ED Note: Michael Campbell calls Greg Weldon – “The One Analyst other Analysts can’t Wait to Read.”

One of poker’s unwritten rules is … ‘you can’t bluff a novice’.

The theory provides that bluffing an inexperienced player is more-often-than-not, unsuccessful … since a novice would not understand that he might actually be beat, by numerous other hands than the one he might hold, and will thus NOT fold to a well-timed bluff. Theoretically, a more experienced player might understand that his hand is vulnerable, inducing a fold to any show of strength (bluff).

In my first book, ‘Gold Trading Boot Camp’, I hypothesized that three decades of parabolic credit growth in the US ‘household’ sector, the denouement of which was the US property bubble … was one big, unsustainable ‘bluff’ …

…with the US Consumer, in collusion with, and staked by, the US Federal Reserve, repeatedlybluffing the markets ‘with a ‘weak hand’ that failed to have the support of wage-income growth and adequate savings, relative to the degree of increasingly leveraged credit being created …

… in 1987 … 1990-91 … 1997-98 … and in 2000-01.

However, bluffing…. ‘all-in’ at all times, will eventually result in a ‘call’.

Indeed, we believe the ‘markets’ have called the current ‘bluff’ by the US consumer, who is feigning ‘strength’, hoping markets will fold, and equity markets will roar once again.

From the „top-down “macro-perspective, the hard-core data details have become increasingly ‘skewed’ towards the negative, with an abundance of ‘cracks’ developing in the (alleged) ‘recovery’.

This may spell trouble for trigger-happy equity market bulls who have surfed aboard the recent waves of rally days, which actually ‘curls’ into a ‘patterned’ counter-trend bullish move, within the context of a still-evolving bigger-picture bearish trend.

In terms of the US consumer’s current ‘bluff’ … we ‘read’ numerous signs of WEAKNESS, thanks to the data details extracted from within the June Retail Sales report, released Wednesday … revealing a (-) $1.875 billion single-month slide in final sales … which combines with a deep decline in May, versus April, for a two-month cumulative contraction of (-) $5.859 billion, in total monthly Retail Sales.

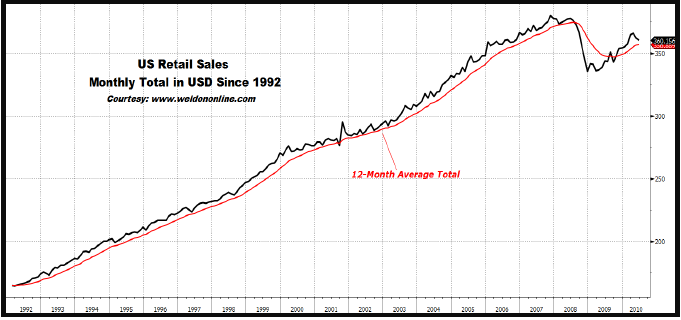

Indeed, we ‘read’ weakness, any time we see outright deflation in headline consumer final demand, in back-to-back months. Evidence the chart on display below plotting Total US Retail Sales, in dollars, per month … reflecting an ominous double-dip pattern. Any further signs of flagging demand in the US consumer-retail sector will strongly suggest that the consumer might be ‘folding’ this time around, rather than going all-in on a bluff. Such a circumstance would be signaled with a push in the Total Monthly Sales back below the 12-Month Average.

Weldon’s Money Monitor offers a FREE 30 Day Trial Subscription. For subscription information contact Eileen @Weldononline.com or Visit www.Weldononline.com for a FREE Trial.

A FREE 30 Day Trial Subscription is defined as a single Trial that is limited to a one-time Signup. Signing up for multiple trials under different names, Fraudulent contact information is illegal. Weldon’s Money Monitor takes this seriously..