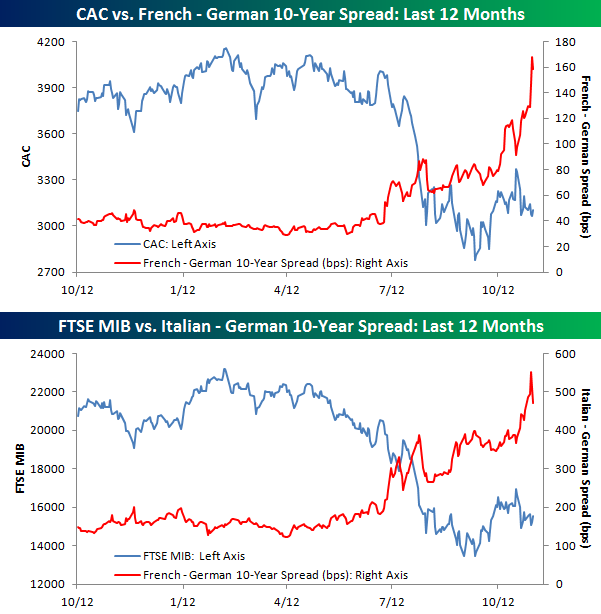

If you are wondering why investors are focusing so much attention on the spreads between sovereign debt yields of Italy, and now France, take a look a the charts below. In each chart, the blue line represents the price of French and Italian benchmark equity indices, while the red line shows the spread between each country’s 10-year sovereign debt yields and the yield on German 10-year debt. For both France and Italy, their benchmark stock indices both went into a free-fall just as debt yields became unanchored from the yields on German debt.

Today, spreads have tightened by between 5% and 8% in both countries, and not surprisingly equities in both countries are higher.

Oil Now Solidly Above its 200-Day

While the S&P 500 has been stymied by its 200-day moving average recently, oil (West Texas) has made mince meat of it. As shown below, oil had a bit of trouble with resistance at its 200-day last week, but this week it has broken solidly above it. Now oil’s 200-day should act as some nice support as the commodity makes another run towards the $100 mark. Just what the consumer needs heading into the holidays!

Brent – WTI Spread Drops to Lowest Level Since June

Is the debt crisis in Europe beginning to make its presence felt in the oil market? A look at the spread between Brent and WTI crude oil suggests that the answer is yes. Even though the price of WTI has recently been soaring, thanks to a lack of a meaningful rally in Brent North Sea crude, the spread between the prices of the two benchmark oil prices dropped to $15.30 today for its lowest close since mid-June. It’s for this reason that the higher price of WTI crude hasn’t yet worked its way to the gas pump, and consumers can only hope that it stays that way.

Subscribe to Bespoke Premium to receive more in-depth research from Bespoke.