When the tech and real estate bubbles burst, many of my friends lost 40-50% of their retirement portfolios almost overnight. Is a similar downturn looming?

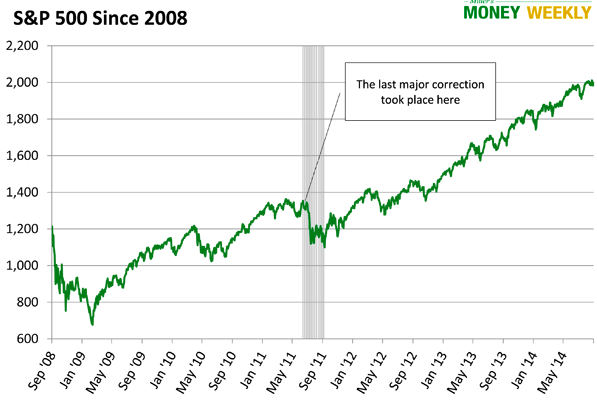

Take a look at the chart below showing the S&P’s performance since 2008.

Caution is in order. We may see a major correction, a huge downturn, or this bubble could continue to grow for quite some time. I’ll leave the timing predictions to others. Still, investor euphoria worries me. Even those playing with retirement money often ignore warning signs, thinking the parabolic rise in stock prices is never going to end. However, this time is NOT different.

Look at the Nasdaq’s performance just before the tech bubble crash:

From March of 1999 to March of 2000, the Nasdaq doubled, and investors were euphoric. Are you feeling that euphoria today?

Don’t Let the Next Downturn Make You Poor

The goal for a retirement portfolio is to create enough of an income stream that you can maintain your current lifestyle over the long haul while the balance grows ahead of inflation. This portfolio should also include enough safety measures to keep you whole regardless of what the market does.

Sounds simple, but it can feel like walking and chewing gum—to the power of 10. Treasuries are supposedly safe… but from what? Sure, you won’t lose your principal, but they won’t protect you from inflation. Certain stocks are solid; after all, many companies survived the Great Depression… but will they keep paying dividends when you need them? Investing in a turbulent market is a gyroscopic balancing act with endless variables.

4 Lifejackets

While outlining the entire Miller’s Money safety system is beyond our scope here, there are four must-do safety measures anyone can easily implement.

#1—Set strict position limits. No single investment should make up more than 5% of your overall portfolio. That means rebalancing at least once a year. I have a friend who brags about how well his portfolio has been doing. Turns out, 80% of his holdings are in Apple. While Apple is a fine company and has done well, he should consider locking up most of his gain and focusing on capital preservation.

#2—Use trailing stop losses. We recommend setting trailing stop losses at 20% or less on all market investments. Stop losses can prevent catastrophic damage to your portfolio. As our portfolio grows, a trailing stop can help lock in a gain. While you may still face setbacks from time to time, a trailing stop limits them. You’ll live to fight another day.

I’ve spoken to some retirement investors who limit each holding to 4% of their portfolio and set 25% trailing stops. Whatever makes sense! Just limit the size of each position—and in doing so the potential for catastrophe.

#3—Diversification is the name of the game. This means internationalizing, too. Holding 5-6 mutual funds all in the United States or in US dollars just won’t cut it. You must diversify into non-correlated assets all over the world; so, should one segment or market tank, it won’t bring down a major portion of your portfolio.

You should also review the correlation of the asset you’re considering. What events in the market will cause the price to rise and fall? And pay particular attention to the near term. For example, until recently, utility stocks were considered the gold standard for retirees. Now there is so much capital in this sector, the stocks are correlating much closer to changes in interest rates.

Look for assets that are either uncorrelated to the market or those which may move in the opposite direction (the market goes down, this goes up, and vice versa).

Again, the game is: hold on to as much capital as possible and live to fight another day.

#4—Look for low duration on income investments. Bond sellers tout the safety of US government and investment-grade bonds. They are correct as far as default is concerned; however, a sudden rise in interest rates would mean a large loss for an investor holding these bonds who resells them in the aftermarket.

Retirement investors normally hold bonds for interest income, and they hold them until maturity. While some say bonds are still a good investment, most of these folks are traders. They buy high duration bonds (their market price moves significantly with changes in interest rates), betting on interest rates continuing to decline, and plan to sell for a profit down the road. We are not traders or market timers. Unless you are comfortable holding a bond until maturity, stay away from it.

When you invest money earmarked for retirement, using models that were in vogue as recently as 10 years ago will leave you vulnerable. Whether you’re considering bonds, utilities or any other investment vehicle, having the most up-to-date information is imperative. You can learn more about where bonds fit—or don’t fit—in your retirement plan by downloading our timely and free special report, Bond Basics, today. Access your complimentary copy here.