BY CHRIS CIOVACCO

As we mentioned Tuesday, the reaction to Wednesday’s Fed statement is important to the market’s intermediate-term direction. However, Apple’s (AAPL) strong earnings have provided investors with a reason to step up to the buyer’s plate. From Bloomberg:

Apple Inc. (AAPL) profit almost doubled last quarter, reflecting robust demand for the iPhone in China and purchases of a new version of the iPad, allaying the growth concerns that sliced shares 12 percent in two weeks.

Since Europe continues to be the possible “fun sponge” for the bullish party, and Germany tends to pay the uncomfortable European clean-up tabs, the German DAX Index has served as a good proxy for the tolerance for risk assets. Germany has had a strong start to trading on Wednesday. Later in this article, we review the longer-term technical backdrop for the German stock market.

Picking market tops and bottoms is difficult at best. It is better to think in terms of a probabilistic bottom or top. One way to help discern if it is probable for a market to move higher is to look at long-, intermediate-, and short-term trendlines on both an absolute and relative basis.

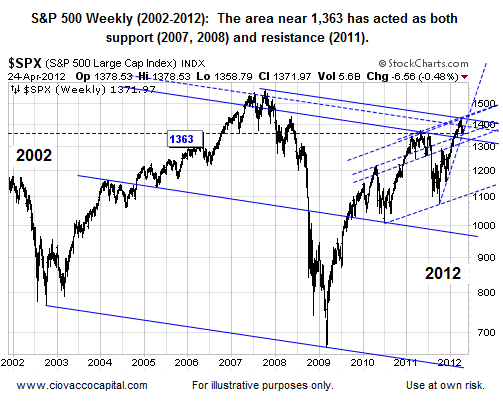

When reviewing the charts below ask yourself, “Does this market seem to be at a logical point where a reversal could take place?” If the answer is “yes”, then we become more open to a possible buying opportunity. A few weeks ago we identified 1,363 as a possible point of inflection for stocks. The S&P 500 has been testing 1,363 for two weeks. On April 10, the S&P 500 closed at 1,358, which thus far has represented the lowest close during the current pullback. While we want to see some real conviction from buyers, the chart below seems to have a reasonable probability of producing a reversal to the upside.

To Read More CLICK HERE