Perspective

It is not just the tech sector that has entered “hyper-drive”, which is a term and convention used for a long time in the world of science fiction. While unwilling to define central banking as “science” or “fiction”, artificial-drive has been employed since the Federal Reserve System was confected in late-1913. In order to prevent bad things from happening hyper-drive has been imposed since the late 1990s.

The saddest part of the experiment is that it has been based upon arbitrary notions about how the economy “ought” to work. It is also based upon the absurd concept of a national economy. The other main absurdity is that expanding credit forces price up.

What’s been happening to commodities?

It is the other way around, soaring asset price permit credit expansions and Mister Leverage has been fully engaged in the financial markets. Not in commodities.

Politically, the US administration has been on hyper-drive on its way to “change” the American culture. This has been the most ambitious assault on the socio-economic fabric, ever, and has employed not just class warfare, but race warfare as well. This was intensified going into the November election with hopes of eliminating any kind of opposition to the Left’s endless pursuit of control.

The election resulted in the strongest Republican position since the 1920s.

Unfortunately, there is the big election in 2016 and while the control freaks were severely damaged in the polls, both kinds of warfare will be fanatically employed. Right through to November 2016.

In a boom everyone gets busy, including the political Left.

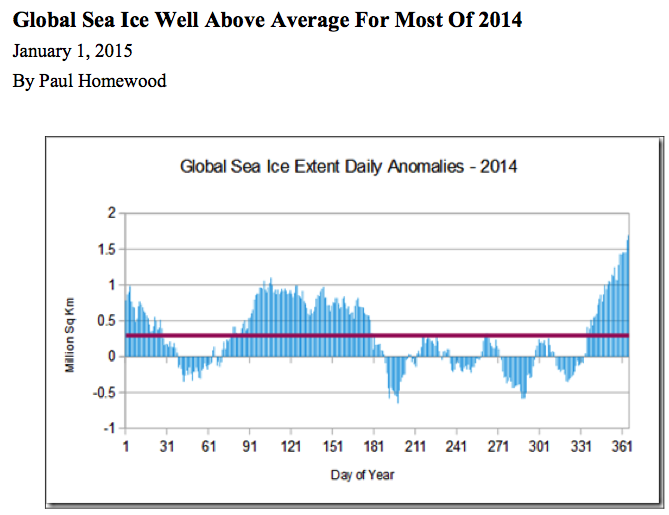

Outside of domestic politics, the global warming movement is becoming particularly frantic. That’s in the face of eighteen years of no increase in satellite measurement of temperature. In America the last three years have set successive record lows in tornado activity. The Antarctic ice sheet has set record highs and the Arctic sheet is the largest in almost ten years. A chart follows.

How long can the mania in central banking, financial markets and political markets last?

This is difficult to pinpoint, but we are comfortable in noting that economic and political nihilism will continue until it is seen not to work.

Wrap: 2014

In November a year ago, we concluded that a significant “Rotation” into depressed commodities would provide a good trade. Energy, base metals, grains and precious metals staged important lows and accomplished rallies into late spring. Each rally soared to enough of an overbought to depart the play.

This would be within the bear market that began in 2011 for most commodities.

On the interest rate side, “Rotation” would naturally be accompanied by rallies in low- grade bonds out to around May-June. We got out on the overbought. And a possible credit contraction would be accompanied by a strong dollar.

Technically in December a year ago, the bond future was poised for a rally and we are still “in” and are now looking for “ending action”.

In the stock markets, outstanding action generated Exuberance, Divergence and Volatility. The result was a correction in October for the senior stock indexes and a resumption of excesses. The full “Resolution” of such measurable excesses has yet to be realized.

Outlook: 2015

Financial markets revived out of October and recorded another set of technical excesses. Ambitious central banking will continue until denied by Mother Nature. In so many words, the notion that eternal prosperity can be obtained through eternal depreciation will get slammed by another wave of asset deflation.

Generations of veteran traders have known that concepts about fiscal and financial intervention have been just another example of utopian nonsense. The reason why it has had so many followers is that intuition is always so appealing. That’s in any century. Without knowing it Keynes “discovered” what so many intellectuals before him had discovered in previous crashes.

And that is that more credit from somewhere will make a credit contraction go away. The earliest one we have found was uttered by Edward Misselden in the 1618 to 1622 crash. The sudden change from prosperity to hardship and unemployment provokes the same policy knee-jerk. That would be from “everything is wonderful” to “we have to do something”.

In December 2007 it was the “Dream Team” at the Fed. Nothing could go wrong. In 2008 it was emergency “shovel ready” plans.

In the early 1600s, England’s government essentially duplicated the cloth-finishing business that existed in the Netherlands. It was a make work program.

A London merchant described the grand scheme as like a sepulcher – “attractive without, dead bones within”.

Milton described such folly as “Tyrannical Duncery”.

Essentially many in 2014 realized that the grand plan to “manage” the climate was just plain stupid. Quite likely as 2015 progresses the public will discover that the grand plan to “manage” the economy is just as stupid.

So where does this place the investor?

Orthodox methods of determining portfolio balances based upon conjecture about what the Fed is going to do or “ought” to do has essentially been impractical. This holds for the gold bugs as well. All that Fed recklessness “ought” to have driven gold to “five thousand”, but it did not happen. Essentially because lower-grade bonds reached the equivalent of “five thousand”. The NYSE was working on the same impetus until this week and the bond future is working on it right now.

Where will the best returns be earned?

High-grade US corporates in the 3 to 4-year maturities are an ideal position in a financial storm. Gold’s unique liquidity and financial character is also good for riding out a storm. By later in the year gold stocks could be showing superior returns.

Stock Market

“Steak, Strippers & Sweet Rides: Wall Street’s Back”

This was from a CNBC article published on January 2nd. We think it is accurate and it included advice on how to “spend a $1 million bonus”. Also noted was that automakers were selling millions of high-priced cars. (A “sweet ride” is a nice car.)

This anecdotal measure ranks right up there with the best in the long history of stock markets.

The latest surge has been based upon the benefits of weakening crude oil prices. On December 1st, the Washington post reported “Tumbling oil prices are…injecting a much- needed boost for American consumers”.

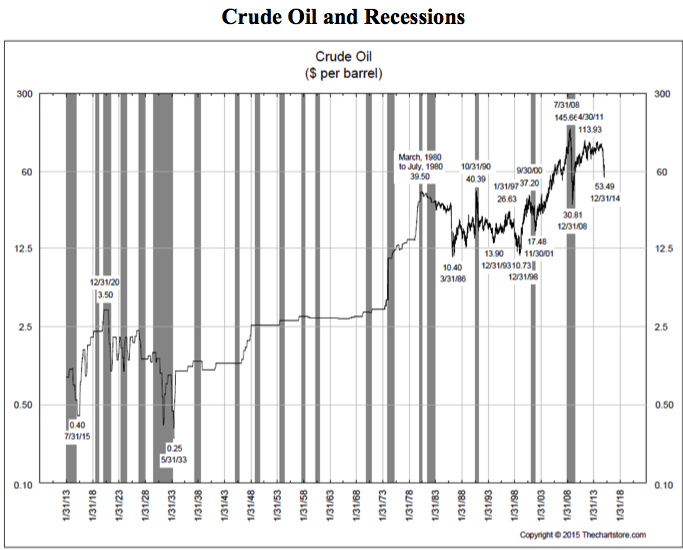

Our view has been that the plunge in oil prices and further weakness in other commodities could be signaling a global recession. This melancholy probability is being confirmed by credit spreads reversing to widening in June. Yet to confirm is the curve reversing to steepening.

Some weeks ago we ran the chart of crude’s price and recessions. The chart from The Chart Store follows and starts in 1913. Most bear markets in crude oil have been associated with a recession. Intense speculation in crude oil can leave a lot of financial damage behind.

The year closed with another burst of enthusiasm, followed by volatility.

