Christmas sales are not just for retail shoppers. Tax selling season is here, and one man’s stock loss may be another man’s super bargain opportunity. In this exclusive interview with The Gold Report, Casey Research Master of Metals Louis James talks about year-end investment strategies in the current market environment, factors to consider next year as the global economic situation may affect precious metals and mining stocks and some of his current year-end favorites.

The Gold Report: We’re now into year-end tax-loss selling season. How do you think 2011 will compare with previous years as far as the performance of resource stocks in the next several weeks and into 2012?

Louis James: This should be an interesting year for tax-loss selling. Whether the market’s up or down, there is selling pressure at the end of the year. If people have a lot of gains, they want to sell underwater positions to offset them. If they have a lot of losses, they may do the same, planning to buy back in at the lower cost basis in the new tax year. In a down year like this, it’s certainly something to be aware of; people will want to offset their winners with losers, and there are a lot of losers out there this year.

Many good stocks are down because the market is down—not necessarily because companies have underperformed or failed to deliver as intended. Some people want to establish losses in stocks they like with the idea of buying back in January. I do like to warn investors, especially new resource investors, that this tax-loss strategy is a dangerous one.

When people take losses, it’s often psychologically difficult to buy back into the same story. If you’re done with a stock and think it’s time to realize the loss, that is one thing. But, if you are selling now to buy back in the next year and the stock happens to move back up between the time you sell and when you might have bought back in, you might wait, hoping it will come back down. If it never comes back, you can end up short and having realized an unnecessary loss on a stock you really wanted in your portfolio.

TGR: Are you seeing any different patterns this year than in past years?

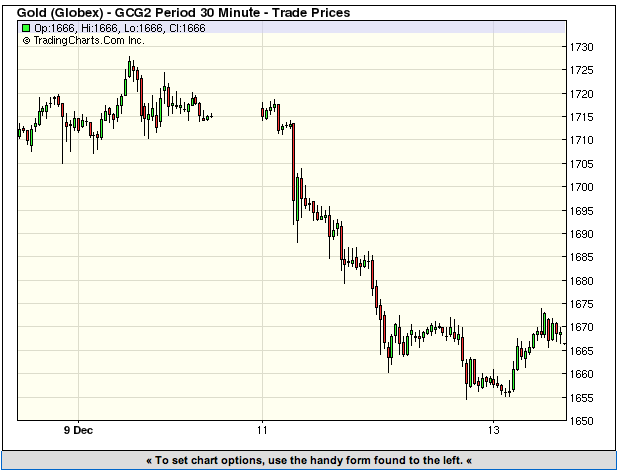

LJ: Some of the selling that we’re seeing now and will see during the next few weeks is certainly going to be tax-loss selling. One thing that’s worth noting is that there is typically a lot of this activity on the last trading days of the month. People will realize a loss if they have to, but they don’t want to lose more than they need to, so, if they think the market might turn up in December, many will wait until the last moment. All kinds of potential news out there could cause precious metals to turn up in these last few weeks of the year, so we may see the most intense tax-loss selling at the very last part of the year.

TGR: For buyers, there’s usually limited availability of stocks at bargain prices, so once the low priced inventory is gone—it’s gone.

LJ: That’s right, and that can be good or bad, depending on which way you’re going in the trade. Some of these juniors have tiny floats and are not very liquid. If just a handful of investors decide to get out at any price and they all hit the bid on the same day, you can see very dramatic moves, providing tremendous buying opportunities. This is something to watch out for at the close of 2011.

TGR: Are there better bargains this year than there were last year and in previous years? It seems this market has been pretty sick.

LJ: You have to remember that metals are not all the same. Precious metals, particularly gold and silver, are not just industrial commodities. Silver has its industrial uses but gold and silver are monetary metals and have different dynamics. So, if you’re thinking that the economy is looking worse in 2012, which we at Casey Research are, then you’re not terribly excited about base metals plays. Their prices may be down, but that doesn’t make them bargains we want to load up on now. The bargains we see now are in precious metals stocks.

There’s opportunity when you think you know what’s ahead—higher prices for gold and silver, in this case—and the market seems to be discounting that or is betting in the wrong direction. If you’re right, you can win big. The caveat is that old saying that the market can remain irrational longer than you can remain solvent. But, if you can bet with money you can afford to leave on the table for as long as it takes, with assurance in your mind that you will be right and with the patience to wait until you are, then buying when others are selling is exactly how you “buy low to sell high.”

TGR: Why do you think there’s been such weak upside market reaction to positive news releases? In the last few months, it seems that most stocks have been immune to good news.

LJ: We’re seeing that, too. But, we’re seeing it as an opportunity. If you have confidence in the underlying trends, then the fact that the market doesn’t care when a company has good news is great for us. It allows us to build a position at lower prices with the benefit of added value that has not been factored into the share price. If a story gets better and the stock gets cheaper, that’s a good deal.

I tend to think that prices are signaling disbelief in the market that the rally in precious metals is sustainable. In industrial metals, I’d say the market is quite right to be skeptical about their prices. If you’re looking at the so-called economic recovery unraveling, there’s good reason to be skeptical as to whether copper can and should stay at $3.50–4.00, or whether it’s more likely to retreat in 2012.

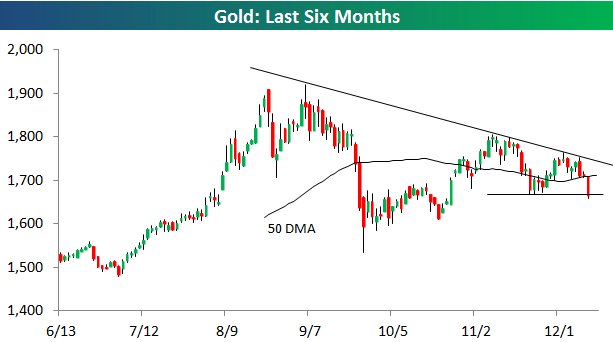

Gold at $1,000/ounce (oz) was a big deal and $1,500/oz seemed unimaginable to many before it happened. Even industry insiders and goldbugs thought gold wasn’t likely to hit $1,500/oz, except maybe as part of a brief spike, as in 1980. When we spoke about $2,000/oz gold a couple of years ago, people thought we were being silly and exaggerating. But we came pretty close this year, topping $1,900/oz. A lot of people are saying, “Wow, gold’s gone way up. Gold’s really expensive. Why should I buy something that’s up?” We think that’s wrong; the fact that something has gone up does not, by itself, make it expensive. You have to ask, expensive relative to what? If you look at what’s been done and continues to be done to the U.S. dollar, which gold is priced in, there’s every reason to think gold’s rise will continue and accelerate. We’re quite happy to take the other side of the gold bears’ bet and take shares off of weaker hands.

TGR: Gold has traded well above $1,300/oz for over a year now. What’s it going to take for people to finally realize that it’s staying there and to start buying some of these juniors that are just trading back and forth?

LJ: The move usually starts with the producers. Goldbugs and many people in the industry are already long and some are cashing in. Much of the energy going forward will come from new people realizing that gold is holding when other asset classes are tanking. Then the people who thought that gold was a “barbarous relic” will suddenly discover that those gold miners are making big money when nobody else is. Above $1,500/oz, just about everybody in the gold mining business is making a bunch of money. Even the more expensive ones are producing at close to $1,000/oz.

The global markets have many trillions of dollars looking for profitable places to hide from the storm, and the entire gold market is only worth a few hundred billion dollars. Even a small shift to gold on the global scale will put on a lot more demand than supply can meet. We believe it will start with the producers, then it will go down the feeding chain as people realize that the midtiers have better growth profiles, and then to the juniors, which provide the greatest leverage. And even if investors in general don’t get this, the producers still need to replace depleting resources, so they’ll be buying the successful juniors. So, one way or the other, successful juniors end up winners.

TGR: So where are we in the cycle as far as when it filters down to the juniors?

LJ: We’re seeing a very risk-averse market right now. People who already know about gold mining are much more interested in production and leery of junior exploration plays. Even juniors with excellent exploration results are not getting a lot of market respect. But, as the profitable quarters continue coming in for the reporting producers, I think we’ll see greater interest moving down the food chain to successful juniors in 2012.

Plus, if we have the economic malaise ahead that we think we’ll have, the fear factor will come more into play too. Gold really is a barometer of fear. There’s a lot of supply of refined gold out there, tucked away in vaults all over the world. What keeps that supply off the market is people thinking that they need the security of owning gold and, secondarily, people speculating that gold is going to go up. So, if we’re right about what’s ahead economically in 2012, that fear barometer should go even higher.

The coming year should be a very good year for precious metals investors. The one caveat I would stress very strongly is that there’s a risk the economy won’t just falter or weaken, but could actually go into a tailspin. There could be some big scary event like Lehman Brothers in 2008, which reportedly brought the entire banking system within hours of not working. Then everything gets hit, even gold, because people become illiquid and are forced to sell anything they can get a bid on.

People who follow this logic should be prepared for that. Don’t go all in now, but participate in the market so you can take advantage of the opportunities, in case there is no crash. But keep some powder dry to be able to back up the truck, as Doug Casey says, for great companies at fire sale prices if there is a crash. We may very well see such opportunities in 2012. And, you’ll be kicking yourself if you didn’t keep any funds in reserve for those low prices.

TGR: Talking about fear, one of the more recent concerns in the resource sector has been the fear of political risk regarding property locations. How serious a concern is political risk?

LJ: It’s very serious. It’s happening now in Peru, where a good chunk of the gross domestic product and the bulk of direct foreign investment in the country come from mining. Yet the current government came to power stirring up anti-mining sentiment. Now they find themselves in the unenviable position of trying to defend mining against the population they stirred up, and it’s getting ugly.

And it’s not just Peru. It’s a big risk all around the world. As mining profit margins go up, cash-strapped governments in a global economic crisis are going to look at increasing their take. A profitable sector like mining is going to see windfall taxes, tax and royalty increases, permitting fee increases and anything else the governments can do to take advantage of the situation.

Even in Canada, Québec had a sliding tax scale and they slid it on up. That can happen anywhere. If you see that a country is going to take a turn for the worse, you may want to exit before the harm is done. But, if you’ve got really great projects that can take any reasonable level of taxation in a good area, then you may have to take a stand. You can’t move a mine to another country, and you can’t go running from country to country at every alarming bit of news, or you’ll end up nowhere. In provinces like Québec or countries like Chile where they understand mining, when they raise the taxes, they do it within the existing legal structure with an eye to avoiding killing the goose that lays the golden eggs.

One place we’re more alarmed about now is Argentina, which has shown a willingness to break deals that it has made. It had a no-changes-in-mining-taxes-for-30-years pledge on the table to encourage investment in mining, and they’ve already broken that. Moves made by the recently re-elected government of Cristina Fernandez de Kirchner are quite alarming. We see that writing on the wall and are minimizing our exposure to Argentina risk.

TGR: Mexico seems to be a pretty favored and stable location. There are a lot of companies that have some pretty interesting projects going on there. Tell us about some of your favorites.

LJ: Politically, Mexico has remained wonderfully stable and we’re very pleased with it. It has a past history of nationalizing left and right, but for some time now, it’s been quite business friendly. Pretty much everybody in the ruling class gets it. It understands that if it nationalizes and socializes things, the crowds may cheer, but soon industry declines. It knows it has a huge problem with Pemex, the nationalized oil company, for example.

However, Mexico has an escalating drug war problem. Fortunately, this has largely remained between the government forces and the narco forces—it has not yet turned more generally predatory against all targets, including civilians and industry, as happened in Colombia. That’s the reality to be aware of in Mexico. There are places that are dangerous and you need to be careful. But, the good news is that in the safer places, at least, the government has remained solidly pro-business. And, even in the more dangerous places, there are miners working with no problems. There are good companies we like a lot working in Mexico.

One of those would be First Majestic Silver Corp. (FR:TSX; AG:NYSE; FMV:Fkft). It has a lot of growth on tap. The stock corrected sharply from highs earlier this year and we see a lot of upside. It has robust economics and profitable production that’s growing. It’s a good story. Another one we like a lot in Mexico is Fortuna Silver Mines Inc. (FSM:NYSE; FVI:TSX; FVI:BLV). Its new San Jose mine is in Oaxaca, southern Mexico, far from most of the drug problems in northwest Mexico. Instead of being the typical silver mine, which is a lead mine with silver in it, this is a gold-silver mine. Gold as a byproduct is much more attractive to us than lead. We also like Great Panther Silver Ltd. (GPR:TSX; GPL:NYSE.A) andEndeavour Silver Corp. (EDR:TSX; NYSE:EXK), both of which have projects in the historic Guanajuato area, source of more than a billion ounces of silver production over the last 400 years. Profitable, growing producers operating in safer parts of Mexico are stories we like a lot.

TGR: Do you have some prognostications as to where you think the stocks might be going from where they are now?

LJ: With two steps forward and one step back, we think they’ll end up significantly higher than they are. All of these have potential to be at twice the price they are now by the end of 2012—or higher, depending on what the precious metals do. They all have profitable, growing production, so I’d expect all of them to progress upward, even if the price environment remained unchanged.

We could, however, see tax-loss selling on all of these, except Fortuna, at the end of this year from people who bought the peaks earlier this year. And, as I mentioned earlier, we’re not going all in on anything because there will be lower prices ahead if there is a meltdown in 2012. We recommend that people buy in tranches. Buy a first slice now. If it gets cheaper, you buy a second slice and then you wait. You wait for that big sale to come on and you buy a big chunk at a great price that you know you’ll be very excited to have. And if that doesn’t happen, you still have the lower cost-base position you built with the first two tranches.

TGR: Are there any other companies you particularly like at this point that you think may be super bargains?

LJ: The best of the best are not down in the dumps the way the earlier stage companies are. The ones that people have confidence in have corrected much less or not at all. Fortuna is up for the year. Other ones I like include Silver Wheaton Corp. (SLW:TSX; SLW:NYSE). If you believe in precious metals, the Silver Wheaton model is just a phenomenally great business idea. It’s one to buy on the dips. We should probably throw some gold names out, also.

TGR: That would be good.

LJ: One of my favorites is an Australian company called Medusa Mining Ltd. (MML:ASX; MML:AIM; MLL:TSX.V). The mine is in the Philippines. The stock’s gone on sale. There’s been some scary news out of the Philippines, guerilla activities on some of the islands, but this has not been near Medusa. It has the cheapest gold production costs that I know of anywhere—less than $200/oz, which at $1,700/oz gives a $1,500/oz margin. It’s an unbelievably profitable production with continuing exploration success. So, if you have access to the London Stock Exchange or Australian Securities Exchange, I really like that one.

Another great opportunity for bargain hunters is a company operating in Mali, West Africa, called Avion Gold Corp. (AVR:TSX; AVGCF:OTCQX). Avion had some operational difficulties resulting from some of its supplies and equipment taking longer than planned to get to the mine, which affected its production and profitability. It’s still highly profitable. It’s in the process of doubling plant capacity while developing higher-grade underground material and more open pit to simultaneously feed that expanded mill. The disappointing news recently made it cheaper, but I see strong growth ahead.

TGR: In parting, what you are basically saying is people should buy on dips and hold onto cash for bigger opportunities. Is that right?

LJ: Yes. I think it’s really important to stress that if the wheels come off the financial system and things come to a crunch, it will create fantastic buying opportunities. If you go all in before then, it won’t look like a fantastic buying opportunity because your portfolio will be off by very large, alarming fractions. However, we are not recommending that people wait for that. You don’t want to be short in this market because nobody knows the future. The governments of the world may throw enough money at the problem that they may ignite massive inflation, which will hit commodities hard and precious metals even harder—on the upside. It’s possible that we will see another enormous reflationary boom, perhaps even Zimbabwe-style hyperinflation. So, as before, we are recommending that people buy in tranches.

One other parting thought is that the stocks are the way to play this market with leverage. The precious metal stocks are, hands down, the best bet for what’s going on in the world today. That’s your speculation on what’s going to happen in the future. But for prudence, for financial peace of mind, you want to own the physical metals. As Doug Casey likes to say, gold is the only financial asset that is not simultaneously someone else’s liability. If you don’t own any of the physical metals, you definitely want to start building a position now, because nobody can tell you things will not get seriously bad—chaotically bad—in the months and years ahead. Whether that happens or not, an ounce of gold will always be an ounce of gold. An ounce of silver will always be an ounce of silver. And, someone, somewhere will take that off your hands and give you something of value in exchange for it.

TGR: Thanks for all your insight and taking the time to talk with us today.

LJ: Thanks for having me.

Louis James is the master of metals at Casey Research, where he’s the widely read and well-respected senior editor of the International Speculator, Casey Investment Alert and Conversations with Casey.Fluent in English, Spanish and French, James regularly takes his skills on the road, evaluating highly prospective geological targets and visiting explorers and producers at the far corners of the globe and getting to know their management teams.

Try the Casey Research holiday “buy-one-get-one” package for full junior resource coverage in metals and energy: Buy Casey International Speculator today and get Casey Energy Report free for a year.

Want to read more exclusive Gold Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Exclusive Interviews page.