Gold equities and related exchange traded funds listed on the TMX finally came alive on Friday after gold bullion prices rose sharply on news that China’s second quarter GDP recorded a healthy 7.6 per cent annual growth rate. Gold advanced to US$1,587.10 per ounce and briefly broke above its 20 and 50 day moving averages.

Seasonal influences for gold and gold stocks are starting slightly earlier than usual this year as they did last year. Thackray’s 2012 Investor’s Guide notes that the period of seasonal strength for the gold equity sector is from July 27th to September 25th. The equity sector trade has been profitable in 17 of the past 25 periods including 11 of the past 14 periods. Average gain per period for the past 25 periods was 7.2 per cent.

On the charts, the S&P/TSX Global Gold Index at 289.06 has a negative, but improving technical profile. The Index bottomed in mid-May at 265.59, rose strongly to 340.71 in early June followed by a recent test of its low. The Index remains below its 20, 50 and 200 day moving averages. Short term momentum indicators are deeply oversold and showing early signs of bottoming. Strength relative to the TSX Composite Index has been positive since mid-May. A move above 340.71 completes a modified reverse head and shoulders pattern. Preferred strategy is to accumulate gold equities and related ETFs at current or lower prices between now and July 27th for a seasonal trade lasting until the end of September.

Canadian investors can choose between five ETFs when interested in entering the sector. Each ETF has unique characteristics;

The most actively traded gold equity ETF in Canada is iShares on the S&P/TSX Global Gold Index Fund (XGD $18.01) The fund tracks the performance of 59 precious metal stocks that make up the S&P/TSX Global Gold Index. The Index is capitalization- weighted. Largest holding are Barrick Gold, Goldcorp, Newmont Mining, Kinross Gold, Anglogold Ashanti and Agnico Eagle. Management expense ratio is 0.55 percent.

Horizons offers the BetaPro S&P/TSX Global Gold Bull + ETF (HGU $7.08) and the BetaPro S&P Global Gold Bear + ETF (HGD $12.59). Both are leveraged ETFs that track the S&P/TSX Global Gold Index. The Bull ETF is designed to generate twice the daily upside performance of the Index. The Bear ETF is designed to generate twice the daily downside performance of the Index. Management expense ratio is 1.15 percent.

Horizons also offers the AlphaPro Enhanced Income Gold Producers ETF (HEP $5.88). The ETF tracks the performance of a portfolio holding 15 equally weighted senior global gold and silver producers. At or near the money listed call options are written against security positions. Option premiums and dividends earned by the fund are distributed to unit holders on a monthly basis. The strategy is enhanced by high implied volatilities on the call options of senior gold producer stocks. Management Expense Ratio is 0.65 percent.

Bank of Montreal offers the BMO Junior Gold Index ETF (ZJG$13.28). The ETF tracks a diversified portfolio of 35 junior gold stocks that make up the Dow Jones North American Select Junior Gold Index. The Index is capitalization weighted. Largest holdings are Allied Nevada Gold, Coeur D’Alene Mines, Alamos Gold, AuRico Gold and Nova Gold Resources. Management Expense Ratio is 0.55 percent).

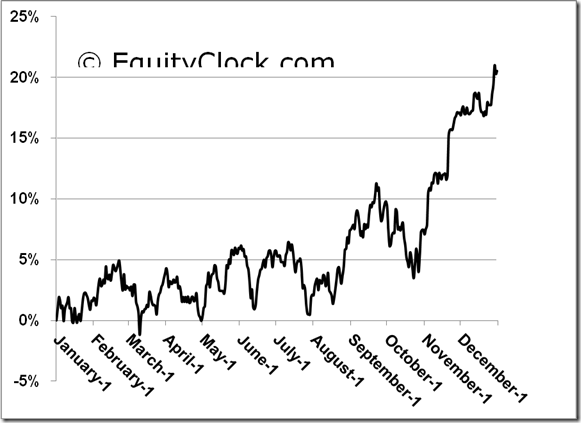

Below: The Nine year seasonality chart on the S&P/TSX Global Gold Index

Don Vialoux is the author of free daily reports on equity markets, sectors, commodities and Exchange Traded Funds. He is also a research analyst at Horizons Investment Management, offering research on Horizons Seasonal Rotation ETF (HAC-T). All of the views expressed herein are his personal views although they may be reflected in positions or transactions in the various client portfolios managed by Horizons Investment. Horizons Investment is the investment manager for the Horizons family of ETFs. Daily reports are available at http://www.timingthemarket.ca/ & http://www.equityclock.com/