Recession Watch

Recession Watch

Earnings Recession

Is GDP Flatlining?

High-Yield – Rising Defaults

Reverse Deleveraging

Who Are These Reckless Borrowers?

Working Out of Debt

San Francisco, Portland, New York

“Growth is never by mere chance; it is the result of forces working together.”

– J.C. Penney

“Strength and growth come only through continuous effort and struggle.”

– Napoleon Hill

“We’re lost, but we’re making good time.”

– Yogi Berra, 1925-2015, RIP (For a most moving and memory-laden tribute to Yogi, see The Lefsetz Letter.)

The Yogi Berra quote above, which was brought to my attention this week, seems an apt description of where the markets and the economy are today. Nobody is quite sure where we are or where we’re going, but we all seem to think we’re going to get there soon.

I think it’s pretty much a given that we’re in for a cyclical bear market in the coming quarters. The question is, will it be 1998 or

2001/2007? Will the recovery look V-shaped, or will it drag out? Remember, there is always a recovery. But at the same time, there is always a recession out in front of us; and that fact of life is what makes for long and difficult recoveries, not to mention very deep bear markets.

The problem is that our most reliable indicator for a recession is no longer available to us. The Federal Reserve did a study, which has been replicated. They looked at 26 indicators with regard to their reliability in predicting a recession. There was only one that was accurate all the time, and that was an inverted yield curve of a particular length and depth. Interestingly, it worked almost a year in advance. The inverted yield curve indicator worked very well the last two recessions; but now, with the Federal Reserve holding interest rates at the zero bound, it is simply impossible to get a negative yield curve.

Understand, an inverted yield curve does not cause a recession. It is simply an indicator that an economy is under stress.

So now we are in an environment where we can look only at “predictive” indicators that are not 100% reliable. Actually, most are not even close. Some indicators have predicted seven out of the last four recessions. Some never trigger at all.

All that said, looking at data from the last few weeks suggests that we need to be on “recession watch.” Global GDP is clearly slowing down, and the data we are getting from the US suggests that we are going to see a serious falloff in GDP over the next few quarters. I want to look at the recent (very disappointing) employment numbers, earnings forecasts (and some funny accounting), credit spreads, total leverage in the system, and the overall environment where credit, which has been the fuel for growth, is under pressure. The totality of this data says that we have to be on alert for a recession, because a recession will mean a full-blown bear market (down at least 40%), rising unemployment, and (sadly) QE4.

The jobs report on Friday was just ugly. Private payrolls increased by just 118,000, which is about the minimum level needed for unemployment not to rise. Government payrolls added 24,000. There were serious downward revisions to the last two months, as well. August was taken down by 37,000 jobs, and July was reduced by 22,000. The last three months have averaged just 167,000 new jobs compared to 231,000 for the previous three months and 260,000 for the six months prior to that.

My friend David Rosenberg dug a little deeper into the numbers and noted:

Adding insult to injury and revealing an even softer underbelly to this report was the contraction in the workweek to 34.5 hours from 34.6 hours in August, which is effectively equivalent to an added 348,000 job losses.

So take the headline number, tack on the downward revisions and the loss of labour input from the decline in the workweek, and the “real” payroll number was [a minus] 265,000. You read that right.

He added: “Have no doubt that if the contours of the job market continue on this recent surprising downward path… [m]arket chatter of QE four by March 2016 is going to be making the rounds.”

While the unemployment rate remained at 5.1%, it did so largely because of a significant drop in the labor participation rate, which is not a good way to enhance employment. Further, the U-6 unemployment number is still a rather depressing 10%. Those are the people who are working part-time but would like full-time jobs, as well as discouraged and marginally attached workers. Very few part-time jobs pay enough to finance a middle-class lifestyle.

Leo Kolivakis of Pension Pulse has a downbeat earnings season preview, aptly titled “A Looming Catastrophe Ahead?”

Analysts have been steadily cutting 3Q earnings projections, and those revisions threaten to make some richly priced stocks even more so. Thomson Reuters data shows analysts expect a 3.9% year-over-year decline in S&P 500 earnings. Expectations are falling for future quarters as well.

These expectations have some strategists talking about an “earnings recession.” Just as an economic recession is two consecutive quarters of falling GDP, an earnings recession is two consecutive quarters of falling corporate profits.

The headwinds are no mystery. China’s weaker import demand is hurting all kinds of companies, especially raw materials and infrastructure suppliers. Caterpillar (CAT) slashed its revenue forecast and announced 10,000 job cuts. That probably isn’t playing well in Peoria. Accompanying the falloff in Chinese demand is an increase in the number of containers coming into the US as the strong dollar allows us to buy more and sell less. Not a particularly useful combination.

I love this quote from a Reuters story:

“How can we drive the market higher when all of these signals aren’t showing a lot of prosperity?” said Daniel Morgan, senior portfolio manager at Synovus Trust Company in Atlanta, Georgia, who cited earnings growth as one of the drivers of the market.

As we all know, it is every portfolio manager’s job to “drive the market higher.” Daniel evidently wants to do his part.

Sadly, despite our best efforts, the stock market faces an uphill climb. More from Reuters:

Even with the recent selloff, stocks are still expensive by some gauges. The S&P 500 Index is selling at roughly 16 times its expected earnings for the next 12 months, lower than this year’s peak of 17.8 but higher than the historic mean of about 15. The index would have to drop to about 1,800 to bring valuations back to the long-term range. The S&P 500 closed at 1,931.34 on Friday [Sept 25].

Moreover, forward and trailing price-to-earnings ratios for the S&P 500 are converging, another sign of collapsing growth expectations. The trailing P/E stands at about 16.5, Thomson Reuters data shows. Last year at this time, the forward P/E was also 16 but the trailing was 17.6.

The last period of convergence was in 2009 when earnings were declining following the financial crisis.

The Energy sector is the biggest drag on earnings, meaning that we now see analysts everywhere calculating estimates “ex-energy.” I suppose this produces useful information, but if we are going to exclude the bottom outlier, shouldn’t we exclude the top outlier as well? Healthcare is carrying much of the earnings burden for S&P 500 stocks, but I have yet to see an ex-healthcare or ex-energy & healthcare estimate.

A funny thing about earnings: they’ve been going up for the past year, even as top-line revenue has not. Generally, those go hand-in-hand. What’s happening?

And for the answer I have a story. A few years ago I made an assumption as to how a new stream of income would be taxed. I made that assumption based on my knowledge of having had similar income in the ’80s and ’90s. It turned out the rules had changed, and I hit the end of the year owing what was for me a rather large sum, as I was also trying to finance and build my new apartment.

I told my tale of woe to my accountant, Darrell Cain, who obviously detected the distress in my voice. He smiled at me and said, “John, I have an elephant bullet.” He reached under the table and pulled out an imaginary elephant bullet. “This is a big bullet. But I only have one of them. Once you use this bullet you can never use it again. If another elephant comes down the road, there will be nothing you can do.”

And yes, there were some one-time tax maneuvers that reduced my taxes to a manageable number. But as he said, those were a one-time option.

There is no way to prove it, but I think corporate accountants have been using up their elephant bullets this past year, as corporations want to be able to maintain the fiction that earnings are rising, so that price-to-earnings ratios don’t come under stress and cause stock prices to fall. You can move expenses from quarter to quarter, put off certain spending, recharacterize certain expenses one time, and so on. I deeply suspect we are going to find that some recent corporate earnings have been of the smoke and mirrors type.

Further, as I’ve written in previous letters, earnings forecasts are notoriously trend-following and typically miss the turns. If earnings are beginning to fall – and it appears they are – it is highly likely that earnings estimates will miss to the downside. If we slide into a recession at the same time, they will miss to the downside rather dramatically.

The Commerce Department will release its first estimate for 3Q US GDP on Thursday, Oct. 29. By then we will be in the thick of earnings season and will already know how many companies performed.

