Michael Campbell’s MoneyTalks – Complete Show

01:16 – 06:26 Mike’s Editorial – Big government loving politicians are squaring off against doctors, farmers and entrepreneurs. In one corner some prominent economists – in the other angry accountants saying enough already with the increasing complexity of the tax code. $250 million a year in tax money at stake.

15:29 – 18:54 – Bullish Gold for the balance of the year is this weeks Big Fat Idea using a reduced risk option strategy

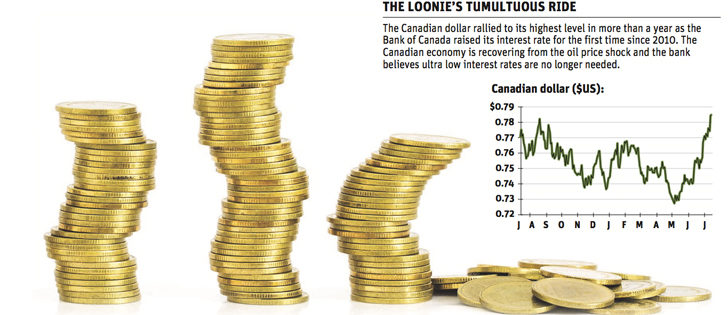

03:23 – 18: 20 – Featured Guest Jack Crooks talks about where to next for the Canadian dollar, gold and the key to the market moves.

21:55 – 24:08 – Plus a fun shocking stat from the NFL. Who’s The Best Bargain in the NFL?

25:41 – 32:36 And Ozzie Jurock talks about the collapse in Toronto – is Vancouver next?

34:13 – 37:51 – Victor Adair is Live From the Trading Desk

01:13 – 07:19 – Michael’s Editorial – The push to eliminate thinking that opposes what is considered acceptable thought on University Campuses, or the attempts to crush any thinking that reveals flawed data or conclusions on the environmental file continues to gather steam. It could be easily called the tyranny of onsided opinion because the groups opposed to contrary opinion are prepared to use violence to squelch alternate thought.

07:25 – 16:24 – Hot stories with Michael Levy

16:25 – 18:50 – Special treat from Michael if you are interested in what one of the Worlds most respected economists had to say to the liberal talk show host Phil Donahue about greed, which societies have it, and which don’t.

02:05 – 05:41 – Quote of the Week – Once you allow an authority to determine which opinions are to be allowed, you make your own speech vulnerable to it. The U. of Berkley listened and has declared it will be a “Free Speech Year at Berkley”.

06:30 – 11:50 – Victor Adair Live from the Trading Desk

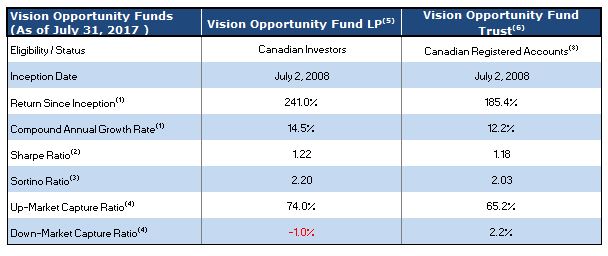

11:54 – 27:54 – Being either long or short North American real estate is the goal of Featured Guest Jeff Olin of Vision Capital.

This two pronged approach has lead to the Vision Opportunity Fund yielding a 241% return vs the 41.9% return of the S&P/TSX Composite Index over the same period July 2, 2008 to July 31, 2017, outperforming since inception Canadian Equity, Hedge Fund and Real Estate indices with a substantially low risk profile.

Jeff shares with Michael today’s most attractive real estate sectors, some to avoid and as well names a brace of specific stocks including some with dividends that are attractive to purchase now. One stock GGP is worth $32 but is trading at $21 because of sector market conditions.

Michael begins his show with an Editorial that is sure to set some activist groups teeth on edge. He follows it up with a Bonus Editorial about the current trend of groups trying to powerwash history. Tyler Bollhorn on techniques to improve your Stock Market profitability.

01:02 – 06:28 – Michael’s Editorial – 35 million Canadians currently gets access to 300 million of the richest customers on the planet, 50% of Ontario’s economy is dependent on US/Canada Trade. A major disruption in trade would be a disaster, but common sense doesn’t matter when you have an ideaolgy.

