Daily Updates

Over the past couple months everyone seems to have been preparing for a sharp market correction. Crazy part is that the SP500 dropped about 10% from the high and that is a typical bull market correction. The thing is… the stock market has a way of slowly unfolding making it look and feel minor, then before you know it, the correction is over and it’s back to an uptrend. That is kind of how this one unfolded.

The good news is that we caught the low risk portion of the correction locking in a 4.5% drop, and we are now in a long trade and in the money by 2.5% with very little down side risk at this point. Time will tell if this up trend is sustainable or not…

Now, let’s take a look at the charts…

Dollar 60 minute intraday chart

As you can see below the dollar looks to have started a breakdown today. If there is continued selling pressure in the next couple days then expect to stocks and commodities to move higher as the US Dollar drops. It is important to know that when a bullish pattern fails we typically see a very strong reaction in the opposite direction (down) catching the majority off guard and they rush to the door.

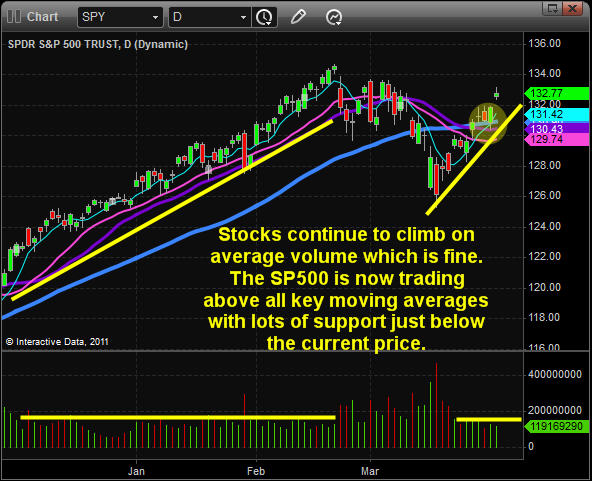

SPY Broad Market ETF – Daily Chart

A couple weeks ago we watched the market go into a free fall creating a washout bottom. From there we saw prices bounce back and retake my key moving averages. This gave us a bullish bias and dips should be looked at as buying opportunities. I will admit that stocks still have a long way to go before the masses are convinced. I feel we need to see the February and March highs get taken out first. Once they get taken out there should be strong buying as short covering (protective stops from traders who are short) causes a surge in buying pressure sending stocks sharply higher yet again.

My trading buddy David Banister at Active Trading Partners is starting to see small cap stocks come back to life. Money is starting to flow into these lucrative areas of the market and he is on top of things… This week’s trade is up 20% in less than 24 hours which is very exciting.

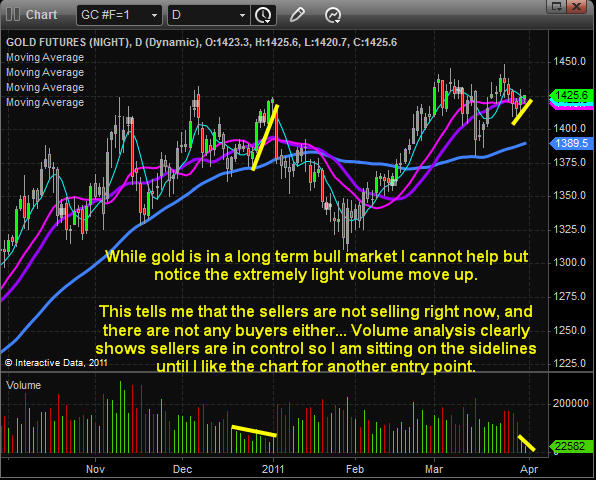

Gold Daily Chart

Gold has been moving up this year but the current price action is not really getting me excited to buy just yet. Recently we have seen strong selling volume and very light buying volume. My bias still favors higher prices but there is still a good chance we get another dip in the coming sessions.

Mid-Week Trading Conclusion:

In short, I feel as though the dollar will trigger the next wave of buying in stocks and commodities for the next week or two… We should see the dollar make a clean moving in either direction shortly and that will help guide my analysis, positions and setups. I hope this analysis helps you to see the market from a different perspective.

If you would like to get my mid-week reports free please join my free newsletter here: http://www.thegoldandoilguy.com/trade-money-emotions.php

Chris Vermeulen

Van Eck’s lead energy analyst, Shawn Reynolds, has an MBA from Columbia Business School and a master’s in petroleum geology from the University of Texas. As an investment team member of the Van Eck Global Hard Assets Fund and the Van Eck VIP Global Hard Assets Fund, he travels the world searching for new opportunities in the energy space.