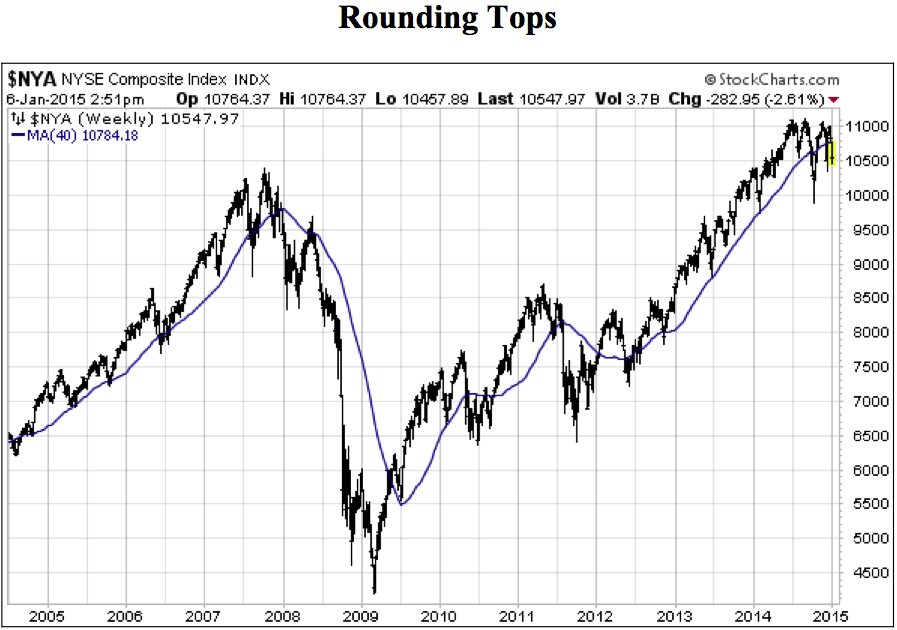

On the big market, the NYSE Comp (NYA) has been a good guide for cyclical peaks. This set a Rounded Top in 2007 and seems to working on one over the past six months.

On the nearer-term chart, taking out the December low of 10360 would be interesting. Taking out the October low at the 10000 level would set the downtrend.

Banks stocks (BKX) have taken out the 50 and 200-Day moving averages, as well as the December low.

Europe’s STOXX recorded Rounding Tops in 2000 and 2007 that is being replicated since mid-2014. Of interest is that the high in 2000 was 5552, in 2007 it was 4572 and in 2014 it was 3325. That was in June and now it is at 3007, which is at December support.

The sequence of descending highs in Europe helps explain the focus on NYSE senior stocks. The S&P high in 2000 was 1553, in 2007 it was 1576 and December it was 2093.

Selling pressures across many sectors has been impressive – enough to register a Springboard Buy on the senior indexes.

Commodities

Crashes in crude don’t happen all that often but when they do they are impressive.

On timing there are seasonal forces that have been likely to complete in December. Some crashes have run for 6 to 7 months and this month is number seven on the count.

Percent declines have been impressive and the action can take a pause.

In gold terms the full bear could amount to a decline to some 25% of the cyclical high. That was the decline in the last Great Depression.

Another measure of the real price is against the PPI.

One example we used was the 1985 to 1986 crash when the deflated price fell 66% from that fateful November to the following March. The bear market from October 1990 to February 1994 amounted to 65%. The crash from June 2008 to December 2008 amounted to 75%.

As deflated by the PPI, the high in June was 102 and at 48 the plunge is 53%. In gold terms it is down 53% as well.

After a pause, crude can decline further.

At the height of the boom in 1980 all of the banks had to be in the Oil Patch, and then it turned bad. So bad that there were hearings and one of the problems that non-market people have in a bust is wondering where the money went.

There was a particularly aggressive young banker with a new bank in Oklahoma. When the judge asked the question about the money he responded “Well, your honor, we spent it on wine women and song – the rest we just pissed away.”

This was quoted in the Wall Street journal on the way to the nasty conclusion in late 1990. The Fed had to move dramatically to bail out Citigroup and Chase Manhattan.

Grains (GKX) enjoyed a rally from a “saucer” base and became overdone a couple of weeks ago. The low was 290 in September and the high was 342 in mid-December. The drop to 316 took out the 50-Day and it has bounced to 330 yesterday. If it stays above the 50-Day it would be constructive.

Base metals (GYX) continue to decline and are getting somewhat oversold on the Weekly RSI. The 319 set earlier today is a new low for the bear that started at 502 in 2011.

Base metal miners (SPTMN) rallied from the December low of 606 to 710 last week. This could be mainly with the rally in the big market and it has given up a little. We will watch this one as the stocks tend to lead changes in metal prices.

Will there be a “Rotation” such as we called for last year?

That was likely to be significant, but can’t make the equivalent call now.

Credit Markets

With hits to stocks and commodities the bond future has rallied – right up to a Daily Upside Exhaustion on the TLT. In so many words, a correction in high-grade bonds is starting. This could be within our prospect for “ending action”, which would require a Weekly signal as well.

Lower-grade stuff has whipped-sawed with JNK at a Springboard Buy in the middle of December, which was followed by the opposite ten days later.

JNK has declined from 39.98 to 38.18. The last low was 37.08 and that is now support.

Spreads from BBB to treasuries narrowed from 210 bps in mid-December to 197 bps at the end of the year. It has widened to 206 and the trend will likely continue.

