Daily Updates

For some perspective on all-important long-term interest rates, today’s chart illustrates the 112-year trend of the 10-year Treasury bond yield (thick blue line).

As concerns over government debt as well as a struggling global economy have increased and fears over inflation diminished, investors have moved towards safety resulting in a significant decline of the 10-year Treasury bond yield. The 10-year yield has declined a fairly dramatic 300+ basis points (i.e. 3%) since the peak of the credit bubble. This decline has brought the 10-year Treasury bond yield to a 112-year monthly low. It is worth noting, however, that the quarter-century downtrend of the 10-year bond yield remains intact and will remain intact even if the 10-year yield were to drop significantly below 1.5% over the near-term.

To view more Charts of the day go HERE or at <a href=”http://www.chartoftheday.com/”>Chart of the Day</a>

Nothing endures but change.

-Heraclitus, Lives of the Philosophers by Diogenes Laertius

As the year slowly draws to a close, you may notice some change in the air. Not the annual, nostalgic-laced look-backs that are so ubiquitous around this time of year, but rather, actual shifts in the underlying firmament of our world.

Consider each of the following as an early warning that your expectations may not be met — unless you are expecting surprises:

• Santa Clause Rally: Saint Nick has yet to appear on Wall and Broad this year. If Santa “passes over” the houses of traders this year, I fear we could see 10 plagues in 2012.

• Earnings: Always look great at record, cyclical peaks. But what will they do if the major economies of the world fall into recessions? A 20-30% drop is certainly possible.

• Economy: Continues to show signs of softening. Job creation almost is keeping up with population growth, unemployment is ticking down because workers are leaving the labor pool. Retail sales, despite the NRF spin, are poised to disappoint.

• Gold: This could be the biggest disappointment of the year. The Gold pullback has some traders declaring this to be the end of the bull run. Who knew the shiny yellow metal could turn into a lump of coal?

• International Affairs: From the Arab Spring to the mess in the Euro-zone to Iran’s nuclear ambitions, the world is getting ever more complex, challenging and difficult. 2011 could be the most confusing and complicated set of events in many decades. Macro investors are having enormous challenges navigating. It is unlikely to get any easier in 2012.

• Oil: Seems to sliding with all of the other commodities. OPEC seems to be ready to pump more to offset falling prices (Someone should give them an Econ primer). The usual suspects will declare how good this effect is for the consumer, while ignoring the cause: Recession in Europe, a potential recession in the US, and a huge slowdown in production in Asia.

• Psychology: Most investors continue to operating out of the rear view mirrors. They have been damaged by the 3 boom & busts — Tech, Housing, Stocks — of the past decade. If commodities succumb as well, it will have a pernicious effect on their outlook.

• Politics: The corruption of Congress is now taken for granted, as their single digit approval numbers reach record lows. Perhaps more surprising is the lack of leadership on both sides of the aisle. President Obama arrived with great fanfare but disappointed anyone who hoped for change from the Bush bailouts (I blame Rubin’s proteges, Summers & Geithner for that). Despite the incumbent being vulnerable, the other side seems unable to nominates anyone “Presidential” — or at least capable of garnering a majority of GOP supporters.

The bottom line remains simply this: If you ever made the mistake of believing you could rely on forecasts as to what is coming next, that error in thinking should be all but eradicated as of now. And for those of you smart enough not to have relied on Wall Street’s forecasts, for God’s sake, don’t start now . .

Article by The Big Picture

The blog is a compendium of what a Wall Street money manager is looking at, thinking about, and writing on. It is written by me (& the crew) for people ranging from investment professionals to media to anyone else interested in investing, markets, and the economy.

It is, by design, laden with facts, statistics, and informed, data-driven opinions. We avoid the squishy, touchy-feely “I think/hope/want” type of fact free analysis so prevalent in the media and on Wall Street.

I have been writing about these topics for ~15 years, and blogging since 2003. By sheer accident, TBP has become one of the best reviewed finance blogs on the web. We key in on what you should be thinking about when it comes to markets ans the economy — and what you should not be doing with your money.

