Radical Self-Honesty

01/10/2017 12:32 AMJanuary is a time for reflection and planning. While it’s easy to admit we need to lose a few pounds or watch less TV, matters related to our skills and competence strike closer to home, i.e. closer to our ego. This is where it gets delicate, and also where real...

How Did We Get 2016 So Wrong?

01/09/2017 10:19 PMGo through the late 2015/early 2016 articles published on this and similar sites and you’ll find a consensus that 2016 was going to be a really bad year. Corporate profits were falling, business inventories had spiked, and deflation was deepening in Japan and Europe. See More Ominous Charts For 2016 for a longer list of indicators that seemed, a year ago, to portend imminent recession if not full-blown financial crisis.

As David Stockman put it in a late-2015 prediction piece,

The Keynesian Recovery Meme Is About To Get Mugged, Part 1

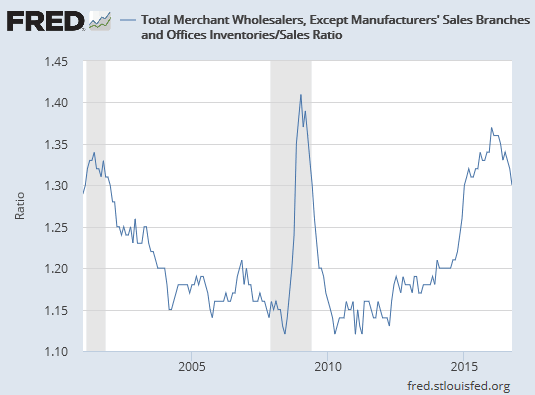

Just consider the most recent data on wholesale sales and inventory. This sector of the domestic economy embodies the leading edge of business activity, meaning that trends in wholesale level sales and inventory stocking are advance indicators of the general macroeconomic outlook.

Needless to say, the soaring inventory-sales ratio is not a sign that “escape velocity” is just around the corner. Contrariwise, whenever the ratio has busted through 1.30X in the past, what came next was a recession.

Live From The Trading Desk: Long & Short Term Positions Now

01/09/2017 6:32 PMVictor Adair covers the recent action in Gold, Interest Rates, Crude Oil, CDN Dollar, US Dollar and the very powerful Stock Markets. Also Victor on what he is doing long term to protect all assets. ....related: Agri-Equities and Agri-Food Prices: Both Strong...

Real Estate Forecast 2017

01/09/2017 6:13 PMOzzie Jurock first covers the 2016 year end real estate numbers, the big story being Toronto up powerfully. Victoria, Vancouver and other cities in BC have seen sharp decreases in single family homes, though increases in condo sales. ....related: Surprising New...

Gold Price Plummets After Trump Win, Huge PM Purchase Opportunity

01/09/2017 5:57 PMGold per troy ounce (toz or oz) in $ terms has slumped by a whopping 11% since the November 8, 2016 election. The dollar’s trade-weighted value, meanwhile, has risen by 4% over the same period, while the value of the 10-year Treasury has fallen by a considerable 6%...

ETF Trends: Hedge – 1/9/17

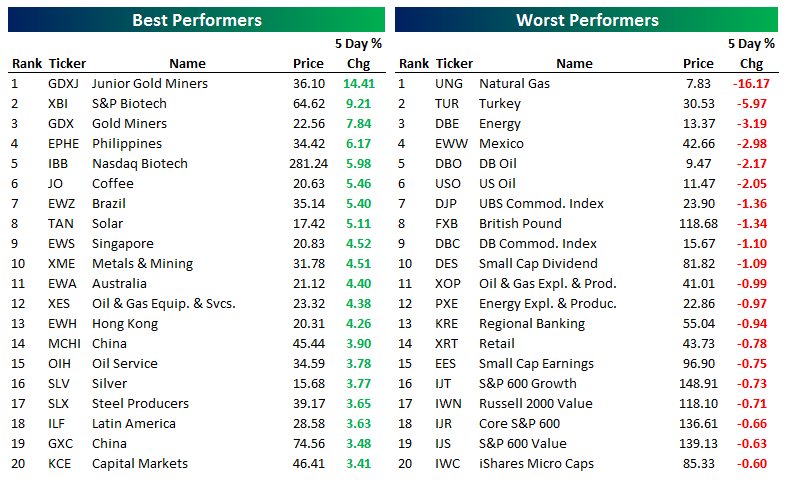

01/09/2017 5:53 PMGold miners have surged over the last few days with the shiny metal’s recovery in recent sessions. Biotechs have also made a bit of a comeback while metals and mining, east Asian equity indices, and oil services have also done well. Over the past week natural gas has...

Hang ‘Em If They’re Not Progressive

01/09/2017 5:36 PMThe same assault on free speech that is attached to those who question Global Warming has crossed over into any discussion of economic systems that isn't one of high taxation on corporations and massive government spending. So-called "progressive" economics.. ....more...

Agri-Equities and Agri-Food Prices: Both Strong

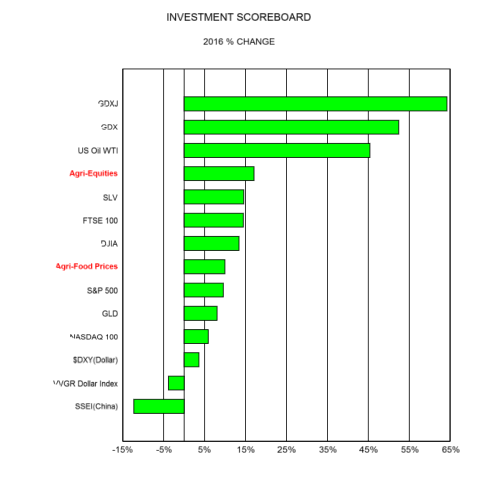

01/09/2017 4:20 PMWhen has food been more valuable than technology? Aside from all of history, that was especially true in 2016. Chart below is our Investment Scoreboard for 2016. In it are portrayed the returns for a variety of important market measures. Gold stocks, Silver, oil, and...

Real Estate Forecast 2017

01/09/2017 2:17 PMOzzie Jurock first covers the 2016 year end real estate numbers, the big story being Toronto up powerfully. Victoria, Vancouver and other cities in BC have seen sharp decreases in single family homes, though increases in condo sales. ....related: Surprising New...

Live From The Trading Desk: Long & Short Term Positions Now

01/08/2017 2:26 PMVictor Adair covers the recent action in Gold, Interest Rates, Crude Oil, CDN Dollar, US Dollar and the very powerful Stock Markets. Also Victor on what he is doing long term to protect all assets. ....related: Agri-Equities and Agri-Food Prices: Both...