We would like to provide an update on all of our stock suggestions beginning with our gold stock suggestions, then our silver stock suggestions and finally our agriculture stock suggestions.

NIA Gold Stock Suggestions:

Capital Gold Corp. (CGLD) reached a 52-week high on Monday of $0.93 up 50% since we suggested it on August 5th at $0.62. CGLD just announced on Friday that first fiscal quarter 2010 gross proceeds were up 27% over the first quarter of 2009 to $11.7 million on 11,733 ounces of gold sold. Monthly gold production is currently running at approximately 4,200 ounces and CGLD expects further increases once their additional crushing plant module and the new leach pad becomes operational by the end of this calendar year. CGLD’s proven and probable reserves recently increased to over 1.5 million gold ounces. We expect this stock to eventually move off of the OTC BB and on to a higher exchange which will allow institutions the opportunity to invest.

Entrée Gold Inc. (EGI) reached a 52-week high in early October of $3.16 up 127% since we suggested it on July 9th at $1.39. It has since then drifted back down to $2.64. EGI could underperform other gold stocks in the short-term now that the anticipated investment agreements in Mongolia have been signed. It will take years for EGI to generate revenues through either license agreements or production, but it is possible that EGI will begin generating revenues during the peak of gold mania. Therefore, there may come a time in two or three years that EGI becomes the biggest gold play in the entire market.

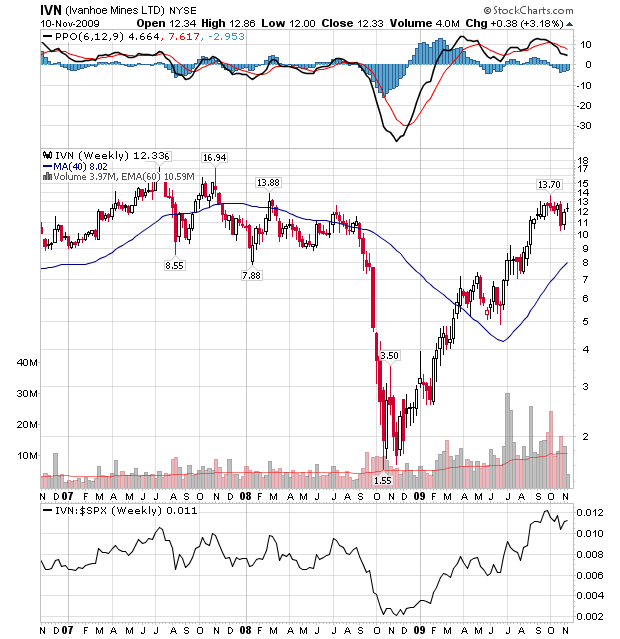

Ivanhoe Mines Inc. (IVN) reached a 52-week high in early October of $13.70 up 135% since we suggested it on April 15th at $5.84, and has since dipped back to $12.33. We expect IVN to follow EGI somewhat closely as IVN owns a percentage of EGI and they are joint venture partners in Mongolia. IVN is the safer play of the two but EGI has the potential for larger gains over the long-term.

DRDGOLD Ltd. (DROOY) is currently down 24% to $5.45 since we suggested it on October 18th at $7.20. We went over DROOY’s financial problems in our report and said we felt it was factored into the share price, but clearly we were early and the stock hadn’t yet reached its bottom. We believe the investment community was surprised by DROOY’s rapidly increasing electricity costs, which have gone up 32% since July. DROOY has had a perfect storm of bad news that started with seismic events damaging the high grade shaft at their Blyvoor mine, which was followed by a worker strike that lasted for four weeks. South Africa’s rapidly increasing Rand, which has gained this year by more than gold, has also hurt DROOY’s margins. DROOY has been in business for over 100 years and we believe the company will turn around. Most likely we will look back at this current time as having been an excellent buying opportunity.

