U.S. equities outperformed commodities this year by a long shot, but commodities have a good chance to regain investor favor in 2014 after three consecutive years of declines.

“Something has got to give in 2014,” said Phil Flynn, senior market analyst at the Price Futures Group in Chicago.

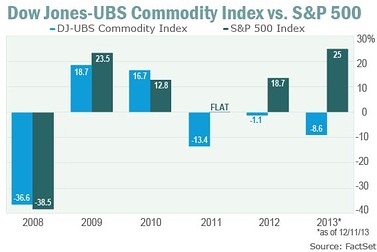

As the investing game draws to an end for the year, the near final score is: commodities down roughly 9%, based on the Dow Jones-UBS Commodity Index. The Dow Jones-UBS Commodity Index Total Return Exchange-Traded Note has lost 10% year to date. The S&P 500 Index, on the other hand, has surged 25%, on track for its best year since 2003.

“Based off historical norms, either stocks are way too high or commodities are way too low. The odds are high for either a massive commodity rally or a rather large stock market selloff,” said Flynn.

This year will mark a third year in a row in which commodities have underperformed U.S. equities. Including 2013, the Dow-Jones UBS Commodity Index has fallen for each of the last three years, as the S&P 500 Index scored significant gains over the past two.

….read more HERE