Is it time to lock in your variable mortgage?

The Bank of Canada has recently raised rates a few times and experts are saying that they expect another 2 rate hikes by the end of the year. This affects you if you have a Variable Rate Mortgage or a Line of Credit (aka HELOC). You can thank the increasing strength of the global economy for that.

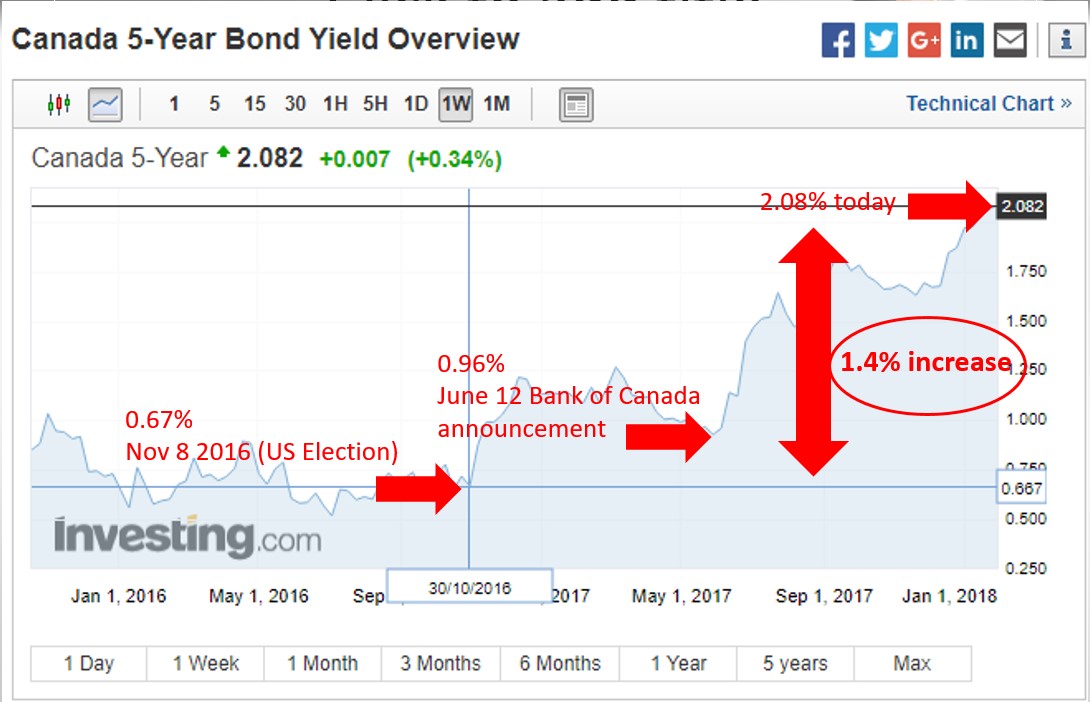

Bond yields, from which the fixed rate mortgages in Canada are derived, have been climbing significantly over the past 14 months.

So the question is, “should I lock in my variable rate”?

Due to many variables, this is a difficult question to answer immediately answer, everyone’s own personal situation is unique. There is no one size fits all…

Well, there are 3 main considerations:

- Your current variable interest rate,

- Your future goals and housing/mortgage plans, and

- Your potential new fixed rate (this is a big one).

If your variable rate has increased to 3% and over, you may want to think about locking in. We suggest you talk to your bank about what they would offer you to lock in, and convey those rates to our team to see if it makes sense to lock in with your existing bank or transfer the mortgage to another lender.

If your mortgage fits a certain qualification box (called insurable), vary attractive rates that are about .4% lower than the banks are available. It may make sense to break your mortgage with your bank and transfer to another lender if the difference in rates is large enough to offset the penalty to move the mortgage. To be qualified for the best rates right now, an insurable mortgage must follow the following criteria:

– Mortgage funded before Oct 2016

– Owner occupied or if a rental, must be 2+ (legal) units

– No refinances allowed, but you can transfer your mortgage as long as you are not adding any more money to your mortgage

Current insurable 5 year fixed rates are around 3.19%. Uninsurable rates are around 3.59%.

However, variable rates may be preferable over the fixed because the variable rate has the lowest prepayment penalties. Variable rate prepayment penalties are below 1% of the mortgage, where fixed rates at big banks can be 4%+ of the outstanding mortgage. Insurable 5 year variable rates are as low as Prime -.95% (2.5%)

If you have a Line of Credit (aka HELOC) and are not using it to its potential or have a balance sitting on it, you should call me to discuss if that is what is best for you. The rates on a HELOC are higher than a mortgage and it may make sense to lock that in.

Call ASAP for more details and don’t miss this window of opportunity!