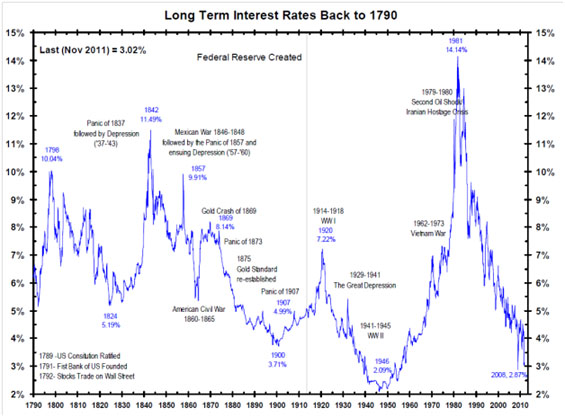

Danielle addresses the challenge posed by generational low interest rates and dividend yields, especially to retirees. The chart shows that in the past 220 years interest rates have been lower than the current 2.87% only once, in 1946.

TGR: In your book, Juggling Dynamite: An insider’s wisdom about money management, markets, and wealth that lasts, you advise against a buy-and-hold strategy. How can individual investors pick the right time to buy and sell stocks in a volatile market?

Danielle Park: When I talk about avoiding buy-and-hold, I mean being aware of this secular bear phase. We are in year 12 of a 15 to 20 year cycle. During secular bears you get recessions every three or four years, during which stocks tend to lose about 45% of their value. It is not a good reward for the risk to hold a stock on such a wild rollercoaster; even if it is paying you some dividends, the emotional and financial costs to your capital are just too extreme.

Today, I tell people: first of all, pay off your debt. Second, downsize your non-productive assets like personal use real estate. Third, figure out how to increase your income through your ingenuity and effort. Once you have a pile of savings you have a couple of choices.

You could decide to stay out of equity markets completely and put your money in short-term deposits. Even though they pay very little, they keep your capital intact to fight another day. This is a very reasonable approach and, frankly, is the one most people should take.

Another approach is to pare off a portion of your capital and trade with that. You might take 20% of your assets out of guaranteed deposits and hire a money manager or see if you can trade day-to-day swings. This is extremely hard to do with success, but if you can define the portion of your life savings you are willing to risk and maintain that discipline, it may be a reasonable idea to try with a controlled portion of your money.

The disastrous approach in my view, which many people are doing today is to give 50%, 60% or 70% of their life savings to brokers and financial planners to plop it into equities without paying any attention to the secular climate or to whether we are approaching the next recession or to where market prices are. They plop it in with reckless disregard, and within short order a huge chunk of capital could vaporize.

If that is the approach offered, then I say you are better off avoiding stocks altogether and sticking with interest-bearing, short-term deposits. Keep your capital safe and wait until conditions improve in the next few years.

TGR: Danielle, you recently wrote in EQ Trend Watch about the challenge posed by generational low interest rates and dividend yields, especially to retirees, illustrated with a chart showing that in the past 220 years interest rates have been lower than the current 2.87% only once, in 1946. When might that shift?

DP: That interest chart shows definite secular swings. Rates trend higher for 25 to 30 years and then lower for about the same time period. We are about zero-bound now, so we ought to be heading into a rising rate environment again.

TGR: Will global problems like the European debt crisis prolong low interest rates or cause inflation to rear back?

DP: We have a pretty complex little puzzle right now. I believe a global recession is coming in the next 12 months or is already underway. The U.S. was the only country in the developed world with any positive momentum in Q411. Even that was the result of trillions of dollars of deficit spending and debt. Going into 2012, the headwinds are mounting.

Most European countries are in recession. The austerity measures the International Money Fund and the EU are insisting on for Greece, Portugal and Ireland are a self-fulfilling prophecy of deep recession. China recently cut its reserve ratios for its banking system out of concern about a drop-off in shipments and demand from its best customers.

The other side of the coin is what happens when countries become so indebted that their bond yields suddenly begin to spike because of credit concerns. That is when central banks ultimately lose control of the bond market. We have the likelihood of policy rates remaining extremely low—Ben Bernanke says until 2014. The U.S. recently added another $1.6 trillion to its debt; the amount of money owed is mind boggling. For 20 years, Japan pushed rates to zero and tried to control interest expense because its economy was so indebted. However, despite or really because of its efforts the economic malaise continued and Japan is back in recession today.

Worse, today we have a world of Japans; there is nowhere to look for better yields. When all countries are going through a similar dynamic with credit agencies downgrading in concert, you have to wonder how the bond market will force rates higher when there are relatively few options to go to. Recently, global money has shown a strong appetite for the U.S. dollar and the U.S. bond market as a safe haven. But, at some point—and probably sooner than many people think—even that will become a credit risk.

