4:30PM EST November 02/10

With foot in cast and aching back from hopping on one foot for a week, I’m back in the office full-time. Many thanks for all the best wishes and here’s to a cast-free leg by months-end.

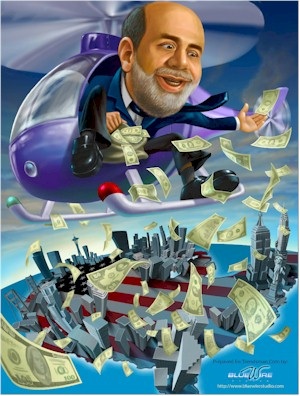

U.S. Stock Market (DJIA 11,189) – I’ve been targeting the 11,300 area on the DJIA and Election Day in the U.S. as a point in time when the “steroid-craze” rally meets horrific economic, political and social fundamentals and no amount of “QE” easing can provide enough legs to take this rise much further. My Yellow alert is now turning Red. The time has come to put the bear suit back on and suggest bearish strategies. Bearish call spreads on major indices and liquidation of most non-metals related equities now appear appropriate in this person’s eyes.

As you know, I’ve not had an official bearish stance against the U.S. stock market since March 2009 and have expected the “Don’t Worry, Be Happy” crowd to once again lead the sheep to slaughter. Bullish sentiment has returned with a bang thanks to the Pied Pipers who fill the airwaves on Tout-TV and elsewhere. This comes at a time when corporate insiders have dramatically increased their selling. Despite what many in the financial arena would like you to believe, the stock market is a place where you get to be a part owner of companies. Who knows more about what’s happening at a company than the key personnel who run the company? If they’re selling shares aggressively while the public is buying, who do think has an edge? If you don’t believe it’s the insiders, I have a bridge and some Texas Rangers World Series Champions memorabilia for sale – cheap!

I’ve often stated I’m not interested in the day-to-day movements in markets as the cemetery is filled with people who tried beating markets trading. My outlook is for the long-term and as you know I’ve stated our market and economy is likely to mirror what happened in Japan from 1989 until now. QE flamed out in Japan and it shall here as well. Borrowing and spending our way out of this mess is not the answer nor is it the first time America has tried it and failed.

We’re also not going to solve our problems simply because one party gets back into a majority because the enormous problems America faces is a sum total of both parties mishandling of things. Yes, politicians are part of the problem, but remember I believe the real culprits are Americans themselves. Having too much stuff got us here and until they’re closing public storage facilities versus opening them, we’ll never get to the root of the matter.

A beautiful Canadian sang a song a few years back that accurately described Americans then and now.

Gold and Silver – Another correction/consolidation is mostly behind us now and while we can back and fill near-term, the “mother” of all bull markets remains fully intact. As usual and on cue, the perma-bears showed up (with heavy make-up covering up their wounds from years of being run over by the greatest bull market of all-time). They’re a necessary evil and other than creating some cheap laughs are nothing to be concern about. Yes, like a broken clock they may be right twice over a very long period of time, but following them would have been worse than a quick death. (Tokyo Rose has given many different reasons for the many tops he has called for over several years, all of which were laughable if not truly sad. To say he’s not a bear is like believing soon to be ex-Senator Harry Reid saved us from economic Armageddon).

Just remember when we hit $1,400 to send your dollar to the Tokyo Rose Relief Fund.

And to all us kooks who claimed manipulation in the metals markets, the smoking gun I claimed was revealed at the CFTC hearings has at least fired some bullets that has caused the mainstream media to report on it even if they still have to fill their commentaries with “kooks” claims. Space helmets on, Captain Video.

U.S. Dollar – The relief countertrend rally has unfolded but my target of 74 on the U.S. Dollar Index has never looked more likely. When all the hoopla over elections and QE easing have come and gone, the extremely sad state of affairs in America will rise out of the dust and the terminally ill U.S. Dollar shall continue to slip and slide down to new lows below 70 in the next 12-24 months.

U.S. Bonds – While I’ve avoided any short positions since early 2010, I think bubble searchers should march straight to the U.S. bond market to find what they’re looking for. I continue to avoid any U.S. debt past two years maturities.

Oil and Natural Gas – Oil is now fully priced barring a serious conflict in the Middle East and Natural Gas remains a total avoid.

…also read the following:

Grandich Client Lithium One

Grandich in the Monitor Newspapers

He Didn’t Save The Economy and Please God, He Won’t Be Able to Save Himself

Grandich Client Spanish Mountain Gold

On Major Moves, Grandich has been very right and not only saved many investors fortunes, but expanded them dramatically. On November 3, 2007 at the MoneyTalks Survival Conference, Peter Grandich of the Grandich Letter warned that “an unprecedented economic tsunami will hit American beginning in 2008”. Peter advised publicly to short the US market two days from the top in October, 2007 and stayed short until the last week of October, 2008. He began to buy stocks in March 7th, 2009. He also bought oil and oil related investments near the lows after the dive from $147.

….go to visit Peter’s Website.