Daily Updates

(click on image or HERE for Larger View)

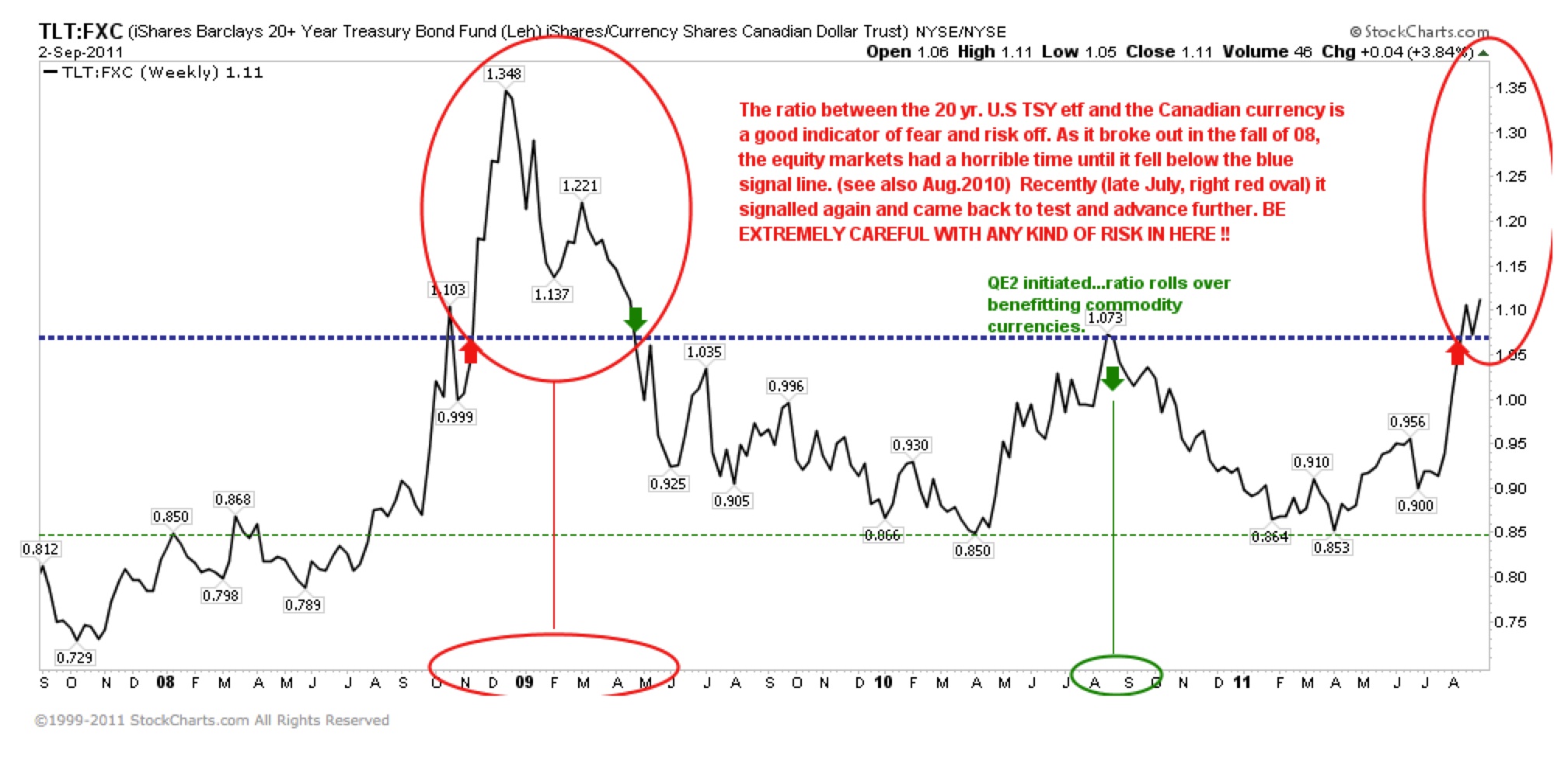

The fear trade has come to life the last few weeks and the above chart from Technician Cory suggests fear may well be here to stay for the next several weeks.

Here he shows the US long bond index “TLT” as a ratio over the Canadian dollar Index “FXC”. When the TLT moves up more than the FXC we see the deflation fear trade has the upper hand over growth or inflation prospects. The TLT ratio came up to resistance in August last summer and then rolled over on the euphoric hopes that QE2 would revive growth. Lately as this hope has been dashed, the TLT/FXC ratio has broken out just as it did in the fall of 2008. Harbinger of things to come?

Mark Leibovit of VRTrader: Mark Leibovit is on a Stock Sell Signal. “The S&P 500 plummeted from 1230 (precisely my forecast rally point) to 1170 late Friday.” If we’ve truly entered a bear market, then as I’ve told you, we could ultimately see a move back to the 800s”

The above is just a fraction of Mark’sVRTrader. Much more analysis contained every day in Mark’sVRTrader Silver or Platinum Service. Send an email to mark.vrtrader@gmail.com or call 928-282-1275

As a general rule the most successful man in life is the man who has the best information

It’s a fact in the mining world that most discoveries are made by a) junior mining companies and b) old time individual prospectors. Why are the juniors so successful at making discoveries and finding mines? Well, the good ones are lean mean boots on the ground exploration and development companies run by people who have been out there and know what it takes. They know how to raise money from the suits and they know how to get the story out to the retail investor.

They are not tied up in bureaucratic red tape and can make the important decisions without commissioning a six month study or running it up through 12 layers of pencil pushers and then sitting on their butts waiting for an answer while somebody else scoops the prize. They can and do make up their minds very quickly and can execute immediately on plans.

I believe junior resource companies offer the greatest leverage to increased demand and rising prices for commodities. There is also a very real and increasing trend for Mergers and Acquisitions (M&A) in one of the few bright spots available for investors – resources.

“As the potential for commodity scarcity escalates, M&A activity in the global mining sector will likely intensify, mimicking a ‘global arms race. With few large targets in play and diminishing key resource reserves, we expect global miners will continue to scour the globe for projects and broaden their deal strategies.” M&A in the Global Mining Sector – No Stone Unturned, PricewaterhouseCoopers

Juniors, not majors, own the worlds future mines and juniors are the ones most adept at finding these future mines. They already own, and find more of, what the world’s larger mining companies need to replace reserves and grow their asset base.

Junior resource companies, the owners of the worlds next mines, are soon going to have their turn under the investment spotlight and should be on every investors radar screen.

If I was looking for superior investment vehicles to take advantage of what I think I know regarding the future for commodities I’d be looking at junior producers, near term producers and companies that are in the post discovery resource definition stage with the occasional green field exploration play thrown into the mix.

Remember, our junior resource companies, the same ones who today are so oversold and undervalued, are the present owners of the world’s future commodities supply.

Company stage – risk v. reward

Juniors are risky, managing that risk is what investing in the junior resource sector is all about – in a nutshell it’s all about when you invest. Some people invest extremely early because of management, some on the possibility of what a property might host, some people will wait and invest as you start to drill and build resources thus reducing their risk. You pay less because there is more risk or you pay more because there is less risk, only you can decide the level of risk you can tolerate and how much patience you have to sit while developments, the story, plays out.

The most upside (and by far the greatest risk) comes from buying a junior when they are exploring and make an initial discovery. Great drill assay results can send a juniors share price skyrocketing. The reverse can also be true. Junior explorers, the green field plays, are the riskiest plays by far. Strike out on assay results and it could be goodbye to a share price rise for a very long time – till the company finds another project they can work on. If you’re buying into this kind of play make sure the company has another fallback project in its portfolio.

My favorite stage junior is a junior in the post discovery resource definition stage (also known as brown field stage companies). These companies have already found something, the share price has settled back after the initial discovery (never chase a company whose share price has already exploded, the share price has had its run, for now the moneys been made. I try and enter after the excitement has died down and the share price has settled back) and the company is going in to see what they have and hopefully produce a 43-101 compliant resource estimate and build upon it. The risk has been greatly reduced, the waiting time for a discovery non-existent and the reward very nice considering the much lower amount of risk.

For nearer term producers – for those further down the development path towards a mine – you have:

· Preliminary Economic Assessment’s (PEA) or scoping studies are done to examine potential mining scenarios and economic parameters – A PEA or scoping study is an important milestone for a mineral project, it’s the first step in a company’s economic and technical examination of a proposed mine

· Preliminary feasibility studies or pre-feas studies are more detailed than PEA’s and are used to determine whether or not to proceed with a detailed feasibility study. They are also used as a reality check to determine areas within the project that require more attention

· Feasibility studies will determine definitively whether or not to proceed with the project. A feasibility study or bankable feasibility provides budget figures for the project and will be the basis for raising capital to build the mine

Remember all these different stage studies are only yes/no decisions on whether to move to the next stage. NONE of them mean you are going mining, there’s no mine till every stage is completed, permits approved and the necessary financing has been arranged.