08: 28 – 12:25 Mike Levy’s top stories

14.30 0 18.31 – Michael’s Bonus Editorial

01:21 – 02:55 – Michael’s Quote of the Week – The War On History

Something’s wrong. Ontario teachers want a founding father of our nation, John A. Mcdonald, a removed from schools, Canadian veterans are getting nickle & dimed while a confessed murderer of a medic is lauded as a hero and made a multimillionaire overnight!

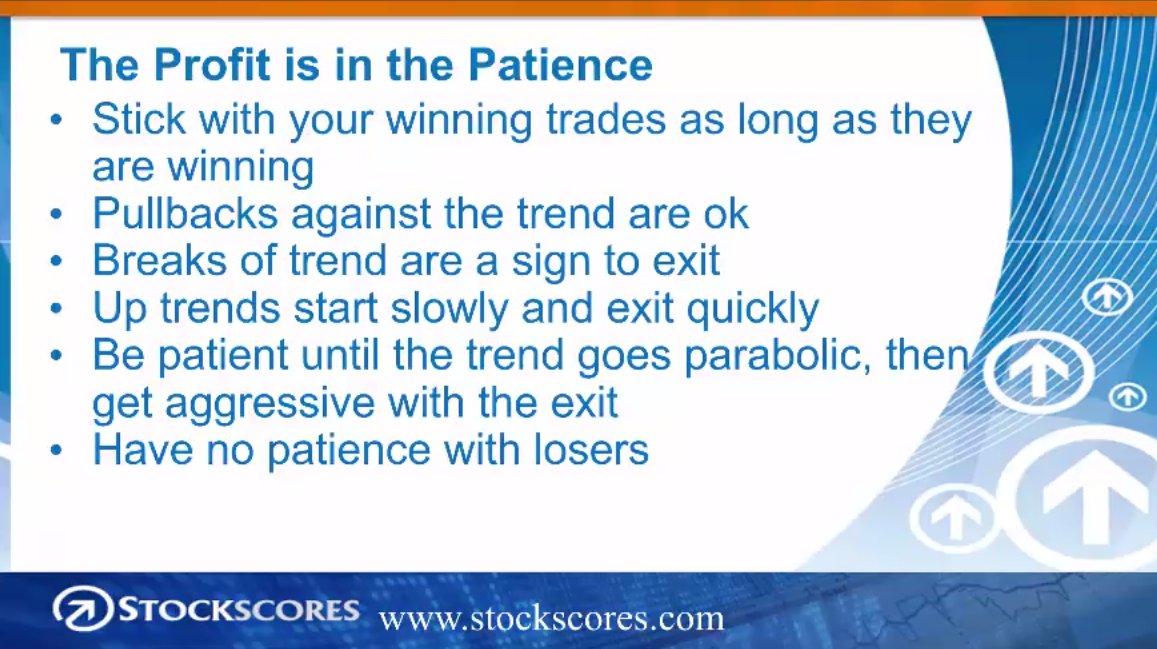

02:56 – 18:06 – Michael’s Featured Guest – Tyler Bollhorn identifies statistically significant abnormal trading activity, a method that yielded 30%+ returns in his small cap portfolio picks last year. In today’s interview Tyler discusses his techniques to improve your Stock Market Profitability. One example, with markets like Bitcoin rising $2500 in a few months Tyler warns against chasing what has been working, and instead focusing on what is just starting to move up.

20:44 – 23:48 – Shocking Stat: The concern of illegal asylum seekers into Canada pales in comparison to what is going on in Europe right now.

25:20 – 33:54 Michael shares a costly mistake he himself made in real estate and gets Ozzie’s advice on how everyone can avoid making the same mistake too.

35.06 – 37:19 – Michael’s Goofy Award Winner!

….also from Michael: Ignorance – Trump & Canada’s Anti-Free Trade Contingent

01:03 – 05:42 Michael’s Editorial – Maybe it’s one of those much ballyhooed Liberal values. In a strange twist to the NAFTA negotiations, the federal Liberals are demanding to keep supply management – a program that costs Canadians far more than they saved with the middle class tax cut. Hint: low income earners are really screwed.

07:02 – 12:14 – Craig Burrows of Tri-View Capital with a Big Fat Idea to take advantage of the fastest growing group of people 65 and over. Specifically taking care of those that can’t take care of themselves in that cohort. Two companies, Chartwell Retirement Residences CSH/UN.TO with a 3.8% dividend and Sienna Senior Living SIA.TO with a 5% dividend.