Yamana Gold Inc. (AUY) is currently $12.61 up 54% since we suggested it on April 8th at $8.17. We believe AUY has established itself as the safest and most solid mid-tier gold producer with the greatest chance of becoming the next large-scale miner. AUY’s revenues in the 3Q of 2009 were up 50% over a year ago to $333.2 million and adjusted net earnings were up 180% over a year ago to $88.3 million. AUY is committed to the sustainable production of at least 1.1 million gold equivalent ounces annually and increasing from 2010 onward.

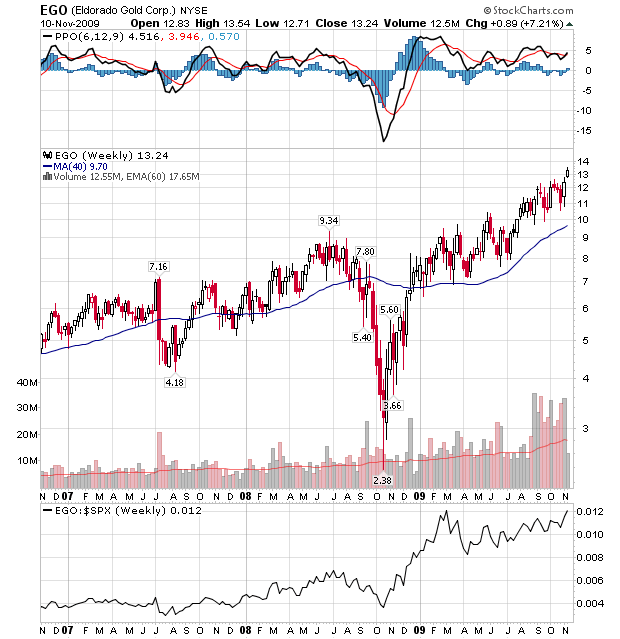

Eldorado Gold Corp. (EGO) reached a new 52-week high on Monday of $13.54 up 48% since we suggested it on April 1st at $9.14. EGO is our second favorite mid-tier gold producer. EGO isn’t growing as fast as AUY but they have the lowest production costs out of all mid-tier gold producers. In the event gold prices were to make another dip EGO won’t have any problems continuing to operate profitably.

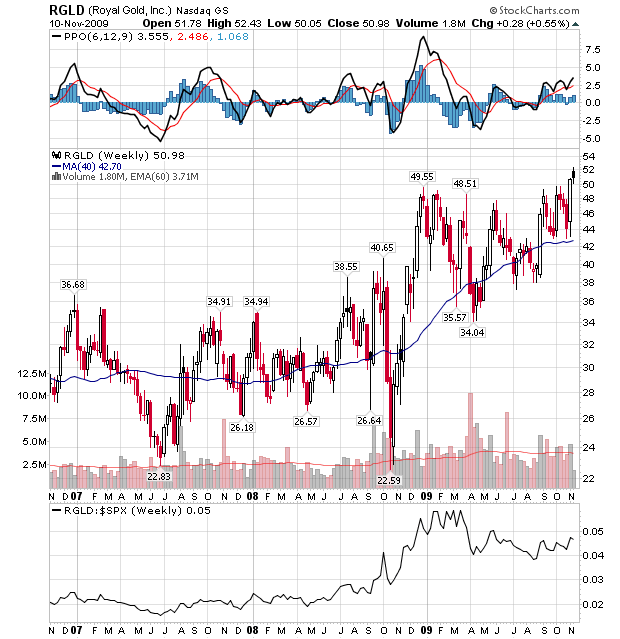

Royal Gold Inc. (RGLD) reached a new 52-week high on Monday of $52.43 up 24% since we suggested it on March 18th at $42.21. RGLD has been generating very consistent revenue growth quarter after quarter. This company is leveraged to the upside potential of gold without the downside risks of having to pay for the production costs. We consider it to be a very safe play but most likely it won’t be able to outperform many of the mid-tier gold producers.