TGR: Will anemic interest rates, fear of debt and inflation and currency problems continue to support rising commodity prices, particularly gold?

DP: Yes and no. Oil has been trading above $105 per barrel on fears about Iran. When oil appreciates dramatically, that puts a huge tax on an already weak consumption base; we have seen that in lower U.S. gasoline consumption for example. So yes, the geopolitical scenario may continue to feed a fear premium on sectors like energy.

However, in the liquidity crunches of 2001–02 and again in 2008–09, we saw levered players in equities and the commodity space sell across the board because cash became the desperate elixir that everybody wanted to meet margin and redemption calls. The selling becomes a self-fulfilling circle. When that happens, it hits everything, including gold. As a result, I think the price of commodities could fall off again and much harder than many people today are thinking possible.

TGR: You paint a pretty dark picture. Based on historic bear periods, how much downside do we have to go before we get into another bull cycle?

DP: We have had six secular bear phases in the last couple of centuries, each lasting 15 to 20 years, followed by a secular bull phase of similar duration. The secular bear market starts with massive overvaluation, anemic dividend yields, over-levered consumers and weak savings rates. We have to work our way through that. Debt gets paid down or written off. Consumers build up their savings. They learn to live on less. They become more resilient. At the end of the period, they are in better shape than at the beginning. This sets up the next secular boom phase.

From all the sign posts on this process, we are not through the bear phase yet. The price/earnings ratio on equities in general is still well above 20. That is not the valuation levels from which secular bulls are born. Dividend yields are below 3%. At the start of a secular bull phase, they are more likely to be double that. Saving rates need to be above 10%. They are now around 4% in the U.S. and Canada. We will not get into a period of greater economic strength until debt levels fall and savings are built back up.

I think the most important thing individuals can do is be self-protective, realistic and patient, because all of this comes full circle. We are now working our way through the healing process. We have probably another five years or so to get debt levels paid down and savings levels built up.

People do not have to be decimated by this. They need to realize this is not a time to embrace a lot of risk. It is not the time to retire on a couple hundred thousand bucks or even a couple million bucks. Be pragmatic and protect what you have. Keep working to augment your income. If you have too much non-income producing real estate or are over-levered, figure out how to pay it down. If you do this, you will have liquid assets, capital, savings and the ability to buy things when the opportunities arrive.

TGR: When the market comes back will certain sectors or subsectors improve faster than others?

DP: As an asset class, I call equities jelly beans. Do I like red jelly beans more than purple jelly beans or more than yellow jelly beans? They are all similar. My preference would be to earn income, first of all. You would like to have dividend-paying instruments and small caps tend to produce very little income. But price is also very important. If you buy something today for a 3% dividend and it drops 20% to 30% in value, it will not feel like you got a good deal or made a prudent move. What you want to do is let the price risk come out of the asset. Lower prices mean lower risk to capital. When dividend yields are twice what they are now, you can allocate some capital to jelly beans of all the colors you want. But, basically all of the jelly beans move together. When capital flow leaves the market, it leaves everything. When capital flow returns, it goes back into everything.

Central bankers are trying to stop asset values from declining. The status quo keeps trying to pump prices up and keep them at unattractive valuations. There is a push-and-pull going on. Eventually gravity wins. Central banks will not prevail, asset prices will continue to move lower and that will be a very healthy thing.

TGR: Can investors take some of the risk out by being active investors and being smart about what they invest in?

DP: Sure. There are lots of ways to be smart. I am a trained financial analyst and in the ’90s I spent a lot of time studying management, pouring over balance sheets and income statements. I came to the conclusion that it was a complete and utter waste of time.

I may decide a company is excellent and the management is wonderful. I think it is worth $20/share, but it is trading at $40/share. You have to decide: Will you buy it anyway or will you be disciplined about the price you are willing to pay? Very few people have the discipline to stick to a set of rules.

We follow a regimented set of rules that takes into account many factors, that looks for opportunities. We have successfully executed that discipline over many years, but it is not easy. Ours is not a day trading system, but a longer trend approach that selects sectors and indices rather than individual companies.

I describe it as a person holding a piece of paper right up to the end of her nose, trying to read what is on the paper. If she held the paper at arm’s length, it is much easier to read and understand the bigger picture. The minutiae rarely help you navigate the broader picture of capital market cycles.

Investing in a local business owner is different. You can see what he is doing. His company is not traded in the public auction of stock markets. If you want to invest in the triplex up the street, you can fix it up, monitor it and rent it. Individuals can be well-equipped to make those kinds of assessments. Publicly traded assets are a whole other kettle of fish.

TGR: If someone has a good, trained money manager, is it worth it to take advantage of some of these opportunities?

DP: Well, of course. I happen to be a money manager, so I hope people think it is still worthwhile to hire some of us. People need to ask themselves two questions. The first is how much capital should I apportion to that approach? The second is what were my money manager’s returns in 2001 and 2008 when the markets lost half its value?

Too many people ask, what was your return last year? What will you get for me? In a rising market, everything gets capital flow. You do not need much skill to allocate capital in a rising market. It does take skill to protect capital in a falling market. If a manager lost in step with down markets, it tells you his strategy is not worth the fee. That manager is simply riding flows up and letting your capital fall along with everything else. In a secular bear environment you will be one of the masses, devastated and trying to liquidate at the last moment. You will not have the psychological strength you need to maintain liquidity and to know what you want to buy when prices sell off. Only a handful of money managers exercise the discipline to protect your capital in this kind of environment and can participate in the upside where it presents.

TGR: Will you share your strategies for the down years?

DP: Sure. We actually have achieved positive returns throughout, but it has not been easy. Our investors have had to be content with years where they made 1% or 2% in order to be prepared for downturns in years like 2008, when we made more than 8%.

Mainstream economists, commentators and politicians never see recessions coming even though they are regular features of a secular bear market. They occur every three or four years and they are catastrophic for capital. Rather than focusing on being there for all the gyrations to the upside, it is far more important to be as protected as possible from the downside.

The only way to survive is to have your own set of rules that work for you, or to have an independent manager who does not work for the sell side. You want an absolute return manager who says, I don’t want to lose money in any particular year, so our benchmark is to always advance the capital, even if the advance is small in a given year. The whole focus is on not losing, because once you lose, it sets you back years.

TGR: What was the role of gold and gold equities in your strategy during the down years?

DP: I think it is a mistake to think of gold as a separate asset class that is impervious to the panic swings in the market. When things sell off in concert, these assets sell off, too. Gold has been in a secular bull run for a long while, and it may go higher. But secular bulls always come to an end. When you are 12 years into a secular run, you have to at least be thinking about the possibility of it coming to a peak like we did in 1980.

My second caveat is this nonsensical idea that gold is the only thing that cannot be manipulated. Anyone who has studied the history of gold could not make that comment with a straight face. Humans have always found ways to lie about how much gold is in reserve whether it be in bank vaults, Fort Knox or in the ground at a particular mine. The incidents of fraud and manipulation around gold are legendary. If you don’t realize that, you are in grave danger.

TGR: Your talk at the World MoneyShow in Vancouver on March 28 is called “The Best Way to Make and Protect Gains That Most Financial Advisors Will Never Tell You.” Can you give our readers a sneak preview?

DP: I start out with some big picture stuff. For example, the best way to make money in the stock market is not to be a buyer in the stock market but to be a seller to the stock market. Take an enterprise you built and sell it in an initial public offering (IPO) that creates billions of dollars for the original investors. But, the investment public should be extremely cautious and skeptical about IPOs because those instruments are always brought in at the peak of a valuation. After it is marketed to the investment public, it is common for those shares to lose 30%, 40%, 50% in short order.

Another example is the importance of knowing your sell point before you buy anything. Very few people do this. They see the stock market as an endless mountain. They think, if I start climbing today, 5, 10 or 15 years from now I will be higher than I am today. Not in a secular bear market. The secular bear market is range bound. You will climb up, then come back and retest, four or five times before that period ends.

I am not dispensing conventional wisdom. Yet, in the 20 or so years I have been managing risk for myself and others, these are the things I have learned that are most important to long-term success. I try to pull back that piece of paper stuck to the end of everyone’s nose and say, hey look, this is the big picture.

TGR: Any last thoughts for our readers?

DP: Good luck and I wish them well. And remember, it is not dark to be a realist and be a pragmatist. I believe it is the best way to survive and thrive through all market conditions..

TGR: Thank you so much for your time and your insights.

Portfolio manager, attorney, finance author and a regular guest on North American media, Danielle Parkis the author of the best selling myth-busting book Juggling Dynamite: An insider’s wisdom on money management, markets and wealth that lasts, as well as a popular daily financial blog Juggling Dynamite.Park worked as an attorney until 1997 when she was recruited to work for an international securities firm. Becoming a Chartered Financial Analyst (CFA), she now helps to manage millions for some of North America’s wealthiest families as a portfolio manager and analyst at the independent investment counsel firm she co-founded, Venable Park Investment Counsel Inc. In recent years Park has been writing, speaking and educating industry professionals as well as investors on the risks and realities of investment behaviors. She is a member of the internationally recognized CFA Institute, Toronto Society of Financial Analysts and the Law Society of Upper Canada.

Want to read more exclusive Gold Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Exclusive Interviews page.

DISCLOSURE: