Agriculture has been depressed for many years but I’m still extremely optimistic about agriculture, more so than many sectors of the world economy” “Successful crisis investing boils down to one skill. The ability to go against the crowd to buy beaten-down assets that have been left for dead.” – Jim Rogers

Winning the Hunger Games: Tom Wallace on How to Choose Successful Agriculture Investments

Starting with the premise that people have to eat, The Agletter Editor Tom Wallace has found productive fields in the many subsectors of the ag investment space. Wallace also names three favorite companies that span the spectrum, from planting the seed to foodstuff. Without discounting the risks, he explains to The Energy Report how investors can recognize and hedge those risks.

The Energy Report: Is investing in agriculture like investing in any other commodity, or do investors new to the space need to get familiar with special considerations?

Tom Wallace: Agricultural investment is composed of a multitude of subsectors, so when it comes to making an investment decision, investors need to focus their efforts. Agricultural investment encompasses everything from a sheep and beef farm in New Zealand to a phosphate mine in Brazil. We’re talking about very different operations that come under the same banner of agriculture, but some cross into other sectors. Obviously, fertilizer is directly related to agriculture, but a phosphate mine, for example, is part of the mining sector as well. You have those considerations to take into account.

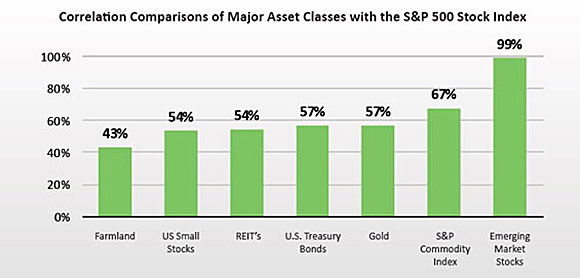

The fundamentals that support growth in agricultural commodities are different from those of other commodities for a number of reasons, the main one being that people have to eat. You don’t need gold bullion. It’s great to have some to protect yourself from the actions of central bankers, but you don’t need gold to live. Everybody needs agriculture, so agriculture tends not to correlate with other assets like stocks or bonds. Those considerations are important.

Source: The Agletter

TER: What risks are inherent in agriculture investing?

TW: After we first acknowledge that the two greatest risks to investors are 1) their own herdlike actions and 2) the actions of government, we have systemic risk. That incorporates wild cards like weather, and disasters like a plague. Given that the majority of the world’s agriculture is conducted by small farmers, these risks have far-reaching consequences.

We also have market risk, especially in emerging countries. We have the cyclical and seasonal price fluctuations of agricultural products, and government meddling with import and export restrictions. A current example of that would be the ludicrous sanctions that Western governments like Australia’s have imposed upon Russia.

We also have exchange controls and subsidies. A perfect example of the failure of subsidies would be the current water situation in California. Farmers have had access to essentially free water for quite some time, and as a result, they developed ridiculous habits of growing crops like almonds, which are extremely water-intensive, in a desert. Problems like that can be solved very quickly if the government gets out of the way and lets the market solve them.

You also have credit risk. Farmers and agricultural companies take on huge amounts of debt, but agricultural capital revolves fairly slowly. We’re talking about one or two crops a year. So a disaster or some sort of weather event can spell failure for farmers. In developing nations, land rights and boundaries can be a problem, especially when it comes to pledging collateral for a loan.

Finally, political risk is always inherent because government is essentially violence and coercion. People only need to go and ask a Zimbabwean farmer about political risk. It’s definitely something investors need to be mindful of.

TER: How do investors hedge these risks?

TW: The risks might make investing in agriculture sound like holding an Easter egg hunt in a minefield. But you can protect yourself relatively easily through diversification by location and by subsector. When it comes to agriculture, definitely don’t put all your eggs in one basket. If you’re buying farmland, for example, don’t just buy in one location. Do some research and find out where land is still reasonably priced, because many markets have experienced dramatic valuation increases in agricultural land in the recent past.