Because these companies are well advanced along the development path a lot of the guesswork about grade, size, costs and metallurgy have been taken out of the equation for us. They have done sufficient work to give investors a certain level of confidence that their project will successfully move towards being a mine. The later stage companies (those doing feasibility, permitting and money raising) can have an excellent entry point for investors – they often enter a quiet period when they are doing the advanced studies and raising money to go into production. They often base (a flat share price) for quite a while through this period – possibly a good time for accumulation of their shares if you believe in the story. After the money is raised for production investors can see they are going mining – cash flow is just over the horizon – and the share price will often break out of its trading range.

With producers you have to look at the balance sheet, consider their plans for the future and judge for yourself the ability to meet those plans. Remember cash flow is king, but can they grow that cash flow? These large well established producers have the least risk and the least upside. But gains could be steady and maybe they pay a dividend.

The International Monetary Fund (IMF) recently published its report World Economic Outlook for October 2010 and in it they talked about commodity demand from emerging countries. “Because their growth is more commodity-intensive than that of advanced economies, the rapid increase in demand for commodities over the past decade is set to continue…the current era of higher scarcity, rising metal price trends and a balance of price risks tilted toward the upside may continue for some time.”

Also consider the following:

· Population growth

· Scarcity of new resource discoveries

· Declining grades and ore reserves at existing deposits

· Resource nationalization

To me it all means we are going to see much tighter supplies of, and higher prices for commodities going forward.

Because of:

· Rising commodity prices

· Soaring share prices because of outstanding drill assay results

· Increased excitement being brought to the junior sector by increasing M&A activity for junior “fish”

The soon to be tidal wave of money coming into the resource sector is going to bypass the majors and roll right over the few surviving mid-tiers. This money is going to be looking for the greatest leverage to increased commodity demand, rising commodity prices and the potential for an extremely lucrative buyout.

This is going to happen at the same time senior miners are going to be buying, earlier in their life cycle, junior exploration and development companies.

New money is coming into the junior sector, bids are building and the asks are being taken out. Significant drill assay results are giving companies share prices a rocket ride when released.

Conclusion

It’s an exciting time to be an investor in the junior resource market. Are there some quality junior producers, soon to be producers, post discovery resource definition, green field exploration companies and potential takeover targets on your radar screen?

If not, maybe there should be.

Richard (Rick) Mills

rick@aheadoftheherd.com

www.aheadoftheherd.com

If you’re interested in learning more about the junior resource sector, bio-tech and technology sectors please come and visit us at www.aheadoftheherd.com

Site membership and our AOTH newsletter are free. No credit card or personal information is asked for.

***

Richard is host of Aheadoftheherd.com and invests in the junior resource sector. His articles have been published on over 300 websites, including: Wall Street Journal, SafeHaven, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Uranium Miner, Casey Research, 24hgold, Vancouver Sun, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, and Financial Sense.

***

Legal Notice / Disclaimer

This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard Mills does not own shares of any companies mentioned in this report.

The below is just a portion of Mark’sVRTrader. Much more analysis contained every day in Mark’sVRTrader Silver or Platinum Service

Mark Leibovit’s Special Trial Offer: Use this month to kick our tires. Pay 50% for the first 30 days (No refund) and sample our Silver or Platinum service and then decide what works best for you. If you aren’t 100% ready to move forward, simply email us to cancel one week before your 30 day 50% off trial subscription ends and it will be canceled and you will not be charged ANY FURTHER, no questions asked. Just send an email to mark.vrtrader@gmail.com or call 928-282-1275 to cancel. You will receive an emailed confirmation of your cancellation at that time.

TIMER DIGEST SIGNALS:

Stocks – NEUTRAL

Sure enough, we touched 1230 and the SPX immediately began to sell off. VR Platinum subscribers are short the S&P. Ahead is the long Labor Day weekend. A minor respite! Immediately following we will hear Obama’s new ‘gameplan’ for the economy and later on September 21 we’ll find out what Bernanke has up his sleeve. Will he QE3 or not? All along we cannot forget about the ever deteriorating Europe sovereign debt issue. I am NEUTRAL but leaning more and more bearish. Here, traders are short, especially since the S&P 500 rallied in a ‘textbook’ manner precisely up to my forecast 1230 target and has now begun to fail. I’m not so sure this sell-off will gain legs here, but ultimately a test or break of the August 9 low (1101 in the SPX) appears increasingly likely. Let’s see where we’re at after September 21 into early October.

