatives before investing. Some of the cryptocurrencies listed here don’t detail how they store and account for gold either, so proceed with caution. Any questions regarding each coin should be referred to their social media channel or forum listing.Since this post was first published there have been new coins added to the list and some are now ready to buy. The list is now sorted in order of availability.

Flashmoni (OZT)

Location: UK

Website: flashmoni.io

Flashmoni is a blockchain-powered fintech company that offers a physical gold-pegged cryptocurrency, innovative payment solutions and a smart contract-based advertising solution. In addition to using gold to back their tokens, they also plan to raise funds to directly operate mines to “improve miner’s working conditions, their lives and of the communities where they live.”There are two gold-backed tokens: OZG which is a private token pegged with 24 K gold stored in Dubai’s DMCC Free Zone and in Singapore. 1 OZG = 1 grain of gold (1 grain is approx 0.065 gram). OZT is the public token tradable on crypto exchanges and OZTs core value is 1/20th of the OZG.

GoldCrypto (AUX)

Location: Belize

Website: goldcrypto.ioAuX tokens by GoldCrypto are a cryptocurrency backed by physical gold. Currently, each 750 AuX Tokens will be backed by one ounce of gold (approximately US$1.70 per AuX Token). This gold backing per AuX Token then progressively increases.

Gold Bits Coin (GBeez)

Location: Australia

Website: goldbitscoin.comGold Bits Coin is a gold-backed crypto but the site and White Paper is light on details. It says that each coin is “backed by real gold”, but it doesn’t say how much gold is in each coin, or how it is stored. Gold Bits Coin Pre-ICO is on until 31 January 2018.

XGold Coin (XGC)

Location: Panama

Website: xgold.luXGold Coin (XGC) is a gold backed digital crypto-currency option. The price of one XGC Coin at initial pricing is based on a single gram of Gold. PRE-ICO First Round is on until 10 February 2018 and is offering a Pre-ICO 35% bonus.

AurusGold (AWG)

Location: Netherlands

Website: aurus.ioAurusGold is fully-allocated, gold-backed cryptocurrency. The Aurus asset tokenising protocol is used by top European gold traders to tokenise 99.99% LBMA approved, fully audited gold under the AurusGold (AWG) currency.

PureGold (PGT and PGG)

Location: Singapore

Website: puregold.ioPuregold is a payment gateway using Gold backed cryptocurrency. They offer two digital tokens called PGT for transactions; and PGG which is a cryptoasset backed by physical gold. The company uses physical gold (of 999.9 quality) as its security. Puregold’s gold reserves equal or exceed its circulated amounts of PGG gold-backed tokens. The physical gold is stored by a third party in a decentralized storage unit that Puregold stores investment grade gold, gold jewellery, small ingots (up to 100 grams) and coins. Puregold is part of Puregold.sg, which is a private mint in Singapore with its own in-house factory producing gold and bars. The ICO for Puregold runs from 15 January 2018 to 14 March 2018

Reales (RLS)

Location: Estonia

Website: realescoin.ioReales coin is a token that combines a basket of precious metal and cryptocurrencies. The breakdown of each token is 10% physical gold, 35% physical silver, 20% Bitcoin, and 20% for ICO’s and alt-coins (total 85%). The remaining 10% is for company’s budget and 5% for operational costs. Reales ICO ends 8 March, 2018.

Icing on the cake

The forces driving precious metals higher (out-of-control credit creation pretty much everywhere, geopolitical chaos in much of the world, bond and stock bubbles that should, if history still matters, burst shortly, and the looming mass devaluation of fiat currencies) are already nothing short of spectacular. So gold and silver don’t need the blockchain to be big winners in the next few years.

Still, the number of gold-related blockchain products is apparently going to soar in 2018 as the big gold players stake their claims. The result? A potentially significant jump in demand for physical gold as all these promoters acquire metal to back their offerings. So while gold is likely to soar in any event, the blockchain connection might be a big help. Think of it as icing on an already tasty cake.

There is a very good chance we witnessed the top in bitcoin when it hit just under $20,000 in December of 2017. The rapid price gains it achieved last year officially put it in the record books as the largest bubble ever recorded, exceeding even the Tulip Mania of 1634-1637.

Recently, we saw the dollar index (the DXY), which measures the USD against a basket of the world’s major currencies, break below its support of 91 for the first time since January of 2015 (Figure 1). This event may signal the most important trend of 2018: the breakdown of the dollar.

The recent drop of .96 percent was the second largest drop in over a year and caught many traders by surprise…

The USD was the talk of the town this week, if you were in Davos that is. Treasury Secretary Mnuchin gave a “weak dollar” statement that the market jumped on, pushing the USD index down to lows we haven’t seen since the end of 2014. Trump has since tried to “walk back” the statement saying they USD is based on the strength of the economy and will therefore get much, much stronger. Trumps headline was enough to push the USD a full point higher before it faded again on Friday.

So what did we learn from the USD action this week? 1) Get ready for a little more volatility this year. I think that means in the amount of “chop” and the willingness for trends to persist. 2) Momentum is like a train, it is a lot easier to jump on than stand in front of. Even with the President out to talk up the USD, it is finishing the weak on a soft note. The USD is now down for its 5th quarter in a row, 3rd month in a row and 6th week in a row. It has been very weak. Given that so many markets are priced in, or looked at relative to the USD we have seen this impact across markets.

The key date on this USD move is the middle of December in which I can look across markets and see that they started to diverge from what I call their typical “drivers” or what moves that particular market. And from that date the one common theme is that many markets have had the majority of their moves from that date because of excessive weakness in the USD. I had originally attributed this divergence to light holiday, however when it became more exacerbated through the start of this year I had to spend more time looking around for a better reason. David Rosenberg argued that the Fed meeting mid-December was when Yellen gave the “green light” to markets in her final Fed Chair press conference. Since we have had a weak USD (no Fed tightness??), strong commodities and a very strong stock market (up over 8% from mid Dec!). So while this wasn’t as implicit as the Bernanke Put, the market seems to have gotten the message.

So with the momentum surging across markets, do we have a catalyst for a turn? We have a Fed meeting this week on the 30-31st, but as it is Yellen’s last meeting and only a FOMC statement, not much is expected. However, as this is the end of the Yellen era, will we start to see a different tone out of the Fed? What if we start to see Jay Powell offer a different view from what Yellen has been saying?? Especially with speed of the recent market moves.

The trader in me thinks that this USD move is overdone and therefore many other markets that are “far off” their regular drivers are also mispriced. But this is in piano catching territory, so it makes sense to be patient!

CAD: while much higher than I think it should be, it is has also lagged behind many other currencies during this USD weakness. While NAFTA could be a key component of this, even the Mexican peso has outperformed CAD over the last several weeks. My view is that the Bank of Canada will be hold longer than the market is currently pricing in, especially after watching recent Poloz comments about the incremental interest rate hikes becoming more burdensome for indebted Canadians. The perception of this longer pause in rate hikes is also showing up in the interest rate spreads against the US. Oil prices have jumped higher with a weak USD, but the rise to $66 WTI has been “numbed” for CAD due to an over $28 discount for Western Canada Select, Canada’s oil benchmark. So given that I think the USD is oversold, I wanted to take a position in the weakest currency in the pack, it tends to be slightly less risky to go after the laggard rather than expecting a big move from the currency that is the strongest. I have initiated a small position short CAD this week after Mnuchin’s comments.

Interest Rates: While the USD has grabbed the headlines, US interest rates have continued to move higher with the US 10yr closing the week at 2.65% up over 30bps from the mid-December level. In my view the US 10yr is all about the run to 3%, will it get there?? Will it move through it? I think it will be this move in interest rates that finally pressures stock market prices, whether the rate rise is from the Fed or market driven. I’m continuing to hold my short position in 10yr treasuries.

Gold: Given the recent rise in interest rates and muted inflation picture, the rise in real rates is telling me that Gold should be trading much lower than it is right now. However, the excessive weakness of the USD has driven the momentum higher in the gold. But I think gold is set up for a scenario is which it is very vulnerable to any USD strength. There are some trade tensions mounting, however the current geopolitical picture does not justify the current excessive bid in gold.

|

Today has been momentous because the dollar has finally broken down from its giant 3-year long Broadening Top pattern, and fundamental developments suggest that it will continue to weaken, and since it has now broken down decisively, the rate is decline is likely to accelerate. These fundamental developments include the imposition of tariffs, long proven to be self-defeating and economically destructive, which invite retaliation and will slow the global economy, and the administration stating that it wants to see a weaker dollar as a means of increasing competitive advantage, which again will invite a “beggar thy neighbor” response from other powers.

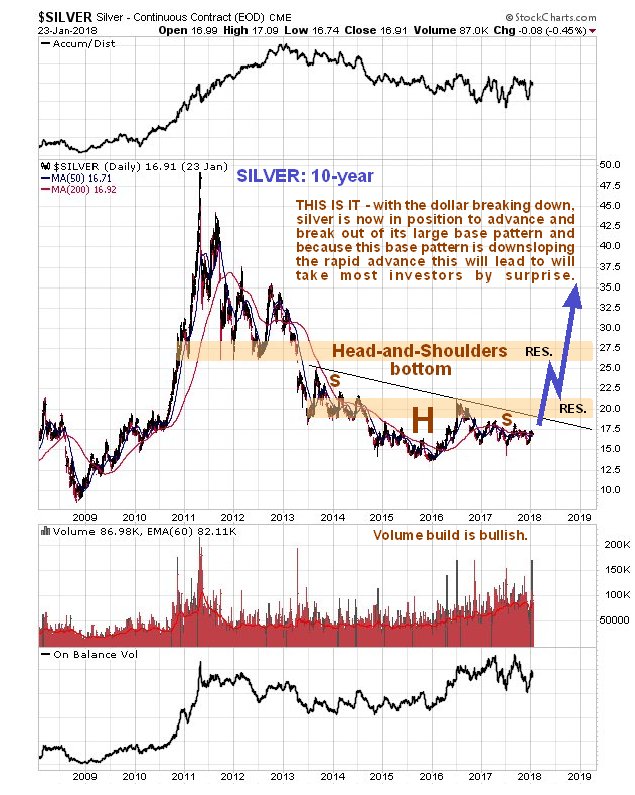

Thus the underpinnings of the stock market rally are being kicked away. The outlook for the dollar is now grim, but on the other hand the outlook for gold and silver could not be better, and they are now limbering up to break out of their giant Head-and-Shoulders patterns, and once they do will enter a vigorous bull market. Gold and silver stocks will soar when that happens, because after years of tough conditions, producing mining companies are slimmed down and efficient and rises in metal prices will go straight down to their bottom lines.

For my subscribers, on Jan. 13, I presented 49 of the best gold and silver stocks for the imminent precious metals sector bull market. In the environment that we will soon be moving into you will basically be able to “throw darts” and pick winners in this sector, while most of the rest of the stock market goes into meltdown.

As we can see below, gold is now in position to break out of its giant base pattern that has taken almost five years to build out. The talk about it being suppressed by manipulation is largely “sour grapes”—the plain fact of the matter is that versatile investors were partying elsewhere, in the broad market, the FANGS, Bitcoin and Cryptos, etc., most of which will soon hit a wall.

Ditto silver, which will take a lot of investors by surprise because it has been more depressed, but has the capacity to rally more strongly.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years’ experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.