If you’re buying equities—a potash or a phosphate mine, for example—get to know the projects, the people, the financing, the location, the target market; everything you’d normally research when it comes to securities analysis. Find and follow the serially successful people within whatever agricultural subsector interests you. For me, that’s agro-mineral miners, so I follow people like Simon Ridgway, the founder of Focus Ventures Ltd. (FCV:TSX.V), and the guys from Sprott Global Resource Investments Ltd. (a wholly owned subsidiary of Sprott Inc. [SII:TSX]), like Rick Rule and Jason Stevens. It’s the easiest way not to lose money. That should be your No. 1 investment goal, closely followed by making money.

TER: Is there seasonal volatility or variability?

TW: There definitely is seasonal volatility and variability in many agricultural subsectors. If you’re directly exposed to agricultural commodities like corn or canola, this is especially pertinent. Agro-mineral miners, for example, can be affected if they operate within higher rainfall areas. Some mining operations in Latin America have to be suspended during the wet season because it gets too muddy.

TER: What commodities come under the heading of agricultural investment? Is it just crops?

TW: I can’t give you a complete answer, because there are so many components. But obviously there are crops and commodities futures for things like corn, soybeans, coffee, orange juice. You also have fertilizer, potash, calcium and magnesium. But I also throw water into the mix. Water is obviously a very important component of agriculture, but access to that component is somewhat limited for retail investors. Very few publicly listed companies operate purely in the water sector.

TER: What companies are particularly interesting to you right now?

“Input Capital Corp. generated $11M in streaming revenue during 2015; That’s a beautiful business model.“

TW: By far, my favorite company in the agricultural space is Focus Ventures. That is closely followed by Clean Seed Capital (CVE:CSX) and DuSolo Fertilizers Inc. (DSF:TSX.V). Focus Ventures and DuSolo operate in the phosphate space. Clean Seed Capital is an agricultural machinery manufacturer. Input Capital Corp. (INP:TSX.V) is high on my list of companies to examine. I have a favorable outlook on the company so far, but I still have to do a fair amount of due diligence before I’d give it any sort of rating.

TER: What competitive edges do these companies have?

TW: Let’s start with DuSolo Fertilizers, which is a beautiful logistics play. It has a high-margin phosphate mine, the Bomfim project, that’s within one of Brazil’s most productive agricultural regions. It is the only direct-application natural fertilizer (DANF) producer within 500 kilometers. It already has sales contracts in place for 81,100 tons of DANF, and that’s worth $8.5 million ($8.5M). It just submitted an application to increase its mining capacity from 100,000 tons per year (100 Ktpa) to 200 Ktpa. The beauty of being located so close to the farmers within Brazil’s agricultural region is that the company doesn’t incur the transportation costs that rival fertilizer companies do in terms of importing. DuSolo’s edge is its location and lack of local competitors.

TER: What near-term catalysts do you see for DuSolo?

TW: DuSolo is putting out an updated resource estimate later this year. I don’t think the market realizes what DuSolo is sitting on at Bomfim. It has identified significant resources past the initial resource estimate area. If the company comes out with a much larger estimate than what it currently has, that could propel DuSolo much higher. Also, if the company gets approval for an increase in its mining allocation permit so it can mine 200 Ktpa, that, along with additional sales contracts, will definitely get noticed.

TER: Is DuSolo’s management deeply invested in the company?

TW: Inside and institutional ownership is roughly 15%. Tembo Capital Mining Fund L.P. is a big holder as well. As with all the companies that I hold in The AgLetter, I like to see when management has put its own money on the line.

TER: What about Focus Ventures?

TW: Focus Ventures has several big things going for it. First, it was founded by Simon Ridgway, who is a serially successful mining entrepreneur. He is the founder of Fortuna Silver Mines Inc. (FSM:NYSE; FVI:TSX; FVI:BVL; F4S:FSE), and he’s already put a mine into production within Peru. He has country-related specific experience, and to go along with that experience, a level of institutional ownership and backing by firms like Sprott Global. Sprott has already done a significant amount of due diligence that investors can leverage upon.

“Very different operations come under the same banner of agriculture, but some cross into other sectors.”

Second, Focus has, potentially, a world-class deposit. It’s huge. It’s very close to The Mosaic Co.’s (MOS:NYSE) Bayóvar mine. The company has infrastructure in place to start exporting its product. It has a port only 30 minutes away, which is owned by its partner in the project. The phosphate in the mine is some of the best quality in the world: It’s known as Sechura rock. I won’t go into specifics, but if this stuff weren’t brown, it would be called gold because it achieves such good results with crops.

Focus is not only a people play, but also a project play. If you do an extremely conservative calculation on just the Indicated resources, that’s well over 100M tons of phosphate. The stuff has been selling within the region for between $100–200/ton. The company is trading at $0.22/share, so that’s definitely a no-brainer for me.

TER: Focus Ventures has been criticized for slow development of its Bayovar 12 project. Is that a valid complaint?

TW: Sure it is, but everybody wants things done instantly. The reality is that the natural resource world is a tortoise. Things take time. You have to pick your teams with a long-term viewing line. If they get everything done quickly, that’s a bonus and investors get some low-hanging fruit. But don’t count on things happening quickly when we’re in a commodity bear market.

TER: Are you anticipating a more rapid pace from Focus, or is this about what we should expect?

TW: I think once the preliminary economic assessment on Bayovar 12 comes out, we’ll start to see some movement. As I mentioned, Focus has an absolutely huge deposit, and only heaven knows where things go from here. The agro-mineral giants have openly said that they’re looking to acquire these sorts of projects, so we could see a buyout. Who knows? But $0.22 for a share in well over 100M tons of a commodity that is both irreplaceable and utterly essential to life on the planet, plus the backing of the most knowledgeable natural resource investors in the world? I’ll take that.

TER: What brings Clean Seed Capital to the top of your list?

TW: Clean Seed Capital has developed a revolutionary no-till seeding machine. It has put together and patented a machine that I think will have the same effect on the agricultural machinery market as the iPhone had on the cell phone market.

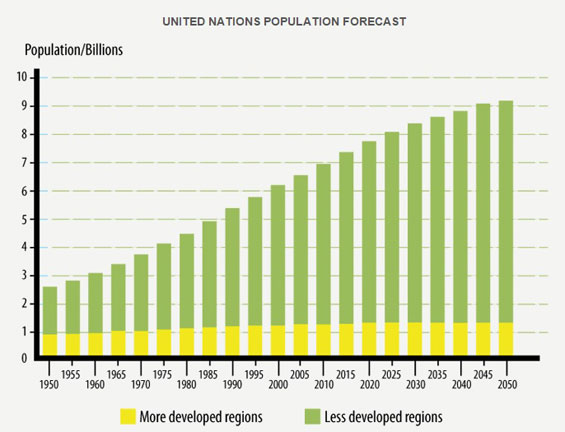

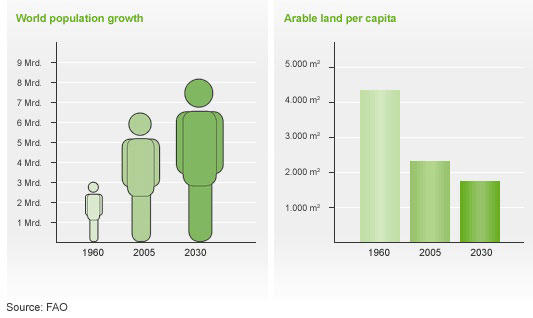

Current seeding machines are using technology that is 30 years old. The technology is way past its use-by date, and it’s not very precise. The CX6 SMART Seeder that Clean Seed has developed is essentially a laser printer. It sows seeds with amazing precision. It’s the way of the future, because as we lose more and more agricultural land, we have to make more efficient use of the land base that is left. I would encourage everybody to get on YouTube and have a look at the CX-6 seeder. It’s amazing technology.

The company is going into production with the CX-6, and has distribution and manufacturing agreements in place. It’s my personal opinion that Clean Seed Capital will be bought out by one of the giants or, at the bare minimum, some sort of royalty deal will be done. But at around $0.47/share, it’s money for jam [an easy way to make money].

TER: What draws you to Input Capital?

TW: Input has an excellent streaming model for its canola business. For investors who are unaware of how this works, Input Capital provides a farmer with an upfront cash payment in return for a share of the farmer’s crop production. The farmer can use this money to buy inputs like fertilizer during the off season and this can save him anywhere between 20–40% compared to purchasing in season. The farmer also gets access to an agronomist who helps him grow an excellent crop. The farm then delivers Input’s share of the crop and is paid a discounted contract price per tonne. If the crop yield has improved, Input can buy additional tonnes at the same contracted price, so both the farmer and the company benefit from an improved crop. Input then sells the crops at the market rate and can invest the proceeds into new streaming contracts.

“Everybody needs agriculture, so agriculture tends not to correlate with other assets like stocks or bonds.”

Input deployed $49.1M in capital during the 2015 financial year and now has 78 cash-producing streams in place, with 10 more being added in Q1 of the 2016 financial year. The company generated $11M in streaming revenue during 2015, which is a 258% increase over 2014. That’s a beautiful business model. In terms of the profit margin, Input Capital’s total costs per tonne of canola are around $310. It sells the stuff for around $500 a tonne. Not bad for a hard day’s work, is it? Input gets canola price upside, production upside, compounding cash returns and diversification without the need for heavy management.

TER: Canola prices have surged 17% since early May, but Input’s share price has remained in a fairly stable range. That would be a significant statistic in crude oil or gas. How important is it for Input?

TW: It should be significant for Input, but it shows how disconnected the market is at the moment when it comes to valuations. Less than a month ago, the company was trading at around $3/share, now it’s at $2.50/share. These are the buying opportunities that investors should be taking advantage of. When you go shopping, you look for quality clothing that is on sale so you get the most bang for your buck. Buying stocks is no different, and you’ll know you’re on the right investment track when you can identify these buying opportunities.

TER: What advice would you give new investors to the agricultural investing space?

TW: First, study the fundamentals that are driving the growth in the market. Once you’ve got a good understanding of the “why,” look for the “how.” The “how” is the agricultural subsector or subindustry that you want to focus on. Second, identify the people operating within that subsector who are serially successful and follow what they do. Finally, when you identify projects that these people are involved in, do your own due diligence, and if everything adds up, back these people.

Agricultural companies are like any other businesses—they’re only as good as the people that comprise them. The best deposit in the world can always be screwed up by an incompetent management team. You’ll only learn that investment lesson once, trust me. Learn to read a financial statement; that’s an absolute must. The difference between solvency and insolvency is about 15 seconds on SEDAR. Contact company management and ask to speak to the CEO. If you get through to the CEO, it’s a bonus, but even if you get stuck with the investor relations rep, pay specific attention to demeanor. Is the person enthusiastic about the company he or she works for? Does it feel like the person just wants to be left alone? People love talking about success, so if the company has nothing to say for itself, it’s probably best to move on to the next one.

TER: Tom, thank you very much.

Tom Wallace is the publisher and editor of The Agletter. He is a successful natural resources investor who specializes in the agricultural sphere. His research covers a plethora of agricultural subindustries ranging from agri-mineral miners to farm machinery producers. He has spent significant time in the Middle East, Australia and New Zealand, where he currently resides. Wallace is a passionate anarcho-capitalist and free market advocate. He publishes his research at www.agletter.com.