“The risk is quite high over the coming summer months,” Jason Goepfert told me yesterday.

“For investors, I wouldn’t want to make any more additional purchases right now,” he continued. “I would hold back a little bit.”

When Jason talks, I listen…

I rely on Jason – more than anyone else – to help me figure out whether investments are “hated” or not…

Long time readers know that I want to buy “hated” investments. But how do I define hated? What do I look for? And how do I track it?

My go-to source for these answers for years has been Jason Goepfert of SentimenTrader.com.

Jason shared some key insights with me yesterday… and I wanted to pass those along to you today…

Jason tracks investor sentiment. He looks for times when investors are extremely optimistic (so he can sell), or when investors are extremely pessimistic (so he can buy).

Right now, in the U.S. stock market, investor sentiment is becoming overly optimistic. And when you see that, typically the upside potential won’t be good over the next few months. Specifically, Jason has a 1-10 scale of stock market “risk.” And right now, he says the risk level is 7 – “well above average.”

What does that mean? “At a risk level of 7, stocks have returned 1.1% on average over the following three months,” he explained. “For comparison, when the risk level is at 3, stocks have returned 5.4% on average over the following three months.” (That’s based on 10 years of data.)

When the risk level is at an extreme – in the 9 or 10 range – you lose money, on average, over the next three months. We are not at an extreme – yet.

I asked Jason what he looks at to determine whether investors are optimistic or pessimistic. He said he looks at two types of indicators:

- What people are saying (typically sentiment surveys).

- What they are doing (what real money is doing).

He says the “real money” gauges are typically more useful because “people don’t always do what they say they’re going to do in a survey.”

So when you see an extreme in sentiment, what happens next? How quickly do you need to act?

I thought Jason’s answer was interesting…

“Bottoms usually are immediate. When it’s that panic phase, everybody is selling. So when those indicators trigger an extreme, typically the market will bottom within days.”

“Looking at tops is much more difficult… The sentiment extreme typically starts to take effect in one-to-three months’ time.”

In my opinion, Jason Goepfert is the best at what he does. I personally rely on his work.

Right now, Jason says that – based on his main sentiment gauge – the risk is “quite high.”

I wouldn’t bet against him…

Good investing,

Steve

P.S. If you have a serious interest in learning more about investor sentiment, I highly recommend you check out his site, www.SentimenTrader.com. The service is fantastic, and it’s significantly underpriced for the quality of work he does.

MARKET NOTES

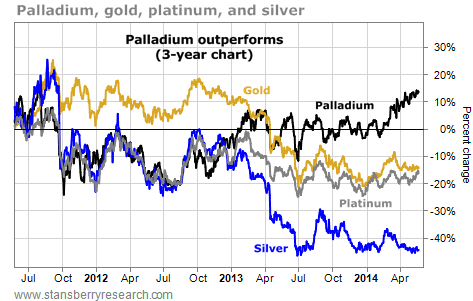

THE “OTHER” PRECIOUS METAL LEADS THE PACK