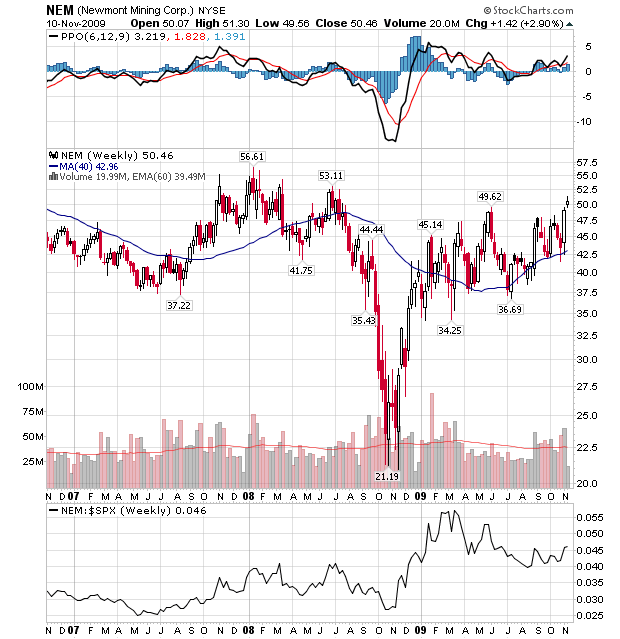

Newmont Mining Corp (NEM) reached a new 52-week high on Monday of $51.30 up 26% since we suggested it on February 26th at $40.68. For the past six months NEM has underperformed the price of gold and we believe it could have some catching up to do in the short-term. We expect to see NEM keep rallying to new 52-week highs.

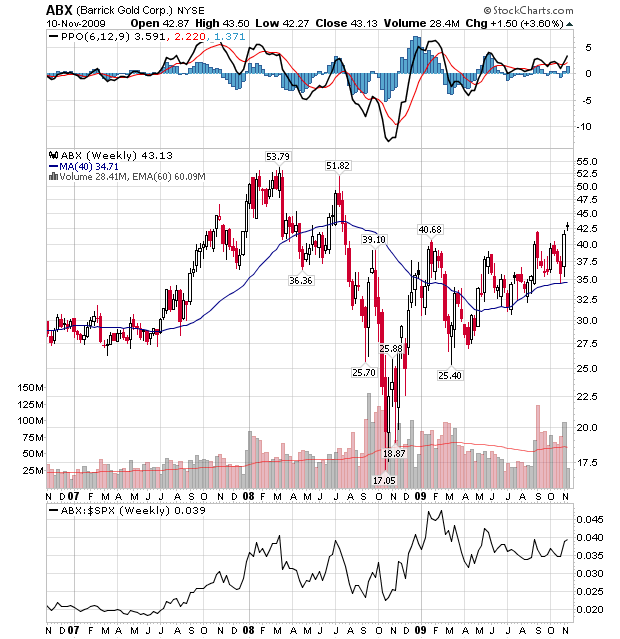

Barrick Gold Corporation (ABX) reached a new 52-week high on Monday of $43.50 up 39% since we suggested it on February 26th at $31.34. ABX reported a $5.4 billion loss last quarter after a $5.7 billion charge to remove its gold hedging program. This will allow ABX to profit on the full upside potential of gold.

NIA Silver Stock Suggestions:

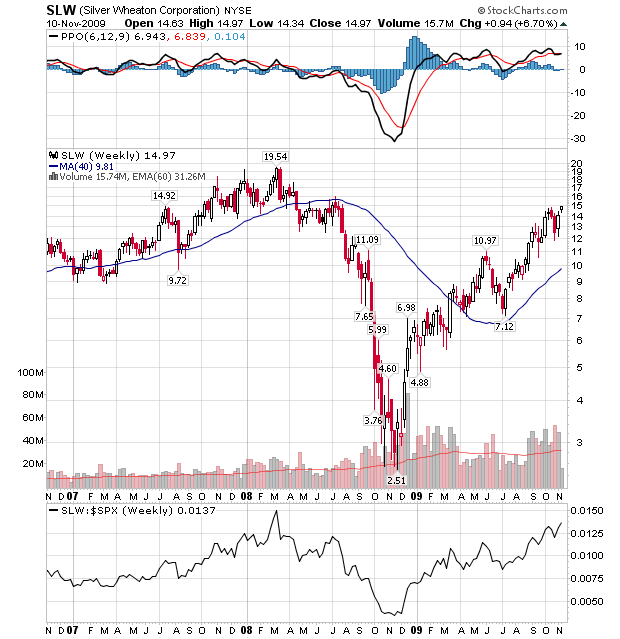

Silver Wheaton Corp (SLW) reached a new 52-week high today of $14.97 up 122% since we suggested it on February 26th at $6.74. SLW just reported 3Q attributable production of 4.3 million silver equivalent ounces at a total cash cost of $3.97 per silver ounce, representing an increase of 59% over the comparable period in 2008. SLW’s net earnings for the quarter were $33.6 million up 66% over a year ago. SLW recently entered into an agreement with ABX to acquire 25% of the life of mine silver production from its Pascua-Lama project, as well as 100% of the silver production from its Lagunas Norte, Pierina and Veladero mines until the end of 2013. SLW expects to finish 2009 with production of 17 million silver equivalent ounces and grow production to 40 million silver equivalent ounces by 2013. We believe SLW is the safest silver play.

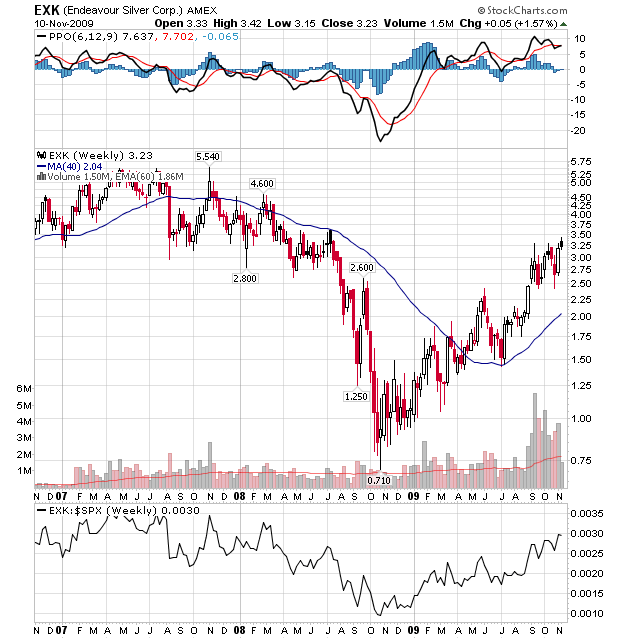

Endeavour Silver Corp (EXK) reached a new 52-week high on Monday of $3.42 up 106% since we suggested it on June 17th at $1.66. EXK just announced that their silver equivalent production rose 14% to 878,143 oz in the 3Q of 2009 over a year ago with cash costs down 46% to $5.20 per ounce. EXK expects the 4Q to be another record quarter for growing production, rising cash-flows and falling cash costs now that the bulk of their 2009 capital programs are complete or nearing completion. EXK is our favorite small-cap silver producer.

