The March 2004 issue of The Elliott Wave Theorist postulated a 7-year crisis cycle going back to 1973 and used it to predict another crisis in 2008. Here are the table and the forecast from that issue:

—1973: Arab oil embargo, with spillover into 1974 stock market low of wave IV.

—1980: peak in the inflation rate; top in gold, silver and mining stocks, interest rate spike, stock-market “massacre” and low of wave 2 (circle).

—1987: stock market crash and low of wave 4 (circle).

—1994: “Republican Revolution;” suspicion of government due to Waco attack (1993), “black helicopters,” etc.; stock market breaks uptrend line at low.

—2001: successful terrorist attack on the World Trade Center; low of wave (3) of 1 (circle) [actually 3 (circle) of a].

Seven years after 2001 is 2008, so that is the next year to look for an extreme in social fear.

There was certainly a crisis and plenty of social fear in 2008, so this cycle performed as it should have. This rhythm prompted me to wonder if there might be a 7-year cycle in the stock market that would explain the regular appearance of these crises.

THE OUTLOOK FROM TIME CYCLES

Cycles can be quite useful for a time.

For some time, I had tracked a 3.3-year cycle, which was distinct from 1978 to 1997 and then disappeared. The venerable 4-year cycle was distinct from 1962 to 2002. There was a minor pullback into late 2006, and if the 4-year cycle were still operating, its next low would be due in late 2010. This is one reason why I expected a sharp rally off the 2009 low and then a crash. This rally has been sharp, but it has gone on too long to fit into a four-year cycle profile, so we have to treat the 4-year cycle as also gone. This outcome prompted me to go back to the charts to see if there have been any consistently reliable cycles since the beginning of Cycle wave V to now. I think I have found something very interesting.

The 7.25-Year Stock Market Cycle

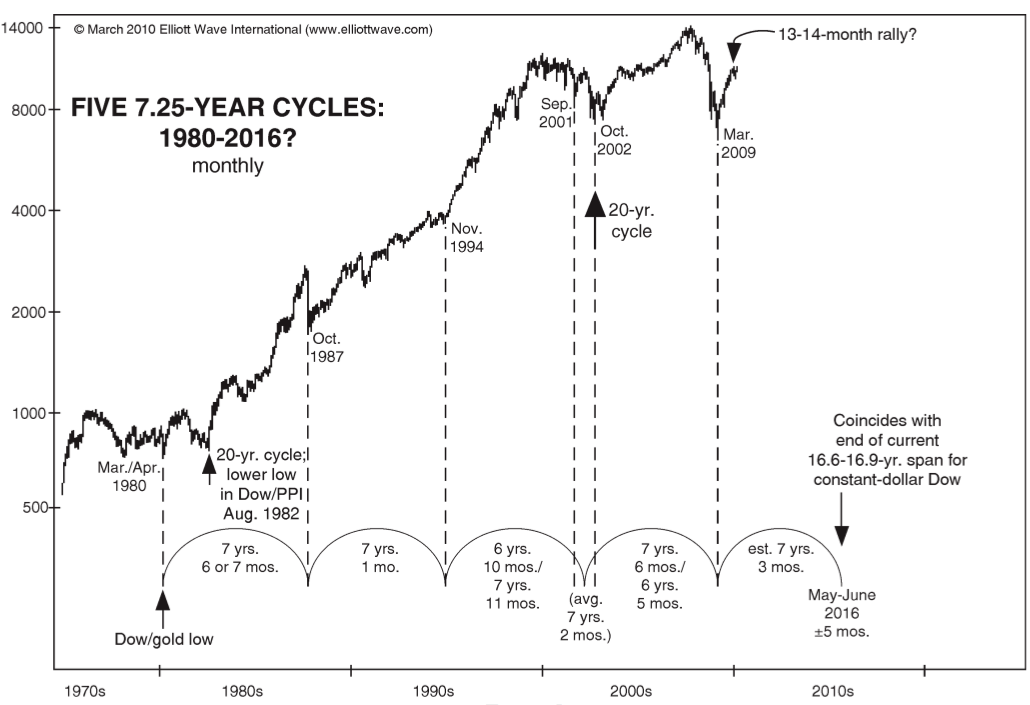

I do not recall anyone talking about 7-year cycles in stock prices. I’ve heard about 3-, 4-, 6-, 8-, 9-, 10-, 11-, 12-year cycles and longer but not a 5- or 7-year cycle. As it turns out, seven years has been the most important cycle duration since Cycle wave V began. It marks the lows of 1980, 1987, 1994, 2001/2 and 2009.

The average length of this cycle is very close to 7 years, 3 months. The next major bear market bottom is thereby due 7 years 3 months after the March 2009 low, i.e. in June 2016.

Ed Note: This commentary on cycles came from a 10 page Forecast titled published in April 2010 in which explains in detail Robert Prechter’s Market Forecast.