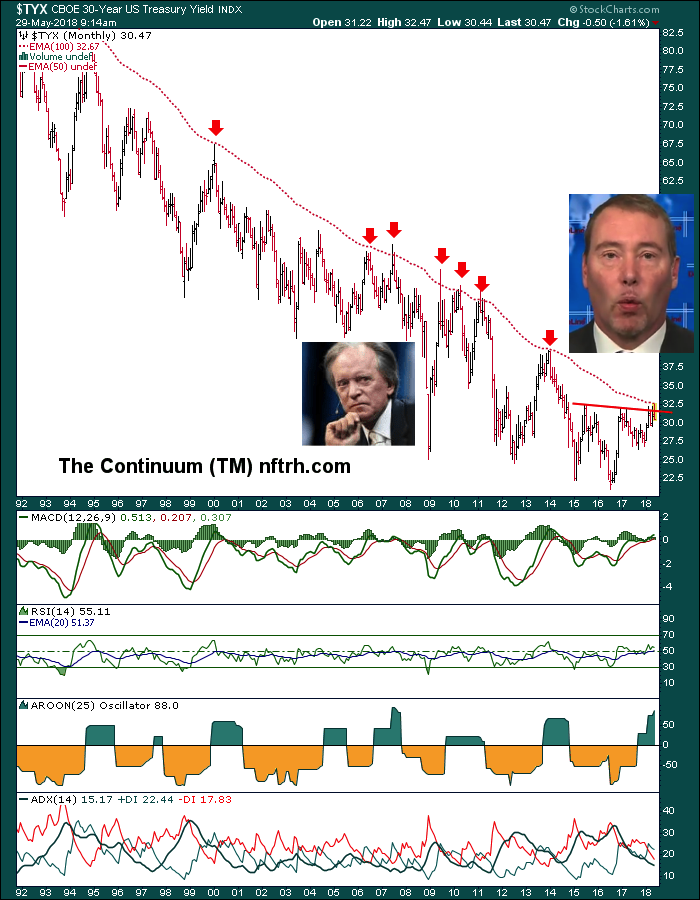

After nailing the recent peak in rising yields, Gary Tanashian takes a look at where we are likely going intermediate term from here – R Zurrer for Money Talks

It was just a little over a week ago (May 20) that NFTRH 500 presented a case for caution on the rising bond yields tout that was vigorously in play across the financial media. Here is an excerpt from the Bond Market Sentiment segment presented at the time.

From this public post:

I want to make clear that I am not trying to predict anything. I am simply trying not to have people (myself included) running like stupid lemmings (do lemmings run, waddle or put themselves in motion in some other way?) over a media-obscured cliff.

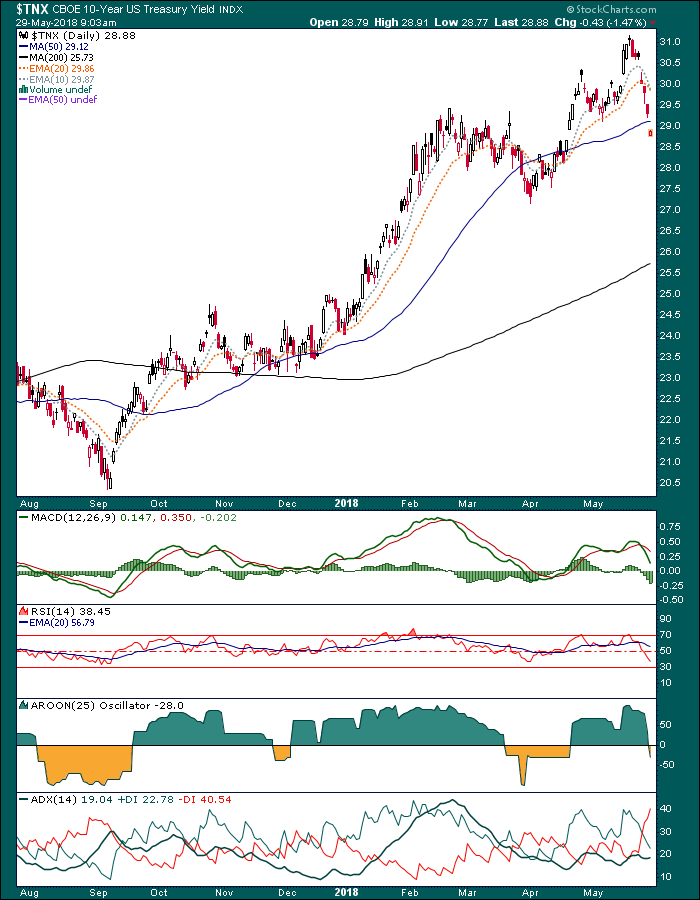

So today here we are, with the 10 year yield having dropped from the cacophony-inducing 3.1% level and I wish to announce that I am not making fun of the bond gurus anymore because the froth has been skimmed off and the intermediate trend in yields is bullish, not bearish.

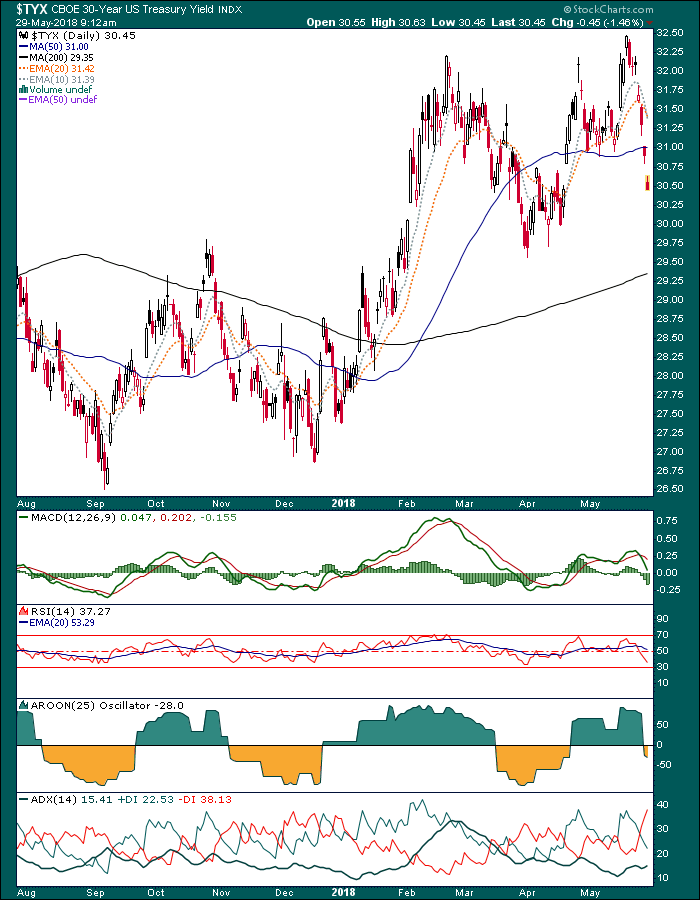

The 30 year is even more soundly corrected.

also from Gary:

GOLD, US STOCKS AND BONDS