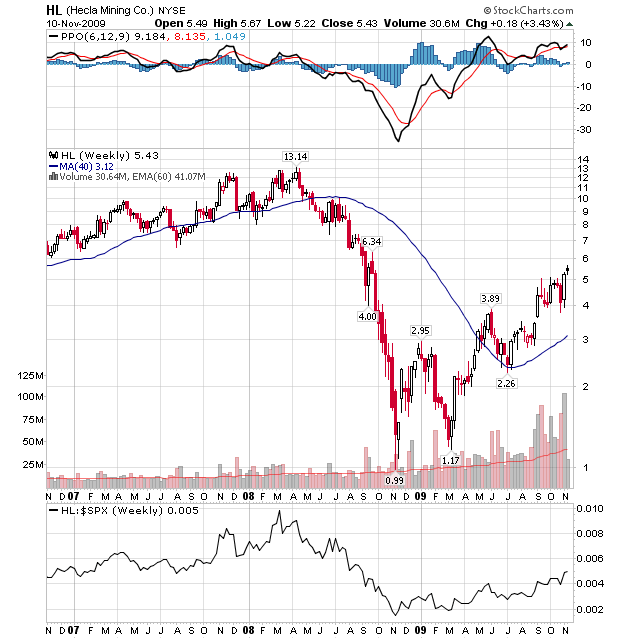

Hecla Mining Co (HL) reached a new 52-week high on Monday of $5.67 up 130% since we suggested it on June 17th at $2.47. HL just reported net income applicable to common shareholders of $22.5 million on revenue of $95.2 million in the 3Q of 2009, compared with a loss of $7.2 million on revenue of $68.5 million for the corresponding quarter in 2008. HL’s third quarter silver production was 2.7 million ounces at a cash cost of $0.85 per ounce of silver produced after by-product credits. For the first nine months of 2009, HL produced 8.6 million ounces of silver at a cash cost of $3.00 per ounce of silver produced after by-product credits. HL increased their cash position last quarter from $27 million to $85 million. HL is now the largest silver producer in the U.S.

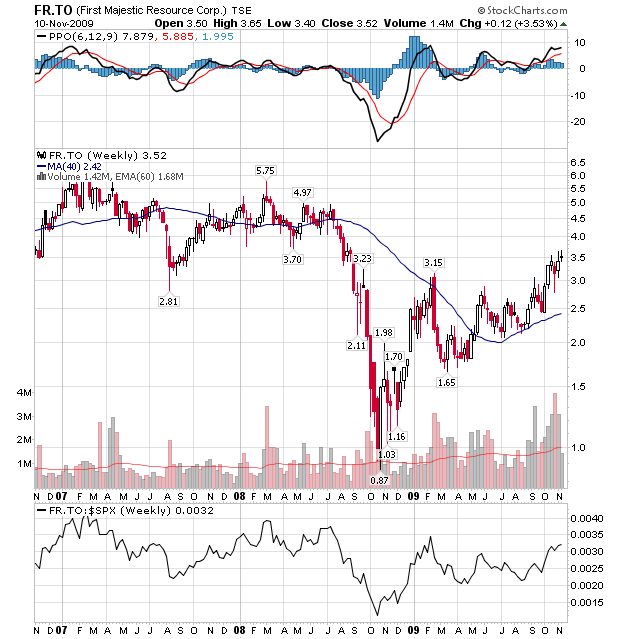

First Majestic Silver Corp (FR-T) reached a new 52-week high on Monday of $3.65 up 34% since we suggested it on June 2nd at $2.72. FR-T produced 1,089,481 silver equivalent ounces in the 3Q of 2009 up 30% over a year ago. FR-T will begin generating revenues from their new 3500 tpd plant in the 4Q.

NIA Agriculture Stock Suggestions:

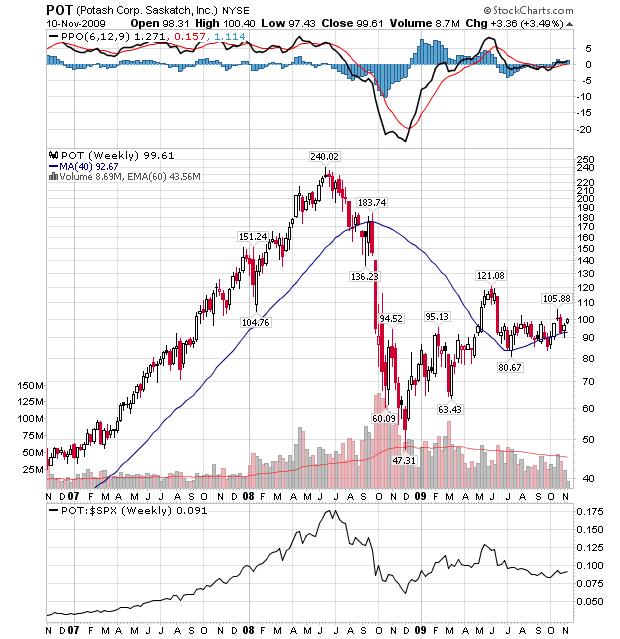

Potash Corp. of Saskatchewan, Inc. (POT) is currently $99.61 up 33% since we suggested it on March 4th at $74.63. POT is the largest fertilizer company in the world and a great way to diversify into agriculture. POT’s 3Q net earnings fell by 79% over a year ago to $248.8 million reflecting the continuing caution among fertilizer buyers around the world, which has negatively affected sales volumes and prices for nutrients. We believe the fundamentals for POT’s products are improving underneath the surface and their business will see another boom in the years ahead.

Zhongpin Inc (HOGS) reached a new 52-week high last month of $16.79 up 45% since we suggested it on April 1st at $9.16, but has since then dipped back down to its current price of $12.80. HOGS’s 3Q revenues increased 26.7% to $194.9 million from $153.8 million in the third quarter 2008 and net income increased 30.7% to $13.2 million from $10.1 million in the third quarter 2008. However, HOGS reduced guidance for the year 2009 to account for stable but not increasing pork prices. We believe HOGS offers a great way to diversify into China and the company is positioned to grow for decades to come.

AgFeed Industries (FEED) is currently $4.23 down 8% since we suggested it on November 3rd at $4.60. FEED announced today that revenues for the 3Q were down 9% from the prior year to $45.12 million and net income was down 65% from the prior year to $2.9 million. FEED’s balance sheet strengthened from a year ago with their cash position up 135% to $36.5 million and their shareholder equity up 32% to $142.8 million. FEED is currently positioning themselves for the long-term agriculture boom we expect to take place for decades to come in China.

A co-founder of NIA has purchased 7,400 shares of DROOY at an average price of $6.76, 16,500 shares of EGI at an average price of $2.50, 5,950 shares of EXK at an average price of $3.05, 2,700 shares of IVN at an average price of $12.64 and 2,300 shares of AUY at an average price of $12.07, and can sell shares in any of these companies at any time.

Our legal disclaimer: http://inflation.us/legaldisclaimer.html

Subscribe for FREE updates HERE

The National Inflation Association is an organization that is dedicated to preparing Americans for hyperinflation and helping Americans not only survive, but prosper in the upcoming hyperinflationary crisis.

With an $11.4 trillion national debt and $55 trillion in unfunded obligations for programs such as Social Security, Medicare and Medicaid, it is our belief that the United States for all intents and purposes is bankrupt and Americans need to take steps immediately to protect themselves from the potential loss of the purchasing power of their U.S. Dollars.

With total United States Federal Reserve and Treasury bailout commitments now at $14.1 trillion, of which $3.7 trillion has already been spent, we believe the largest financial crisis in history is ahead of us as a direct result of the U.S. government unwilling to accept a much needed recession.

It is our belief that foreigners will eventually stop lending the U.S. money and the Federal Reserve will most likely have to print the money to fund our deficit spending out of thin air.

The U.S. has abused its status of having the world’s reserve currency for far too long. With the potential for China to become a net seller of U.S. Treasuries to fund their own rightfully deserved stimulus plans, we believe there will soon be a run on the U.S. Dollar and a rush into hard assets like Gold and Silver.

Our goal is to help as many Americans as possible become aware of the disaster we are rapidly approaching. In our opinion, the wealth of most Americans could get wiped out during the next decade, but it will be an opportunity for a small percentage of Americans to become wealthy by investing into companies that historically have prospered in an inflationary environment, such as Gold and Silver miners and Agriculture producers.

Please sign-up to our free newsletter today to receive our latest stock suggestions and articles before they are posted on Inflation.us: