Currency

“If Bernanke doesn’t reverse course.”

Peter Schiff, CEO of Euro Pacific Capital, lambasted the Federal Reserve on Monday and said that the United States dollar is going to collapse unless Fed Chairman Ben Bernanke stops stimulating the economy and inflating the money supply.

Peter Schiff, CEO of Euro Pacific Capital, lambasted the Federal Reserve on Monday and said that the United States dollar is going to collapse unless Fed Chairman Ben Bernanke stops stimulating the economy and inflating the money supply.

“The dollar is going to collapse if [Fed Chairman] Ben Bernanke doesn’t reverse course,” Schiff said in an interview with Yahoo! Finance. “And if he does, the whole phony economy that has been built on the foundation of stimulus is going to collapse as well.”

During a policy meeting last week, the Federal Reserve confirmed that quantitative easing will persist and didn’t provide any hints as to when it will end – Bernanke has consistently stated that it’s an indefinite policy.

“Ben Bernanke believes that somehow he can withdraw the stimulus and the economy will keep on expanding. It’s impossible because we have an economy that’s of stimulus, by stimulus and for stimulus,” explained the 2010 Republican Senate candidate.

Although the U.S. dollar has gained against other currencies within the past year, Schiff believes that eventually investors will get wise to the Fed’s disastrous policies and get out of the greenback immediately.

“People are going to realize, or call the Fed’s bluff, that our economy is stimulus-based,” stated Schiff. “There is not a real exit strategy. The Fed is going to print money indefinitely.”

Will a financial collapse come about in 2013? Marc Faber gives his advice for gold and silver stackers and some economic forecasts.

Marc Faber is the publisher of the Gloom Boom and Doom report and often shares his recommendations in interviews regarding the financial markets. He believes equities will fall 20% in the short term in most countries, except Japan, Vietnam, China due to their underperformance over the past few years. He was also asked about bonds? He says they could rally from here because they’re oversold, we could have seen the lows but he would not buy US treasuries. Other questions asked include what do you see the price of oil going to in 2013 and is Apple stock (AAPL) overvalued? Will the price crash or correction continue?

– in a recent interview with McAlvany – Click here to watch the full interview >>>>>>

Bitcoin. Up 1,439,900% since inception and up 84% since the European Government attempting to steal investors savings in Cyprus!

Wow, you think. Better at least find out how it works.How hard it is to open an account (easy), whether its a good investment and how much would I have to risk (US$72 last thursday, up 84% from just two weeks ago on news of the Cyprus bailout ) and perhaps buy one just in case it is.

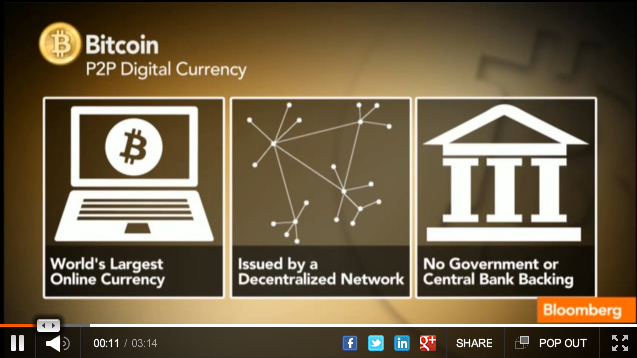

If you want to watch how Bitcoin works, click on the video below. Otherwise keep on reading underneath the video.

After it was noticed that Spaniards are opening accounts in a flurry after the European Union attempted to steal investors money in Cyprus, this video below was posted on Bloomberg’s “Market Makers” March 21. In it the guests explain what’s happening, what Bitcoin is, and how it is used:

All around the world governments and central banks are expanding the current debt bubble. As a result, the global banking system failures and massive dilution to money are brining light to new forms of wealth protection. The following is an excerpt all about Bitcoin and Gold from Equedia’s full article The New Currency Movement. You will find more full articles of all different views from other authors also below this:

Bitcoin: The World’s Largest Online Currency

Bitcoin, an open-source software code founded in 2009, is a complex and anonymous type of electronic currency that can be swapped for local currencies like dollars, yen and euros.

Users create accounts and use their local cash to buy Bitcoins, at a rate that fluctuates with the supply and demand of the market — just like any other currency. The Bitcoins can be stored in an online wallet, used to make purchases and converted back into local currencies.

The beauty of Bitcoin is that — unlike most currencies that are controlled by central bankers — Bitcoin is highly decentralized with the number of Bitcoins in circulation expanding at a predictable and limited rate. Bitcoin also notes that its accounts cannot be seized by local authorities. ( that last bolding and underlining via Money Talks editor, all other bolding by Equedia)

If you think that Bitcoin is simply just a novel idea, think again.

The Strongest Currency: Up 1,439,900%

Nearly two years ago, Bruce Wagner, organizer of New York’s Bitcoin developer’s meet-up, told Forbes that, “Someday (Bitcoin) will probably have the Fed scrambling…They still don’t know what Twitter is. By the time they figure this out, it will have already taken hold.”