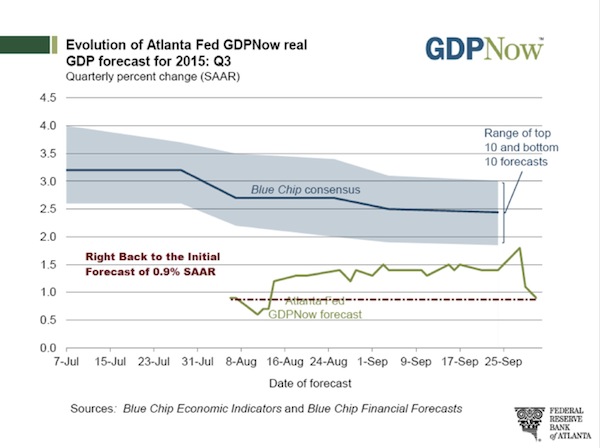

In the big picture, income (corporate or individual) can’t grow unless the economy grows. GDP may be a flawed way to measure economic growth, but it is the best tool we have. Blue-chip estimates right now are that it ran at near a 2.5% annualized growth rate last quarter. However, the Atlanta Fed has sharply revised their GDP estimate for the third quarter down to under 1%. (See chart below.)

Will economic growth come into harmony with income growth? We know they have to meet eventually. At present, it appears GDP will stay in slow-growth mode. That means it probably won’t be able to pull earnings up with it.

High-Yield – Rising Defaults

High-yield spreads have been tightening and interest rates have been rising for some time. This is starting to cause some distress in the high-yield (otherwise known as junk bond) market. My friend Steve Blumenthal has been following and timing the high-yield market for 20 years. He recently wrote the following, which I’m going to blatantly cut and paste as it clearly depicts the level of distress in the high-yield market. If credit becomes more difficult to get, then growth is going to come under stress as well. I note that corporations that I think of as issuing higher-quality debt are paying 10%. Thank you very much. Ten percent interest rates don’t seem to me to be very low.

Don’t take a lot of time to try and absorb the details of the following. What I want you to come away with is an impression of the distress that high-yield markets are facing. Quoting from Steve’s “On My Radar” blog:

Edward Altman, the New York University professor who developed the Z-Score method for predicting bankruptcies, says “Defaults will breach the historical high next year and the Fed is the ‘wild card’ that has the power to determine how quickly the current credit cycle ends.” (Bloomberg)

“We have blamed the wider Junk Bond spreads on Energy issuers, but last week there was a buyer’s strike. If this continues, you can say goodbye to easy financing for M&A, which will remove one large pillar of support from stock prices.” (361 Capital)

- Altice on Friday sold $4.8 billion of junk bonds to fund its $10 billion purchase of Cablevision Systems Corp., according to S&P Capital IQ LCD. When the deal was shopped earlier this month, Altice expected to sell $6.3 billion of debt, investors said. A 10-year bond was priced to yield 10.875%, compared with yields as low as 9.75% that were suggested by bankers initially, according to S&P Capital IQ.

- Olin on Friday sold $1.2 billion of bonds to pay for its pending acquisition of Dow Chemical Co.’s chlorine-products unit. Earlier in the month, Olin was expected to sell $1.5 billion of bonds, fund managers and analysts said. The annual interest rate on Olin’s 10-year bonds sold Friday was 10%, up from 7% expected earlier in the month, according to S&P Capital IQ.

- Companies have announced $3.2 trillion of M&A this year, according to Dealogic, emboldened to merge by cheap debt and the long stock rally that began after the financial crisis.

- That puts 2015 on pace to rival 2007 as the biggest year ever for takeovers. Issuance of junk bonds backing M&A deals hit a year-to-date record of $77 billion through Friday, according to data from Dealogic.

- A souring of investors on junk bonds could limit the availability of financing for deals that require a lot of borrowing. Banks have been under pressure from federal regulators to reduce their loans to such companies, and a pinch in the bond market could leave those deals struggling for financing. (WSJ)

- After investors snapped up more than $37.5 billion of bonds issued by junk-rated energy companies in the first six months of 2015, just $5.9 billion has been raised since then, according to data compiled by Bloomberg. (Bloomberg)

- Junk-bond investors are bracing for a surge in corporate defaults that would exceed the most pessimistic forecast from credit raters as the Federal Reserve contemplates its first interest-rate increase since 2006.

- A measure of distress in the market is suggesting investors have priced in a default rate of 4.8 percent during the next 12 months, according to Martin Fridson, a money manager at Lehmann Livian Fridson Advisors LLC.

- That’s almost two percentage points higher than the pace being projected for June next year by Standard & Poor’s, the world’s biggest credit rater, as concern mounts that energy companies that loaded up on cheap debt are going to struggle to refinance.