13:38 – 18:44 – Michael comments on the Charlottesville attack. For many the problem is Donald Trump, but Michael thinks that misses the bigger picture. What about the left wing group that promotes violence Antifa?

00:00 – 03:03 – This Quote of the week addresses the escalating problem in society where we can’t bridge our divisions because we are increasingly unable to have honest respectful conversations, with so many areas and topics no-go zones. It’s all leading to escalating civil violence.

03:04 – 19:01 – Dr. James Thorne was very clear when he last joined us in April 2017 that Trump’s deregulation of the financial sector and though he expected it to be a 2-3 year process things have gone very well in that area. James tells Michael what opportunities investors should be looking at to take advantage of this deregulation.

Jame also thinks that we are early in the transition from analog to digital and recommended Amazon and Google last time, both which are trading higher now. James says the rate of change of technological innovation is accelerating, and with Amazon doing significant damage in the retail space, any company that isn’t spending significant amounts of money on technology “is going to go away”.

In a fascinating segment of this interview, the US Government & the Obama Administration is about to be accused of committing the largest financial crime in history, stealing money from Fannie Mae and Freddie Mac to finance a bail-out Wall Street and to also finance ObamaCare. Documents are now coming out but it is not yet being covered by the mainstream media.

Thorne like the fact that their is fear in the market, and he scours the world for places where that fear is in place, Europe is interesting, Greece looks good oThe Problem With The Relentless Middle Class Messagever the next 2-3 years. Canada is looking expensive.

24:05 – 29:49 – Ozzie Jurock answers all of Mike’s questions of the current and future state of the real estate market

31:33 – 34:18 – The state of the markets with Live from the Trading Desk and Drew Zimmerman

34:34 – 37:37 – This week’s Goofy Award Winner

01:42 – 06:35 – Michael’s Editorial – On Thursday the BC NDP/Green government held a news conference to announce that from here forward they would stop using cars, cease buying any goods transported by gas or diesel trucks, and immediately cease all air and ferry travel. Just kidding! Naturally they did no such thing, but they did promise to do everything they could to delay the Kinder Morgan Pipeline.

06:40 15:44 – Top stories of the Week with Michael Levy

15:45 – 18:47 – This weeks Big Fat Idea is Electric vehicles power source of choice – lithium ion batteries. Several companies involved, Battery material suppliers – Albermarle Corp. (NYSE: ALB) which supplies lithium. Imerys (EPA: NK) which supplies graphite and Glencore (GLEN.L) which supplies cobalt

01:42 – 02:34 – This Quote of the Week features George Orwell, and you might want to ask if his quote applies to you.

02:35 – 15:36 – Featured guest Joel Solomon is the chairman of the Renewal Fund and author of The Clean Money Revolution, a book that argues that the 50 Trillion dollars that will move from the older generation to a younger generation by 2050 will transform capitalism by powering sustainable businesses that build social and financial equity and change the world. The renewal fund invests in early stage companies the food, skin care and water businesses.

15:42 – 17:16 This weeks Bonus Shocking Stat! This one is for sausage lovers who have to know what is actually in their sausages!

20:20 – 22:53 – This Shocking Stat give us a horrifying glimpse into the danger from islamic Jihadists that surround us in the west. From a British Intelligence report in the wake of the attack in Manchester we find that there are 23,000 Jihadist extremists living in the UK and 3000 of them pose an active threat! The UK is not the only European country with a problem either as Michael’s list of statistics underscores

24:15 – 32:19 – Ozzie Jurock on the massive change in investment money coming from China. Also Ozzie on the most interesting real estate story you will ever hear! The latest big story on what is happening with shopping malls in North America.

33:19 – 36:05 – Live from the Trading Desk with Victor Adair – Reuters estimates that global stock markets lost over $1 Trillion (1.3%) in value this week as rising tensions between American and North Korea caused prices to fall. The benchmark S&P 500 Index hit All Time Highs on Tuesday but Friday’s close was the lowest in over a month, creating a Weekly Key Reversal Down on the charts.

36:19 – 38:01 – Michael’s candidate for the stupidest man in BC is this week’s Goofy. Believe it or not he has some challengers for the title as Michael explains.

…also Michael’s Editorial: “If The Right People Say The Right Things, It Matters Little What They Do”