Jim Rogers is good at what he does. Really good. This masterful investor co-founded with George Soros the Quantum Fund. A fund that posted astonishing returns of 4200% in 10 years, over the same period the S&P gained a mere 47%. Rogers retired 31 years ago in 1980 at the age of 37 but is still active as a private investor.

Clearly one of the most successful investors of all-time, Rogers buys value. Accordingly in 1999, he predicted a “Supercycle” commodity bull market, raw material prices advancing for longer than in any previous uptrend led by gold and silver. At that time gold was trading near is low at $252, the lowest real price in nearly a 100 years, and silver at $4 the lowest real price in 5000 years.

Click on the Chart “The real price of gold 1344-1988” for a larger image.

With gold up 650% from its lows and silver with an even greater gain….. obviously Rogers was right.

Rogers has stopped buying gold now. “I wouldn’t buy more gold and silver right now” “I don’t like to jump on a moving bus”. That doesn’t mean Rogers is selling, he still believes that “gold is certainly going to go to $2,000 over the years; it looks like it’s going to go much higher during the course of the bull market,”. Even after soaring to an all-time high of $1678.25 on August 4th/2011, Rogers thinks “gold prices are not in a bubble because not everyone is buying yet”. Right now Rogers is moving towards a greater commodity opportunity that he thinks offers the same kind of values that gold and silver did a decade ago.

Agriculture: The Next Big Bull Market

Consistent with his devotion to buying undervalued assets, he now sees the same quality of values in agriculture that he saw in gold and silver. No, he’s not selling his gold and silver but he is predicting that “Agriculture prices are still, on a historic basis, extremely depressed, and in my view I’ll probably make more money in agriculture than other things”.

Rogers thinks that the current commodities supercycle will last for 20 to 25 years, a view supported by the research of Chris Watling of Longview Economics. Whatling traced secular bull cycles back to 1750 and identified that commodity super cycles last 20 to 25 years. As this commodity bull started in 2000, if Whatling and Rogers are correct this bull will run higher until 2020-2025.

In short, if you missed buying gold and silver at extremely depressed levels, if you missed participating in what Peter Grandich calls The Mother of all Bull Markets, Rogers thinks you have another great chance to buy into an imminent bull market at great value:

Its about demand and low historical prices. “If the fundamentals weren’t right the price would not go up. Many people invested in commodities in the 1980s and 90s and didn’t make any money because the fundamentals were bad, now people are investing and making money because the fundamentals are good” Rogers Said. There is a powerful underlying demand for food. When food prices surged in 2007 millions went hungry, and there were riots from Egypt to Haiti and Cameroon to Bangladesh. Rioting calmed down in 2008 prices when prices dropped but starting at the beginning of 2009 they’ve been going up and Rogers expects “more turmoil, but I didn’t expect it to happen this quickly because food prices are somewhat depressed”. Clearly a bull market rise from current levels will cause even more starvation, riots and urgent demand.

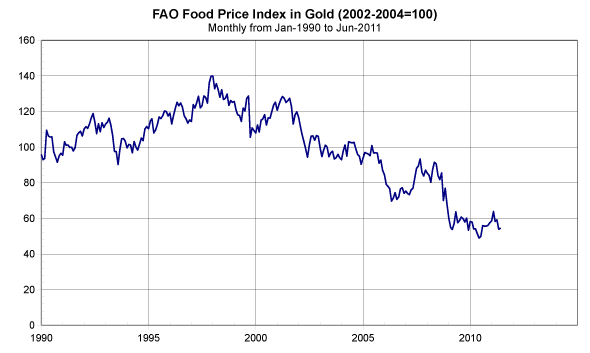

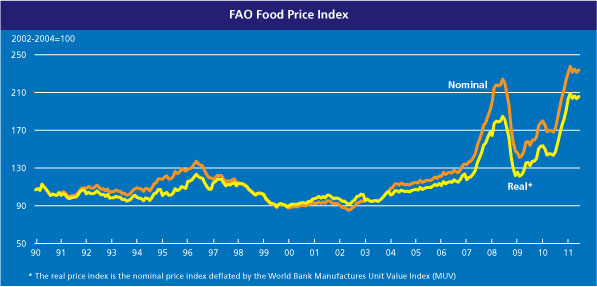

The FAO Food Price Index measures the prices of Dairy, Oils & Fats, Cereals Sugar & Meat

On the longer term chart real food prices were more expensive in 1917 than they are here today. Demand is there. Agriculture will be “wildly exciting” as global food shortages worsen, according to Rogers. “You pick an agriculture product and I’ll say buy it,” he said. Shortages are showing up right now as the world population has more than doubled from 3 billion in 1960 while the amount of arable farmland has been decreasing. If world population rises from its current 6.8 billion to 9.1 billion by 2050 as the United Nations forecasts, a lot of people are going to be scrambling for food.

Click on the 1900-2008 FAO Food Chart for a Larger Image

What to Invest In to Take Advantage

Good advice from Daniel Keirnan in his article “Farmland Investment, the next big Portfolio“

The question is what are the best ways for making money from the agricultural sector? One way is to invest directly into agriculture stocks such as farm equipment maker John Deere (DE), global seed giant Monsanto (MON) or fertilizer company Potash Corp of Saskatchewan (POT).

Another method is to invest in agricultural futures through Exchange Traded Funds (ETFs) such as AIGA on the London Stock Exchange or DBC in the US which tracks an entire basket of agricultural commodities including corn, soybeans, wheat, cotton, sugar, coffee, cattle and pigs. These commodities ETFs try to track the spot price of the various commodities they include.

The advantage of these stocks or ETFs is that they are easily trade-able by anyone who has an online brokerage account. The disadvantage, however, is that they are still financial instruments, and as such can fluctuate widely in price.

One option most individual investors tend to overlook is direct investment in farmland. In many ways, a farmland investment is more secure, stable and tangible then putting money into stocks.

Farmland investments for individuals will pay a regular yearly dividend from the sale of crops, and also provide the opportunity for long-term capital gains as farmland increases in value during a bull market in Food.

Don’t buy Gold now. Rogers says food and agriculture are great values and will be the next big demand driven bull market.