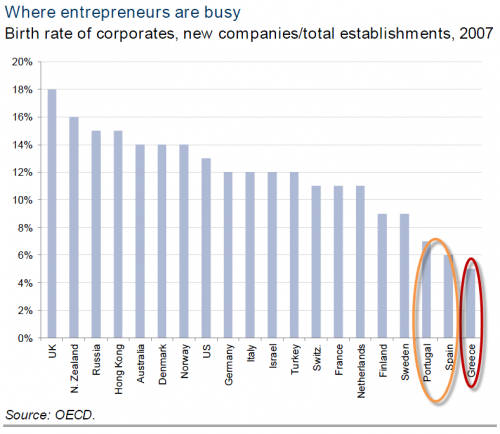

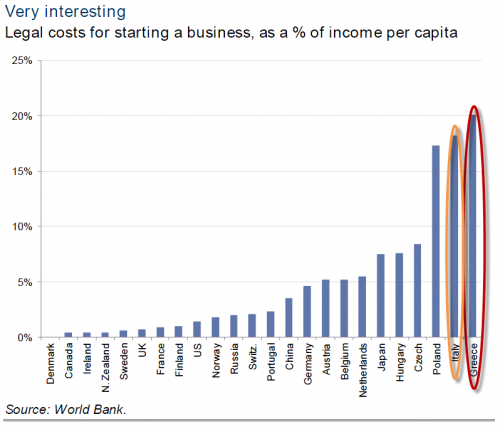

Perhaps after today’s budget miss in the Hellenic Republic it is time that the focus shift from the reality of a pending #fail for the voluntary PSI (for all the reasons we have at length discussed no matter how many headlines the markets tries to rally on) to a post-restructuring real economy reality in Greece. Whether self-imposed by devaluation or Teutonia-imposed by Troika, austerity is in the cards but there is a much more deep-seated problem at the heart of Greece – a total and utter lack of innovation and entrepreneurship. As Goldman’s Hugo Scott-Gall focuses on in his fortnightly report this week “the competitive advantage of innovation is one that developed markets need to keep” and in the case of European nations that desperately need to find a way to grow somehow, it is critical. Unfortunately, Greece, center of the universe for a post-restructuring phoenix-like recovery expectation, scores 0 for 3 on the innovation front. Lowest overall patent grant rate, lowest corporate birth rate, and highest cost of starting a new business hardly endear them to direct investment or an entrepreneurial dynamism that could ‘slow’ capital flight. Perhaps it is this reality, one of a Greek people perpetually circling the drain of dis-innovation and un-growth, that Merkel is starting to feel comfortable ‘letting go of’. Maybe some navel-gazing after seeing these three doom-ridden charts will force a political class to open the economy a little more, cut the red tape (after a drastic restructuring of course) and shift focus from Ouzo, Olive Oil, and The Olympics. We also suggest the rest of the PIIGS not be too quick to comment ‘we are not Greece’ when they see where they rank for innovation.

As if these were not bad enough, via Wikipedia, we also note the following three fun facts about the glorious Mediterranean nation:

Greece has the EU’s second worst Corruption Perceptions Indexafter Bulgaria, ranking 80th in the world, and lowest Index of Economic Freedom and Global Competitiveness Index, ranking 88th and 90th respectively.

Quite impressive…and no wonder 5Y CDS held their high cost of protection even when immediate credit event triggers were doubted…sooner rather than later they will default again unless something drastic changes and our admittedly premature discussion of more violence is becoming more and more likely every day as social unrest seems the only catalyst for change in a surreal world of central bankers, banks, and politicians.