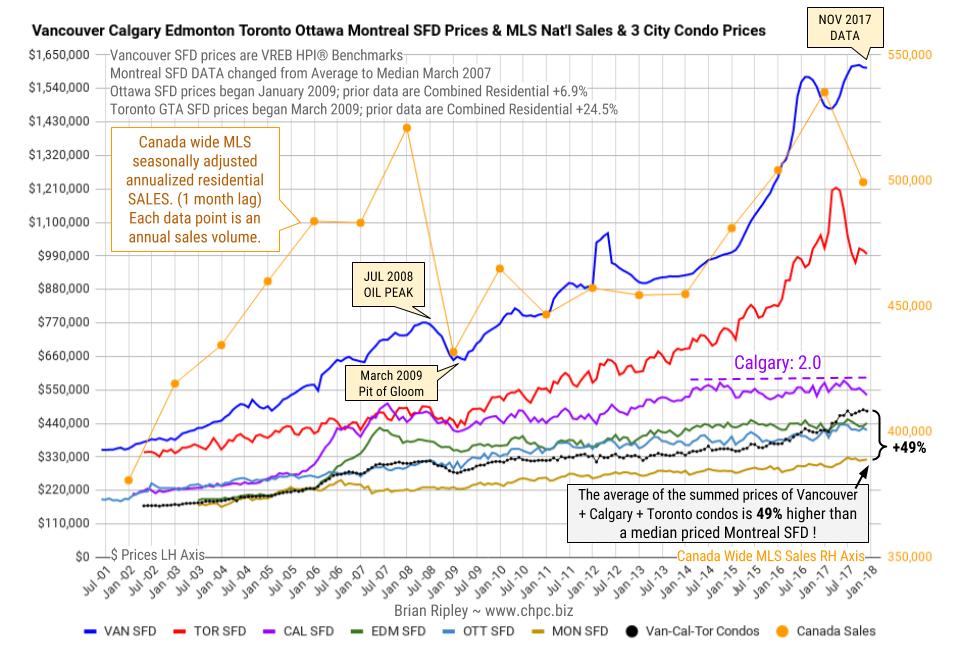

Click chart for Larger Version

In December 2017 Toronto metro SFD prices, 8 months since the March 2017 spike and peak price, continued slipping and to date have lost $207,895 or 18%. Vancouver prices are still defying gravity; FOMO and speculative pricing is still on.

Anyone owning a detached house in the scorching hot Vancouver market is sitting on an unredeemed lottery ticket with time running out as buyers hibernate into the seasonal decline. The Bank of Canada interest rate up-moves is thinning the crowd even more.

It remains interesting to note that the combined average sum price of a Vancouver, Calgary & Toronto condo is currently 49% more expensive than a median priced Montreal SFD; last month it was 52% (no typo). It was 51% in APR 2017, 49% in FEB 2017 and 41% in July 2016 at the Vancouver peak. Montreal has more listing inventory available for sale than any of the other 5 biggest metros in Canada and the lowest monthly absorption rate based on total listings and sales.

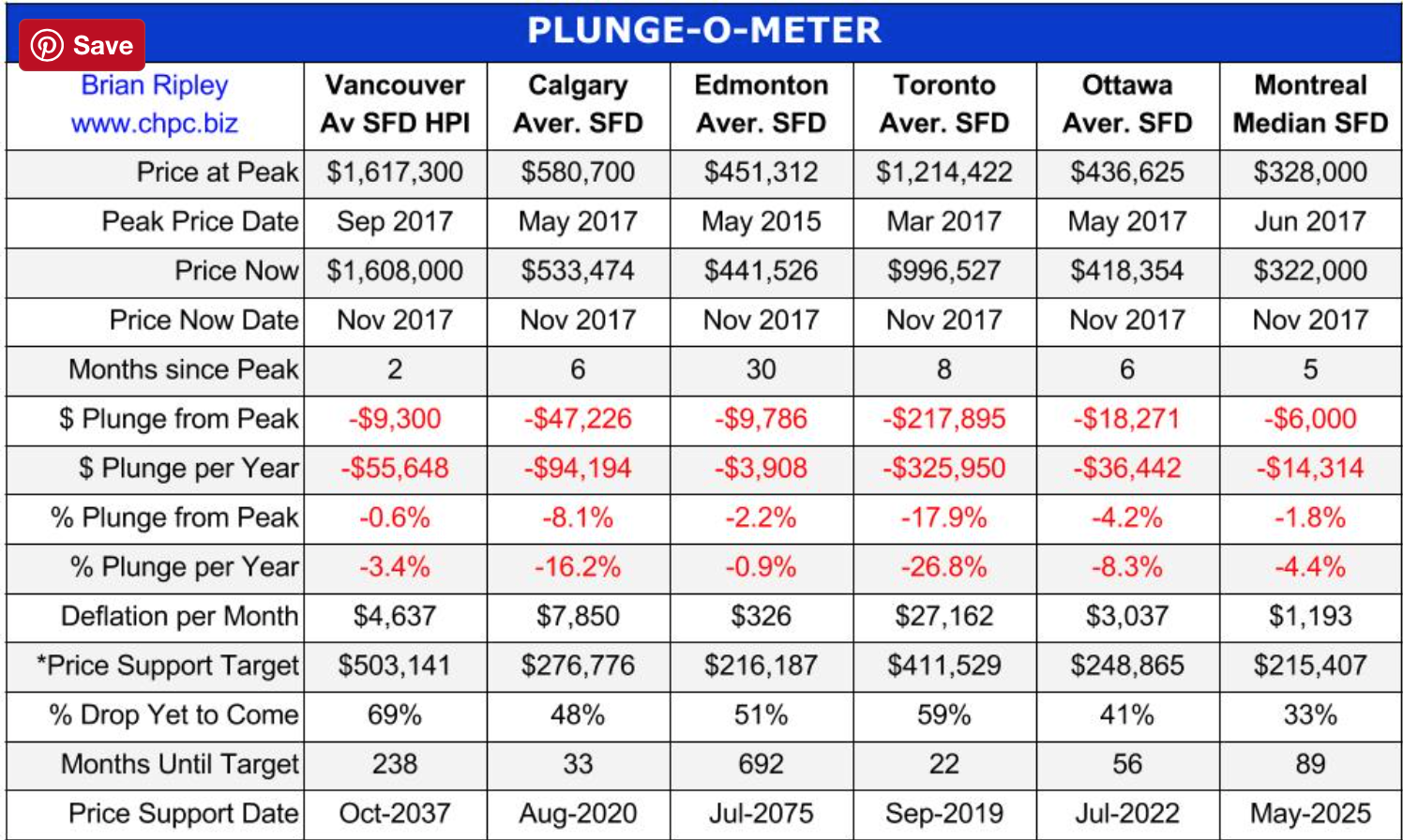

In case you have forgotten the depth and velocity of the previous market reversal when Canadian real estate prices plunged in 2007-2008 (chart); householder equity vanished as follows:

- ’07-’08 Average Vancouver SFD lost $122,900, or 15.9% in 8 months (2%/mo drop)

- ’07-’08 Average Calgary SFD lost $92,499, or 18.3% in 18 months (1%/mo drop)

- ’07-’08 Average Edmonton SFD lost $78,719, or 18.5% in 21 months (0.9%/mo drop)

- ’07-’08 Average Toronto SFD lost $63,867, or 13% in 13 months (1%/mo drop)

- ’07-’08 Average Ottawa Residence lost $25,664, or 8.6% in 6 months (1.4%/mo drop)

- ’07-’08 Median Montreal SFD lost $6,000, down 2.6% in 6 months (0.4%/mo drop)