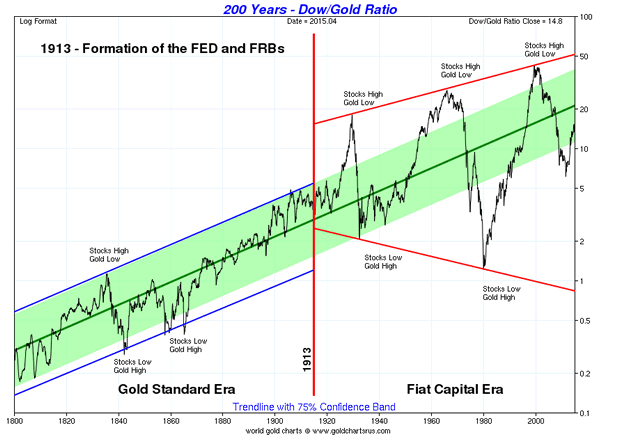

Larger Image – Source: www.sharelynx.com

One of the best ways to gain some perspective on stock markets and gold is to look at the Dow Jones Industrials (DJI)/Gold ratio. The Dow/Gold ratio has a long history as the 200-year chart above attests to. The ratio has had considerable movement over the years, which is an accomplishment in itself since gold was until August 1971 fixed first roughly at $20.67 and then at $35 in April 1933 when the Roosevelt administration revalued gold up in order to devalue the US$. The devaluation of the US$ was a part of the currency wars of the 1930’s. The Roosevelt administration also forbid the hoarding of gold, gold bullion and gold certificates and gold was purchased by the US administration at the then fixed rate of $20.67. The resulting profit was used to fund the Exchange Stabilization Fund (ESF) a fund that was established by the Gold Reserve Act of 1934.

One thing that stands out with the above chart is that following the creation of the Fed in 1913 the Dow/Gold ratio has become a lot more volatile. Sharp peaks (favouring stocks) were seen in 1929 at 19, 1966 at 29 and 1999 at 45. Deep troughs (favouring gold) were seen in 1933 near 2 and in 1980 near 1. Prior to the formation of the Fed, the Dow/Gold ratio ranged from roughly 0.2 to 5. Sharp lows were seen in the 1840’s and again in the 1870’s. Economic depressions were a feature of both those periods. If the broadening pattern that appears to have formed following the formation of the Fed were to hold to form, the Dow/Gold ratio could fall to the bottom of the channel that is currently below 1.

To give some further perspective to the ratio one should look at gold’s two bull markets – 1966-1980 and 1999-2011.

Charts created using Omega TradeStation 2000i. Chart data supplied by Dial Data

The Dow/Gold ratio peaked near 29 in February 1966. The ratio began a slow steady decline and made its final peak in April 1971 just under 25. By the time of the 1974 stock market bottom in December 1974 the ratio had fallen to near 3. The period that followed was the one that saw gold prices almost cut in half while the stock market started a recovery. By September 1976, the ratio was almost back to 10. It was at that point that gold began its sharp rise to $878 by January 1980. The stock market continued its range trading and in January 1980, the Dow Jones Industrials closed at 875. The ratio had fallen to roughly 1:1.

That turned out to be the low for the ratio and the Dow/Gold ratio began a long climb back in favour of stocks. It was not until 1995, however, that the Dow/Gold ratio finally broke the down trendline from the 1966 top. What followed was a swift rise in the stock market and a long period of weak gold prices. From 1995 to the top in 1999, the Dow/Gold ratio rose from roughly 10 to 45 as the DJI exploded from 5,100 to almost 12,000 while gold was falling from $388 to $252.

Source: www.bmgbullion.com

Charts created using Omega TradeStation 2000i. Chart data supplied by Dial Data

The last major peak for the Dow/Gold ratio was in August 1999 near 45. As with the market following the 1966 peak, the initial decline was gentle. The collapse got under way following the events of 9/11. There were brief rallies in favour of the Dow in 2003/2004 and again in 2006/2007 otherwise the trend of the Dow/Gold ratio was relentlessly down in favour of gold. There was another brief rebound for the Dow during the 2008 financial crisis but by 2009, the trend resumed in favour of gold. The ratio bottomed in August/September 2011 just under 6.

Since then a strong rally has been underway in favour of the Dow. Despite the strong rally in favour of the Dow, the Dow/Gold ratio remains well below its peak of 45 only recently hitting a high just above 15. The key downtrend line from the 1999 peak is currently near 20. A break of that level would signal that the trend has shifted firmly in favour of stocks as represented by the DJI. The current period from September 2011 is the first strong rally in favour of stocks since the gold bull market began back in 2001. Some have compared this period to 1974-1976 another time that stocks were favoured over gold during a gold bull market.

The Dow/Gold ratio appears to be forming what may be an ascending wedge triangle pattern. This pattern is normally bearish. A similar pattern is being seen on the S&P 500. A breakdown of the Dow/Gold ratio below 14 would be negative. Confirmation of a breakdown underway would be a decline below 13.50. Final confirmation of a breakdown would come when the ratio breaks under 11.30. Note the declining RSI that has been making lower highs even as the Dow/Gold ratio has been making higher highs. This suggests a deterioration in the Dow/Gold ratio even as it has been moving higher. The question now is not so much as to will the tide turn in favour of gold to when will the tide turn in favour of gold.

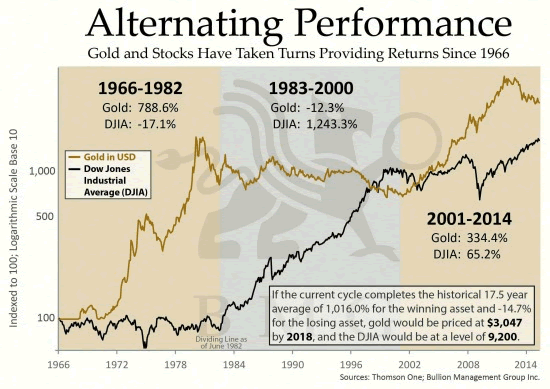

The next chart is an alternative way of looking at the record of the Dow/Gold ratio. The chart is courtesy of Bullion Management Group (www.bmgbullion.com). The chart sub-divides into three periods 1966-1982, 1983-2000 and 2001-2014. The former period largely covers the 1966-1983 Dow/Gold ratio chart above while the latter period covers primarily the 1997-2015 Dow/Gold ratio chart shown above. The 1966-1982 period was one of a bull commodity market while stocks were primarily in a long term bear market. The situation reversed itself from 1983-2000 as stocks soared while commodities were a bust. Since 2001, commodities have generally outperformed once again while stocks have suffered.

Source: www.bmgbullion.com

What stands out that setting aside the periods where gold outperforms stocks or stocks outperform gold, since 1966 gold has gained 3,328% ($35 to $1,200) while the DJI has gained 2,177% (785 close December 31, 1966 to 17,920 close April 8, 2015). Further, despite the bear market experienced by gold since September 2011, gold has gained 328% since 2001 vs. 79% for the DJI. Since gold became free trading in 1971 gold has proven to be the superior investment despite periods of underperformance.

This outperformance is dependent on where one wishes to start. I have seen studies suggesting gold’s gross underperformance. Those studies invariably started with the top in 1980 and a time when the Dow/Gold ratio was about 1:1. Argumentively I could also be criticised for starting back in 1966 at a time when stocks were high relative to gold. A more reasonable measurement of gold’s performance vs. the DJI might be to start in August 1971 when the gold standard ended and the current fiat system commenced. Except the DJI was higher in August 1971 then it was at the end of 1966. The Dow/Gold ratio was around 25.6:1.

Maybe where it should truly be measured from is the inception of the Federal Reserve that was founded on December 23, 1913. On that day, gold was fixed at $20.67 while the DJI closed at 78.11. The Dow/Gold ratio was 3.8:1. On that basis, the DJI wins with a gain of 22,819% vs. gold’s gain of 5706%. The DJI’s gains are before dividends. But then an ounce of gold back in 1913 is still an ounce of gold today whereas the DJI has undergone numerous changes over the years with weak companies removed and new strong companies added.

Probably the best reason for following the Dow/Gold ratio is to help in determining as to whether one should be in gold or stocks. While gold topped in September 2011 the confirmation that the tide had shifted in favour of stocks did not happen until 2013. It was on April 12 and 15, 2013 that the gold market broke down when parties unknown offered the equivalent of 400 tonnes of gold in the futures market at the open all at once. It was a definitive statement that the futures market or paper gold dominates the gold market and not physical gold. The question now is can paper gold continue to dominate? The slow shift of the physical gold market from London/New York to Shanghai suggests that physical gold may soon dominate once again.

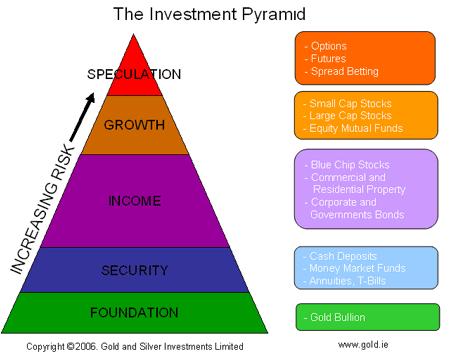

Physical gold has no liability unlike derivatives (futures), stocks and bonds. It is for this reason that some investment analysts place physical bullion as the foundation of any investment portfolio. This is the opposite of where traditional investment analysis places bullion. Following the Dow/Gold ratio can help one stay on the right side of the market.