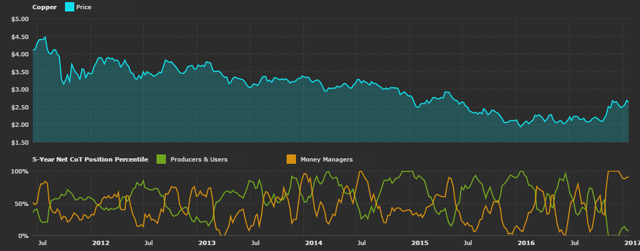

– Commodities: Money managers are extremely long copper and WTI crude futures. Commodity producers are actively hedging future cotton and natural gas production at current prices.

– Currencies: Everybody’s long the U.S. Dollar relative to other foreign currencies.

– Stocks: Surprisingly, hedge funds have shorted a ton of S&P futures over the past two weeks. Net positioning levels are still quite optimistic though.

This is the 43rd weekly update that outlines how traders are positioned and how that positioning has recently changed. I break down the updates by asset class, so let’s get started.

Commodities

Money managers are extremely bullish on copper (NYSEARCA:JJC).

…..to view all assett classes & larger charts go HERE

…also: