Michael Campbell: Welcome back to the show with me Don Vialoux he’s the author of timingthemarket.ca tech talk. Don first of all appreciate you taking the time as I know you’re on vacation. Let’s start with just introducing people exactly what you do, about the style of Technical analysis that you’ve been doing for 37 years.

Don Vialoux: What we do is we combine technical analysis fundamental analysis and seasonality analysis to come up with investment recommendations. A good example is right now, right around this time of year there’s a very interesting sector which normally does very, very well and that’s gold.

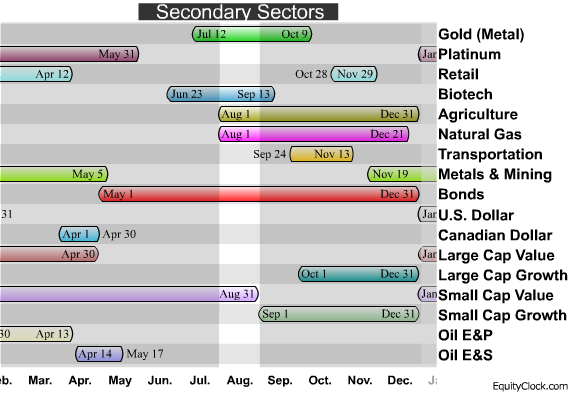

Michael: Let’s start with seasonality. The seasonality is looking at patterns to find out as an example, 18 of the last 23 Augusts or August/September periods gold has risen. Is that the kind of thing that’s starting with seasonality?

Don: Yes that’s exactly what we do, historically gold equities move higher from July the 27th to September the 25th and that’s been a very consistent pattern for a very long period of time. In fact it’s very interesting no comment came up by Jim Kramer last week on CNBC, that wild guy. He mentioned that the price of gold during the last 17 periods and actually the gold Philadelphia gold index itself has gone up 8.3% per period on average during the last 17 Septembers. So we’re just entering this period when gold normally does very, very well.

Click on the image or go HERE to view all of the Seasonality Charts.

Michael: Are you making a distinction here between gold bullion prices and gold stock prices or are they basically the same in this movement?

Don: They both [move in] about the same time. The key is you want to be in the sector that has the best relative performance. So right now for example gold stocks are out performing gold. So the preferred strategy this year for gold trade is to go into gold equities as opposed to gold.

Michael: I think what people really enjoy is looking at those historical probabilities, to say that July 27th to September 25th there is normally this kind of movement. How does technical analysis work into your analysis?

Don: Yes we use short term indicators to give us buy and sell signals. So for example this year we had a technical buy signal based on RSI (Relative Strength Index) and moving average convergence divergence. They all came in around the third week in July this year they actually came in slightly earlier than normal.

Michael: Now let me ask you when you look at these segments of the market do you find that some are more attuned to the seasonality analysis and in some segments it’s not as reliable an indicator?

Don: Yeah there are certain sectors which perform better on basis than others. The key is to look at the annual recurring events that trigger the seasonality. And if those annual events are happening then yes you go for it. And in the case of gold for example the annual recurring event is buying of gold to make into jewelry for Christmas and for the Indian diwali season. But this year there’s something different that’s happening which is I think even more important. We’re starting to see people in China buying more gold to make into jewelry than even India which is quite amazing. Historically India has been the biggest buyer of gold for jewelry purposes for many, many years and now we have an extra buyer coming in the market.

Michael: Now let’s come within the individual stocks themselves do you do, do you apply the same analysis to say some of the senior gold stocks I’ll pick a couple maybe a Gold Corp. or Barrick Gold.

Don: That’s a great question because my site timingthemarket.ca focuses on markets and sectors. It turns out there is another site that recently was introduced in February this year that focuses on individual security and that site is equityclock.com. Once again it’s a free site and it’s offered by my son John

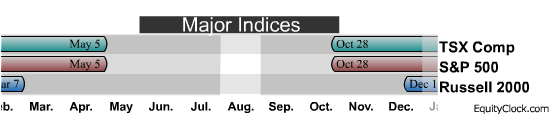

Michael: Let’s start with the big picture which is the overall market itself, maybe the Canadian market or the US market you tell me. Where are we at with those?

