Chen Lin was one of the very few who foresaw the collapse in oil prices, so investors are well advised to pay attention to his advice. In this interview with The Energy Report, the author of the What is Chen Buying? What is Chen Selling? newsletter touts the prospects of a few oil companies that can prosper in the downturn, and explains why cheap oil means high profits for U.S. ethanol producers.

The Energy Report: You anticipated the collapse of the price of oil. How did you see this coming when so few others did?

Chen Lin: I was very fortunate. In an interview with The Energy Report last year, I expressed my fear that the price of oil could fall as low as $47 per barrel ($47/bbl). Because I invest in and follow a lot of fracking companies around the U.S. and Canada, I knew how fast North American oil production was increasing. Coincidentally, major Wall Street firms started to agree with my assessments one year later.

On Sept. 5, 2014, I alerted my subscribers that I had sold out a lot of energy stocks and reduced a lot of other positions to raise cash. Thanks to these timely sales, I’ve had a good year so far. But it’s been very tough watching oil fall as far and as fast as it has.

As the oil price is in free fall, many companies with high leverage to the price will likely go under. Investors need to be extra careful in picking beaten-down stocks in the energy sector. My personal view is that the oil price is likely to continue to fall into next year, and possibly won’t find a bottom until next spring. I am watching it closely. It is very important to stay with companies that can survive this downturn, if not benefit from it.

TER: Angelos Damaskos of Sector Investment Managers Ltd. told The Energy Report that increased North American oil production due to development in the shales has been balanced by decreased oil production elsewhere in the world. Therefore, he argued, there must be another cause for the oil price fall, and suggested significantly reduced buying from China. Do you agree?

CL: No. China’s oil demand has been increasing, and there’s no way the Chinese government can hide it. China is the second-largest oil importer after the U.S. In fact, China’s oil imports have increased by as much as 50% recently because of the price reduction. China is filling up its strategic reserve.

North American oil production has increased, so if demand stays constant, the Organization of the Petroleum Exporting Countries (OPEC) would have to reduce production to keep the price stable.

TER: Since the price has fallen, does this suggest that OPEC has increased production?

CL: Possibly. I can understand Saudi Arabia getting sick of Canada and the U.S. taking its market share and acting accordingly. Partly because of the American military presence in the Gulf region, those countries cannot squeeze U.S. shale production without American permission.

Another possibility is the U.S. acting to squeeze Vladimir Putin and Russia. The U.S. and the Saudis, acting together in the 1980s, brought the price of oil so low it was a big factor in the collapse of the Soviet Union. I can see the Saudis and the U.S. doing that again. You have Goldman Sachs calling for an oil price crash, and the Saudis are selling aggressively—and selling to the U.S. at much lower price than to Asia and Europe. The West Texas Intermediate (WTI) price is based in the U.S., and Saudi Arabia wants WTI to go down.

TER: About 90% of Saudi Arabia’s revenues come from oil production. How long can the country keep prices down?

CL: When oil was over $100/bbl, Saudi Arabia built up its cash reserves, so it can easily ride out $80/bbl prices for 2–3 years. The real losers in this price war are oil producers with much higher costs—countries such as Russia and Iran. In November, the Russian ruble was defending 40 to the U.S. dollar; now it’s defending 50.

TER: Back to China, are you worried or sanguine about the state of the Chinese economy? We hear stories about overleveraging, problems with debt and the banks, and a real estate bubble.

CL: All this is true. China definitely has a property bubble. Bank leverage is definitely high. The situation is not good and getting worse. But the Chinese government has more freedom to take action than the U.S. does, or the countries of the European Union do.

Ideally, China needs to depreciate its currency to stimulate exports to Japan and Europe, its biggest trading partners. The U.S. would not allow devaluation, however, so China is somewhat stuck. But I believe China can weather this situation for some time.

TER: Is the “revolution of rising expectations” a threat to China’s stability? People who have long been poor become inured to poverty. When they become a little bit richer, however, they come to expect ever-increasing prosperity. When this doesn’t happen, people can get very angry very quickly.

CL: That’s a very good point. It’s a possibility. We must keep in mind, however, that the Chinese government retains strong control of the media and other means of popular discontent. Despite the recent problems, the current Chinese regime has been very popular because of its anti-corruption campaign and its moves against the state monopoly. The new regime’s honeymoon isn’t over yet and is likely to continue for the near term.

TER: How long before oil prices again reach $100/bbl?

CL: It’s hard to say. The lower oil price will decrease production, but not immediately. This will occur in 2–3 years. As I see it, the drop in oil price will actually help the price reach $100/bbl in the future. Many oil companies are now reducing capital expenditures (capexes), so exploration is being curtailed. Fracking companies are reducing their activities. Ultimately, this must lead to higher prices.

TER: Lower oil production will lead to higher oil prices, but lower gold production hasn’t led to higher gold prices. What’s the difference?

CL: We cannot live one day without energy, without oil. Without oil, we cannot drive our cars, get to our jobs, heat our homes. We can, however, live without gold for a few years. Gold is more of a financial instrument than a commodity.

