Gold – The Breakout Must Hold

The downside reversal in the U.S. Dollar during the past two weeks has put a bid under the U.S. gold price. However, the Dollar has become oversold on a daily basis and it is imperative that gold hold $1230 or we will likely see a quick decline to test the May lows of $1166.

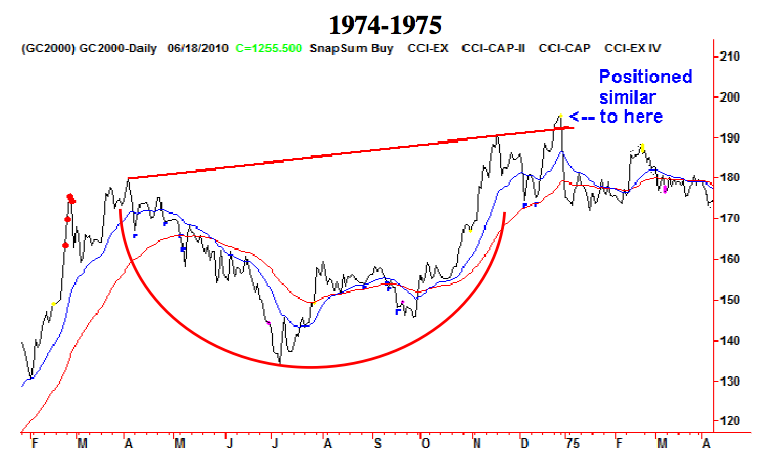

The Cup and Handle Pattern is common in gold. This pattern occurs when you have a correction followed by a test of the high and a smaller correction followed by a breakout. The initial rally following a successful breakout measures 61.8% of the height of the base. It currently exists in both the hourly and daily charts with respective measurements of $1300 and $1380.

Since 2007 we have seen numerous Cup and Handle patterns in gold that met their initial .618 goals before pulling back to the breakouts:

• Monthly chart of 1980-2007

• May 2006 to September 2007

• March 2008 to September 2009

Previous successful examples in gold

Three important failures

While daily sentiment is at 93% and 95% for gold and silver respectively (www.trade- futures.com ), the weekly sentiment figures are in neutral territory for both. This leads to a conclusion of a possibility of a short term decline within an ongoing bull market.

The opinions in this report are solely those of the author for the private information of clients. Although the author is a registered investment advisor at CIBC Wood Gundy, this is not an official publication of CIBC Wood Gundy and the author is not a CIBC Wood Gundy analyst. The views (including any recommendations) expressed in this report are those of the author, and are not necessarily those of CIBC Wood Gundy. The information contained in this report is drawn from sources believed to be reliable, but

that accuracy and completeness of the information is not guaranteed, nor in providing it does the author or CIBC Wood Gundy assume any liability. The information given is as of the date appearing on this report and neither the author nor CIBC Wood Gundy assume any obligation to update the information or advise on further developments relating to the information provided herein. This report is intended for distribution in those jurisdictions where both the author and CIBC Wood Gundy are registered to do business in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited. The author and / or CIBC Wood Gundy may have holdings in the companies discussed and may offer advice or have an investment banking relationship with the companies discussed in the report.