Recently, HardAssetsInvestor.com Editor Lara Crigger caught up with Reynolds to discuss the lasting impact of the Sendai earthquake and Fukushima reactor scare in the energy markets and investment opportunities arising from the disaster.

The mail is POURING IN! Hundreds, if not thousands of readers seem to want my head for being short-term bearish on gold and silver.

I have never, and I mean NEVER, seen such an outpouring of emotions!

But truth be told, the level of emotions that are now running so high against anyone who dare say that gold, silver, other metals, and commodities could, and should, fall in the short term — is one large reason precisely why they probably will decline.

For one thing, bullish sentiment in the precious metals is at record highs. That means there are hardly any buyers left.

For another, when any decent selling does hit gold and silver, guess what will happen? The crowd will turn on a dime, and start selling en masse, leading to an even sharper decline.

Don’t get me wrong. As I’ve said many times in the past few weeks, I am very, very bullish on the precious metals on a long-term basis. Ditto for most commodities.

But — the only way commodities in general are going to fulfill their long-term price targets — which across the board, are much higher than they are now — is if they wring out some of the short-term excess that has flooded these markets.

If they do that, then all will be fine.

If they do not, and gold, silver, and virtually every commodity rips higher, here and now — then we’re going to see a blow off situation, one that could kill the commodity markets for as long as two years, before they resume their bull markets.

With emotions running so high, and with so many events and fundamental forces arguing for higher prices, I know, all of this is very hard to understand and grasp.

Heck, it’s even tough for me, being so bullish on the long-term outlook.

So today, I’m going to publish some of the recent emails I’ve received, good and bad, and my replies. Let’s get started …

Mark writes in: “Larry, if silver crashes to $22 in the next 10 years, you can say — see I told you. To be credible you need a time frame.”

My reply: I am not a stopped clock that’s right twice a day. I have given my time frame in my recent columns and videos. If gold and silver are to stage a very important pullback now, it should be over by June at the latest.

Neil writes in: “Larry, with all due respect, I believe that you are looking at gold and silver like [they are] a stock, the rally in these areas is due to the devaluation of the dollar followed by investor interest … the increase in the money supply, which is the definition of inflation … is what is driving commodity prices period. Gold and silver are the only resort left for true Free Market Money.”

My reply: All assets are subject to the same swings in human emotions, from extreme fear to extreme greed. Whether it’s gold or silver, stocks or bonds, real estate, diamonds, or whatever.

Extreme fear always gives way to extreme greed, and vice versa.

Right now, we have record greed and bullish sentiment in the metals. A major sentiment extreme where the crowd is almost unanimously bullish.

That is not the kind of situation you want to buy into or even add to positions. Quite the contrary, it’s the time to separate oneself from the sheep being led to slaughter, and either stand aside, or go the opposite direction.

As to gold and silver being the only true form of money left, we’re not at that point yet either. That time will come, but not until gold gets above its inflation-adjusted high of $2,300 an ounce, the dollar starts really losing its world reserve status, and gold is rising in terms of all currencies, which it is NOT doing right now.

Esten states: “I’m sure glad I didn’t follow your advice to short/hedge precious metals waiting for a pullback of $22-$23 in silver and $1,220-$1,230 in gold. I think you should fess up to your mistake and apologize to those that lost a lot of money following your advice.”

My reply: Losses always stink, and I take them very seriously. However, they do come with the territory. One cannot expect to be right and make money unless one is willing to be wrong and take the inevitable losses that occur from time to time.

As to the current situation and forecast, I have been extremely conservative. Any hedges I have recommended have incurred modest open losses, while core gold and gold share positions have actually gained more than the hedges lost. So my subscribers have done okay there.

Speculative positions so far, have not worked out. But even there, I have kept the positions very light, and not been aggressive.

Lobo writes in: “Where are the comments about the real reason the metals markets are rising? JPM is losing control along with a few other ‘investment banks’ that right now just can’t deliver the physical metal and are paying premiums to the big holders to take cash.

“Could it be that this huge pile of paper silver ‘also called mythical silver’ is at last going to catch up to the largest Ponzi scheme ever?”

My reply: The short squeeze that is occurring in the silver market is precisely that, a short squeeze.

BUT — all short squeezes end badly for investors betting on them on the long side. As soon as the shorts are wrung out of the market, guess what happens? Prices plummet.

The fact of the matter is that history has shown us time and time again that … whether it’s a group trying to corner a market on the long side, like the Hunt Brothers tried to do in silver in 1980, or massive shorts that have been accumulated over time that are now being squeezed … either way, everyone gets hurt.

It’s far better to let the markets do what they are going to do in the short term, let the dust settle, and then invest sensibly, not on emotion, rumor, or conjecture.

Nigel writes in: “If the market is due to correct, in hindsight it will have to from what is now its highest point. I don’t like Larry chasing the price up, it’s now $1,480 which is higher than previous values of $1,453.

“Larry may not like the precious metals market to burn out early, and if that is the case neither do any of us, but unless there is a catastrophic move downwards, we’ve missed the past few months of riding both the recent correction as shorts, together with the recent rise to new highs.”

My reply: Not sure where you’re getting your price for gold. Gold’s high, as I write this, was $1,448. It has not broken through $1,453, yet alone firmly closed above it.

Moreover, since I turned short-term bearish in late December/early January, gold has done nothing but fall hard and then recover. It’s gone from $1,438 down to $1,308 and back up to $1,448.

Bottom line: You haven’t missed anything but short-term wild swings, which have occurred so quickly and suddenly, the only way to have possibly capitalized on them would be to trade the futures nimbly.

Rob writes in: “You are basing your charts off the paper price of the metals which is fantasy. It’s the physical demand which is taking over. The paper price is manipulated … how can one take information short term from a market that is no longer free?”

My reply: Silver IS a manipulated market, that is for sure. Gold is not as vulnerable to manipulation as silver is.

As for physical demand/supply versus paper — gold is not showing any of the type of “backwardation,” where physical demand exceeds supply even on a short-term basis.

Silver, on the other hand, is now in a backwardation market — where the cash price of silver has traded above the futures prices of silver, indicating short-term supply disruptions in the physical silver market.

This is surely a sign that shorts are being squeezed. As I note in another reply above, short squeezes almost always end badly for nearly everyone — both those who either participate directly, or indirectly. It is far better to let the short squeeze play itself out, then invest based on solid fundamentals (the long-term view).

Pat writes in: “You are missing the big picture, CHAOS. You are looking for a correction that under normal circumstances should happen but you only have to look at equities in general to see that normal fundamentals and cycles do not apply anymore.

“Chartists like you, can’t seem to understand that fundamental and cyclical analysis, although useful, are sometimes useless or to be fair, less useful depending on real time events and conditions. Silver and gold will correct when people feel safe, charts I am afraid, do not have a fear indicator.”

My reply: I hear you Pat, but respectfully disagree. It is certainly true that we are seeing plenty of chaos. But we are at a sentiment extreme. Sentiment extremes are points where the least expected happens, markets turn.

Consider the stock markets in March 2009, when almost everyone thought the Dow was going to plummet to 4,000. We certainly had plenty of chaos then.

But, my sentiment and timing measures disagreed. On March 16, 2009, I called for the Dow and S&P to start a multi-month rally that would see the Dow rise from the 6,700 level to over 10,000.

Everyone thought I was nuts. Almost no one believed me. But I was right. I tell you this not to brag, but to merely point out that most trend changes take place when markets reach precisely the kind of sentiment extremes that gold and silver have now reached.

It’s the markets’ way of separating the majority of investors from the majority of their money.

Jack writes in: “For the record, I love [your] column. But … we are in uncharted territory. The multitude of “perfect” storm events is unprecedented in our lifetimes and I think … the 11-year cycle in gold — something [Larry] mentioned in one of his last newsletters — which ended in 1999 is shortsighted.

“Yes, I will continue to buy at these high prices but I am keeping some of my powder dry in the event that Larry is right.

“If silver is going to $100.00 plus prices, I ask you, what does it matter if you buy it at $38.00 or $20.00 per ounce. The point is moot!

“And thank you Larry for following your beliefs although I don’t agree with you. Somehow one just has to respect that sort of fortitude.”

My reply: Jack, thank you for the kind words! And I completely agree with you and have recommended that everyone hold their core holdings for precisely the reasons you mention above!

Vickram writes in: “Larry, I actually wait to see your videos. [But] I am getting the feeling this time in particular, that you are going against the rising tide in silver. I sincerely hope you are right about the sharp pullback to $23 levels. If not, people who are following you may miss the bus.

“God Bless you Larry, for all the good work you are doing. I like your philosophy of trying to explain your thoughts in such a precise manner and in such a short video. That’s commendable. Thanks.”

My reply: Thank you. If I am wrong on either gold and silver, while we may miss a few opportunities short term, there will be plenty more ahead.

David writes in: “Nothing new here. Everything hinges on the dollar. If it rallies, Larry’s forecast seems very plausible. If not, his subscribers will lose money short term and will have to move on to the new reality.”

My reply: Yes, the dollar is at a critical point right now. I suspect it will soon stage a surprising rally. But not one that will change its long-term trend. Just a strong, short-term bounce.

Bottom line: I maintain my view. I believe investors …

A. Should hold all recommended core physical gold and mining shares I’ve recommended, and all gold and metals-related mutual funds and ETFs.

B. Refrain from adding any more positions, until the markets give us the appropriate signals. And …

C. Keep the rest of your powder dry!

Keep in mind that gold is ultimately heading to way more than $2,300 an ounce. Probably to over $5,000. And silver will likely top $100 in the years ahead.

So, we have plenty of time and price action ahead to take advantage of them, not to mention all the other natural resources that are also in long-term bull markets.

Best wishes, as always …

Larry

Larry Edelson has more than 30 years of investing experience with a focus in the precious metals and natural resources markets. His Real Wealth Report (a monthly publication) and Resource Windfall Trader (weekly) provide a continuing education on natural resource investments, with recommendations aiming for both profit and risk management. He is also editor of The Foundation Alliance, an exclusive stock and ETF trading service that leverages the historic strategic alliance between Weiss Research and the Foundation for the Study of Cycles.

For more information on Real Wealth Report, click here.

For more information on Resource Windfall Trader, click here.

For more information on The Foundation Alliance, click here.

1. Dividend payers beat non-dividend payers.

According to Ned Davis Research, firms in the S&P 500 that raised dividends gained an average of +8.8% per year between 1972 and 2008. Those that cut dividends or never paid them produced zero return over this entire time span.

2. Higher yields beat lower yields.

This is such a “no-brainer” that it doesn’t require explanation. Clearly, a bigger dividend puts more cash in your pocket.

3. Reinvesting your checks beats cashing them.

This buys you more shares, which leads to larger dividend checks, which buy you even more shares, and so on (this is how my dividend checks have grown).

4. Small caps beat large caps.

A 70-year study of different equity classes showed that $1,000 invested in small-cap stocks grew to $3,425,250. In large-cap stocks it grew to only $973,850.

5. International beats domestic.

The average U.S. stock pays just 2.0%. That’s peanuts compared to yields overseas. Stocks in New Zealand yield 5.4%… stocks in Portugal yield 4.1%… in Spain 5.3%… and in the Czech Republic 4.8%.

6. Emerging markets beat developed.

It’s much easier for a small economy to post fast growth than a large one. And investors who know this benefit. Since 1994, Vanguard’s Emerging Markets Stock Index Fund is up +268%. Stocks throughout the developed world, as measured by Morgan Stanley’s EAFE index, are up just +55%.

7. Tax-free beats taxable.

Tax-free securities often put more cash in your pocket at the end of the day — especially if you’re in a high tax bracket. A muni fund yielding 6.0% pays you a tax-equivalent yield of 9.2% if you’re in the 35% tax bracket.

8. Monthly payouts beat annual payout.

Getting paid monthly is not only more convenient — you actually earn more. Thanks to compounding, a stock paying out 1% monthly yields far more than 12% — it can actually pay you 12.68% if you reinvest.

Peter Morici is a professor at the Smith School of Business, University of Maryland School, and former Chief Economist at the U.S. International Trade Commission.

The Gathering Storm: Economy Remains too Vulnerable

The economy picked up in the first quarter. After adding 175,000 jobs in February, economists expect the Labor Department will report on Friday that the economy added 188,000 jobs in March. However, events in Japan, Libya and the wider Middle East, and the European sovereign debt crisis threaten to reverse these gains and thrust the economy into a second recession.

Longer term, job gains in the range of 200,000 a month are not enough to push unemployment down to acceptable levels. Dysfunctional energy, trade and tax policies are holding back U.S. growth, adding to unemployment and lowering wages.

…..read more on Private Sector Jobs & Structural Impediments to Growth HERE