The writing is designed to be very accessible — no PHD required. Hell, no college degree is required. If I can make this stuff understandable to my right brain art teacher wife and my 74 year old retired real estate agent mom, then I can help you learn the basics of markets, investing and the economy

With what is happening with the price of gold these past few days it is imperative to take a look at the long and short of it all (the trends, that is). In doing so it shows that we are still very much in a long-term bull market but in a short-term (yes, short-term) bear market. Let’s take a look at some charts that clearly outline where we are at and where we could well be going.

Physical Gold

As can be seen in the graph below the 70s experienced 2 major bull markets and an 18 month bear market in between while continuing to trend upwards.

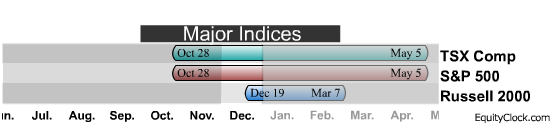

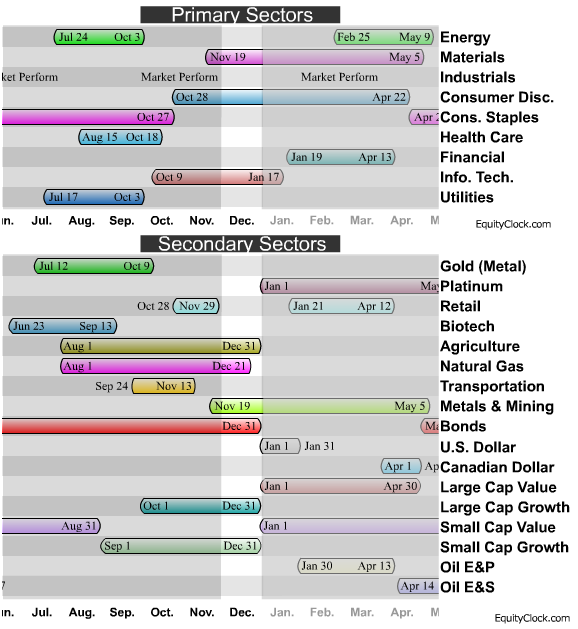

Seasonality refers to particular time frames when stocks/sectors/indices are subjected to and influenced by recurring tendencies that produce patterns that are apparent in the investment valuation. Tendencies can range from weather events (temperature in winter vs. summer, probability of inclement conditions, etc.) to calendar events (quarterly reporting expectations, announcements, etc.). The key is that the tendency is recurring and provides a sustainable probability of performing in a manner consistent to previous results.

Identified below are the periods of seasonal strength for each market segment, as identified by Brooke Thackray. Each bar will indicate a buy and sell date based upon the optimal holding period for each market sector/index.

Entry and exit points provided by Thackray’s 2010 Investor’s Guide.

A seasonality study preferably uses at least 10 years of data. Most of our studies use 10-20 years of data, however, data may not always be available for periods greater than 10 years in length. Studies using less than ten years of data can be used, but they tend to be less reliable. Results of shorter term studies have a higher chance of being skewed by a single data point.

For COMBINING SEASONAL INVESTING WITH TECHNICAL ANALYSIS go HERE

Equity Clock is a division of the Tech Talk Financial Network, a market analysis company that provides technical, fundamental and seasonality analysis on a daily basis via TimingTheMarkets.com andEquityClock.com. Equity Clock’s mission is to identify periods of reoccurring strength among individual equities in the market using methodologies presented by some of the top analysts in the industry, including that of Don Vialoux, author of TimingTheMarkets.com.

Feel free to use any of the content or seasonality studies (charts, timelines, or otherwise) presented as long as a link-back to this site at EquityClock.com is provided.

Canadian Oil to Support Market Growth

As developing countries increase their energy consumption, the oil and gas sector will continue to grow, powered by Canadian companies feeding global demand. In this exclusive interview with The Energy Report, President and Portfolio Manager Bill Bonner of Brickburn Asset Management in Alberta reveals several energy companies with maximum production and growth potential.

The Energy Report: Bill, your bottom-up firm makes its investment decisions based on individual company fundamentals, but do you have a sector bias?

Bill Bonner: Our focus is entirely Canadian energy, with one exception: We also manage private client assets and traditional portfolios. I have two partners who look after non-energy holdings in those portfolios, but our background has been as energy investors for 30 years, so that’s what we focus on. People allocate capital to us because of our energy expertise.

TER: Are you bullish on oil and gas as commodities?

BB: Over the near term, it’s hard to be bullish about the price of natural gas. Even if there were some abnormal weather events this winter, it’s unlikely we’re going to get a big bump in the price of natural gas. Over the medium to longer term, we can be quite bullish. The outlook for gas over the long term is spectacular, given it’s an environmentally friendly commodity. If you had a choice to burn coal or natural gas in your power plant, you probably should pick natural gas. That transition is happening.

There is one caveat. Natural gas liquids are a component of natural gas. Producers today are likely not looking for dry sweet gas—they’re looking for gas that has some liquids component. The heating value is higher, and companies can extract the liquids if the price is positive. So, while operators acknowledge the gloomy near-term outlook for gas, there are companies that want to focus on liquids-rich natural gas.

Oil is an entirely different scenario. Given the volatility of oil, prices are up. We are consuming more energy than ever, and that trend’s not going to decline. Yes, there will be some bumps along the road, the Eurozone issues for example, but the energy demand in Europe and North America is not the most important variable today. Emerging markets in developing countries are driving the demand higher, and that’s not going to change. The outlook for oil demand will continue to be positive in the short, medium and long terms.

TER: What is your oil forecast? Are you using current oil prices or higher oil prices in your models?

BB: The baseline we use is $80/barrel (bbl) for light sweet crude oil (West Texas Intermediate, WTI). There are many other lighter crude qualities that are more important than WTI, but it’s a benchmark that’s commonly used. Our near-term projected range is $80–100/bbl, and we’re at the upper end of that now. In the past six months, we’ve had two tests, and in the worst—Europe’s contagion—$80/bbl was the bottom, so we think that has established a bottom price. Not only that, the Organization of Petroleum Exporting Countries’ range last year in its World Oil Outlook was $75–85/bbl. This year’s report defines the trading range as $85–95/bbl, so we say $80/bbl is a pretty comfortable bottom level.

We’ll look at a business and ask, what happens if the oil price is $80/bbl? What happens to the cash flow and the capital spending program? If we’re comfortable that the company can still plow ahead even at that level, then we want to take a position. It’s possible to be seduced by the higher price at $100/bbl, but you have to recognize that in the short term, that is a windfall. However, one to two years out, the baseline might be $100/bbl. That’s the direction we’re going.

TER: So is the recent WTI of $102/bbl a bit overbought?

BB: I wouldn’t necessarily say that. Does $2 make a difference if your top level is $100/bbl? I don’t think so, but at that level the market is pricing in a degree of optimism that we are comfortable with. If we saw $110/bbl, I wouldn’t feel as comfortable.

The feedback we get from producers is that they are hedging as soon as they see prices in excess of $100/bbl. That indicates industry is thinking cautiously, so perhaps we should be thinking the same way.

TER: Gasoline prices at the pump are down about $0.10/gallon (gal) over the past two weeks, but crude has been in a trading range over H211. If it remained in this range, would that be an extremely bullish scenario for oil producers?

BB: Yes, I think so. If the new baseline could become $100/bbl as opposed to $80/bbl as we believe it sits today, then we have to adjust our thinking. In the U.S., $4/gal seems to be a magical number. Above that, you get lots of chatter in the press about how horrible that is; below that, people seem to be accepting.

TER: As of June 30 in your Dominion Equity Growth Resource Fund, you were invested in oil and gas production 2:1 versus exploration, 62% versus 31%. Why are you weighted the way you are with a growth fund?

BB: The production stories are cheap, yet they have organic growth built into them. There are three names I really like; two are large, and one is small: Whitecap Resources Inc. (TSX.V:WCP) and Surge Energy (SGY:TSX.V) being the large ones and DeeThree Exploration Ltd. (DTX:TSX.V) being the small one.

If we want exploration exposure, we tend to focus on international stories as opposed to domestic stories. It’s more and more difficult to find a good exploration story in the Western Canadian Sedimentary Basin. Pre-production or small-production stories in places like Argentina and North Africa are quite exciting. Our investment view and portfolio weight is driven by the fact that we see the production stories are inexpensive.

TER: Surge is one of the larger of these that you like, with $602M market cap. What’s your story there?

BB: Surge is becoming quite oily. You can’t get away from natural gas with most of the producers in the basin here in western Canada, so if you want to play an oil story, you’re probably going to end up owning some gas too. Surge is about two-thirds oil and one-third natural gas.

The management is what really attracts us to the company, as we’ve been invested with the management team a couple of times prior to Surge.

Three of the company’s plays really jump out at us, all light oil plays. The opportunity on those, based on about a 10% recovery factor, is about 30 million barrels (MMbbl) of recoverable crude. When you apply secondary production technology (i.e., water flood), that number almost doubles. It’s not a matter of finding the hydrocarbons; they are there. It’s a matter of exploiting what you already have. And Surge has good operators who can take a challenging situation and figure out a way to improve recovery factors. Surge is also sitting on some big oil-in-place opportunities with just under 500 drilling locations. It expanded its capital expenditure budget from $120M to $160M to take advantage of its inventory of opportunity. The company has had no dry holes in 2011 so far—not a bad batting average.

TER: About a month ago, Surge revised its 2011 production rate up 73% over its exit production of 2010. The market is looking at that as history though. Does that have any bearing on 2012?

BB: Surge is going to continue to organically grow production, however it acquired an asset at Valhalla at the Peace River Arch area in Alberta, Canada, which is partly why production jumped.

As for internal organic growth, Surge has its top three plays well positioned. It’s just a matter of completing exploitation of these plays. We expect the company will exit this year at 7,000 barrels of oil equivalent (boe) and has the potential to double production in 18 to 24 months. That’s pretty good growth.

TER: What’s your investment thesis with Whitecap?

BB: We’ve also had some past experience with management at Whitecap, and it has built previous companies through an active acquisition strategy.

Whitecap has made three or four acquisitions that have all been accretive to shareholders, and now the company is roughly the same size as Surge. Interestingly, Whitecap is in some of the same areas that Surge is in, up in the Peace River Arch area. Whitecap and Surge have similar profiles in terms of production mix—two-thirds oil, one-third gas. That’s the production base; when you look at the revenue however, it’s more like 90% oil and 10% gas; that’s a reflection on how tough the gas business has become.

Whitecap is an aggressive hedger. It will hedge up to two-thirds of its production. We don’t have a problem with that because we just want to make sure the company executes on its budget.

Smaller producers used to be criticized for hedging, and the argument was that they were taking away upside from investors. That has changed. Now, financial analysts say hedging is fine if it achieves the objective, which is to meet the capital spending. We want to see production growth. Whitecap has been a good example of a company that does that. Its hedging experience has added 10–15% to its netbacks.

TER: Is that because there is a very high relative strength that’s up 28% over the past 12 weeks?

BB: Yes, the Whitecap story is partly management and partly execution, which is a reflection of management. The company is positioned to again double the production, and when you start to run through the metrics of the inventory, making some assumptions about how much it will take to finance the process, you can see an added $10–11/share. I look at the stock at $8.50/share, and I think it could potentially double from this point. This production story has growth.

TER: So Whitecap is going from a small-cap to a mid-cap producer.

BB: Yes. It’s a larger small-cap company at the moment, with 7–8 thousand barrels a day (Mbblpd). In Canadian terms, we would probably call this a mid cap at the current $750M enterprise value. Things are a little smaller in Canada in terms of definitions.

