The end is in sight for “fire sale” mortgage rates as Banks begin to push their rates up. In the meantime BC’s & Toronto’s unaffordable mania now leaves only one rational market left in play, where the last 4 years prices have been sideways and winding up for an eventual advance – R. Zurrer for Money Talks

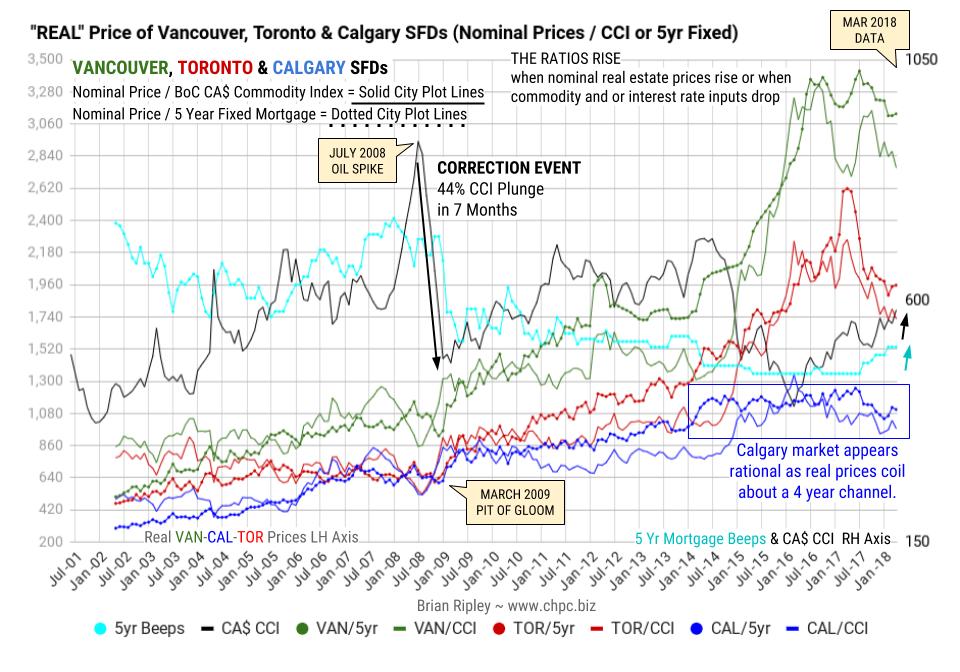

The chart above shows the “real price” of Vancouver, Toronto & Calgary SFDs when looked at from the point of view of the BoC Canadian Commodity Index (CCI) and Borrowing Costs (retail 5yr Mortgage) which are the main input costs apart from operating expenses and tax.

REAL PRICE of HOUSING of Vancouver, Toronto and Calgary Single Family Detached and the Bank of Canada $CAD Commodity Index & 5 Year Fixed Mortgage

In March 2018 commodity prices are still rising and have added to the recent mortgage rate rise in keeping real prices on a downtrend. In Calgary, although prices look rational, the pending seasonal slowdown in the energy sector should limit the nominal purchasing power of weak hands in Alberta but will lift real prices as the cost of energy drops.

There should be no more surprise BoC rate cuts if the federal government mandate plan is to use their fiscal powers, but as we know, the government can surprise us at any time, eg: the new Mortgage Stress Test, the CMHC credit tightening and offloading of risk onto the retail lenders; the threat of new chilling tax and CRA penalties and of course policy flip flops by the federal government like its reversal on electoral reform.

The last 9 years of ZIRP & NIRP monetary policy combined with CMHC’s out-of-control insurance scheme (also add in the BC Gov’t Sub Prime Cash give-away) has been a terrible social experiment in the service of political power and it has replaced affordable housing with indentured mania. Is there a better way?

In a commodity crash, producers lose pricing power as international competitors drop finished prices neutralizing any gains for Canadian exporters from a withering CAD/USD while the +/- 70% of Canadian employees working in the consumer and service sectors look for ways to leverage their deflating earnings at the supermarket and or job fair.

The other major cost input, the retail 5 year fixed mortgage rate (aqua dotted plot line) and last July it moved up off its outstanding record low of 4.64% to 4.84%. This month the Bank of Canada rate remains at 5.14% although street vendors are still pushing sub 3% short term mortgages while the stress test weeds out the weak hands.

The end is in site for fire sale mortgage rates as the major banks push their rates up which forces the real cost of housing (dotted city plot lines) relative to those rates to turn down.

Calgarians are wary of the Trumpster who vows to unleash energy supply 2.0. And when credit is a lifestyle employer as it continues to be in Canada, appraisers will eventually be in demand again.