Cometh the hour, cometh the man.

Cometh the hour, cometh the man.

Or the woman…

The White House is casting about for a new Fed chairman. Three candidates have their mouths open, hoping to snag the hook: Janet Yellen, Larry Summers and Don Kohn.

Herewith, we propose an alternative… in just a moment.

First, we note that the Dow got a nice boost yesterday. It rose 128 points to a new nominal high. Gold sold off a little. As near as we can tell, stocks are still going up along with Fed additions to the monetary base (which keep long-term Treasury yields artificially low).

In other words, the Fed is blowing another bubble. With a Dow of nearly 16,000 in a $16 trillion economy, the math is tantalizing. The Fed inflates the money supply by $85 billion a month. If all of this inflation were exactly mirrored in the stock market, we should see the Dow go up 85 points… which is about what we’re seeing… or more!

A year ago, the Dow was only 13,000. Now it is over 15,000. There seems to be a multiplier effect at work; dollar for dollar, the Dow has gained capitalization about twice as fast as the monetary base.

The Diplomat

But let us return to the hour… and to the man.

The hour is the time when Ben Bernanke must shuffle off to some post where he will do less damage. The man is the person (man or woman) who will take his place in the padded chair.

As to Yellen, Summers and Kohn, we would reject them all. Clearly, none has any idea what is coming his way or he wouldn’t want the job. But this is a minority opinion. So let’s keep an open mind and examine each of these fish separately.

Janet Yellen has three things going for her. According to Alan Blinder’s recent piece in The Wall Street Journal, she (1) is a woman, 2) is a good diplomat and (3) has been around the Fed since 1990 and nothing bad has happened.

We offer a trio of replies. (1) There are roughly 120 million adult women in the US; womanhood is not a qualification for the job. (2) Diplomacy is irrelevant. (3) Having been around since 1990 is a disqualifier. Yellen was at the Fed as US total debt rose from about 230% of GDP to over 350%. If she had had her wits about her, she would have realized that the Fed was enabling a huge credit bubble that would one day burst. Yellen should be passed over.

The Insider

This third argument also disqualifies Don Kohn, a Fed insider for the last 40 years. The Washington Post describes Kohn as “the consummate Fed veteran” and Alan Greenspan’s “right-hand man.”

Well, that pretty much eliminates him. When Alan Greenspan took over as Fed chairman, the US had a statutory debt limit of $2.8 trillion. Today, there is $16.8 trillion of US government debt – much of it accumulated during the 19 years while Alan Greenspan was in the chairman’s seat, with Don Kohn on his right side.

When Greenspan took his post at the Fed a total of about $250 billion of US debt was in foreign hands; today it is $5.6 trillion. Greenspan, with Kohn as his sidekick, blew up the debt that later blew up the US economy.

Then, after Greenspan left the Fed in 2006, Kohn kept at it. From The Washington Post: “He was Bernanke’s No. 2 during the financial crisis.” As his oft-repeated public comments make clear, Greenspan had no idea what was going on. Evidently, neither did Kohn.

The Washington Post also says he has “credentials as a crisis manager.” But the Fed reacted to the crisis like a crowd in a nightclub fire: It panicked.

Instead of allowing a credit crisis to smoke out the weakest debtors, it rushed in to save them all – offering them all more debt on better terms. Bankers who had made the biggest errors were left unpunished. Instead, they were rewarded with lower, Fed-guaranteed borrowing rates.

“You boys got yourself into a little trouble,” said the Fed cop on the beat. “But here’s a new Corvette… and a bottle of Jim Beam. Go have a good time.”

The Genius

As to Larry Summers, what can we say that isn’t already public record? That he blew up Harvard’s endowment is well documented. That he is “brilliant” is also beyond dispute. But that is the problem. Even Summers believes it.

“Brilliance” is defined in a description of Summers that also appears in The Washington Post:

You can bring him up to speed on anything in 15 minutes. And if you can be interesting enough to keep his attention for half an hour, he will start throwing out hypotheses and what-ifs and suggesting connections you would never have thought of.

The brilliant man has a brain that spots “connections.” These lead to “hypotheses” – visions of the future as it might be. As he becomes more brilliant, even God himself is dazzled. But in contrast to the deity, Summers is at an existential disadvantage: He has no idea what will happen next.

The wise man has an advantage over the brilliant man. Socrates himself pointed it out. Brilliant men think they know something. Socrates knew his limitations. He knew he know nothing.

Larry Summers is no Socrates…

More to come… including our surprising nomination for the top post at the Fed!

Regards,

![]()

Bill

Market Insight:

Turning Japanese?

From the desk of Chris Hunter

Whoever the next Fed chairman is, he will have his work cut out for him.

Second-quarter US GDP growth came in at just 1.7%. Stall speed, in other words. The only reason this is considered an improvement over the first quarter is that first-quarter growth was revised down to 1.1% from 1.8%.

The Fed is doing its best to compensate for the slowdown through the voodoo of monetary policy. But over the last five years, the US economy grew just 0.7%. That’s less than the 0.8% expansion Japan’s economy saw during its deflationary lost decades.

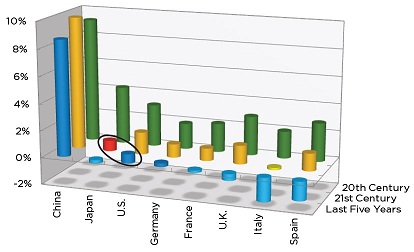

Take a look at this chart, which uses data from the Economic Cycles Research Institute.

You’re looking at average yearly GDP growth for China, Japan, the US, Germany, France, Britain, Italy and Spain over three distinct periods – from 1Q 1980 to 1Q 2001 (green bars on chart), 1Q 2001 to 1Q 2013 (yellow) and 1Q 2008 to 1Q 2013 (blue). For Japan, the ECRI divided the periods to 2Q 1992, the lost decades (red) and the last five years.

As you can see, average 20th-century growth for the six major developed economies was significantly higher than in the first 13 years of the 21st century. And bar Italy and Spain, it as also significantly higher then it has been over the last five years (when central banks around the world were “stimulating” in unison).

Most disturbing is the obvious parallel between growth during Japan’s lost decades (circled red bar) and growth in the US (circled blue bar) in the last five years.

Over the last five years, the US grew just 0.7% – less than the 0.8% expansion Japan’s economy saw during its deflationary lost decades.

A bet on stocks now is largely a bet that central banks can overcome this structural slowdown with monetary intervention. But there is no evidence, so far, that the Fed has any influence over the real economy.

The track record over the past five years is proof of that…