Gold – BULL –

Gold has defined a trading range bounded by 1829 and 1782 over the past three days and beyond that 1906 to 1702. In my work, we saw negative volume post right off the top (1906), but we also saw volume decline into the low (1702). Since that low, we’ve seen gold creep higher touching 1841 on Tuesday. Next stop would be around 1880 and from there nirvana! As you know, my next objective whether we see it now or early 2012 is the 2200-2300 range. We could very likely see 2000 before year-end which many of you know I had been predicting well ahead of the ‘Street’. The mere fact the New York Times and the Wall Street Journal are presenting negative stories on gold is bullish from a contrarian’s perspective (please see comments in yesterday’s Closing comments).

Bonds – NEUTRAL –

Bonds remain extended continued their pullback earlier yesterday, until the market started to sell-off and found buyers. I am awaiting signs of renewed upside volume but continue to remain NEUTRAL. It is unclear whether the expected correction I’ve been talking about has run its course.

The markets are going through another sell-off phase, yet the traditional notions of a ‘safe haven’ are changing. No longer is the US dollar the default shelter; instead, gold, the Swiss franc, and the Japanese yen are the preferred assets.

All three of these havens – gold, francs, and yen – have been surging upward this month. Two of them, however, are being actively devalued by central banks desperately (and foolishly) trying to curtail appreciation. The Swiss and Japanese are enlisting both policy measures and all the banker-speak they can muster to stem the tide of investment flows into their currencies.

The game is Last Haven Standing, and Spielberg has already acquired the movie rights.

SWITZERLAND: FROM NEUTRALITY TO INTERVENTION

Looking to Europe, the Financial Times now has the awkward task of reporting that mighty European Union’s currency is coming apart at the seams, while neighboring Switzerland has barely enough hotels to house the world’s waterlogged financial refugees. The franc is up 5.41% against the euro this year and almost 14% against the dollar. One wonders if the only way to prevent a collapse of the these major debtor currencies is to back them with Swiss-made wristwatches. At least then they’d have a partial gold standard and there’d be no excuse to be late for an austerity protest!

Unfortunately, the Swiss National Bank is so afraid of the franc’s rise that it has flooded the market with liquidity and cut interest rates to zero. The SNB even recently threatened to peg the franc to the euro. It’s as if survivors on one of the Titanic’s lifeboats were so confused and bewildered that they began tying their boat to the sinking behemoth out of a desire for a ‘stable relationship.’

NOTE TO JAPAN: IT’S NOT THE SPECULATORS

Japan, ironically, has been blessed that while its debt problems are severe, they’ve been severe for so long that markets are willing to take that as a sign of stability. And, aside from the public debt problem, Japan does have fairly impressive fundamentals. They are still a productive economy with high personal savings and exposure to booming China. So, it’s no wonder the Yen has risen 6.63% against the dollar so far this year.

Former Finance Minister, and now Prime Minister, Yoshihiko Noda stated recently that he would “take bold actions if necessary and won’t rule out any possible options” to restrain the yen’s appreciation. Yet, while Noda has said the ministry will study whether “speculation” is behind the yen’s rise, he doesn’t seem to understand that this is a permanent move away from dollars and euros and into anything which might be a better alternative. This is not driven by Wall Street gamblers, but rather by everyday investors seeking shelter.

CLEARLY SHIFTING SENTIMENTS

My readers know that I see these past years in the US markets as one ongoing crisis. We’re not “facing a double-dip recession” as the media suggests; instead, we’re really in the midst of a prolonged economic depression. The periodic market panics since 2007, both in the US and Europe, all stem from the same disease and, as such, ought to be properly understood as related symptoms, not as separate events.

And as one long, ugly narrative, these subsequent panics resemble a series of steps; sharp drops leading down either to a dismal “new normal” or – more likely – a collapse in both the fiat dollar and euro currencies and a widespread return to gold as money.

My brother, Andrew Schiff, wrote an article for my brokerage firm this month reviewing the market turmoil and how it compares to previous crises since ’07. He found a steady shift in what investors perceive as a safe haven.

During the depths of the credit crunch, from October 2008 to March 2009, the S&P lost over a quarter of its value, as investors flocked to the US dollar, driving it up 8%. Foreign stock markets sold off and most foreign currencies fell substantially. The Swiss franc fell over 3%. Gold rose some 6.5% and the yen rose 5.75%, but neither kept pace with the US dollar, which rose 13.5%.

Then, during the dip between April 23, 2010 and July 2, 2010, the S&P dropped again by almost 15%. The dollar rallied barely more than 3%. The Swiss franc gained slightly instead of falling. And this time, both the yen and gold beat the dollar, gaining 4% and 5.5% respectively.

Now here we are in August, and what’s happening?

In extreme volatility, the S&P fell over 13% before rebounding to its starting place. The dollar has remained essentially flat even with intensified fears in the euro zone. The yen is also flat, despite heavy intervention to push it down. The Swiss franc rose 8% before Switzerland’s central bank threatened to peg the currency to the euro, and gold has surged almost 12%!

See the pattern? On each step of this multi-year downward spiral, global investors are slowly but coherently altering their preferred safe haven. Alternatives are being desperately sought, though actions first by the Japanese central bank and more recently by the Swiss have prevented their currencies from fully realizing potential gains as dollar-alternatives.

Fortunately, gold doesn’t have a central bank, so it can rise as fast as the dollar falls.

THE FIAT DOWNGRADE

Whether it is in their interests or not – and I argue it is not – central bankers look set on continued competitive devaluation of their currencies so that their economies don’t have to do the hard work of retooling for the new reality.

That is why gold is doing so phenomenally well, and why it should continue to do so. New gold comes into the market at a rate of about 2% per year. This number has been fairly steady over time, and reflects the ability of mining companies to locate, finance, purchase, and develop new gold mines. I invest in these companies, and trust me, it’s not an easy job.

Contrast this with a paper currency – more dollars can be created by Bernanke simply printing extra zeros on his banknotes. See that $10 bill? Shazam, it’s a $100!

The reason currencies like the yen and Swiss franc are considered safe is simply a longstanding habit of their central banks not to print too much. But a habit is much less reliable than a physical constraint.

Think of a dog that has been trained not to eat steak. If you put it in a room with a juicy ribeye, would you be more confident the steak would be there when you came back if the dog was in a kennel or just sitting there? Just like a dog always craves steak, and will grab a bite when no one’s looking, central bankers always crave the printing press.

That’s why we need to hold an asset for which scarcity is dictated by nature itself – gold.

As this realization becomes more commonplace, and as this depression accelerates, I expect gold to be the Last Haven Standing. This will not be a “new normal,” but rather a return to thousands of years of economic tradition.

A NOTE ABOUT THE FUNDAMENTALS

Those who do not really understand the fundamentals, such as commodity trader Dennis Gartman, continue to look at gold’s rise as a bubble. In fact, Gartman just called the top in gold, again, claiming that one of the “great bubbles of our time” had finally popped.

He cites as evidence the quick 200-point rise to over $1900/oz, which Gartman sees as a speculative blow-off top. He also cites the meaningless fact that one Gold ETF, GLD, has a larger market cap than one S&P 500 ETF. He absurdly compares this situation to the Japanese Emperor’s palace eclipsing the value of the entire state of California at the top of Japan’s real estate bubble. Those ETFs simply represent one way of owning assets, and do not, as Gartman contends, indicate that investors value gold higher than the entire US stock market. In fact, a true comparison of the two asset classes reveals gold’s value is historically low relative to the value of US stocks.

Rather than the bursting of a bubble, the recent technical action in gold is more indicative of a break-out. In fact, the positive divergence of gold stock from bullion in this recent correction is evidence that a more powerful leg in this bull market is about to begin. Up until now, the market for gold stocks has been characterized by fear. However, it now appears to me that gold stocks will make a new high before the metal itself. If the stocks finally begin to lead the metal, it means traders are finally starting to believe in this rally. Rather than evidencing the end of the trend, such a shift in sentiment likely indicates an acceleration in that trend. Maybe when the last skeptic finally throws in the towel, we may finally get the blow-off top Gartman thinks already occurred – but that day is likely many years into the future.

In fact, all the talk about a gold bubble seems to be based on the fact that so many investors are now talking about gold. However, the problem with this argument is that despite all the talking, very few investors are actually buying. Bubbles are not formed by talk, but by action. Before we get a gold bubble, all those investors talking about gold actually have to buy an ounce. In fact, before a bubble pops, its not just investors, but the average man in the street who will have to be buying. Thus far, he has not even joined the conversation.

Peter Schiff is CEO of Euro Pacific Precious Metals, a gold and silver dealer selling reputable, well-known bullion coins and bars at competitive prices. To learn more, please visit www.europacmetals.com or call (888) GOLD-160.

For the latest gold market news and analysis, sign up for Peter Schiff’s Gold Report, a monthly newsletter featuring original contributions from Peter Schiff, Casey Research, and the Aden Sisters. Click here to learn more.

Yesterday we heard Eric Sprott, a leading resource investor, explain why gold is destined for $2,000 and beyond.