On Thursday, the value of one Bitcoin hit an all-time high of US$72, up 84% from just two weeks ago on news of the Cyprus bailout. That means there is over US$800 million worth of Bitcoin in circulation. It also means that since Bitcoin was introduced, the value of a Bitcoin has gone up 1,439,900%.

Bruce Wagner was right. Not only has the value of a Bitcoin increased exponentially, the Fed is beginning to scramble. Virtual currencies have garnered so much attention that even regulators are now taking notice as earlier this week the Treasury Department said it is applying money-laundering rules to so-called virtual currencies.

They say virtual currencies such as Bitcoins could become a haven for criminal activity. An FBI report last year revealed that at least one online service accepts Bitcoins in exchange for illegal drugs. I guess no one buys drugs with dollars anymore…

The recent media explosion of virtual currencies such as Bitcoin brings to light that people around the world are truly beginning to lose faith in central bank controlled paper money. When you have money that can be printed from thin air, stored in government controlled banking systems that can impose bailout taxes on your savings, it would be stupid not to look for alternative ways to protect your savings and wealth.

I am not writing about Bitcoin because I am promoting it. As a matter of fact, I don’t. I still don’t trust my wealth and security to open-source software codes or virtual currencies – even if they return me 1,439,900%. Perhaps if I had invested some dollars in Bitcoin years ago, I may be singing a different tune. However, Bitcoin already glitched earlier this month which caused the currency’s value to briefly plummet 23% before recovering.

Do you know what alternative currency doesn’t glitch and is being hoarded by central banks around the world?

Gold Hoarding Intensifies

With the recent media frenzy surrounding Cyprus, Bernanke’s announcement of continued QE, and Japan’s upcoming massive stimulus increases, gold’s value should only rise.

As I mentioned in “The Coming Shockwave,” countries around the world engaged in the race to devalue have been big purchasers of gold because they know they need to protect themselves from their own currency.

In January, I talked about Germany requesting their gold back from the U.S and France. Now it seems the Swiss want to do the same.

According to Swissinfo:

“A right-wing group has submitted more than 106,000 signatures to the federal authorities, seeking a vote on stopping the sale of gold reserves held by the Swiss National Bank (SNB). It also wants gold bars stored in the US to be returned.

The group, led by members of the Swiss People’s Party, the far-right Swiss Democrats and the Lega dei Ticinesi movement, is confident a nationwide vote will be called on the issue once the signatures are verified. A date still has to be set by the government.

People’s Party parliamentarian Luzi Stamm criticised the sale of gold reserves which started 13 years ago following a decision to abandon the gold standard.

“Gold reserves guarantee the stability of the Swiss franc. They ensure that that private savings, salaries, pension keep their value,” Stamm said. He warned gold must not be the object of speculation for the SNB or for politicians.

The initiative also seeks to enshrine in the constitution a clause obliging the central bank to keep a minimum of 20 per cent of its assets in gold, twice the current level. Promoters say higher gold reserves will boost the SNB’s credibility. In addition, they want to force the government to disclose where the gold reserves are stored.

An important part of the reserves are kept in the United States, according to People’s Party parliamentarian Lukas Reimann. He doubts whether the heavily indebted country can be trusted with the Swiss gold.

“It is only in safe hands if it is kept in Switzerland,” he told journalists.”

Back on June 2011, in my Letter, “The Greatest War in History,” I mentioned that many US states were beginning to introduce precious metals as legal tender.Now it appears that some states also want their gold back.

Texas Rep. Giovanni Capriglione now has a bill in play that would move the state’s gold from New York to a depository within the state of Texas itself. Via the Texas Tribune:

“Freshman Rep. Giovanni Capriglione, R-Southlake, is carrying a bill that would establish the Texas Bullion Depository, a secure state-based bank to house $1 billion worth of gold bars owned by the University of Texas Investment Management Company, or UTIMCO, and currently stored by the Federal Reserve.

“…We’re trying to figure out the right amount of gold to have here in Texas,” Capriglione said. “We don’t want just the certificates. We want our gold. And if you’re the state of Texas, you should be able to get your gold.”

Meanwhile, Argentines are buying more gold than ever to protect their savings from the fastest inflation in the Western Hemisphere.

According to Bloomberg, Banco de la Ciudad de Buenos Aires, Argentina’s only bank offering gold bullion coins and bars to investors and savers is negotiating with mining companies to purchase gold direct because there is so much demand.

It’s estimated that prices in Argentina are rising 26 percent a year and Argentines are using gold to protect their wealth because buying the buying of US dollar has been banned since last year.

One Argentine, as Bloomberg reported, bought gold a year ago and is already up nearly half as a result of a devaluing Argentine peso.

So while the world watches the paper market of gold being manipulated, the physical world continues to explode.

It’s catch up time.

End Notes

Ivan Lo

Equedia Weekly. Questions? Call Us Toll Free: 1-888-EQUEDIA (378-3342)

More Bitcoin Articles:

Canadian house first on sale for Bitcoin currency

Jittery Spaniards Seek Safety in Bitcoins – Businessweek

Sorry, Bitcoin Isn’t a ‘Currency’

Why Bitcoins Are Just Like Gold

….so much more at this google search HERE

“Can you by legislation add one farthing to the wealth of the country?” The great classical-liberal thinker Richard Cobden asked the House of Commons on Feb. 27, 1846.