TER: It opens up the possibilities of being owned by larger mutual funds too.

BB: It certainly helps.

TER: DeeThree has had a bumpy ride over the past 12 weeks. It’s down 40%.

BB: This is more of an exploration story than a production story, although the company certainly has production. The leverage here, compared to either Surge or Whitecap, which have the potential to double, is that DeeThree has potential to quadruple.

TER: It’s a value play.

BB: It’s a matter of execution too. Again, this is a situation where we’ve been familiar with management and have made money with them in the past. When DeeThree first set out, it made a significant acquisition in southern Alberta that included all kinds of infrastructure, gathering systems, plants, etc. What the company didn’t realize at the time was underlying its lands is a play that is now emerging and catching everybody’s attention. It’s the Alberta Bakken. DeeThree has been able to farm out part of its massive land spread. There are 250–300 prospective sections on trend (a section is 640 acres). Recent land sales on trend have gone from $500/acre to $1,000/acre. That equates to a large “conceptual” value for DeeThree and it got us interested in the name.

Royal Dutch Shell Plc (RDS.A:NYSE; RDS.B:NYSE), Crescent Point Energy Corp. (CPG:TSX), Murphy Oil Corp. (MUR:NYSE), Nexen Inc. (NXY:TSX; NXY:NYSE), an independent called Legacy Oil & Gas Inc. (LEG:TSX) are all playing this trend in southern Alberta. If it works out, DeeThree’s farmout on 30% of its lands will have essentially confirmed the trend is present on its lands, which in our opinion sets it up to be an acquisition target.

In addition to the Alberta Bakken lands, DeeThree made an acquisition we thought was absolutely spectacular. It’s a light oil play in the Brazeau area of northwest Alberta. The Belly River formation is the producing horizon. The company acquired 42 sections of land that prospectively may have oil in place of 50 MMbbl per section. That represents an incredibly large resource number. However, because the oil formation is very tight, well completion success will be determined by successful multistage fracks. It is in its early stages, but DeeThree is getting results.

I think DeeThree can triple its production on Brazeau, in addition to its growth potential with its Alberta Bakken play. The company would emerge from roughly 3,000 boe to something closer to 10,000 boe and have that Alberta Bakken inventory still sitting there. There’s great leverage in the name, especially at $2.20/share.

TER: Why has DeeThree been so weak recently?

BB: It’s partly market cap, but there have also been confusing signals coming out of the Alberta Bakken play. There was some suspicion that Legacy, partnered with Bowood Energy Inc. (BWD:TSX), was going to abandon it. Crescent Point also suggested there might be some challenge with the play itself. That’s not surprising, but some of those negative comments affected DeeThree’s stock.

I’m looking back to when DeeThree bought the Brazeau property in Q111. That was a $125M acquisition, and the company issued a bunch of equity. The market hasn’t focused too much on what’s happening at Brazeau, though, and has just focused on Alberta Bakken.

TER: You’re clearly not averse to owning private equity in this fund. ET Energy Ltd. is your largest holding, representing nearly 22% of your Dominion Equity Resource Growth Fund net asset value as of June 30. Is that percentage holding?

BB: It’s increased slightly because the fund has shrunk in size, but it wasn’t our plan to have that large a weighting.

TER: How do you value a private equity in your portfolio?

BB: There’s the fantasy valuation, and then there’s the valuation that our auditors will accept. Under the new International Financial Reporting Standards rules, we have to value it based on what we really believe the value is, but we need reference points like third-party pricing events. We look at whether the company issues equity to outsiders or there’s trading activity in the stock, and even then we have to make a judgment call. For example, if a company has 66M shares outstanding and 100K shares trade at $3/share, is that really the value of the company? I would argue it’s not. In terms of our analysis, we’ll look at a variety of things, including third-party pricing events, but we’ll also pay attention to what the company is publishing and what the independent engineering data suggests. Then it’s a judgment call.

We have to be careful in that our fee revenue is based on the value of these portfolio components. We tend to err on the conservative side in terms of valuation because we never want to be accused of raising prices to get more fees.

