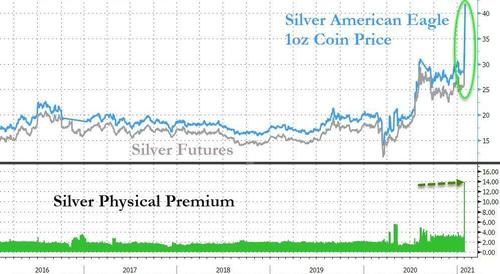

So John (and Jack2343 and Jane1928273) went long, and silver went up, and physical silver split from paper – because if you are going to nail yourself to a cross of precious metal then do it properly, right?

At least it made a change from the social media meme of Fry from Futurama holding out (paper) money and saying: “Shut up and tell me which stocks to buy to punish rich people.” And did we achieve a global reflation as a result?

Ironically, Bloomberg crows that, yes, reflation trades are indeed back on, with the US Treasuries 5s-30s spread widening out to 143bp on Monday, the widest since 2016. All I can say is that those buying that particular market trend are like Fry from Futurama holding out (newly printed central-bank paper) money and saying: “Shut up and tell me which commodities to buy to punish poor people.”

What we see all round us is global billionaire after billionaire getting more billionaire-y, and their pet projects to match: overnight Hollywood genius, galactic explorer – how long until one decides to turn the moon into cheese? Hedge funds would buy it; and if it were shorted by them then Redditors would, so cheesy moons are surely a win-win. Or how about just wiring up a monkey brain to play video games? But rather than gargling such central-bank bong water, let’s recall markets are allegedly trading for The Great Reflation, and not The Great Gatsby, because we are going to see joined up fiscal and monetary policy.

Now this would be a real game-changer. Really. Except it isn’t happening.