The Argentines think so. So do the Europeans. And of course, the Americans.

But first let us continue with Cobden’s remarks:

“You may, by legislation, in one evening, destroy the fruits and accumulations of a century of labour; but I defy you to show me how, by the legislation of this House, you can add one farthing to the wealth of the country.”

Two news items yesterday reminded us how vain and treacherous the politicians can be.

Uh Oh!

First, from the Argentine press came a story with the following headline: “Kirchner Government to Tighten Capital Controls.”

Uh oh! It’s already a pain in the neck to try to keep the lights on south of the Rio de la Plata. If you move money into the country officially, you will take about a beating. Officially, the exchange rate is under six pesos to the dollar. But guys will come up to you on the street and offer you eight pesos to the dollar — and more.

In Salta, for example, you pull up in front of a bank at the corner of the central square. You beckon to one of the many money changers standing on the sidewalk. You don’t get out of your car.

“How much do you want,” he asks.

“I want to change $1,000,” you reply.

“Then, I’ll give you eight.”

“No thanks,” you say… shooing him away.

“Alright, 8.1.”

“OK… we have a deal.”

You count out your money and go on your way. No standing in line. No need for photo IDs. Cash and carry. Remarkably efficient. As long as you stay in the black market. You can spend your money, no problem.

But try to do business in an aboveboard way and you will quickly be caught in a trap. The government is running out of dollars. It tries to force you to give up dollars at less than the market rate.

Already, these controls have driven many imported products off the market completely. And now, with even stricter controls coming, it’s going to get even tougher.

But what would you expect from Argentina? Is there any foot in the Argentina banking system that isn’t missing at least a couple of toes? Give them a super-stupid policy “gun,” and they will aim for their feet.

The Turning of the Screw

Europe is a different matter. Or so we thought. More sophisticated. More subtle. More careful. Run by German bankers with memories that stretch all the way back to the Weimar debacle of the 1920s.

But here’s another story from yesterday’s news. You’ll see that Europe is thinking of imposing the same capital control policies that are hobbling the Argentine economy. From Reuters:

Eurozone finance officials acknowledged being “in a mess” over Cyprus during a conference call on Wednesday and discussed imposing capital controls to insulate the region from a possible collapse of the Cypriot economy.

In detailed notes of the call seen by Reuters, one official described emotions as running “very high,” making it difficult to come up with rational solutions, and referred to “open talk in regards of (Cyprus) leaving the eurozone.”

“Some additional laws need to be passed. Overall we are in a very difficult situation,” the official said, according to the notes. “(We’re) trying to do everything within the powers to limit any unauthorised outflows.”

We hope you are paying attention, dear reader. The euro feds are talking about passing laws to stop “unauthorized” outflows. In other words, they will make it illegal for you to put your money where you want. You will need their permission to move it. They want it right where they can get it… if they need it.

They think they can pass laws and add to the wealth of the nation — or at least parts of it. And it won’t be too long before Americans join in. They’re already robbing savers with ultra-low interest rates. And the U.S. has already passed laws to make it difficult to keep funds in foreign bank accounts.

As their financial problems mount, the feds will turn the screws harder — just like the Europeans and the Argentines.

Regards,

Bill

Bill Bonner started Diary of a Rogue Economist to share his over 30 years of economics and market experience with as many interested readers as possible.

Diary of a Rogue Economist is always free, and it’s delivered to your email each business day.

What Planet Are These U.S. Congressmen On?

REVEALED: Straight FACTS on the Most Lurid… Stomach-Churning… and Un-American Behavior Seen in the “Corridors of Corruption” since Watergate Brought Our Nation to Its Knees.

Outrageous? Yes. But profitable too. Here’s the entire exposé on this sordid and breaking affair…

Like Bill’s Diary?

Republish our articles on your website or blog for free. Learn How

Have a question for our editorial team?

Contact Us

In Niall Ferguson’s Civilization: The West and the Rest, he presents a list of institutional arrangements that turned a bunch of ignorant, “malodorous” Europeans into the world’s dominant culture in the space of a couple of centuries. One of those institutional arrangements was property rights. That is, when something is yours it’s yours, not the king’s or the clergy’s or the local lord’s. A contract, once agreed to, is sacred before the law and is enforced by the powers-that-be.

In Niall Ferguson’s Civilization: The West and the Rest, he presents a list of institutional arrangements that turned a bunch of ignorant, “malodorous” Europeans into the world’s dominant culture in the space of a couple of centuries. One of those institutional arrangements was property rights. That is, when something is yours it’s yours, not the king’s or the clergy’s or the local lord’s. A contract, once agreed to, is sacred before the law and is enforced by the powers-that-be.

This institution hasn’t always been perfectly respected, of course, but in the West’s more successful capitalist democracies it has been solid enough to allow citizens to work, save, create and innovate, reasonably secure in the knowledge that they’ll get to keep most of what they earn and all that they save.

The centrality of property rights is why Cyprus is sending shock waves through the global financial system.

…..read more HERE