Special Guest: Mark O’Byrne feels that holding a Degree in Greek and Roman Civilization with a focus on their economic and monetary history, gives O’Byrne insights into the cyclical nature of societies that few other writers have. It is these insights that Mark shares in this 42 minute video. Bank Bail-Ins are only a modern day indicator of financially collapsing societies. “Unfortunately, we don’t learn the lessons of history to our own downfall!”

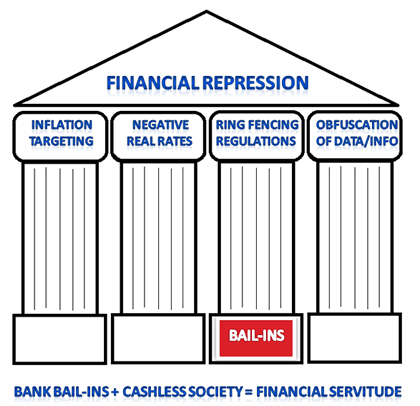

Financial Repression

“Given the large amount of debt in the world today we are seeing almost ‘anti-free market philosophies’ whereby the governments don’t like price signals and the pricing mechanism, so they are trying to repress this to repress interest rates.”

“Given the large amount of debt in the world today we are seeing almost ‘anti-free market philosophies’ whereby the governments don’t like price signals and the pricing mechanism, so they are trying to repress this to repress interest rates.”

“By artificially suppressing the pricing mechanism, similar to forcing an inflated beach ball under the water, it will shoot up in another direction and can go in the opposite direction to what is initially intended!”

Bank Bail-Ins

“We are told Bail-Ins are to protect the taxpayer from the government having to bail-out the banks. But the depositors are the tax payers? Bail-Ins are just to protect the Senior Secured Debt holders!”

This is wrongful deception as people belief their money is safe in the bank It is intended to protect the assets of the Senior Secured Creditors within the banks capital structure. Private individuals and depositors are not holders of Senior Secured Credit to the banks which is strictly the relm of select international banks

Confiscating Depositor Funds Means Deflation

“If you confiscate depositors funds (in a Bail-In) you will cause deflation like you would not believe!”

If you follow Mark O’Byrne’s analysis you quickly realize that Bail-Ins are both economically very dangerous and basically nothing more than regulations to protect elements of the bank financial structure. The question may be: are regulations today to protect tax payers from the banks or to protect the banks from taxpayers (depositors)?

“Maybe today we need to come to the obvious realization that the government is no longer regulating the banks, but rather the banks are regulating the government!” Gordon T Long

International Diversification is The Answer – While the Doors are Still Partially Open

….and much, much more in this fact filled 43 minute Video.

Mark O’Byrne, Founder & Research Director, Goldcore. Mark O’Byrne founded GoldCore more than 10 years ago and today it has clients in over 45 countries. Mark contributes to media internationally and takes part in the Reuters, CNBC and Bloomberg gold and precious metal surveys.

Mark O’Byrne, Founder & Research Director, Goldcore. Mark O’Byrne founded GoldCore more than 10 years ago and today it has clients in over 45 countries. Mark contributes to media internationally and takes part in the Reuters, CNBC and Bloomberg gold and precious metal surveys.