Daily Updates

Europe’s parade of surreal financial news just keeps coming. This week, investors are paying Germany to take their money by accepting negative interest rates on new government debt:

Germany Issues Bills With Negative Yields As Economists Agree Country Is In Recession

Continuing the schizoid overnight theme, we look at Germany which just sold €3.9 billion in 6 month zero-coupon Bubills at a record low yield of -0.0122% (negative) compared to 0.001% previously. The bid to cover was 1.8 compared to 3.8 before.

As per the FT: “German short-term debt has traded at negative yields in the secondary market for some weeks with three-month, six-month and one-year debt all below zero. Bills for six-month debt hit a low of minus 0.3 per cent shortly after Christmas…The German auction marks the start of another busy week of debt sales across Europe. France and Slovakia are also selling bills on Monday, with Austria and the Netherlands selling bonds on Tuesday. Germany will auction five-year bonds on Wednesday, while Thursday sees sales of Spanish bonds and Italian bills. Italy finishes the week with a sale of bonds on Friday.”

Still the fact that the ECB deposit facility, already at a new record as pointed out previously, is not enough for banks to parks cash is grounds for alarm bells going off: the solvency crisis in Europe is not getting any easier, confirmed by the implosion of UniCredit which is down now another 11% this morning and down nearly 50% since the atrocious rights offering announced last week. On this background Germany continues to be a beacon of stability, yet even here the consensus is that recession has arrived. As Bild writes, according to a bank economist survey, Germany’s economy is expected to shrink in Q1, with wage increases remaining below 3%. And as deflation grips the nation, potentially unleashing the possibility for direct ECB monetization, look for core yields to continue sliding lower, at least on the LTRO-covered short end.

“Not all dirt is the same. Some dirt is astonishing, compared to other dirt,” – Jim Rogers 01/10/2012

“If I were buying anything I’d be buying agricultural commodities,” “Going forward we’re going to have huge shortages of everything – including farmers – I think ag will be a great place for the next 10-20 years” – Jim Rogers 12/30/2011

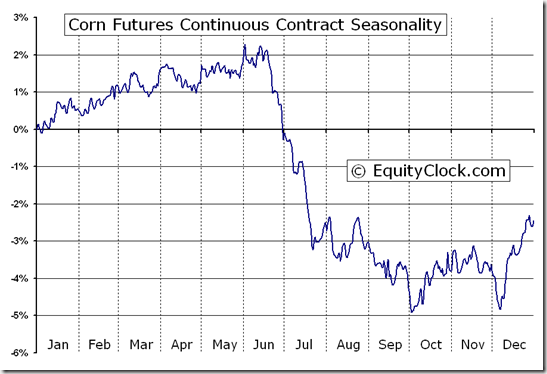

Analysis has revealed that with a buy date of December 6 and a sell date of June 13, investors have benefited from a total return of 95.14% over the last 10 years. This scenario has shown positive results in 6 of those periods. – by Don Vialoux who is Michael’s Moneytalks Guest Saturday.

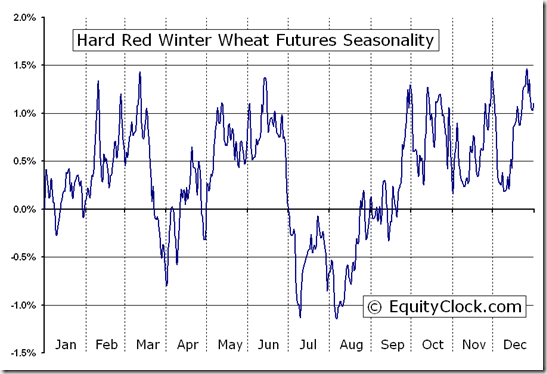

Analysis has revealed that with a buy date of December 6 and a sell date of March 12, investors have benefited from a total return of 58.35% over the last 10 years. This scenario has shown positive results in 5 of those periods. – by Don Vialoux who is Michael’s Moneytalks Guest Saturday.

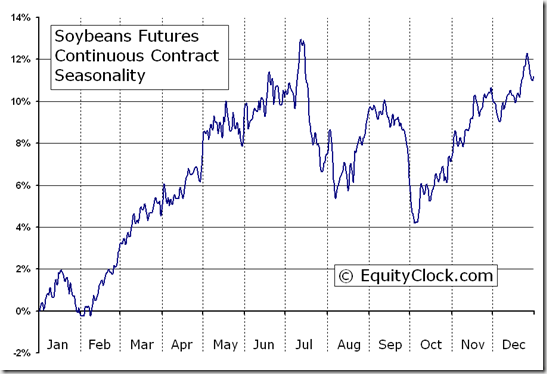

Analysis has revealed that with a buy date of October 22 and a sell date of July 13, investors have benefited from a total return of 1276.17% over the last 10 years. This scenario has shown positive results in 8 of those periods. – by Don Vialoux who is Michael’s Moneytalks Guest Saturday.

Sioux County, Iowa: Ground zero for U.S. farm boom

by P.J. Huffstutter – Reuters

If there is an epicenter of the nation’s farmland boom, it can be found here amid the rolling hills of northwest Iowa.

A fortune is being plowed into the dirt of Sioux County, where well-heeled farmers and wealthy investors compete fiercely for some of the most fertile land in the Corn Belt. While farmland prices across Iowa have been among the heartland’s fastest growing – up 261 percent since 2000 – they’ve more than tripled in Sioux County, rising faster than most of the state.

Locals could not be more pleased about such prosperity – or more nervous.

Like many people across the Midwest, they’re increasingly anxious of a potential pull-back in values, despite stark economic differences with the 1980s farm crisis.

But their greatest fear is that if this boom turns to bust, as the housing market did last decade, people may well trace one of the key causes to this corner of the Hawkeye State — and blame local farmers and investors for creating an artificially inflated benchmark for the Midwest.

In what has been termed the “Iowa effect,” farmers and ranchers across the nation now routinely look to this 768-square-mile county as a benchmark for America’s 408 million acres of crop land. Record-setting land deals in this corner of the state are quickly deemed the new high-water mark for surrounding states.

“I hear people talk and it’s not in a good way,” said Bill Tentinger, president-elect of the Iowa Pork Producers Association, who runs his family’s hog farm in Les Mars, Iowa, in south Sioux County. “People see these prices and think, ‘Well, if land in Iowa sells for $20,000 an acre, then why can’t my farm in Illinois or Minnesota or Nebraska sell for that much?'”

Locals here will tell you exactly why: rich soil, favorable weather trends, a high concentration of livestock and biofuel operations, and an intensely competitive farming culture.

Those are some of the reasons state records have been shattered time and again at local auction halls and barnyard gatherings. Sioux County bidders cracked $13,000 an acre for crop land two years ago. Last fall, the price tag on a farm field jumped to $16,750 an acre. In December: $18,250. Then: $20,000.

That run-up, warn economists, is fueling a potentially dangerous axiom in the minds of investors: that there is plenty of profit to mine from U.S. cropland, even if prices continue to reach once unimaginable highs.

“Not all dirt is the same. Some dirt is astonishing, compared to other dirt,” said Jim Rogers, the billionaire commodities investor and author. “But it ultimately comes down to economics: How much does that land cost, what crop can you grow on that land, what price you can get for that crop, and how much it costs you to produce that crop?”

Economists are hopeful there will not be a repeat of the boom-to-bust farm cycle in the late 1970s and early 1980s.

Farmers today do not appear to be borrowing heavily against their high-value land in order to fund new real estate purchases, economists said. Such leveraging was one of the key causes behind the last agricultural bust: grain surpluses depressed prices, farmland prices dropped by half and farmers were squeezed by deepening debt.

WHAT IS FARMLAND REALLY WORTH?

As word spreads of each heady price tag from public sales in Sioux County, auctioneers and real estate agents said the boom is quick to ripple outward. The latest spike was set off in early December, when farmer Leland Kaster paid $20,000 an acre for fields next to his dairy near Hull, Iowa, a Sioux County hamlet located about 50 miles southeast of Sioux Falls, S.D.

If Kaster were to grow corn on his new 73.4 acres, he’d be able pull in about $1,250 per acre in gross revenues next year, given futures market prices and average corn yield. More simply put: It would take the Kaster family more than half a generation to recoup their money – and that’s only if corn prices remain relatively high.

“We call it the Iowa Effect,” said Nebraska auctioneer Randy Ruhter. Land prices in eastern Nebraska, a state which saw a more than 40 percent jump in the third quarter, edged up another 3 to 5 percent after the deal.

“When prices go up there,” Ruhter said, “prices go up elsewhere.”

Part of the reason that land values can be so easily influenced by a single auction in a small rural county is that calculating the value of a farm field is different than figuring out what people are willing to pay, say economists.

Land values can fluctuate wildly, depending on who is doing the math and what income and expense factors are used. The Federal Reserves’ Midwest farmland surveys come out quarterly. Researchers at land-grant universities regularly roll out their research, too.

And there are so many different elements to weigh – including human emotion and other hard-to-quantify factors – that nailing down a transparent answer that is universally accepted can be difficult.

“Each land sale is unique and each person will take their own set of assumptions into the calculation,” said Michael Duffy, an agricultural economist at Iowa State University.

That inconsistency is partly why investors and sellers alike have turned to public auctions to figure out what the market will bear.

PERFECT PLACE FOR A PERFECT STORM

In many ways, Northwest Iowa is unusually ideal for such a perfect investment storm.

Amid the rolling hills that border the Big Sioux River, tilled fields abut ethanol plants, hog farms and dairy factories.

The soil is rich. Weather patterns have shifted in recent decades, allowing the dirt to retain more water and improve crop yields in northwest Iowa. The county’s annual precipitation has averaged 30.44 inches in the past 30 years, up 13 percent from the previous three decades, according to state climatology officials.

Extreme summer heat has been less frequent. In Sioux City, for example, there were only seven days where the temperatures hit 100 degrees or higher in the past decade, down from 21 days in the 1980s.

Competition for land and grain is also intense. Sioux County has more farms – 1,664 – than any of the state’s other 98 counties, according to the USDA’s 2007 Census of Agriculture. It’s the state’s top seller of cattle and hogs, and the second largest seller of corn.

There are 13 ethanol plants, and two biodiesel factories, within a 90 minute drive of the county’s center, reducing transportation costs. Those plants compete for crops with the region’s scores of hog farmers, dairy producers and cattle feedlots, the engine that drives much of the county’s success.

Worries about Washington, and the growing regulatory influence of the U.S. Environmental Protection Agency in rural America, have livestock farmers here scrambling to buy more land to dispose of their animals’ manure. The EPA has already warned dairies in California over their failure to dispose of manure.

The growth of a larger local customer base has reshaped land values, too, according to data compiled by Iowa State University.

During the farmland boom of the 1970s, land prices were valued higher on the eastern side of the state, where farmers were physically closer to barge transportation on the Mississippi River.

Louisa County in southwest Iowa, which sits alongside the Mississippi, saw its farmland valued among the highest in the state during that period: It jump 355 percent during the 1970s, according to Iowa State University research.

Now, however, its value has risen 64 percent in five years, lagging behind Sioux County’s 80 percent leap. Graphic:Iowa farmland values: link.reuters.com/byt85s

EMOTION, NOT ECONOMICS

Then, there’s the human factor. Auctioneers and real estate experts say the extreme high-priced deals are often driven by a regional culture of competitiveness, rather than economics.

Dutch immigrants flocked to Sioux County in the mid-to-late 1800s, in search of cheaper land to carry on their farming heritage. They brought with them a culture of faith and frugality that exists today, with farmers flush with cash and deep emotional roots to their land.

But they also carried with them an intense enmity between neighbors and outsiders. Such rivalries were so intense that, back in 1872, a fight over where to set up the county seat reportedly prompted farmers and townsfolk in Hull and Orange City to raid the log courthouse in Calliope, Iowa, and steal a safe with all the county property records in it. (The documents were later returned.)

Such clashes continue today.

“I’m hearing a lot of, ‘You were rude to me and by god I’m not going to let you have it.’ Or, ‘That was granddad’s land and I’m going to get it back’,” said Duffy, of Iowa State University.

Such was the case with the Kaster deal. The land he bought a month ago for $20,000 an acre does not look particularly dramatic: a field of tilled black soil where frost sparkles on clumps of dirt the size of bowling balls. But the auction price tag spiked when Kaster, who runs a relatively small dairy, faced off against a rival neighbor, who operates a much larger farm.

Kaster “told me at the break that he was going to get that land, no matter what,” said auctioneer Pete Pollema.

Despite the dangers of extrapolating Sioux County’s land values for outside guidance, and given that the federal ethanol subsidies quietly expired last year, some people still believe there is plenty of life left in the local boom.

That faith prompted town officials in Hull — home to nearly 2,200 people, eight churches and no stop lights — to join the land rush: The town’s economic development team bought a nearby 80 acre parcel two years ago for $1 million.

City administrator Les Van Roekel insists the deal was a savvy move. Area crop and dairy farmers clamored to cash-rent the land, after a local cheese plant recently announced plans to double the amount of milk it processes each day.

Recently, local real estate agents and auctioneers pegged its worth at nearly $19,000 an acre, Van Roekel said. Local leaders are shopping for more land, either to buy or trade.

“We’re somewhat in a bubble here,” Van Roekel said. “But I think we’re going to be fine.”

Investing in the Oil Services Sector With ETFs

The Oil Services sector is about to enter its period of seasonal strength. What are prospects this year?

According to EquityClock.com, the oil services sector has a period of seasonal strength from January 15th to May 9th. The trade has been profitable in 18 of the past 21 periods. Average return per period is 17.0 percent.

Seasonality is influenced by the traditional increase in crude oil and refined product prices during the February to May period as well as an increase in demand for rigs during the winter drilling season.

Prospects are more promising than usual in 2012. The industry recently predicted that spending on oil services will increase by 9.0 percent in 2012. Gains will come partially from a ramping up of horizontal drilling in North America. Added to demand is development of offshore fields in Brazil and the South China Sea and a recovery of oil producing facilities in Iraq. Higher crude oil prices are stimulating demand. Crude oil prices on a year-over-year basis have climbed from $90 in January 2011 to over $100 per barrel. Events in Iran could boost crude oil prices further.

Strong fourth quarter earnings also will help the group. The top 10 companies are expected to record a 16.5 percent gain on a year-over-year basis. The top 10 companies are Baker Hughes (BHI), Cameron International(CAM), Diamond Offshore Drilling (DO), Halliburton, Noble Corp. (NE), Schlumberger (SLB), TransOcean (RIG), National Oilwell Varco (NOV), Weatherford International (WFT) and Precision Drilling (PD).

On the charts, the sector is not set up for the seasonal trade yet. The Philadelphia Oil Services Index (OSX) at 223.28 bottomed early in October at 174.66, quickly moved to 244.54 at the beginning of November and subsequently moved sideways. A move above resistance completes a bullish reversal head and shoulders pattern, a possibility during the 2012 period of seasonal strength. The Index remains below its 50 and 200 day moving averages. Strength relative to the S&P 500 Index has been slightly positive since the beginning of October. Short term momentum indicators currently are overbought. Preferred strategy is to accumulate equities and related Exchange Traded Funds on weakness closer to short term support at 204.59 after the sector has entered into its period of seasonal strength.

Exchange Traded Funds that track the Oil Equipment and Services sector include Oil Services HOLDRS (OIH $117.30), Dynamic Oil and Gas Services (PXJ $20.75) and Oil & Gas Equipment and Services SPDRs (XES $35.60). A word of caution on Oil Services HOLDRS! The trust is progressing through a restructuring. As a result, liquidity has significantly declined recently.

About Don Vialoux

Don Vialoux has 37 years of experience in the Investment Industry. He is a past president of the Canadian Society of Technical Analysts (www.csta.org) and a former technical analyst at RBC Investments. Don earned his Chartered Market Technician (CMT) designation from the Market Technician Association in 1995. His CMT paper entitled “Seasonality in Canadian Equity Markets” was published in the Spring-Summer 1996 edition of the MTA Journal. Don also has extensive experience with Exchange Traded Funds (also know as Index Participation Units) as well as conservative option strategies. In 1990 he wrote a report that was released in the International Federation of Technical Analyst Journal entitled “Profiting from a Combination of Technical and Fundamental Analysis”. The report introduced ” The Eight Phases of the Stock Market Cycle”, an investment concept that continues to identify profitable entry and exit points for North American equity markets. He is currently a member of the Toronto Society of Fundamental Analyst’s Derivatives Committee. Now he is the author of a daily letter on equity markets available free on the internet. The reports can be accessed daily right here at www.dvtechtalk.com.

Impossible! That’s what institutional investors say about “Timing the Market”. Mr. Vialoux will explain that, indeed, it can be done with the appropriate analysis. He also will explain why timing the market will be important during the next decade. Buy and Hold strategies are not working anymore; Investors are looking for alternatives. Mr. Vialoux will demonstrate four techniques that can be used to time intermediate stock market swings lasting 5-15 months. The preferred investment vehicles for investing in intermediate stock market swings are Exchange Traded Funds.

John Edwards, first vice president covering energy infrastructure master limited partnerships for Morgan Keegan, is bullish for 2012 and well The Energy Report, Edwards highlights how this sector pairs a low-volatility asset class with stable, secure distributions—a rare combination in today’s markets.

The Energy Report: A year ago, you forecast average returns of 10% with the yield spread between master limited partnerships (MLPs) and 10-year U.S. treasuries at 290 basis points. How accurate did your forecast turn out to be?

John Edwards: It turned out fairly well. The actual performance for MLPs beat our original expectations by about 390 basis points. On the last trading day of 2011, we were looking at 13.9% total return.

We targeted yields on the sector between 6% and 6.5% and it ended near 6.1% at the lower end of our targeted range.

TER: What is the current yield spread?

JE: The current yield spread is approximately 4.2%, 420 basis points.

TER: Do you believe MLPs are valued fairly right now?

JE: We think fair value in the year ahead should be in the 5.75% to 6.25% range, which is where we are. In that regard, MLPs are fairly valued.

If you look at it from the standpoint of spreads against U.S. 10-year Treasuries, you can make the case that MLPs are undervalued. Over the last decade, the average yield spread between MLPs and the U.S. 10-year has been about 324 basis points. Over the last five years, it has been 385. Obviously, that was skewed by the financial crises in 2008 and 2009. The most commonly occurring yield spread is in the range of 200–250 basis points.

We prefer to be a little conservative. With respect to valuation, MLPs have averaged a 7% yield over the last 10 years, and about 7.4% over the last five years. Inevitably, we expect there will be some spread compression, more due to a rise in the yields on the U.S. 10-years than to drops in the yields on MLPs. But overall, looking at the sector’s history, we consider 6% or so to be a very commonly occurring yield.

TER: Will total returns nearing 12.5% in 2012 lead to a flight into MLPs by retail investors? After all, virtually nothing else out there is performing at a consistent level.

JE: On a risk-adjusted basis we think MLPs offer a very compelling opportunity. For 2011 we targeted 6–6.5% yield and a distribution growth of 4–6%. We believe distribution growth ended up at the high end or a bit above. For 2012, we think the growth will be a bit stronger. We recently raised our target to about 100 basis points, or 5–7% growth. We are now thinking it will be even stronger, maybe 6–8% for 2012, in which case, we would be looking at a total return expectation somewhere between 10–22% for 2012. That would put our mid-point expectations in the 15–16% range for 2012.

TER: As of mid-December the Alerian MLP Index, which is basically the industry benchmark, was down half a percent from an all-time high set earlier in December. Did that surprise you?

JE: That did not surprise us too much. The last three months have been surprisingly strong for the sector; it has been at or very near its all-time highs. The Alerian benchmark has recently surpassed its all-time high, set in April 2011 on a price basis, and of course has set an all-time high on a total return basis.

There are not many opportunities for investors where you can find a low-volatility asset class paired with stable, secure distributions. This is a sector with tremendous visibility in terms of growth over the next 20 years. It is very difficult for us to think of other asset classes available to investors that offer what MLPs offer right now.

TER: In 2011, gas processors and MLP general partners were the best-performing MLP subsectors, with total returns at about 18% for gas processors and 17% for general partners. Do you see that trend continuing for 2012?

JE: We do. The opportunity for gas processors remains very strong. A tremendous amount of opportunity remains in shale plays where there is a lack of infrastructure. There is a lot of wet gas out there, which creates demand for the services needed to separate the gas from the liquids.

It is also important to note that fractionation capacity is also in short supply. We expect the capacity of raw liquids pipeline to be much greater than the fractionation capacity additions over the next few years. Consequently, we think companies involved in those businesses should do very well.

The one risk we are always mindful of and that is difficult to diversify away is commodity exposure in gas processing that arises from difficulties in the financial sector. Whenever there is trouble in the financial sector, it tends to create headwinds in gas processing, as natural gas liquids (NGLs) that are produced tend to tie more closely with oil, which in turn could face downside, should we see contagion from the European banking and the financial sector. NGL prices are important to natural gas processing/fractionation margins. We saw this in 2008 and 2009. But assuming the financial sector stays relatively healthy, gas processers should do very well in 2012.

TER: Conversely, it was a rough year for propane and shipping MLPs. Propane MLPs were down around 6%. Do you expect this subsector to rebound?

JE: This was a challenging year for propane MLPs. There is ongoing conservation in that subsector, and as a result, there is no organic volumetric growth at the retail level. Rising propane exports have kept wholesale propane prices relatively strong, which cuts into margins for the propane companies.

We expect the challenges for propane to continue. The subsector is ripe for consolidation. The irony is that, should there be difficulties in the financial area, propane companies would likely do well because wholesale propane prices would probably fall. But barring that scenario, we think propane companies are more likely to lag.

TER: Your recent Morgan Keegan MLP Top 10 list carries the caveat that those names are not necessarily the best fit for all accounts and are not necessarily how you would build an MLP portfolio. How would you build an MLP portfolio?

JE: In building an MLP portfolio our bias is to protect investors’ interests, to protect against downside risk. Thus, although we believe gas processors have perhaps the best upside potential, there also is more downside exposure to difficulties in the financial sector. With that in mind, we tend to overweight the larger-cap MLP names. But we would certainly want to continue to have exposure to that area.

TER: EV Energy Partners, L.P. (EVEP:NASDAQ) holds the top spot in the Morgan Keegan MLP Top Ten, largely due to its exposure to the Utica Shale. Please tell us about that play and how EV Energy is leveraging it.

JE: EV Energy Partners is an unusual MLP, in that it is in the upstream area, meaning it is involved in oil, gas and liquids production. It has a very strong position in the Utica Shale, about 158,000 acres. A number of wells have been drilled there, and it is providing a lot of data points indicative of a play with very strong potential. Some reports liken its geologic characteristics to the Eagle Ford Shale, which has been a very, very strong play.

We need more data, but based on a number of announcements from other players that have signed up for takeaway pipeline capacity out of the Utica Shale, we believe there is tremendous potential, and that it is only a matter of time before EV Energy Partners is able to realize some of that upside. That is why we think it has one of the strongest total return potentials for the coming year. We also see that at current valuation levels investors are effectively valuing the Utica acreage at just $5,000-$7,500/acre compared to recent transactions that effectively valued the acreage at $10,000-$15,000/acre, again supportive of upside potential in the value of EV Energy Partner units, in our view.

TER: It performed remarkably well over 2011. At the beginning of December, its total return for 2011 was close to 80%. Do you expect similar performance in 2012?

JE: Not quite as strong as 80%—somewhere between 27–73%. A good midpoint would be ~50% total return over the next year.

TER: That is still impressive. In January 2011, you named MarkWest Energy Partners, L.P. (MWE:NYSE.A) as one of your top picks. This year it is in your top 10. Why?

JE: MarkWest Energy had a very strong 2011, with a total return exceeding 30%. It has a very well-positioned footprint in the Marcellus Shale. It continues to have very rapid growth, providing midstream assets and services. We also believe it will be very well positioned to take advantage of emerging demand for services in the Utica Shale. We expect MarkWest will be able to invest hundreds of millions of dollars in the Utica and Marcellus Shales each year over the next several years. With that kind of visibility and potential for tremendous distribution growth, we are looking at returns averaging at least in the mid-teens for the next several years, with strong balance sheets and strong distribution coverage. Most portfolios ought to have exposure to MarkWest Energy Partners, in our view.

TER: And, you recently raised your price target to $66.

JE: Yes, as a result of its decision to buy into a joint venture with the Energy & Minerals Group for $1.8 billion (B). The two will be forming a subsequent joint venture to take advantage of the Utica Shale. We expect an announcement in January about additional plans to serve producers in the Utica Shale play.

TER: In a recent description of your investment thesis for the next few months, you included “exposure on liquids and storage” among the attributes you are looking for. Which midsize names in the liquids camp do you favor?

JE: One of the names we believe has very strong potential over the next year is Enbridge Energy Partners, L.P. (EEP/EEQ:NYSE). The partnership itself is based in Houston, but the parent is up in Calgary.

TER: What sort of distribution growth is Enbridge targeting in 2012?

JE: Enbridge’s target is in the 2–5% range, a very conservative target. We believe that given its position, recent performance and opportunities, Enbridge is more likely to be in the 5% range, giving the units some upside potential from a valuation perspective.

TER: Canadian regulators recently approved Enbridge’s Bakken pipeline project to carry oil from the Bakken into Canada, where it would connect with Enbridge’s main line in Manitoba. Is that a significant catalyst?

JE: That is just one project among many. Enbridge has $1–1.2B in projects on the drawing board over the next year. We believe all of those will contribute to Enbridge’s longer-range growth prospects.

We also like Plains All American Pipeline, L.P. (PAA:NYSE) over the next year. It has had a very strong run recently, but we think it is well positioned for the long term.

TER: Plains All American is a large-cap MLP. It made a number of acquisitions last year, including buying BP’s Canadian NGL and liquefied petroleum gas businesses. Which of Plains’ acquisitions are you most excited about?

JE: The one that you just mentioned. We think Plains was able to acquire the BP assets at a very attractive multiple and that it will be immediately accretive. Because the guidance on that contribution was very conservative, the distribution growth rate was raised recently. We anticipate it will be in the 9% range next year. Now a large part of that has been captured recently in its valuation. But, given the conservatism embedded in the guidance, we see a potential for more upside.

TER: You have an outperform rating on LINN Energy LLC (LINE:NASDAQ). Why do you believe Linn will outperform the S&P 500 in 2012?

JE: We think Linn has good distribution growth prospects. We also think it is pretty attractive valuation-wise. We are looking at somewhere in the neighborhood of 6–8% growth and distribution over the next couple of years. You combine that with its ability to make accretive acquisitions and its robust development program, and we think Linn should continue to do well with a roughly 18–20% total return prospect over the next 12 months.

TER: Do you have any parting thoughts for us today?

JE: We continue to be bullish on MLPs for the next several years at least. And we think MLPs should have a place in almost every investor’s overall portfolio.

TER: John, thank you for your time and your insights.

John D. Edwards, CFA, joined Morgan Keegan in October 2006 as a vice president, covering energy infrastructure master limited partnerships. Prior to joining Morgan Keegan, Edwards was a managing partner of Vektor Investment Group, LLC, where he consulted on energy infrastructure projects and real estate development. Edwards also worked with Deutsche Bank Securities as a vice president and senior analyst covering natural gas pipelines and as an associate analyst covering automotive suppliers. Edwards began his career in the energy industry with Edison International where he worked in regulatory finance, M&A, project finance, and business development. He received his Bachelor of Arts from Occidental College in Los Angeles, California and a Masters in Business Administration from California State University, Fullerton, and he holds the Chartered Financial Analyst designation. He is also a member of the Financial Analysts Society of Houston, Texas.

Want to read more exclusive Energy Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Exclusive Interviews page.

“Gold continues to hold above 1600, thereby frustrating the gold shorts while encouraging the gold bulls. Of course the trouble in and around Iran is bullish for gold. Gold always rises in time of war or in time of possible war. Wars are extremely expensive to wage, and they are usually inflationary as shortages appear in all areas. Also, gold is extremely important if one wants to cross a border and land in a safer spot.

When dictators take over a country they confiscate gold, guns, and the media. Citizens use guns to defend themselves, they use the media to tell them what is going on, and they use gold to cross the border as they escape.” – Richard Russell – Dow Theory Letters (always interesting daily commentary for $300, Russell has been bullish Gold since 2001).

Ed Note: Russell, who is to say the least still really not keen on stocks/economy, did point out a small budding head and shoulders pattern in GLD with it closing above the 200 day moving average…which “may mean that gold has carved out a bottom.“

….An article with some great charts – Gold’s a prime buy below its 200-day Moving Average

…Interesting Note from Mark Leibovit on Platinum