- “Unless there is a miraculous turnaround in oil prices there is likely to be a lot of defaults,” Fridson said. “The rating agencies’ approach isn’t capturing the fact that a large part of the economy is far out of step with the overall picture of the mark.” (Bloomberg)

- On HY fair valuation from Martin Fridson this week: Now that the sector has sold off sharply, it’s finally at fair value, finds Fridson, chief investment officer at Lehmann Livian Fridson Advisors. He uses a model that includes current economic and market conditions to judge valuations. (Barrons)

- Note that fair value can move to significantly undervalued as happened in 1991, 2002, and 2008. Recessions are a bear (no pun intended).

- The S&P US High-Yield Corporate Bond Index posted a yield to maturity of 7.51% on Tuesday, up from a recent low of 6.21% in late February. Morningstar data shows that the iShares iBoxx $ High Yield Corporate Bond ETF (HYG) has lost 3.6% in the past six months.

Longtime readers know that one of my core beliefs is that massive debt levels have thrust us into a fundamentally imbalanced world. I believe our next great crisis, whenever it comes, will result from too much of the wrong kind of debt.

Given what happened in 2008, you might think we would have collectively learned our lessons about debt. We have not. Like an alcoholic who wants to cure his affliction with another shot of whiskey, we seemingly have concluded that the way out of a debt crisis is to create more debt.

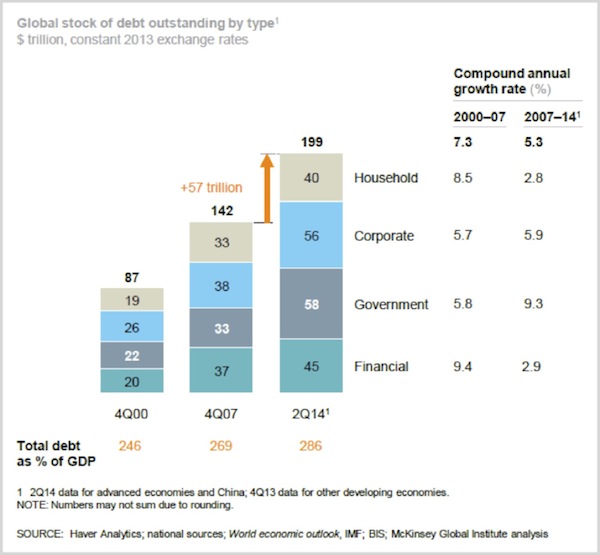

Does that sound insane? It is insane, but it’s also true. This chart explains:

At the end of 2007 the global stock of outstanding debt stood at $142 trillion. Then in 2008 the financial world fell apart. Everyone moaned and groaned about irresponsible lending to irresponsible borrowers. Never again, we said. I actually wrote that I expected to see the world deleverage. Boy, what an optimist.

Less than seven years later, in mid-2014, we had added an additional $57 trillion in global debt, and the data this year is going to show that we’ve hit another record high. All the talk about deleveraging was only talk. We didn’t deleverage; we re-leveraged and then some.

The chart above is from a February 2015 McKinsey Global Institute study called “Debt and (not much) deleveraging.” McKinsey is not an organization given to hyperbole, nor was it necessary in this case. Reality is bad enough.

Does economic growth justify higher worldwide debt levels? Not unless you think the world’s economy grew at a 5.3% annualized rate from 2007–2014. Debt levels grew at that rate. GDP did not grow at that rate anywhere except (possibly) China, where debt growth was in the double digits. Debt as a percentage of GDP is even higher now than it was in 2007: 286% vs. 269%. Using 2007 as a baseline is misleading, too. We now know that debt levels that year were excessive by any measure. If we had too much debt then, we have way too much now.

What has enabled such a debt-fueled boom? Low interest rates. US corporations have spent about $1 trillion over the last 12 months on share repurchases and dividends in order to sustain their stock prices. Much of this money was borrowed. Rather than working for an old-fashioned profit increase, businesses resorted to financial engineering.

Who Are These Reckless Borrowers?

I said above that total debt grew at a 5.3% annual rate from 2007–14. Some types of borrowers added debt faster than others did, according to the McKinsey data.

- Household debt grew 2.8% annually.

- Financial sector debt grew 2.9% annually.

- Corporate debt grew 5.9% annually.

- Government debt grew 9.3% annually.