Weakening commodity prices suggest weakening producer prices and that suggests weakening earnings. As it continues it will weaken the ability to service debt. With some 17% of junk bonds having been issued by the Oil Patch, this became very clear.

Weakening crude prices had a lot to do with the panic in Russia’s bonds and currency. It reached a crescendo in the middle of December as the yield spiked up to 16.24%, much higher than the 12.80% reached in 2009. As the panic eased the yield declined to 13.12% and it has increased to 14.09% today.

As the Russian panic eased, concerns shifted to Greece as their yield jumped from 7.25% to 10.35%. This was on conjecture that Greece would leave the EU. The spike high in the October troubles was 8.98%.

Then just as the Greek yield started to soar, Der Spiegel editorialized that “The danger of contagion is limited because Portugal and Ireland are considered rehabilitated.”

“Contagion” uttered by the establishment is the term we have been watching for. It, or “contained”, has been used to keep the boogeyman of a global contraction away. Sadly – each time since the Asian Crisis of 1997 – without avail.

It seems like only yesterday when in that July the Thai central bank ran out of reserves and the there was a local panic. International policymakers moved quickly with assurances that it would be limited to Thailand. After quickly engulfing the Philippines, the hit took until September to reach the shores of Manhattan Island.

The German Ten-Year continues to plunge, hitting 0.447% on Tuesday. Away back in September it was 1.00%. In the 2008 Crash the high was 4.63%. In 1981 the high was 10.80 (no typo) percent.

However, it is worth putting the 0.447% yield in perspective. In the unprecedented rise in yields to 1981, Government of Canada long rates reached 19.5%. In that panic there might have been days when the spread between the bid and ask was greater than 0.447 percentage points.

Central bankers have become fanatical and investors have had little choice but to go along with the ride. Quite likely the action in US long treasuries has further to go and will set the ending action, which will be opposite to the mania that drove the yield up to 15% in 1981.

Precious Metals

We have been rather cautious in our re-positioning gold stocks and in early December recommended buying a little. GDXJ set a low of 22.18 in early November and bounced to 29.54. The next low was 21.24 in the middle of December and this week’s rush has upped it to 26.91. That it has broken above the 50-Day ma is constructive.

Our January 2nd special “Something Happening?” noted that gold stocks were beginning to move opposite to the big stock markets, which is also constructive. We should keep in mind that this sector took part in last year’s “Rotation” and shot up to a very overbought on the silver/gold ratio in May. We marked it as “dangerous”.

So we have not been looking for a “V” bottom, but have been looking for the sector to constructively end a cyclical bear market. This would have a period of stability with the gold shares outperforming the bullion price. This has risen above the 50-Day ma.

Also needed would be silver beginning to outperform gold. Since November this has been basing and today it got a little over the 50-Day.

Another item would be gold stocks outperforming the big stock market. Using GDXJ/SPX, this has been the case since the third week in December, with the last two days above the 50-Day.

All of this adds up to rather good construction, but the sector is still vulnerable. Thus the advice to buy in modest amounts on weakness.

The most constructive feature of the sector is that gold’s real price continues to climb. Our proxy is our Gold/Commodities chart and it follows.

- Most bear markets for crude have been associated with a recession.

- The 1985-1986 crash was not part of a recession.

- A big Rounding Top described the completion of the 2007 bull market.

- The simple technical guide that “told-the-tale” were the multiple highs and the take out of the 40-Week ma.

- In 2007 it took two attempts late in the year.

- This example is working on the second attempt.

- Our Gold/Commodities Index is our proxy for gold’s real price.

- When it is going up it suggests that the bullion price is outperforming most of the costs of mining.

- We took the low of 3.28 set in June as the end of the cyclical bear that started in 2011.

- This week’s action set a new high for the move at 437.

- This compares to the cyclical high of 487 set in early 2011.

Link to January 9, 2015 Bob Hoye interview on TalkDigitalNetwork.com:

http://talkdigitalnetwork.com/2015/01/collapsing-crude-leads-to-shinier-gold/

Global sea ice extent finished the year at 1.69 million sq km above the 1981-2010 average. This equates to 8.2% above normal.

During 2014, sea ice extent has been above normal for 245 days, at an average of 295,000 sq. km.

BOB HOYE, INSTITUTIONAL ADVISORS

E-MAIL bhoye.institutionaladvisors@telus.net

WEBSITE: www.institutionaladvisors.com