When no-name naysayers opine that the U.S. economy is headed into a tailspin, you can often take it with a grain of salt.

But when credible, well-established government agencies issue hard data denoting a big decline, it’s a different story: You’ve got to stand up and pay attention.

Consider, for example …

The U.S. Energy Information Administration (EIA), the primary government authority on energy stats and analysis. Unlike the Fed, it doesn’t make policy or even advocate policy. By law, no outside officer or employee of the government can interfere with what it concludes or says.

And right now, the EIA says that …

Just from August to September, U.S. crude oil production declined by 120,000 barrels per day …

Production will continue to fall sharply next year, leading to a mass reduction in spending on major oil projects. And, to add insult to injury …

U.S. crude oil supplies have just surged by 7.6 million barrels — over four times more than analysts expected.

Meanwhile, executives attending the Oil and Money conference in London warn that a “dramatic decline” in U.S. production is now under way.

Their reasons: world oil prices are now too low to support U.S. shale oil output, the biggest addition to world production over the last decade. And it’s not just because of declining oil prices; bank financing for shale projects has completely dried up.

OPEC agrees. The oil cartel sees U.S. production falling for the first time since 2008. The big problem is that, despite falling global demand, OPEC members are not cutting production like they might have in prior years. They’re too afraid to lose an even bigger share of the global oil market. So they continue to pump oil at a feverish pace.

Impact on global oil prices: No relief from record lows.

Impact on U.S. economy: Huge. The U.S. energy industry is the third-largest industry in the U.S. And that excludes thousands of companies and millions of jobs that feed off the industry indirectly.

The U.S. Department of Agriculture (USDA), unlike the EIA, is responsible for policy. But ever since Abraham Lincoln started the agency during the U.S. Civil War, millions of players in the commodity markets have relied on its forecasts.

The U.S. Department of Agriculture (USDA), unlike the EIA, is responsible for policy. But ever since Abraham Lincoln started the agency during the U.S. Civil War, millions of players in the commodity markets have relied on its forecasts.

And right now, U.S. agriculture is getting killed.

Take wheat, for example, one of the America’s largest field crops: According to the USDA’s Economic Research Service, U.S. wheat exports have plunged to their lowest level in guess how many years!

Not 10. Not 20. But 44!

That’s right. The last time our wheat exports were this bad was back in 1971.

The big problem: The United States is virtually priced out of the global wheat trade, with still more hits to U.S. exports on the way.

But this disaster is not limited to just one crop or even one industry. Indeed, the primary driver of the slump is a powerful force that cuts across all U.S. exports — the sharp rise in the U.S. dollar.

According to Bob Young, chief economist at the American Farm Bureau Federation, it’s the dollar’s 20% surge since July 2014 that’s mostly responsible for gutting U.S. farmers. (And, as I’ll illustrate in a moment, it’s also the same force that’s now killing U.S. corporate earnings.)

Meanwhile, foreign farmers and agribusinesses can jump in and sell their commodities at dramatic discounts, thanks to an unprecedented plunge in their local currencies.

Brazilians, for example — leading producers of soybeans, coffee and sugar — can greatly undercut U.S. farmers thanks to a 42% crash in the Brazilian real since last July. Russian farmers? They’re leveraging a currency collapse of 48%.

All “contained” to energy and commodities? No way! Anyone who buys that argument is in for a rude awakening, as I’ll show you next.

At the U.S. Department of Labor, the headline unemployment number is not quite as reliable as stats from the other government agencies I just told you about.

At the U.S. Department of Labor, the headline unemployment number is not quite as reliable as stats from the other government agencies I just told you about.

But when all their underlying data is terrible … when big companies are announcing layoffs … and when every other source paints the same dark picture, then you know the trouble is for real.

That’s the situation we have now: In the last couple of months, nervous U.S. employers — small, big and huge — have suddenly started to pull back sharply on their hiring.

A key reason: On top of the U.S. dollar being strong, foreign markets have plunged, foreign buyers have shunned U.S. goods, and U.S. manufacturers are getting stuck with big unsold inventories.

But if you think the latest job numbers were bad, brace yourself for what’s coming next. Giant U.S. companies like Caterpillar, Hershey, Wal-Mart, ConAgra Foods, Chesapeake Energy and others have already announced big layoffs, and these layoffs are not yet included in the Labor Department’s unemployment stats.

There was one bright spot in the September job numbers, though: Most retail companies continued hiring.

The problem: Now the retail sector is also starting to take a hit …

We know because of the latest release last week from the U.S. Department of Commerce.

We know because of the latest release last week from the U.S. Department of Commerce.

Now, if sheer size (not gross inefficiencies) were the criteria, this executive-branch agency would probably be the most impressive data source in the world.

But regardless of their problems, there’s little argument that U.S. retail sales are now getting hammered.

September sales were only half of what economists were expecting …

The gains previously reported for August were totally bogus — completely wiped out by revisions, and …

Only six out of 13 categories showed sales gains, a sign that the malaise is starting to spread throughout the economy.

The clincher to all this is corporate earnings: Despite a few notable exceptions here and there (like Citigroup last Thursday), one major company after another is releasing shockers that cast a shadow over the entire U.S. economy.

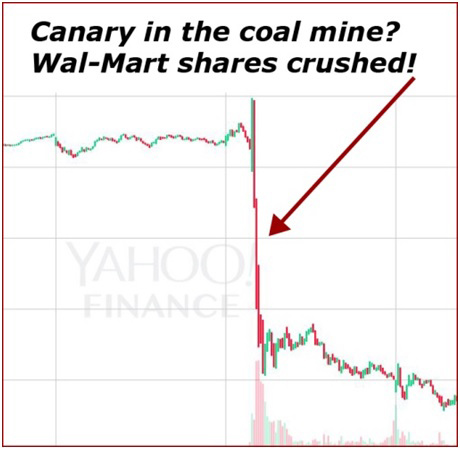

The prime example is retail supergiant Wal-Mart.

The prime example is retail supergiant Wal-Mart.

It’s the world’s largest retailer. It has nearly half of a trillion dollars in annual revenues. And it’s gotten crushed.

Last Wednesday, it announced its profits will miss forecasts by a country mile: Rather than rising 4% in the next fiscal year as analysts expected, they’re going to fall 12%.

Result: Wal-Mart shares suffered their biggest one-day crash in 17 years.

But they’re not alone. CNBC highlights how even industry sectors thought to be immune are now falling by the wayside — luxury goods (example — Burberry), health care (e.g. HCA), consumer discretionary (Garmin), and many more.

Look. Even assuming stock analysts have learned their lesson and are finally getting it right, S&P 500 profits are now forecast to drop at the fastest rate since the tail end of the Great Recession.

What does all this mean? I don’t think I have to connect the dots for you. It’s obviously not good for stock investors … unless you can do four things:

- Use stock market rallies — like the one we’ve seen in recent days — to help build a huge, oversized cash position.

- Wait patiently for most stock prices to take another big hit, whether now or later.

- Then, consider strictly extreme top-notch quality.

- And hedge your risk with investments that are designed to go up when stocks go down.

Good luck and God bless!

Martin