It’s no secret that Goldman Sachs (GS) has an enormously profitable trading operation. In the most recent quarter they reported an astounding $10B in total trading and investments. This represented 81% of the firm’s total revenues. One of the most profitable arms of this trading operation is the commodity desk. Goldman’s commodity calls are often market moving and always noteworthy. Their latest commodity positions reflect the firm’s continued bullish outlook on the economic recovery.

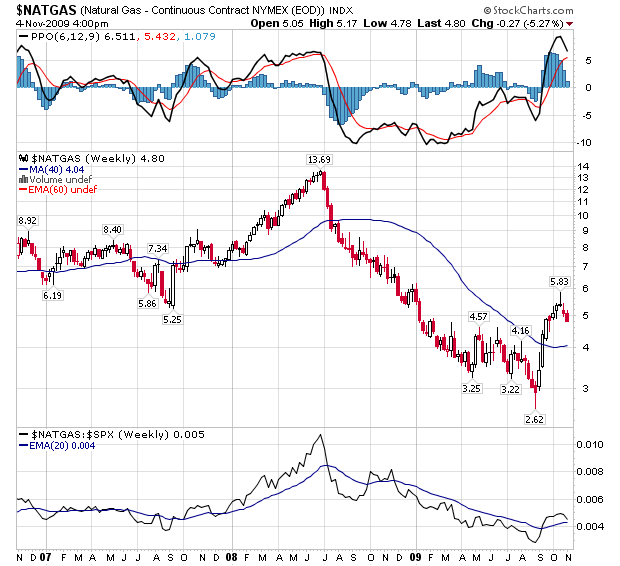

Goldman is very bullish on Natural Gas. Their 3 month price target on Nat Gas is $6.50 while their 12 month target is $7.70. That is a 33% and 57% expected climb.

How to play it? Goldman likes Summer 2010 NYMEX Natural Gas futures.

In the WTI oil market Goldman has a 3 month target of $85 and a 12 month target of $94. That equals a 9% and 20% rise in oil prices. They see continued demand from China as a primary driver.

How to play it? Goldman likes a long timespread. They like buying the December 09 WTI and selling the 2011 WTI contract.

In the metals markets Goldman is surprisingly bearish on Gold and Silver. Their 3 month and 12 month price target for gold is $960. Their 3 month target for silver is $15.60 and their 12 month target is $16. This is consistent with their benign inflation expectations. They do not recommend any specific short trades on the two metals at this time. They do, however, like 2010 January Platinum.

In terms of agriculture Goldman likes Corn futures. They currently have a $4 3 month price target and a $4.50 12 month price target.

How to play it? Goldman likes the May 2010 Corn futures.

More from the Pragmatic Capitalist:

MAJOR INDICATORS REMAIN MIXED, FORECAST WEAK RECOVERY

The author of The Pragmatic Capitalist is the founder and CEO of an investment partnership. Prior to establishing his own business, TPC was a Merrill Lynch Financial Advisor. TPC is a Georgetown University alumnus, growing up in the DC area and now living in Southern California.

The Pragmatic Capitalist is a jack of all trades. Rather than focus on one facet of the U.S. equity markets, the goal is to assess and address global capital markets as a whole – with the understanding that all markets are intertwined and being an “expert” in one segment of the market without a vast knowledge of the others is futile.

The saying “common sense is very uncommon” has never been more applicable than it is to modern markets. TPC attempts to approach markets with sound reasoning and as little emotion as possible. A capitalist through and through, but always pragmatic…

Research

TPC uses a top down investment approach. The research and market methodology is based on cognitive science and the theory of chaos. Through the understanding of market psychology you can derive that markets are non-linear dynamical systems which are susceptible to inefficiencies. Markets are inefficient in short time periods due to their chaotic nature (a symptom of human psychological irrationality). This creates opportunity.

Based on this methodology we employ risk management structures that account for the possibility of short-term inefficiencies and random occurrences within large and liquid systems. Although there are short-term opportunities in markets, risk management is the overriding factor in achieving high absolute returns. Black swans cannot be predicted, but they can be avoided by employing proper risk management. This analytical, quantitative and systematic approach helps us in achieving our goal of high absolute returns.