(Marc Faber suggests preserving your wealth with 25% of your portfolio in this basket of high yielding (5%), high-quality stocks) –

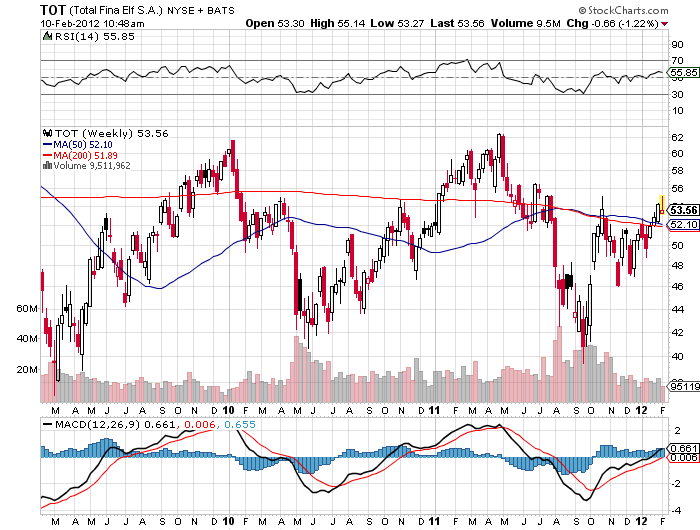

There is a huge amount of underground lending throughout Asia. Mr. Bernanke can drop his dollar bills on the U.S., but the growth in dollars here can lead to strong economic growth and inflation in other countries. That has happened in the past few years. I am the most bearish person you can imagine on earth, which is why I recommend putting, say, 25% of your money in equities, 25% in precious metals, 25% in cash and bonds and 25% in real estate. These assets won’t go up substantially this year, but they could preserve your wealth. People say large-capitalization stocks are inexpensive, and I agree. I would buy a basket of high-quality big-caps in Europe and the U.S. You can by Total [TOT], in France, which yields more than 5%,

and Nestlé [NESN.Switzerland]

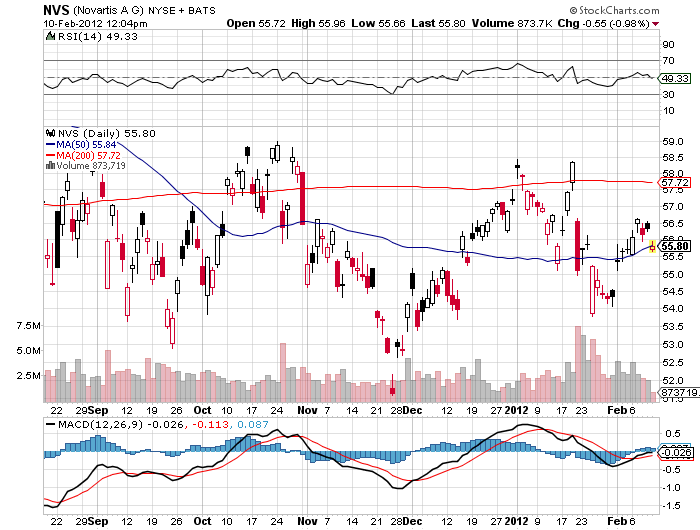

and Novartis [NVS]

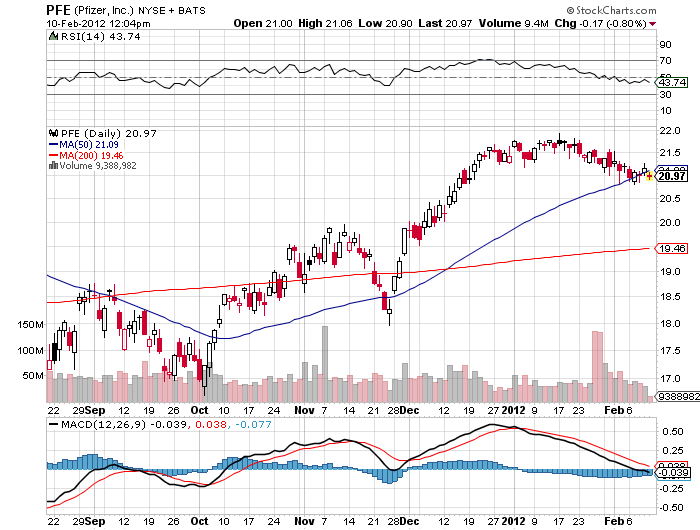

and Pfizer [PFE].

These stocks don’t have huge downside risk.

Because emerging markets saw big declines last year, you could also buy SATS [SATS.Singapore], in Singapore, which provides catering services to the airline industry and ports. It yields 5% and trades for 13 times earnings. I also like K-REIT Asia Management [KREIT.Singapore], a real-estate investment trust that yields 7%. The stock has fallen by about 50% and the dividend might be cut. But even if it is cut to 4%, this is an OK investment. These stocks won’t go up right away, but reinvesting dividends will yield an adequate return over time. StarHub [STH.Singapore], the mobile-phone company, yields 6.9% and the P/E is 14.

Read more articles at Marc Faber’s Financial Doom Blog HERE