With ET Energy, we’ve held our position for almost six years. We bought it at $1/share and have written the position up to $7/share over that time period. We had evidence that the stock traded well over our carrying value, but over that time, we also had the meltdown in 2008 and further trouble in 2010, hence we are comfortable with our current carrying value. We know the company is in the midst of a pre–initial public offering (IPO) financing round, and we’ll have to see how that looks and adjust the value accordingly. Our reference points make us very optimistic about the real value. The company’s execution of its business plan will be the convincing factor.

TER: Will that pre-IPO financing round be equity?

BB: Yes. The most recent financing round was a three-year note with warrants attached to it. Share purchase warrants were valued at $10/share. There’s some anti-dilution provision in that warrant, but there’s a reference point.

TER: Why do you love this company?

BB: We like the oil sands to start with, but also ET’s production technology is environmentally friendly. There’s no water used, and it’s very energy efficient. The capital costs to put it in place are a fraction of the alternatives. We also know the resource is well defined on the company’s land. It’s just a question of executing and unlocking the value. What’s given us real confidence is the fact that Total (TOT:NYSE), the French company, is now partnering with ET in its commercial development. Having a big brother like that by your side adds credibility to ET’s execution of its business plan.

TER: What is your exit strategy?

BB: The exit strategy is to wait and see how the public markets react. We believe ET will be public sometime in the next 12 months. That comes from management, but it’s subject to the markets, of course.

As far as other companies go, our ambition in the portfolio is to hold roughly 20 names. We like the exploration stories that are unfolding in Argentina. Madalena Ventures Inc. (MVN:TSX.V) and ArPetrol Ltd. (RPT:TSX.V) are companies that have land positions, production and growing opportunity in Argentina. Argentina looks like Alberta did 25 years ago. There’s been some political risk over the last 10 years, but a lot of that has been put aside. Argentina knows it has an energy deficit and the solution is to develop its many reserves.

TER: Thank you for your time and insights.

Bill Bonner is co-founder and president of Brickburn Asset Management, a Calgary-based investment counseling firm largely focused on the Canadian energy sector. He is directly responsible for managing energy investments in public market portfolios, private client portfolios and private equity pools. With over 30 years of energy capital markets experience, Bonner brings a perspective to Brickburn Asset Management that has been built on a solid foundation and in-depth knowledge of Canada’s energy sector. Prior to founding Brickburn Asset Management, he was a founding director of Network Capital, the predecessor to Brickburn. His career also included 14 years with Peters & Co. Limited, where he was a significant shareholder, member of the Executive Committee, and managing director of Institutional Sales and Trading.

Want to read more exclusive Energy Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Exclusive Interviews page.

DISCLOSURE:

1. George of The Energy Report conducted this interview. He personally and/or his family own shares of the following companies mentioned in this interview: None.

2. The following companies mentioned in the interview are sponsors of The Energy Report: Royal Dutch Shell Plc. Streetwise Reports does not accept stock in exchange for services.

3. Bill Bonner: I personally and/or my family own shares of the following companies mentioned in this interview: Surge Energy, Whitecap Resources, DeeThree Exploration and ET Energy. (through my ownership in the Dominion Equity Resource Growth Fund). I personally and/or my family am paid by the following companies mentioned in this interview: None. I was not paid by Streetwise for participating in this story.

Streetwise – The Energy Report is Copyright © 2011 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part.

The Energy Report does not render general or specific investment advice and does not endorse or recommend the business, products, services or securities of any industry or company mentioned in this report.

From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles on the site, may have a long or short position in securities mentioned and may make purchases and/or sales of those securities in the open market or otherwise.

Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported.

Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

Participating companies provide the logos used in The Energy Report. These logos are trademarks and are the property of the individual companies.

101 Second St., Suite 110

Petaluma, CA 94952

Tel.: (707) 981-8204

Fax: (707) 981-8998

Email: jluther@streetwisereports.com“>jluther@streetwisereports.com