Don: Well first of all let me give you a very small bit of both. Next week economic data comes from the US will be slightly positive. So you might get a small bounce next week, however be very careful because historically in a mid term election year like we are in right now US equity markets get hit very hard from approximately the middle of August until the end of September. And there’s good reason to believe that that’s exactly what’s gonna happen again this year. That’s the bad news now let me give you the good news. Historically the bottom of the four year presidential cycle occurs in the fourth quarter of a mid term election year. So looking for a significant weakness we are probably gonna testing the lows that we saw in early July for all the major equity indices between now and let’s say at least the end of September. And after that look for a significant move on the up side in North American equity market.

Michael: Is October a factor? In October 1929 thats when that big crash took place, again in 1987. I can think of 2008 where the real damage was done by about the first week of October.

Don: Well historically the weakest month of the year is the month of September we’re finding out that once more for equity markets. The key is that often the month of October is a very interesting month because you’re right historically you had these big down movements in the month of October itself. The great thing is that historically the month of October is usually the bottom of the annual market moves. And that’s also getting lined up once again this year. Actually the low coming up this fall probably will not happen like it normally does at the end of September. I’m guessing it’s gonna happen a little bit later probably closer to the end of October this year. And there’s a reason for that it has got everything to do with taxes. Yes the Bush tax cuts expire at the end of this year. If you have a capital gain you’re gonna want to take that capital gain before the end of this year which implies significant selling by American investors prior to the end of the year. If you take the capital gain right now you pay a tax of 15%. Next year the tax from that same capital gain could be between 30 and 37%. So huge amounts of selling pressure coming into US markets just for tax purposes alone late this year, probably bottoming sometime in October.

Michael: Yeah I’m really glad you’ve brought this factor up because I’ve felt for the better part of this year that this is going to be a huge overhang in the market because the differences are so significant if those tax cuts just get allowed to expire. You’ve just outlined that in dividends or on capital gains there’s a huge change coming that really is going to motivate people to get out of the market. That’s a great example of how you said right at the outset you take seasonality you take technical analysis and then you mixed in the fundamentals. That’s a great example of the fundamental you know giving credence to what your seasonality tells you.

Don: Exactly

Michael: I just want to fire a whole bunch of sectors at you. We’ve just talked about gold what about seasonalities for silver before we leave those two?

Don: Yeah silver is slightly different than gold. It’s more of an economic commodity; its tendency is to strengthen from October to March of each year. But it clearly does benefit from strength in gold equities late in the year as well. It’s a little bit early to play the silver, silver has actually been significantly under performing gold during the last few weeks because it’s more of an economic commodity as opposed to a monetary commodity.

Michael: Let me go down to oil. We’ve had a little bit of a correction in the last week 10 days. What’s the seasonality for oil?

Don: Well actually oil’s kind of a mixed seasonality at this point in time of the year. It turns out another commodity related to it has a period of seasonal strength coming in around the end of August and that’s natural gas. Natural gas tends to respond late in August to hurricane season. We still have hurricanes around that time of the year and that tends to be the time when we get a boost in demand for natural gas because of concerns of what’s going to happen for hurricanes going into the gulf. We’re a little bit early to that trade yet but stay tuned it looks like a very interesting one. Historically natural gas prices do move higher right from usually say middle of August to the end of August right through until the end of December.

Michael: Has natural gas been a very reliable pattern?

Don: Yes it has. It is the most volatile of all the commodities so be very careful when you may go into the trade and when you come out of it.

Michael: Let me just go to the Canadian dollar right now.

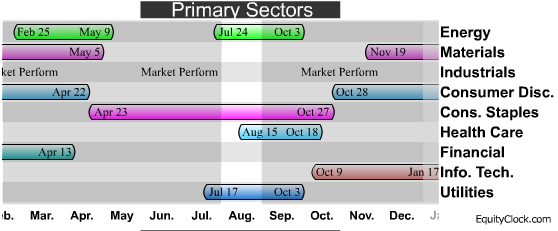

Don: The Canadian dollar is kind of mixed right now. Actually if you’re looking at sectors which are of interest right now consider two that’s agriculture and technology. Those are a couple of areas to be of focus on right now.

Michael: Tell me a little bit more about agriculture.

Don: The periods of seasonal strength are between the beginning of August until the end of December. The reason for that is farmers receive their revenues in the second half when they receive funds from selling their grains. Right near the end of the year the farmers have to make some choices. At that point in time they have revenues at a certain level they have expenses at a certain level in between there’s tax flow income. Right near the end of the year farmers say okay I want to reduce my tax flow income so then they go out and buy a whole bunch of fertilizer or a John Deer tractor. And that result is that faith in the agricultural sector tends to peak right around the end of the year. And this year is looking like a banner year because grain prices are moving sharply higher that’s helping a lot.

