Where To Find Decent Income Returns

01/14/2017 7:36 PMThe number one question we get at MoneyTalks these days is, "Where can I find investments that yield decent cash returns?". Michael interviews income stock guru Aaron Dunn to discuss how to overcome the double whammy of low interest rates and too many investors...

Fake News Rings Hollow

01/14/2017 7:26 PMThe media has a great concern about fake news, an issue that only became one when their favorite Democrats did not win the US Election. Michael on where this political advocacy and groupthink is going. ...also from Michael: Enormous Potential In...

The 3 Most Popular Articles Of The Week

01/14/2017 4:03 PM1. Gold’s fate as Western society cracks apart … by Larry Edelson Right now, gold is still caught in a trading range, but with a long-term bias toward exploding higher over the next few years to at least $5,000 an ounce. ...read more HERE 2. Massive VIX Warning for...

Prepare For Bearish News As OPEC Meets Next Week

01/13/2017 8:02 PMIt’s been an up and down week for crude oil futures with the price action playing out as expected. Going into the new year, we were looking for a choppy, two-sided traded largely because of the uncertainty regarding compliance with the OPEC/Non-OPEC plan to cut production, trim supply and return price stability to the market.

On the upside, we expected prices to be capped by rising U.S. production, while on the downside, prices were expected to be supported by reports that countries who had agreed to limit production would announce compliance with the plan. Based the price action this week, we can conclude that we’ve seen a little of both.

Weekly West Texas Intermediate Crude Oil

The main trend is up according to the weekly swing chart. However, momentum has been sideways for the last four weeks. A trade through $56.24 will signal a resumption of the uptrend. A trade through $44.49 will change the trend to down.

Given the average weekly range, it’s pretty safe to say the uptrend is safe next week.

The major 50% to 61.8% retracement zone is $50.69 to $54.25. The market is currently straddling this zone and to be specifically, it is straddling the Fibonacci level at $54.25.

Based on the price action since December 16, the direction of March Crude Oil next week will be determined by trader reaction to the Fib level at $54.25.

Bearish Scenario

Enormous Potential In Transit

01/13/2017 3:38 PMA conclusion by a new MIT Study says that we are on a brink of dramatic change. NY's current 14,000 taxis will drop to 3,000 and wait times to under 3 minutes! ...speaking of cities: Canada 6-City Housing & the...

These New Numbers Suggest A Big Year Coming In This Oil Sub-Sector

01/13/2017 3:09 PMHere’s one of the most important charts we might see in oil and gas this year. New this week from industry watchdog Wood Mackenzie — showing how many offshore petroleum projects will likely see final investment decisions (FIDs) during 2017.

Wood Mackenzie sees a major surge coming this year in investment decisions on offshore oil and gas projects

There are a few important things to note here. First, approvals of new petroleum projects were running strong between 2007 and 2014 — with the blue bar on the left showing how FIDs during this period averaged 40 projects per year.

Will the Stock Market Bull Continue to Charge or is it time to sell the news

01/13/2017 2:55 PMFor of all sad words of tongue or pen, the saddest are these: ”It might have been!”

John Greenleaf Whittier

For a long time, our theme was to view all sharp pullbacks through a bullish lens as the trend based on our trend indicator was trading firmly in bullish territory. Secondly, onecritical psychological component was in our favour too- the masses were either bearish or they cursed this market from the sidelines (neutral camp); hence the slogan the most hated bull market in history. We must deter for a second by stating that a mild or brutal correction comes down to what level you embraced this market. If you embraced this Stock Market Bull in the early stages from 2009 -2011, then a mild correction would seembrutal or back breaking in comparison to someone who just jumped into the market. A 15-20% correction would knock the socks out of them, but for you, it would appear to be nothing but a blip; this is why we have consistently stated that the best time to open long positions when the masses are in a state of despair.

Having said that what does the future hold?

Towards the end of last year around Dec, we stated that we were getting a tad bit nervous as the crowd had started to embrace this bull market. Up until the Trump win, which we saw as a bullish event for the markets, while most experts viewed it as a death omen, the masses were either bearish or sitting on the sidelines. Bullish sentiment was generally below 40%, and the combined score of the individuals in the bearish and neutral camp was almost always above 55% and in most cases above 65%. After Trump had won the markets experienced an initial shock but recouped twice as fast as they did with Brexit and never looked back since. During this monstrous rally, the sentiment gradually started to improve, and for the past 11 weeks, the percentage of individuals in the bullish camp hasalways been above the 40% mark. On three occasions in the past 11 weeks, the bullish sentiment soared above the 50% mark something we had not experienced even once over the past 30 months. As we pay close attention to the masses, this had to be treated as a significant development.

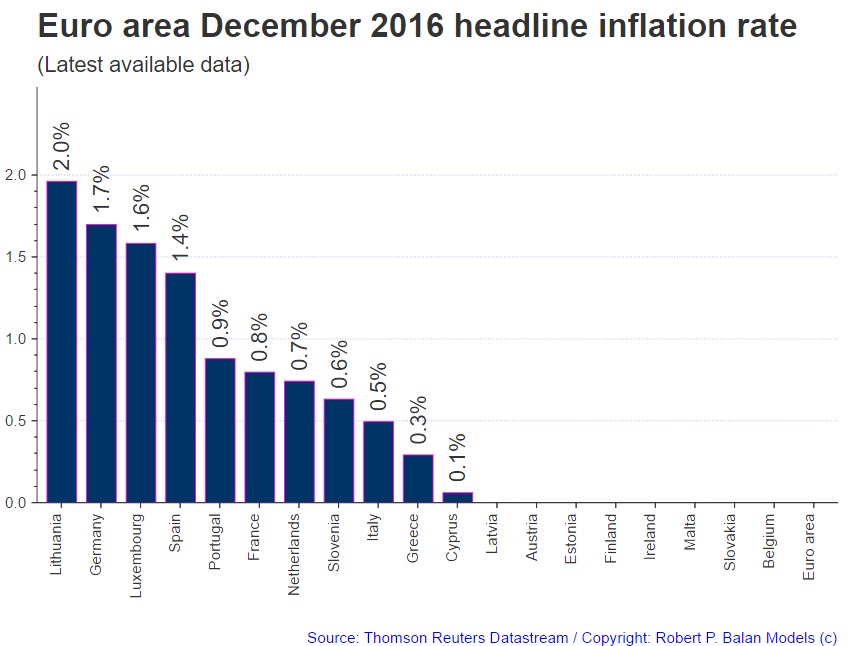

Inflation Is Rearing Its Head Everywhere, And Now In Germany – The Implications For The U.S. Dollar And Euro Relationship

01/13/2017 1:23 PMSummary Latest Eurozone data indicate a substantial jump in inflation in Germany in December , eliciting calls that ECB president Mario Draghi, end his ultra-loose policy and raise the policy rate. The reality is that with energy costs rising quickly, the strong...

Canada 6-City Housing & the Plunge-O-Meter

01/13/2017 1:00 PM

The chart above shows the average detached housing prices for Vancouver*, Calgary, Edmonton, Toronto*, Ottawa* and Montréal* (the six Canadian cities with over a million people each) as well as the average of the sum of Vancouver, Calgary and Toronto condo (apartment) prices on the left axis. On the right axis is the seasonally adjusted annualized rate (SAAR) of MLS® Residential Sales across Canada (one month lag).

They Call Him “The Forecaster” For Good Reason

01/12/2017 7:13 PM- The Italians voted No in what is potentially a monumental referendum - The Austrian rejected the far right anti-EU candidate in the December presidential election - Donald Trump won the US presidential race - The UK voted to leave the European Union My point -...