It’s a multi-dimensional question.

The left says yes — income inequality has soared in recent years, and the way to address it (supposedly) is to tax the rich and capital gains at a higher rate. The right says no — that the rich already create more jobs and wealth, because they spend more money, and why (supposedly) should they pay more tax when they already pay far higher figures than lower-income workers?

Paul Krugman made the point yesterday that the tax rate on the top earners during the post-war boom was 91%, seeming to infer that a return to such rates would be good for the economy.

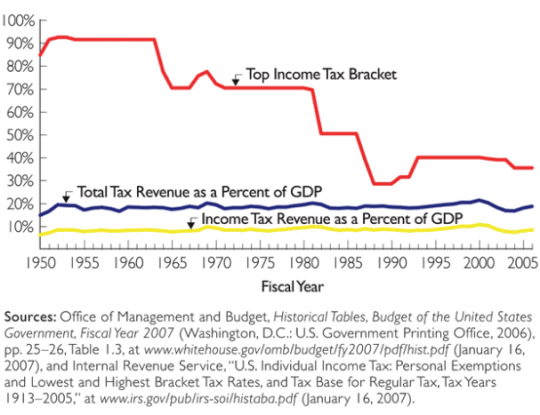

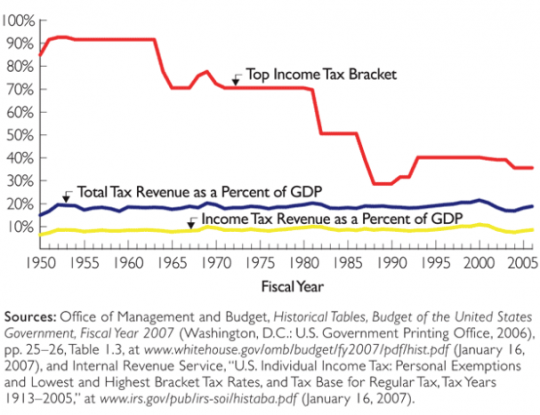

Yet if we want to raise more revenue, historically it doesn’t really seem to matter what the top tax rate is:

Federal revenues have hovered close to 20% of GDP whatever the tax rate on the richest few.

This seems to be because of what is known as the Laffer-Khaldun effect: the higher rates go, the more incentive for tax avoidance and tax evasion.

And while income inequality has risen in recent years, the top-earners share of tax revenue has risen in step:

To Read More CLICK HERE