Michael: So this is the entry point is right around this month?

Don: Actually it happened a little bit earlier than normal this year. The entry point occurred right around the third week in July. The sector on a short term basis is slightly over bought and you may want to wait for a little bit of weakness over the next week or two. But the sector does look very, very strong right through until the end of this year. Lots of reasons for it grain prices are moving strongly higher because of concerns about crops in quite a few countries. You see what’s happening in Russia, they are having a hard time over there. We saw what happened in western Canada a lot of the crops were wiped out by flooding. We’ve seen flooding in China and Pakistan. Meanwhile we are starting to hear about droughts in Western Australia and also Argentina. This is all good news for farmers in the US. And they are going to benefit from higher grain prices going forward. That means they’ll be buying a lot more fertilizer and a lot more John Deer tractors.

Michael: Lets come to the technology side that you mentioned. Is there a more specific idea within the technology side as there are so many aspects of technology?

Don: Yes the key is that right around from October the 9th on average right through until January the 17th the whole sector goes higher. It has a lot to do with people buying consumer electronic goods for Christmas. Now what happens is that there is a lot of buzz at that time for on these new technologies coming to market. And that causes stocks related to those consumer electronic goods to move significantly higher. A good example last year we had the introduction of Windows 7 of the newest edition of Office. At that time we had the iPhone 3 we had the latest Blackberry. So last year was a very good time to do this trade. This year looks even better because we have the iPhone 4 we have the iPad we have the latest Blackberry coming to market. There is 3D television and all kinds of really good and interesting technologies coming to market this fall. So the trade is getting lined up, it’s not there yet as we’re not into October but stay tuned to our sites timingthemarket.ca and equityclock.com and we’ll try to give you an idea on when to enter this trade.

Michael: That’s such a great example of how fascinating this work is. You look back to see if historically has there been a period of time when it’s been better to to buy or sell then you look at the technical side, relative strength etc. Then you look for a fundamental reason, that iPad or iPhone 4, the new RIM cell phone is coming out. The Kindle is a big success you know the new latest version of Kindle coming out of Amazon which is their biggest seller. There is just such a long list.

Don: Exactly something very important though when you’re looking at the technology sector. Notice that I said that January 17th historically is the time that the period of seasonal strength ends and that’s because of a very important event that happens every year that’ s when the Las Vegas consumer electronic show occurs in the second week in January. And that’s when all the technology companies introduce their products for the next Christmas. That’s the last of the good news so that’swhen you take your profits.

Michael: Any other sectors that jump out at you?

Don: Yes actually there is a couple of sectors one in particular transportation this is a sector which has been hot this year and now we’re starting to hear that the economies in the world in particular the United States are starting to show of slower growth. And that means that, the big premium that we’ve seen in transportations stocks is probably going to start coming out of the market. So look for the transportation sector to significantly under perform the market. It’s a good one to get out of right now historically the sectors would lower from approximately the second week in August right to until the end of September.

Michael: Okay. I guess the trouble is Don when I’m talking I’m always making notes at the same time I’m using this advice personally. Alright Don it’s always a pleasure to talk with you and we appreciate so much that you take time and I know you’re on vacation right now I hope the weather stays beautiful as it is and we’ll talk to you in early in the fall I hope.

Don: Thanks Michael.

Technical Analysis by the highly respected Don Vialoux of Timing the Market CLICK HERE for his full Report every day incuding Charts.

Don Vialoux has 37 years of experience in the Investment Industry. He is a past president of the Canadian Society of Technical Analysts (www.csta.org) and a former technical analyst at RBC Investments. Don earned his Chartered Market Technician (CMT) designation from the Market Technician Association in 1995. His CMT paper entitled “Seasonality in Canadian Equity Markets” was published in the Spring-Summer 1996 edition of the MTA Journal. Don also has extensive experience with Exchange Traded Funds (also know as Index Participation Units) as well as conservative option strategies. In 1990 he wrote a report that was released in the International Federation of Technical Analyst Journal entitled “Profiting from a Combination of Technical and Fundamental Analysis”. The report introduced ” The Eight Phases of the Stock Market Cycle”, an investment concept that continues to identify profitable entry and exit points for North American equity markets. He is currently a member of the Toronto Society of Fundamental Analyst’s Derivatives Committee. Now he is the author of a daily letter on equity markets available free on the internet. The reports can be accessed daily right here at www.dvtechtalk.com.