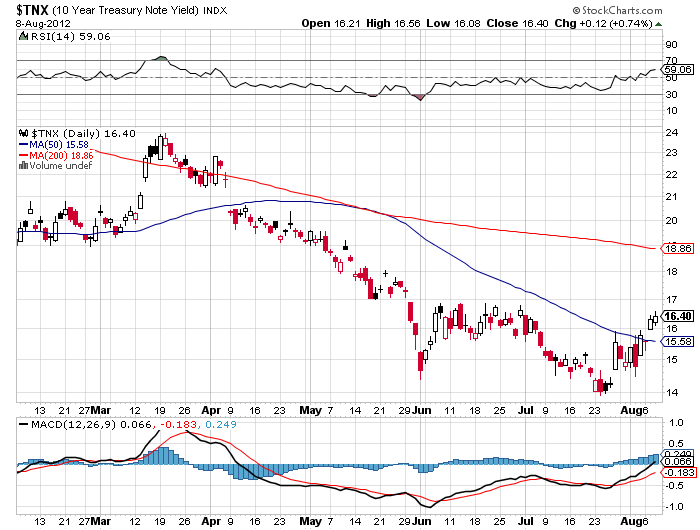

Once again, here’s the yield on the bellwether ten year T-note. And darned if it didn’t gap up yesterday — it gapped clear out and above its 50-day MA. Is the market telling us that the bond boom is over? Has the bond bubble burst, and are interest rates heading UP? Quick, refinance your mortgage.

Wait, don’t laugh away this little gap up in the ten-year T-note. Up until recently, US Treasury debt has represented the world’s ultra-safest haven, the safest place on the planet to store your money. So could this little rally in the yield of the 10-year T-note mean that the world no longer believes US Treasuries are the number one safest place to store money?

Remember, last year S&P lowered the US’s credit rating from AAA to AA+, the first time in history that the rating on the sovereign debt of the US has been lowered. Now, we’re moving ever-closer to the “fiscal cliff” — when taxes will be raised and spending will be cut, thereby almost guaranteeing a severe recession. Will the politicians in Washington let it happen? Well, stranger things have occurred.

On June 8th, S&P issued its latest warning. There’s a one in three chance the S&P will cut the US’s rating again by 2014. Let me put it this way — S&P does not like the way things are shaping up. Time is growing short. And the yield on the 10-year T-note is rising. And that’s not just talk, it’s the market issuing an early warning.

Letters are published and mailed every three weeks. We offer a TRIAL (two consecutive up-to-date issues) for $1.00 (same price that was originally charged in 1958). Trials, please one time only. Mail your $1.00 check to: Dow Theory Letters, PO Box 1759, La Jolla, CA 92038 (annual cost of a subscription is $300, tax deductible if ordered through your business).

IMPORTANT: As an added plus for subscribers, the latest Primary Trend Index (PTI) figure for the day will be posted on our web site — posting will take place a few hours after the close of the market. Also included will be Russell’s comments and observations on the day’s action along with critical market data. Each subscriber will be issued a private user name and password for entrance to the members area of the website.

Investors Intelligence is the organization that monitors almost ALL market letters and then releases their widely-followed “percentage of bullish or bearish advisory services.” This is what Investors Intelligence says about Richard Russell’s Dow Theory Letters: “Richard Russell is by far the most interesting writer of all the services we get.” Feb. 19, 1999.

Below are two of the most widely read articles published by Dow Theory Letters over the past 40 years. Request for these pieces have been received from dozens of organizations. Click on the titles to read the articles.