Banks and households missed their chance to deleverage – which means they will have trouble again in due course – but they at least kept their debt growth in roughly the same neighborhood as nominal GDP growth.

Incidentally, notice that the pattern reverses if we go back further to the 2000–2007 period. Then, household and financial-sector debt grew much faster than corporate or government debt did. That suggests the next crisis won’t look like 2008. However it breaks down, we are now in an even bigger debt bubble than we were in 2008. We are going to pay for it and eventually deleverage, but the process will look different this time. Which is why everyone is so focused on when the Federal Reserve will finally raise rates.

Working Out of Debt

Several years ago, when I was writing Endgame with Jonathan Tepper, I had a fascinating conversation with Kenneth Rogoff and Carmen Reinhart. They wrote the seminal book This Time Is Different, cataloging more than 250 financial crises in 66 countries over 800 years, looking for differences and similarities. You can read some it transcribed in chapter 5 of Endgame.

Among Reinhart and Rogoff’s findings is that it takes much longer to work off the excesses of a banking crisis than it does a typical business-cycle recession. The process can stretch out for years, with unemployment higher than normal and consumer demand sluggish the whole time. Sound familiar?

From Endgame (2011):

REINHART: [We] are still highly, highly leveraged as a nation. And the same can be said for most other advanced economies. So what I am getting at to your question, John, is that I think we are in for a period of subpar growth. And in a period of subpar growth… [y]ou are not going to have the same kind of investment environment that we had in the run-ups to the IT bubble and in the run-ups to the subprime crisis. I think it’s going to be a different, more sobering environment.

ROGOFF: Slow growth is here; that just comes with this debt no matter what way you turn…. Some countries won’t tighten their belts soon enough, won’t figure out how to do it…. But with the slow growth, whatever way you turn, you tighten your belt. Barring certainly a great, unbelievable period of technology growth or a friend from outer space helping us out, we do face slow growth, as Carmen said.

I am not aware of any friends from outer space coming to help us out. If they arrive, I only hope they are more helpful than our friends from Washington, DC.

The working-out process will not be easy. Reinhart and Rogoff said 4+ years ago that after a banking and credit crisis it is typical to have 10 years of slow growth. Elsewhere they talk about how economies in this situation often bump up against a kind of growth “ceiling.” That matches what we see in the US right now.

Are we near the end of the process? I doubt it. If recovery from a banking crisis can take ten years and we are only seven years in, I expect (barring aliens) that we have a few more years to go. A slow, muddle-through recovery may not be exciting – but it’s better than the alternatives. As I noted at the beginning, I am quite worried about the possibility of a recession in our slow-growth, barely limping along at stall speed economy.

A few final thoughts: If we are entering a period of 1% or less growth – or God forbid, a recession – the Fed has few bullets left in its monetary policy gun. Can you actually take the world’s reserve currency to negative rates? Seriously?

A few more months of falling employment growth and the Federal Reserve will be seriously constrained with regard to raising rates. Even though all the talk from the various Fed presidents and governors the last few weeks has been about the high probability of raising rates this year, I don’t think it will take much for the Fed to decide to hold off just another month or three to make sure…

The only real weapon that the Fed thinks they have is another round of QE, but their own research has showed that quantitative easing wasn’t effective this last time. I have no idea what they think it would do next time, but they will feel they have to “do something.” Just for the record, I was talking with my good friend, interest-rate and Federal Reserve expert (he was a former Fed economist) Dr. Lacy Hunt, about what QE might look like the next time. I mentioned providing actual cash to individuals, and he let me know clearly that the Federal Reserve is by law not able to do that. At least the way we interpret the law today. They are also constrained as to the types of assets they can purchase.

I suppose it’s possible that you could get Congress to agree to expand the range of assets the Fed can purchase, but that would require an amendment to the Federal Reserve Act, and no one in their right mind thinks that Congress will actually take that Act up for revision, as the debate would be so contentious as to be almost impossible to resolve.

By the way, if the Fed initiates another round of QE, you can bet that other central banks around the world will double down and match. Try to get your head around another few trillion in various fiat currencies floating around in reserve accounts.

Gold, anyone? Just saying… Right now there is little love for the barbarous yellow relic, but that could change. Stay tuned.

San Francisco, Portland, New York, and Birthdays

The editor of Transformational Technology Alert, my close friend Patrick Cox, will be coming in Sunday, October 11, for a dinner and to meet a few of his readers before we head out the next day to San Francisco, where we will hopefully meet with Dr. Mike West of Biotime and then spend the next day at the Buck Institute, the premier antiaging research center in the world. I hop a later flight to Portland, where I will be doing a speech for Aequitas Capital. Then the plan is that we’ll somehow wind up in New York.

Sunday is my 66th birthday. The kids will be gathering in the evening for what I suspect will be a rather quiet birthday dinner. They say that the older you get, the faster time flies, and that has surely been my experience. There is never enough time in the day or week to get everything done that I want to. Including workouts, which I’ve been lax on this week because of travel.

I’ll close with one of my favorite poems from Dylan Thomas. Its theme seems particularly poignant this week:

Do not go gentle into that good night,

Old age should burn and rave at close of day;

Rage, rage against the dying of the light.

Though wise men at their end know dark is right,

Because their words had forked no lightning they

Do not go gentle into that good night.

Good men, the last wave by, crying how bright

Their frail deeds might have danced in a green bay,

Rage, rage against the dying of the light.

Wild men who caught and sang the sun in flight,

And learn, too late, they grieved it on its way,

Do not go gentle into that good night.

Grave men, near death, who see with blinding sight

Blind eyes could blaze like meteors and be gay,

Rage, rage against the dying of the light.

And you, my father, there on the sad height,

Curse, bless, me now with your fierce tears, I pray.

Do not go gentle into that good night.

Rage, rage against the dying of the light.

You have a great week. Speaking of not going gently into that good night, I intend to see The Martian later tonight. It has been getting rave reviews, and I do enjoy a Ridley Scott movie.

Your not feeling as old as the number suggests analyst,

John Mauldin

subscribers@MauldinEconomics.com

Do you enjoy reading Thoughts From the Frontline each week? If you find it useful and valuable, your friends, family, and business associates will probably enjoy it too.

Now you can send Thoughts From the Frontline to anyone. It’s fast, it’s free, and we will never “spam” your friends and family with unwanted emails.

Copyright 2015 John Mauldin. All Rights Reserved.

Thoughts From the Frontline is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting http://www.mauldineconomics.com.

Any full reproduction of Thoughts from the Frontline is prohibited without express written permission. If you would like to quote brief portions only, please reference www.MauldinEconomics.com, keep all links within the portion being used fully active and intact, and include a link to www.mauldineconomics.com/important-disclosures. You can contact affiliates@mauldineconomics.com for more information about our content use policy.

http://www.mauldineconomics.com/subscribe

Thoughts From the Frontline and MauldinEconomics.com is not an offering for any investment. It represents only the opinions of John Mauldin and those that he interviews. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with, Mauldin’s other firms. John Mauldin is the Chairman of Mauldin Economics, LLC. He also is the President of Millennium Wave Advisors, LLC (MWA) which is an investment advisory firm registered with multiple states, President and registered representative of Millennium Wave Securities, LLC, (MWS) member FINRA and SIPC, through which securities may be offered. MWS is also a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB) and NFA Member. Millennium Wave Investments is a dba of MWA LLC and MWS LLC. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Past performance is not indicative of future performance. Please make sure to review important disclosures at the end of each article. Mauldin companies may have a marketing relationship with products and services mentioned in this letter for a fee.

Note: Joining the Mauldin Circle is not an offering for any investment. It represents only the opinions of John Mauldin and Millennium Wave Investments. It is intended solely for investors who have registered with Millennium Wave Investments and its partners at www.MauldinCircle.com or directly related websites. The Mauldin Circle may send out material that is provided on a confidential basis, and subscribers to the Mauldin Circle are not to send this letter to anyone other than their professional investment counselors. Investors should discuss any investment with their personal investment counsel. John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Mil lennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private and non-private investment offerings with other independent firms such as Altegris Investments; Capital Management Group; Absolute Return Partners, LLP; Fynn Capital; Nicola Wealth Management; and Plexus Asset Management. Investment offerings recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor’s services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER. Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have t otal trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor’s interest in alternative investments, and none is expected to develop.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs may or may not have investments in any funds cited above as well as economic interest. John Mauldin can be reached at 800-829-7273.