TER: How much damage will oil at less than $70/bbl cause to shale oil and oil sands operations?

CL: Many companies in these spaces are cutting capexes by 20–30% for next year. Production could be down 20-30% in 2–3 years.

TER: Shale oil and oil sands operations are, by their nature, very high capex. And shale oil wells don’t produce for long. Could three years of $70/bbl oil kill off shale oil?

CL: No. I have checked with a lot of companies—some I own, some I follow—and the word is that prices of $50–60/bbl would be needed to kill shale oil.

TER: Now that the Republicans control both houses of Congress, will the Keystone XL Pipeline be approved?

CL: This is one of the top priorities for the Republicans in Congress. Though the recent efforts to approve the pipeline failed, Congress will likely bring it up next year. Keystone approval would be great news for Canada. Canadian oil producers have suffered so much, so I’m glad they would profit the most. The oil sands would benefit hugely as well.

But this would be a long-term benefit because it will be years before Phase 4 would go into operation. In the near term, what could be a huge problem for the Canadian producers are new rail regulations coming into effect in 2015. This is in reaction to the many shipping accidents of recent years. These regulations will be really tough. They will raise shipping costs and reduce exports. Canadian oil companies are facing more pain before the Keystone starts.

TER: Which oil sands company is your favorite, and why?

CL: I own Pan Orient Energy Corp. (POE:TSX.V). Its pilot oil sands project is in Alberta, but it also owns many conventional projects in Asia. Pan Orient is my favorite energy play because of its very strong balance sheet. The company just announced a $42.5M asset sale in Thailand. This brings its cash value, plus the other 50% of the Thai project, to CA$2.25 per share. It is trading now at $1.70/share. Beyond that, you get Canada and Indonesia for free.

Pan Orient plans to sell its Canadian asset. But right now, that asset is valued, for share purposes, at zero. At rock bottom, it’s worth $100M. In Indonesia, Pan Orient’s partner will cover drilling costs for 2015. The company announced the Indonesia deal with Talisman Energy on Nov. 11, so its cash position will go even higher. In addition, Pan Orient will have an experienced partner with major Indonesia presence drilling on its very large concessions; the target is as large as half a billion barrels of oil equivalent. That’s a huge wild card the market didn’t expect. The company is in an ideal situation now because the cash position is there, Canada is producing, Thailand is producing, and the cash flow is covering the expenses.

TER: Which pure oil play junior is your favorite?

CL: Mart Resources Inc. (MMT:TSX.V) has been my home run of the past few years. I’ve already received a dividend that was more than my original investment. Mart just announced the new pipeline has started flowing. Once the new pipeline is fully ramped up, we should see the production triple, which will generate huge cash flow. Mart’s production cost is exceedingly low.

TER: Is Mart seeking aggressively to expand its operations?

CL: It is. Mart is part of a consortium that has just acquired a new Nigerian asset from Royal Dutch Shell Plc (RDS.A:NYSE; RDS.B:NYSE), Total S.A. (TOT:NYSE) and Eni S.p.A. (E:NYSE). The consortium will control 45% of a block producing 30,000 barrels per day (30 Kbbl/d).

TER: Which natural gas juniors do you like?

CL: I used to own Rex Energy Corp. (REXX:NASDAQ), but not anymore, the main issue being its heavily indebted balance sheet.

TER: Rex Energy is in the Appalachian and Illinois basins. How long before these regions are tapped out?

CL: They will probably last for quite some time. Right now, prices are low, and producers aren’t generating much cash flow. But we may have a very cold winter, and natural gas stocks could be back in favor. And we might start to export natural gas from the U.S. and Canada as early as next year. That could be very positive in the long run.

TER: Are we looking at a natural gas price crash due to overabundance?

CL: Some recent finds have been phenomenal, so the price could potentially go even lower. Hopefully, we can build up liquefied natural gas exports soon.

TER: Is there another company you like in this sector?

CL: One I do own is Cub Energy Inc. (KUB:TSX.V), which is drilling in Ukraine. Unfortunately, more than half of its production is in East Ukraine, a conflict area. It is still producing, but it cannot drill more wells. It is, however, getting good results from West Ukraine. Cub is a good, long-term Ukraine gas play.

TER: The first oil shock was in 1973, 41 years ago. Since then alternative energy has been all the rage. But we remain essentially dependent on oil and gas, four decades later. Do you worry that the 30% decrease in the oil price could cripple alternative energy companies and their projects?

CL: That depends. Some alternative energy companies will be hurt. One such company I own is Alter NRG Corp. (NRG:TSX; ANRGF:OTCQX). It uses plasma to burn garbage to generate natural gas that’s very clean, with no waste and no pollution. That could be attractive to such highly polluted countries as China and India. Currently, new garbage-burning plants in China generate a lot of resistance, but adopting plasma technology makes it much more attractive.

Alter NRG has already built a plant in the United Kingdom (U.K.), and is building a second. In an island country like Britain, garbage is a huge problem. There is no room for landfills, so garbage must be shipped outside the country. There’s a high tipping fee, raised from consumers, to pay for collection. The natural gas price in the U.K. is very high as well. The return on investment in Alter NRG’s U.K. operations is very high, even after the fall in energy prices.

TER: Can you explain Alter NRG’s business model?

CL: The tipping fee alone makes its U.K. projects worthwhile, so the natural gas generated is free. The company can sell the gas or use it to generate electricity, which is sold for a high price. And this is renewable electricity, so it is of premium value. The ash produced by incineration is pure, and can even be used in construction.

I’ve been to Puerto Rico, another island nation, and I’ve talked to local people and companies that would love technology like Alter NRG’s. The only problem for this company is that it’s a long process from recognition of the technological benefits to government approval and construction.

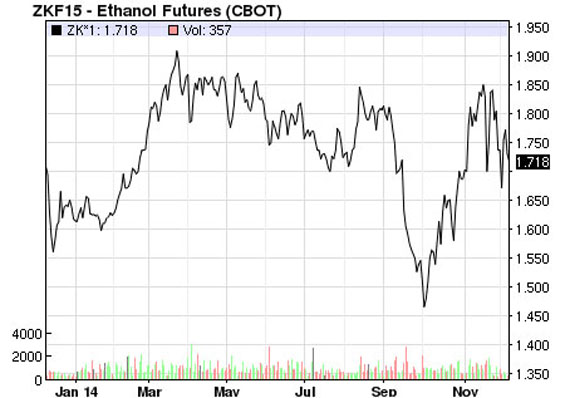

TER: Why do you believe the future is so bright for ethanol producers?

CL: In September, ethanol followed oil down in price. But there was a complete rebound and more in October. The conventional wisdom is that ethanol is considered part of gasoline, 10% by law. So when the oil price falls, and the gasoline price falls, the price of ethanol should fall too. That explains the coordinated short attacks on ethanol in the past two months. Shares of Pacific Ethanol Inc. (PEIX:NASDAQ) fell 60%, while the short interests in REX American Resources Corp. (REX:NYSE) more than tripled. I own both these companies, as well as Green Plains Renewable Energy Inc. (GPRE:NASDAQ).

The conventional wisdom about ethanol has been proved wrong. Lower oil and gas prices encourage more consumption. More gas consumption, by law, requires more ethanol—more ethanol, in fact, than can be produced. According to the Environmental Protection Agency, U.S. plants are running at 930,000–940,000 barrels per day. Maximum daily U.S. ethanol capacity is 925,000 barrels per day. That’s why the ethanol price rebounded sharply in October and is now higher than in the summer, when oil sold at $100/bbl.

On the supply side, few ethanol plants are coming on line because it is very difficult to get Renewable Identification Number (RIN) permits from the Environmental Protection Agency. So don’t expect any major new plants in the next few years. This issue was discussed in detail during the question-and-answer session of the Great Plains’ recent conference call.

TER: But ethanol share prices are still depressed.

CL: That’s why I’m so excited. The oil index funds are short ethanol, but they don’t understand the situation. Last quarter, Pacific Ethanol beat its earnings estimate with $0.33/share. Its margin has since risen from $0.35/gallon to more than $1/gallon. Imagine how much money it’s making now. The company has some debt, but its cash exceeds that by $30M. The company is now considering a dividend and a share buyback, as is Green Plains.

REX American and Green Plains also boast robust balance sheets and record-high margins. I am bullish on ethanol stocks.

TER: The use of ethanol for fuel requires the diversion of agricultural products, which leads to higher food prices. We’ve seen significantly higher food prices in the last few years. Do you think it’s possible that, given the lower prices of oil and gas, politicians might cut the 10% requirement?

CL: Actually, they are looking to increase it to 15%. Thanks to genetic modification, harvests of corn and soybeans are at historic highs, and the commodities are priced at historic lows. That’s another reason why ethanol companies are so profitable. Input costs are at an all-time low, with output prices at an all-time high.

TER: Do you think ethanol companies are a better bet than oil companies?

CL: I do, especially from now until the end of the year. We have a tax-loss selling season. I see a lot of funds potentially going out of business or facing heavy reduction. Meanwhile, ethanol is booming.

Earlier, I mentioned the rail-transportation regulations coming into effect in 2015. They will be particularly beneficial for Pacific Ethanol because it is selling ethanol in California, and its price is based on the ethanol from the Corn Belt, in Iowa, which is transported by rail. Shipping costs will jump in 2015, so ethanol margins will increase.

Again, by law, gasoline must contain at least 10% ethanol, and when shortages occur, the price of ethanol skyrockets. The law is the law. The most recent conference calls of Green Plains and Pacific Ethanol confirmed the coming, strong ethanol price. This is not reflected in share prices yet, which are already bound to increase greatly based on current margins.

TER: Chen, thank you for your insights.

\Chen Lin writes the popular stock newsletter What Is Chen Buying? What Is Chen Selling?, published and distributed by Taylor Hard Money Advisors Inc. While a doctoral candidate in aeronautical engineering at Princeton, Lin found his investment strategies were so profitable that he put his Ph.D. on the back burner. He employs a value-oriented approach and often demonstrates excellent market timing due to his exceptional technical analysis.

Read what other experts are saying about:

Want to read more Energy Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page